USD/JPY News and Analysis

- Rengo announces highest wage increase in 30 years

- BoJ maintains longer-term uptrend and prices continue to rise

- Remaining central banks to meet next week: BoJ, RBA, Fed, BoE

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Rengo Announces Highest Wage Increase in 30 Years

Rengo announced a wage agreement at 5.28% - the largest increase in the last 30 years as conditions begin to align for the Bank of Japan (BoJ) ahead of next weeks policy meeting. Rengo is Japan’s largest trade union group, representing over seven million workers at some of Japan’s largest companies.

Previously, the BoJ mentioned the precondition for a rate hike will be to observe a ‘virtuous wage-price cycle’. Inflation remains above 2% for well over a year, although, it has been falling towards the target from well over 3% raising concerns around the persistence of underlying inflation. Nevertheless, recent developments appear to bode well for the BoJ to forge a new path towards positive interest rates once again.

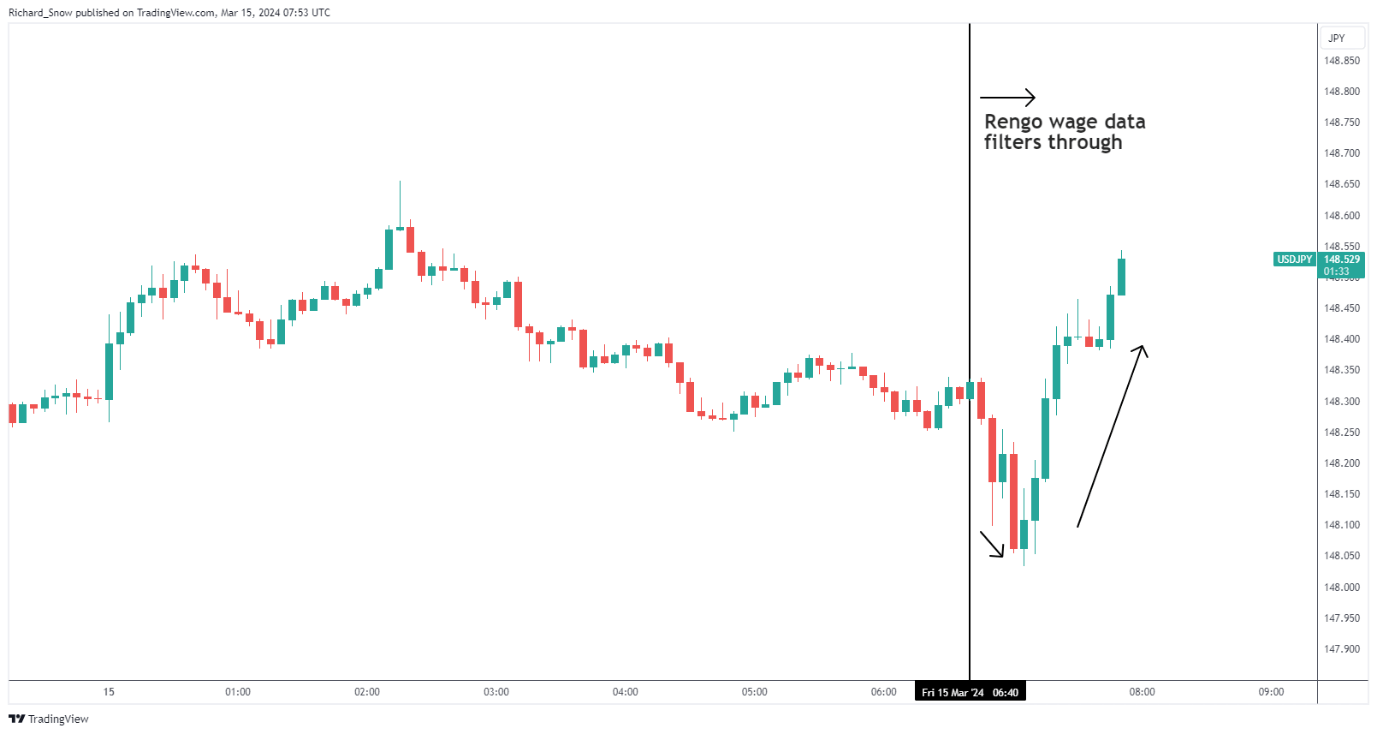

The immediate reaction to the announcement suggested a slight yen bid but it wasn’t long before USD/JPY surprisingly turned higher.

