Japanese Yen Analysis, Price, and Charts

- USD/JPY slides to two-month lows

- Broad Dollar weakness is especially clear in USD / JPY

- Could the end of ultra-loose Japanese monetary policy be in sight?

The Japanese Yen continued a strong run of gains against the United States Dollar on Monday as the monetary stars in both Japan and the US appear to be aligning to strengthen it as they have not for decades.

There’s a clear sense in the market that the Bank of Japan may at least be ready to rein in some of the extraordinary monetary stimulus it has had in place since the early 1990s as it has tried to stoke some domestic pricing pressures. At long last there are signs of those pressures and a chance that they might prove durable as wages rise.

Japan has had negative short-term interest rates for years, along with a huge program of central bank asset buying. The Yen has lagged behind its peers in terms of yield and has usually been bid down as a result.

Wires reported on Monday that the BoJ was absent from the exchange-traded-fund market as perhaps another hint that those extraordinary stimulus efforts are being reined. However, given the Nikkei ’s current altitude, it may simply be that the BoJ has decided it no longer needs much help.

The BoJ meets to set monetary policy again on March 19. It’s important to note that markets have scented a policy exit before and been disappointed. But this time really could be different.

On the Dollar side of things, the prognosis that the Federal Reserve will be cutting rates in the second half of the year remains a base case in the markets, bolstered by the most recent commentary from Chair Jerome Powell. This has sent the greenback broadly lower but its struggle against the Yen is particularly acute.

The week’s main near-term risk event is probably Tuesday’s US inflation data. Any upside surprise is liable to give Dollar bears pause, but anything short of that should see the hammering continue.

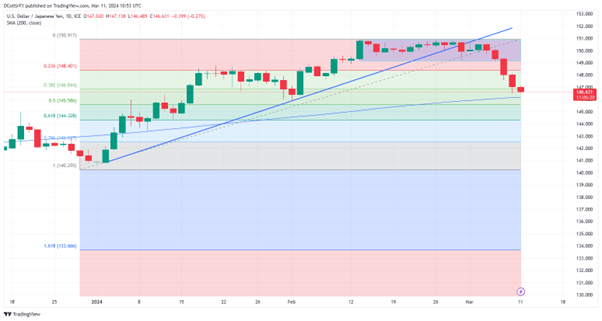

USD/JPY Techncal Analysis

USD/JPY Daily Chart Compiled Using TradingView

February’s apparent range trade took USD/JPY below the medium-term uptrend which had previously been in place since January 2.

February 29’s fall below that line has presaged further deep falls and now Dollar bears are attacking the second Fibonacci retracement of the rise up to mid-February’s peaks from the lows of early January. That comes in at 146.84 and it will be interesting to see whether that can hold on a daily closing basis at the end of Monday’s session.

If it can’t, support at the 200-day moving average of 146.023 will be in the spotlight, ahead of a further retracement prop at 145.586.

Bulls will need to recapture resistance at the former range base of 149.079 if they’re going to swing this market round their way. There seems little sign of their being able to do that, with any pauses in Dollar weakness likely to be merely consolidative for the bears.

Learn how to trade USD/JPY with our free guide: