GOLD PRICE OUTLOOK

- Gold prices retreated this week but are still up more than 5% in March

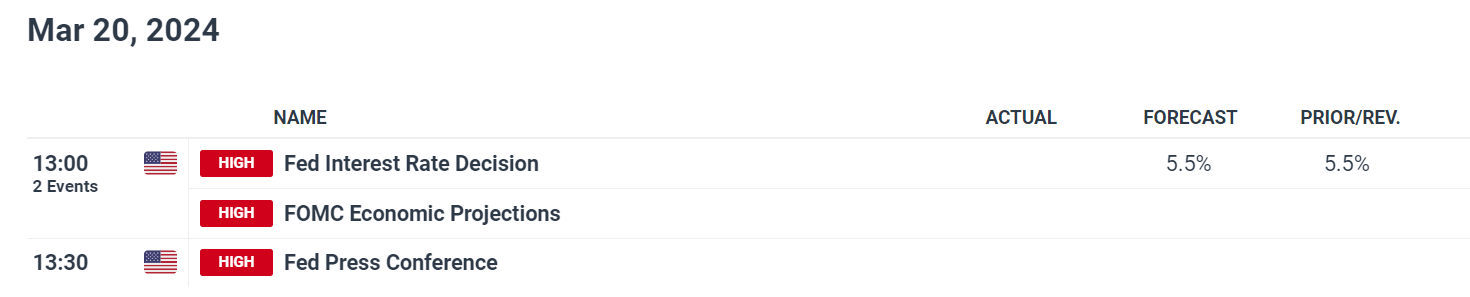

- The Fed’s monetary policy announcement will take center stage in the coming week

- This article examines XAU/ USD ’s technical outlook and key price levels

Most Read: EUR/USD Levels Off at Support Ahead of Key Fed Decision – Outlook & Analysis