USD /JPY 5-Minute Chart

USD/JPY Maintains its Long-Term Uptrend as Prices Continue to Rise

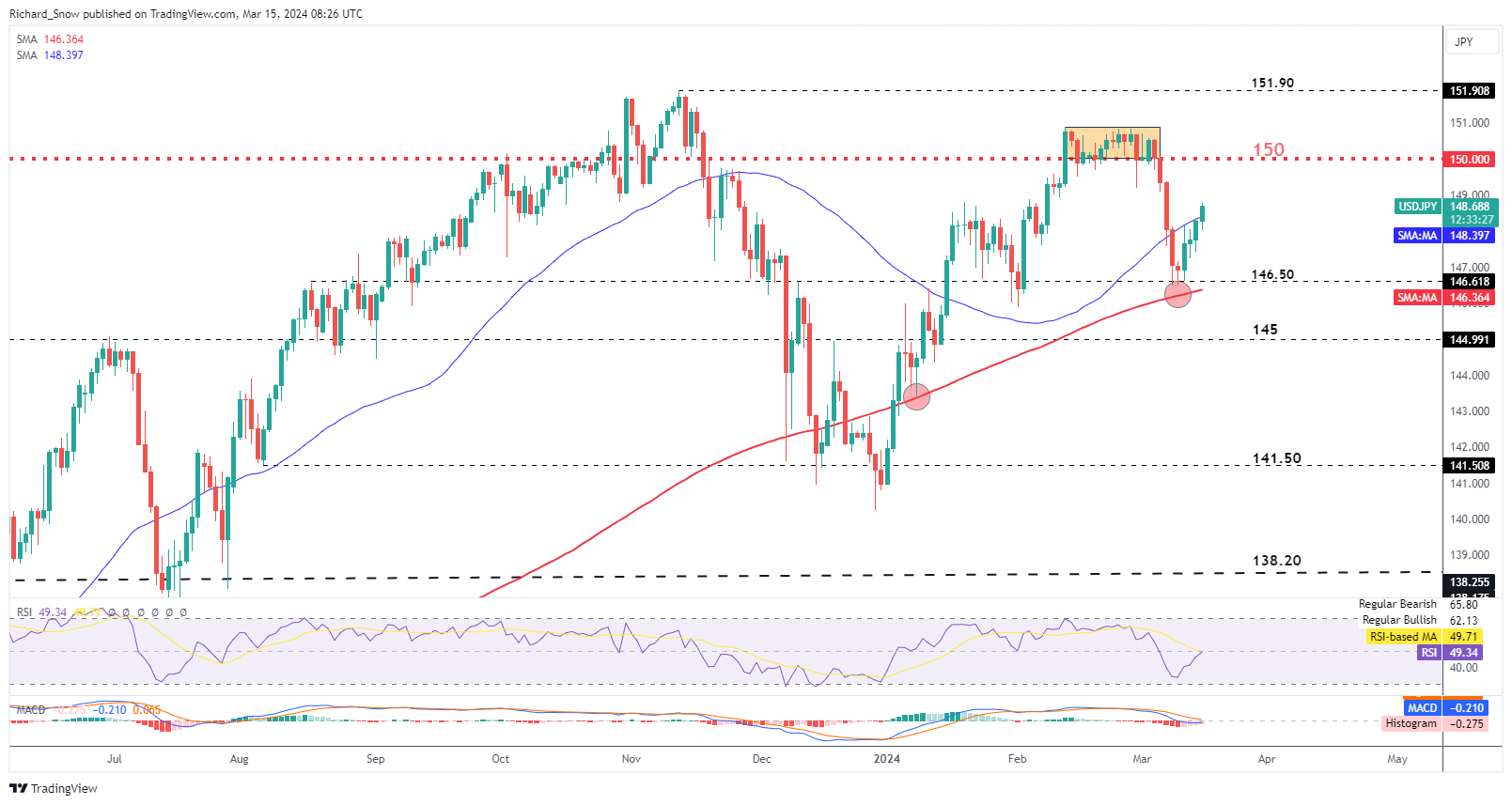

The US dollar received a boost yesterday after PPI data printed slightly hotter-than-expected, buoyed further by rising US treasury yields (2, 10-year). That momentum has continued in the early hours of the London session as USD/JPY looks to end the week with four straight days of gains.

The bullish lift presents improved entry levels for bears looking for further yen appreciation and a move lower in USD/JPY. However, the recent bullish lift has gathered pace after bouncing off the 200-day simple moving average (SMA) and the 146.50 marker, trading above the 50 SMA. Naturally, 150 reappears as the next level of resistance. 146.50 marks the tripwire for a potential change in sentiment if the threat of rate hikes becomes more imminent over the next few days.

One potential stumbling block is Governor Ueda’s own assessment of the local economy where he has noted the recovery is modest and he has seen in some data. This is after a recent revision in Q4 GDP revealed that Japan has not entered into a technical recession, but the slight revision appears academic at this point, with the Japanese economy showing signs of concern.

USD/JPY Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | -11% | -3% | -4% |

| Weekly | -18% | -3% | -6% |

Remaining Central Banks to Meet Next Week

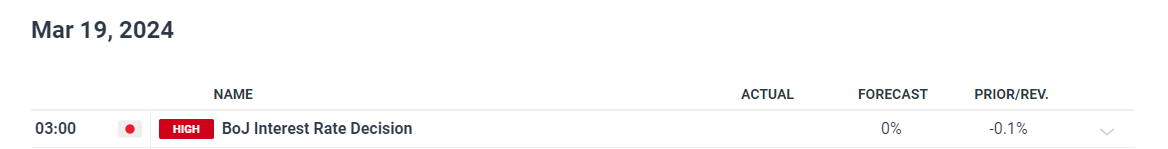

The BoJ is due to meet again next Tuesday to set monetary policy but markets anticipate there will be no change, but the chances of a surprise hike are not to be dismissed (41% at the time of writing). Instead, a more likely outcome will be for the Bank to use the opportunity to tee up the April or June meetings as ‘live’ events for a withdrawal from negative interest rates. The minutes of the meeting will be heavily scrutinised late on 24 March when the transcript is released.

Stay up to date with the latest breaking news and themes driving the market by signing up to our weekly newsletter:

Trade Smarter - Sign up for the Newsletter

Receive timely and compelling market commentary from the team