Bank of Japan, USD/JPY News and Analysis

- BoJ’s hawkish actions accompanied by dovish rhetoric

- Yen depreciated further after the announcement – USD/JPY back above 150.00

- Japanese (10-year) government bond yields ease as BoJ will continue purchases

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

BoJ’s Hawkish Actions Accompanied by Dovish Rhetoric

The Bank of Japan (BoJ) voted to raise the benchmark interest rate into the 0% - 0.1% range in a historic move that marks the end of the Bank’s negative interest rate policy which was implemented to combat deflation that plagued the nation for years. The move sees the policy rate up into positive territory after 8 years and marks the first rate hike in 17 years.

In the lead up to the meeting, the market assigned a 44% chance of a hike, with greater conviction of a hike materializing in April, which meant the hike came as a slight surprise. Moments before the announcement, Nikkei Asia ‘leaked’ the upcoming decision to hike and end to yield curve control (YCC), agency proving to be a reliable source for recent BoJ policy decisions.

Learn how to prepare and setup for major news or data releases that have the potential to move markets:

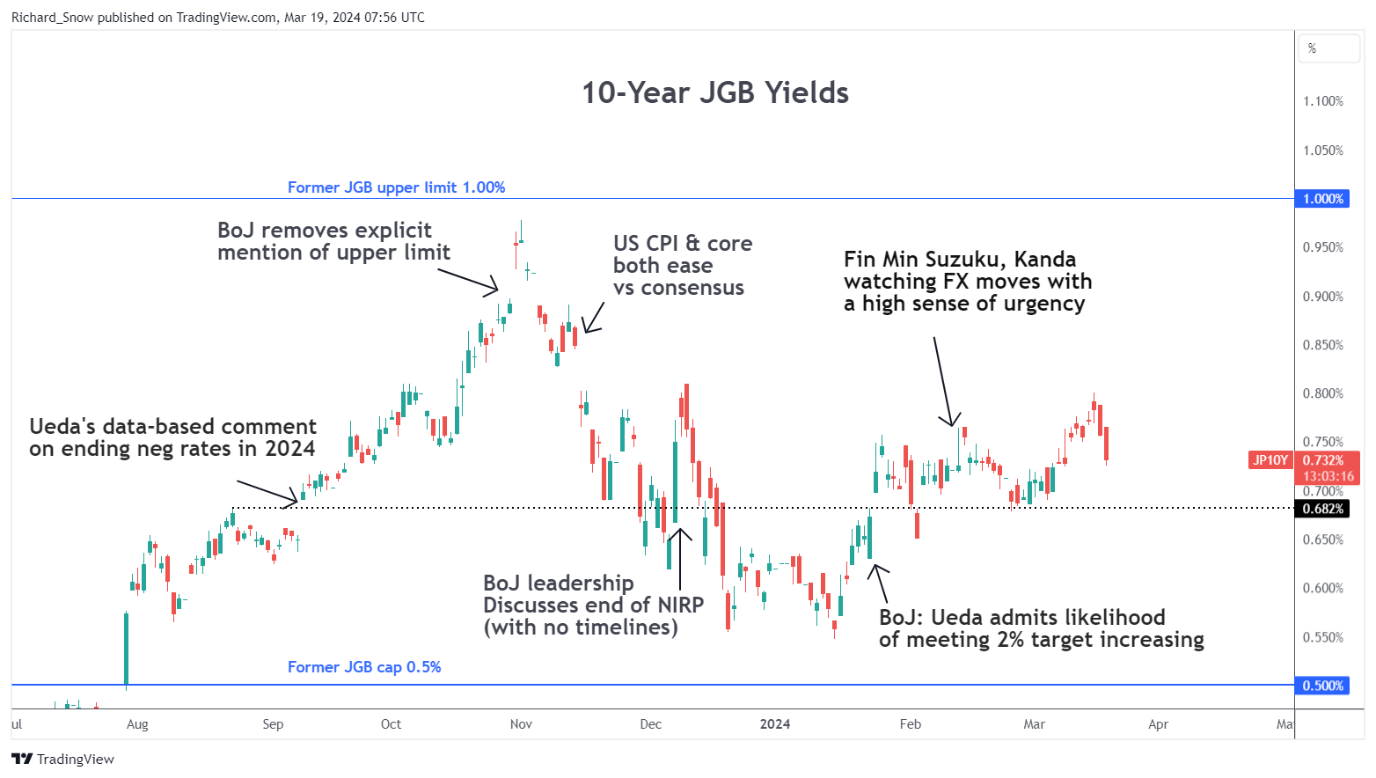

Japanese (10-year) government bond yields ease as BoJ Vows to continue purchases

Alongside the rate hike, the BoJ has removed the official target for 10-year Japanese government bonds but stressed it will maintain purchases around the same level as before to maintain an orderly market (contain any potential blowout in borrowing costs for the Japanese government). The immediate effect of the announcement brought about a further decline in yields, which didn’t help the yen.