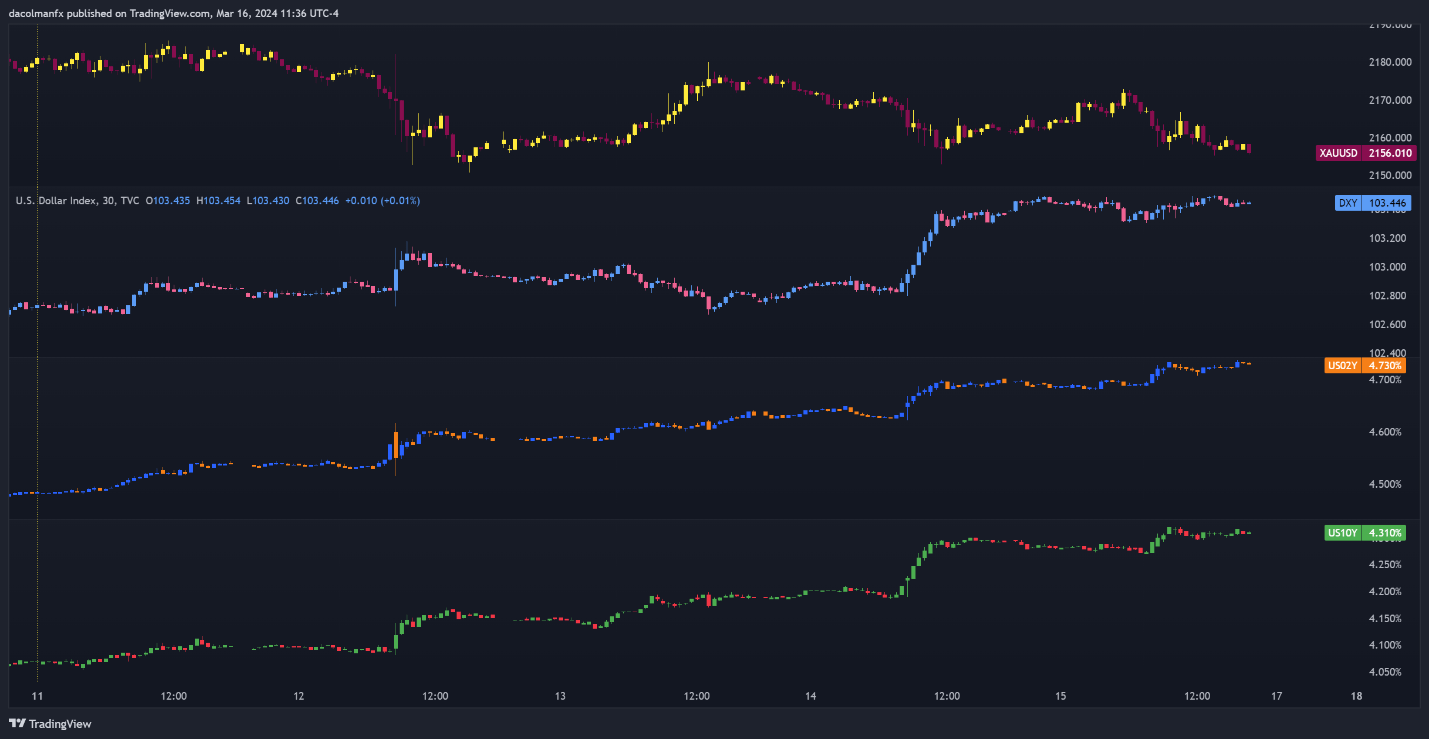

Gold prices (XAU/USD) retreated this week, falling about 1.05% to $2,155, dragged lower by the rebound in U.S. Treasury yields and the U.S. dollar . Despite this setback, the precious metal maintains strong bullish momentum, reflected by its March performance to date, which has produced a gain of around 5.5% and led to recent all-time highs.

GOLD, US DOLLAR & US YIELDS PERFOMANCE

Earlier this month, bullion climbed sharply on bets that the Federal Reserve would soon start cutting interest rates. The rally accelerated after Fed Chair Jerome Powell indicated in an appearance before Congress that policymakers were "not far" from gaining greater confidence in the inflation outlook to pivot to a less restrictive stance.

Markets got overexcited by Powell’s comments, providing bullish investors with a reason to drive XAU/USD upwards. However, the picture has begun to change over the past few sessions, with a new storyline unfolding in the wake of disappointing consumer price data, revealing a stark reality: progress on disinflation is stalling and possibly even reversing.

Eager to gain insights into gold's future path? Discover the answers in our complimentary quarterly trading guide. Request a copy now!

With upside inflation risks starting to materialize, as seen in the last two CPI and PPI reports, traders should not be surprised if the central bank starts to adopt a more hawkish posture, signaling that more patience is needed before removing policy restraint and that fewer rate cuts than initially anticipated will likely occur once the process gets underway.

We will know more about the Federal Reserve's plans next week (Wednesday) when the institution announces its March decision. While policymakers are seen keeping their policy settings unchanged, they could provide different guidance and forecasts in response to new information on the macroeconomic front; after all, data-dependency has been the guiding principle.

In the latest Summary of Economic Projections, the Fed hinted that it would deliver 75 basis points of easing this year and market pricing has converged to this estimate of late. If policymakers were to indicate an intention to deliver fewer cuts than what’s currently discounted, we could see bond yields and the U.S. dollar push higher. This should be bearish for gold prices.

