Euro Forecast: Bearish

- EUR/USD has risen consistently since mid-February

- Markets think the Fed will cut rates first, a scenario which favors Euro bulls

- This week might see consolidation if not necessarily heavy falls for EUR/ USD

Most Read: USD/JPY Sinks on Bets BoJ Will End Negative Rates Soon, US Inflation in Focus

The euro has seen strong gains against the United States dollar in the past few sessions thanks to commentary from both the European Central Bank and the US Federal Reserve.

Fed Chair Jerome Powell said on March 9 that he and his colleagues are ‘not far’ from cutting interest rates. Meanwhile, the European Central Bank left all its monetary policy settings alone for March and, while accepting that the inflation picture seemed more encouraging, suggested that more data will be needed before record-high Eurozone borrowing costs can come down.

Official US labor data saw the overall unemployment rate tick up as wage growth relaxed, two factors clearly taken by the market as keeping rate reductions firmly in focus, even as overall non-farm payroll growth beat expectations.

Want to know where the euro may be headed? Explore all the insights available in our quarterly outlook. Request your complimentary guide today!

In a nutshell the Euro is gaining because all of the above leaves markets with the clear impression that US rates will fall before the Eurozone’s do. However, given that markets remain pretty sure that both will be coming down, the Euro’s current outperformance might seem a little too much, and the prospect of some consolidation only rational.

At any rate the coming week will bring more scheduled economic data action for the Dollar than the Euro. German inflation numbers are on tap Tuesday and will attract attention. Price rises are expected to have decelerated in February, but to remain well the key 2% level. Germany is of course the Eurozone’s largest economy but the ECB’s need to balance the needs of all the others as well may rob these numbers of impact.

Big tradeable numbers out of the US this coming week will include retail sales, consumer sentiment and inflation.

Any or all of these will feed into interest-rate expectations but, on the basis that the Euro is now elevated and, possibly vulnerable, it’s a bearish call this week.

Keen to understand how FX retail positioning can provide hints about the short-term direction of EUR/USD? Our sentiment guide holds valuable insights on this topic. Download it now!

| Change in | Longs | Shorts | OI |

| Daily | 2% | -12% | -3% |

| Weekly | -2% | 11% | 2% |

EUR/USD TECHNICAL ANALYSIS

Chart Compiled Using TradingView

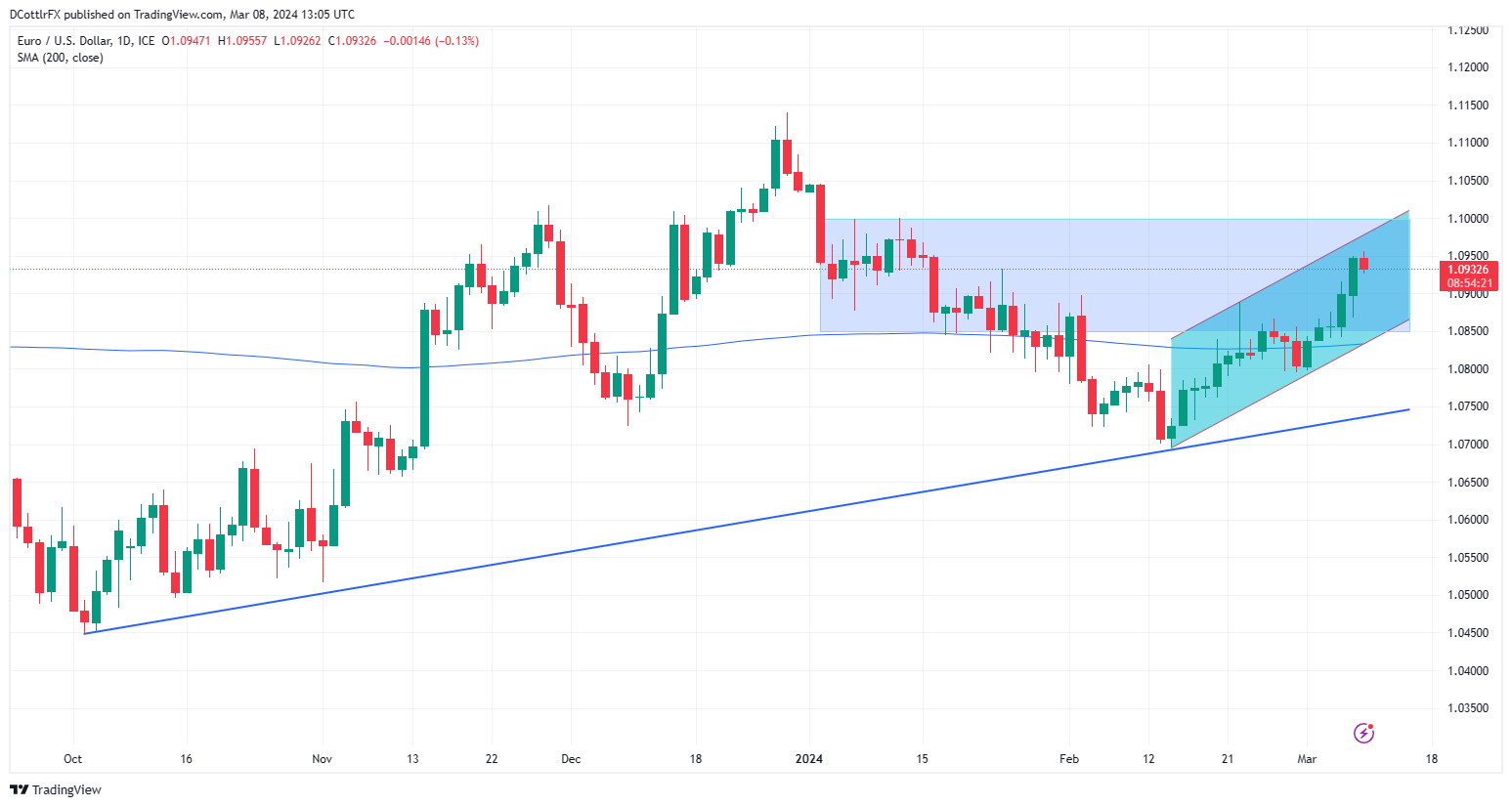

EUR/USD bounced at trendline support of 1.06917 back in mid-February and has risen strongly since with plenty of green candles on the chart. It has now edged back up into a trading band it crashed out of in early February, on the way down to that support.

That band now offers its own support at 1.08524, the intraday low of January 17 and 18. The range top comes in at 1.09981, the intraday peak of January 5 and 11. Any near-term push up to that level would probably leave the Euro looking quite seriously overbought, however, as EUR/USD’s Relative Strength Index has already edged up towards the 70.0 regions which suggests overbuying.

Psychological resistance at 1.10 looks like a tough nut for Euro bulls right now, with sellers emerging on approaches to that level.

The current broad uptrend channel offers near-term resistance at 1.09788, with reversals likely to consolidate ahead of the channel base, now at 1.08282.