10-Year Japanese Government Bonds (Daily)

Learn how to approach USD /JPY currency trading, understanding the fundamental considerations every trade should know:

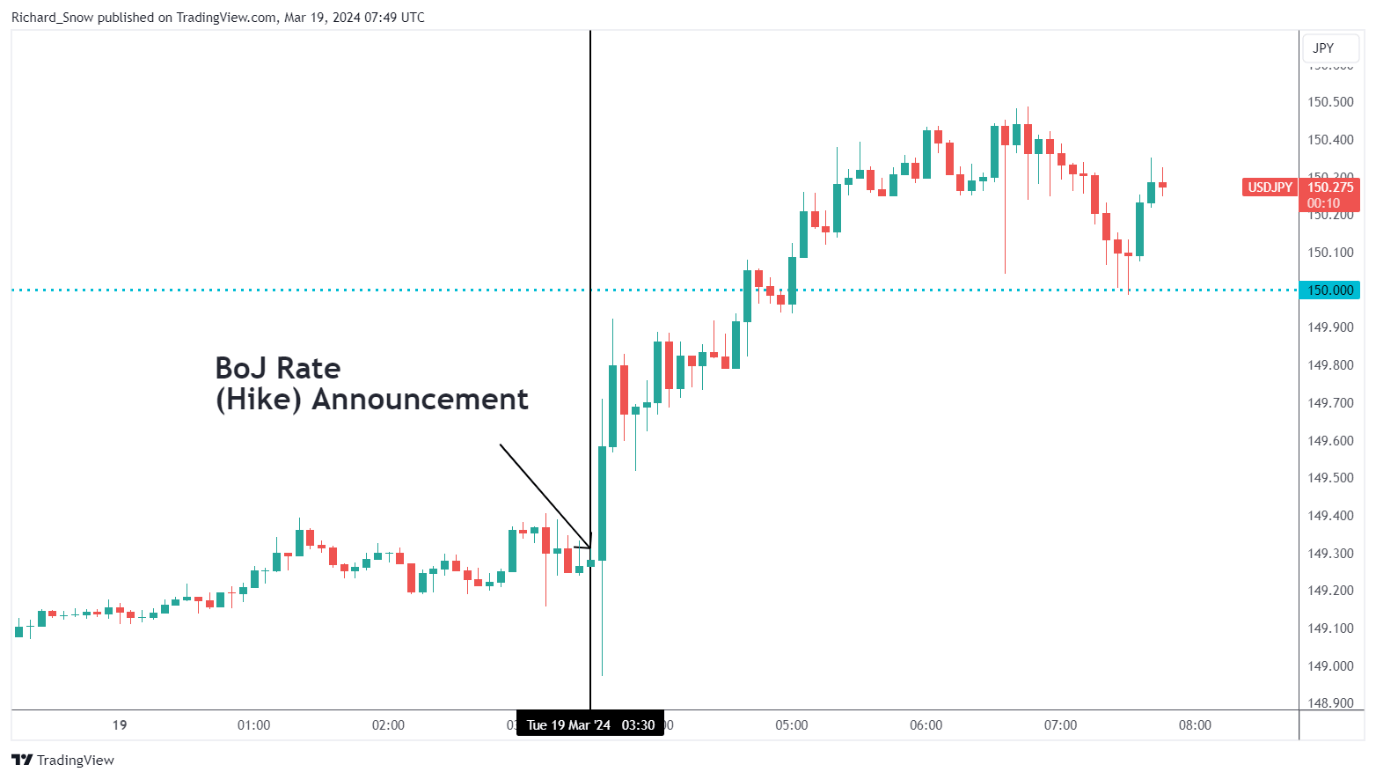

Yen depreciated further after the announcement – USD/JPY back above 150.00

USD/JPY continued the move higher as the yen came under pressure in the moments following the BoJ announcement. Typically, a surprise rate hike lifts the local currency but the lack of forward guidance around subsequent rate hikes meant that interest rate differentials are likely to work against the yen in a low volatility environment – favouring a continuation of the carry trade .

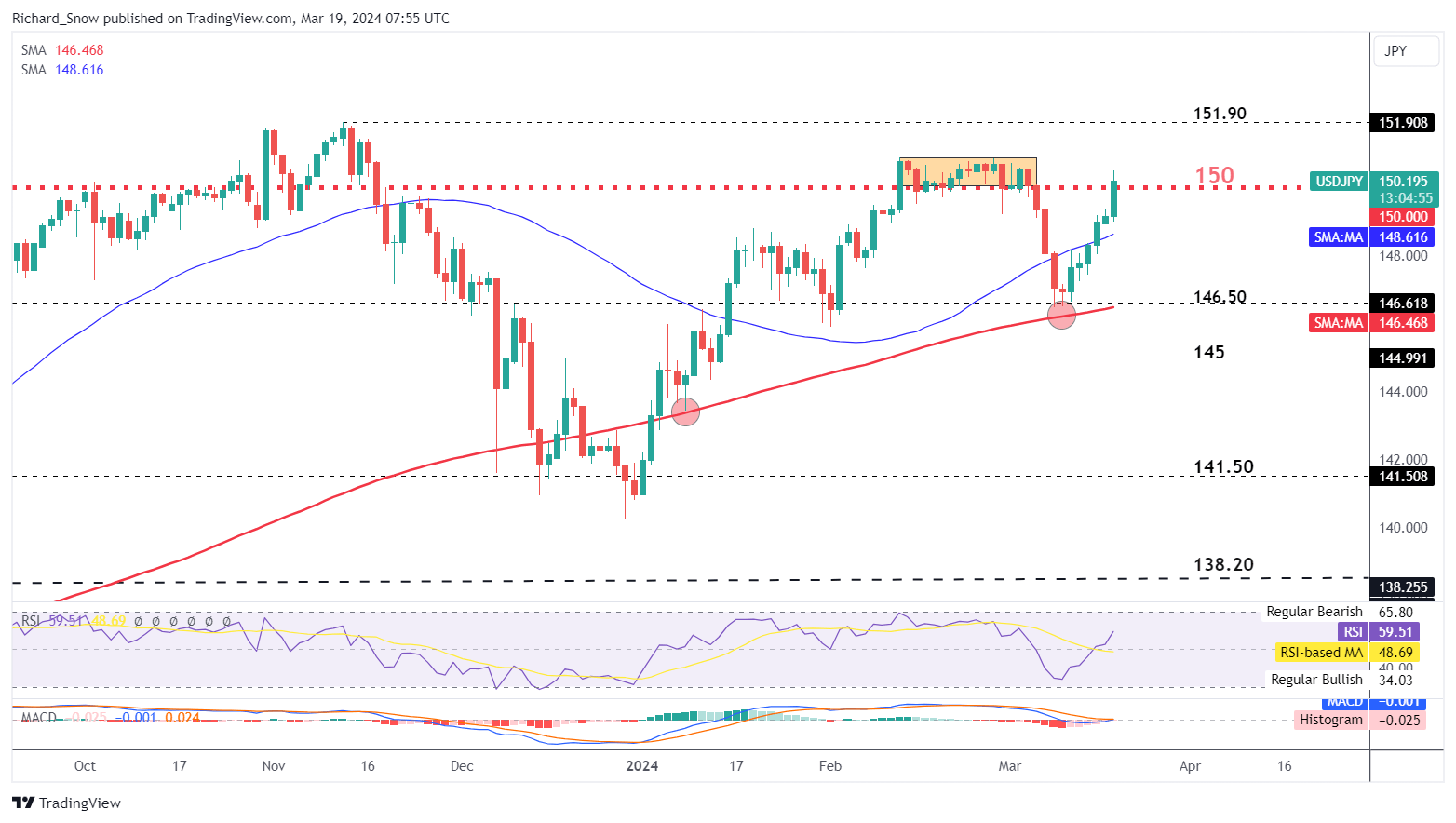

The US dollar is also helping the rally as markets now anticipate a July rate cut instead of June. This has come as a result of hotter-than-expected inflation data (in some form or another) since December and rising energy prices ( oil and natural gas ).

When asked about future hikes the Bank of Japan Governor Ueda mentioned that the April forecasts will shed more light on that and later on he spoke about the need to witness the right conditions in order to continue raising interest rates.

USD/JPY 5-Min Chart

The daily USD/JPY chart shows the large green candle rising above the 150 marker once again, to the dissatisfaction of the Japanese finance ministry which has previously voiced its dissatisfaction with yen depreciation around similar levels.

In the absence of a more hawkish BoJ and while fundamentals continue to support the dollar, USD/JPY may continue to rise further with 151.90 the next level of consideration. A positive carry trade, low volatility and markets delaying the start of rate cuts in the US continues to support the bullish move in the pair.

USD/JPY Daily Chart

Stay up to date with the latest breaking news and themes driving markets by signing up to our weekly newsletter:

Trade Smarter - Sign up for the Newsletter

Receive timely and compelling market commentary from the team