Wondering how retail positioning can shape gold prices? Our sentiment guide provides the answers you are looking for—don't miss out, get the guide now!

| Change in | Longs | Shorts | OI |

| Daily | 7% | -7% | 0% |

| Weekly | 16% | -17% | -3% |

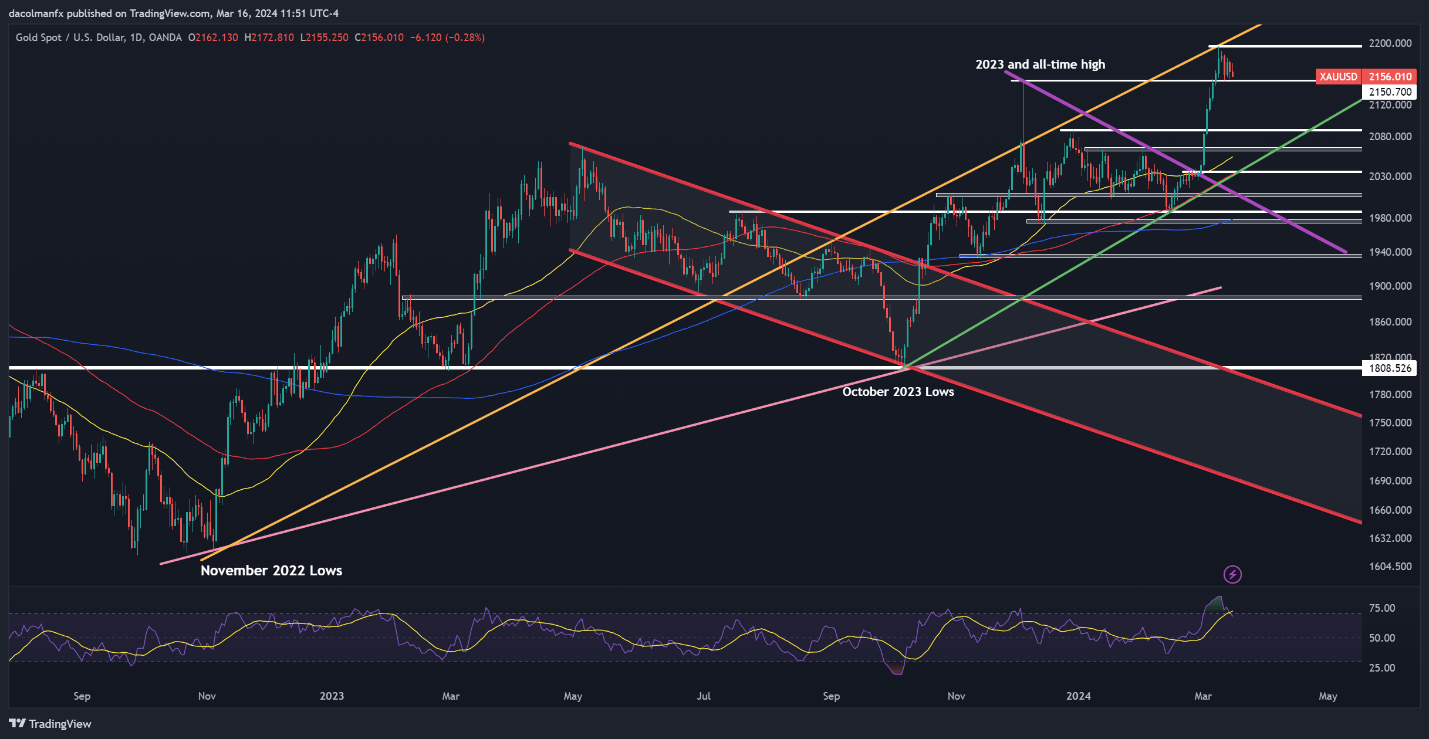

GOLD FORECAST - TECHNICAL ANALYSIS

Gold prices fell this week, but managed to hold above support at $2,150. Bulls must actively protect this technical zone to prevent an escalation of selling pressure; failure to do so may trigger a pullback towards $2,085. In case of further weakness, the spotlight will be on $2,065.

On the flip side, if buyers regain decisive control of the market and spark a bullish reversal from the metal’s current position, the first obstacle lies at the record peak established earlier this month at $2,195. Further upward movement will draw attention to trendline resistance near $2,205.

GOLD PRICE TECHNICAL CHART