USD/JPY FORECAST

- USD/JPY trades higher on Monday, supported by rising U.S. Treasury yields

- The week is marked by high-impact events that could trigger market volatility

- Powell's testimony before Congress and the NFP report will take center stage

Most Read: Gold Breaks Out, EUR/USD Eyes ECB; Powell, BoC & NFP in Focus

USD / JPY climbed upwards on Monday, rising about 0.2% to 150.36, supported by increasing U.S. Treasury yields, with the U.S. 10-year bond back above 4.20% in late morning trading in New York. This week, markets are laser-focused on a series of critical data releases that hold the potential to significantly impact the pair's direction.

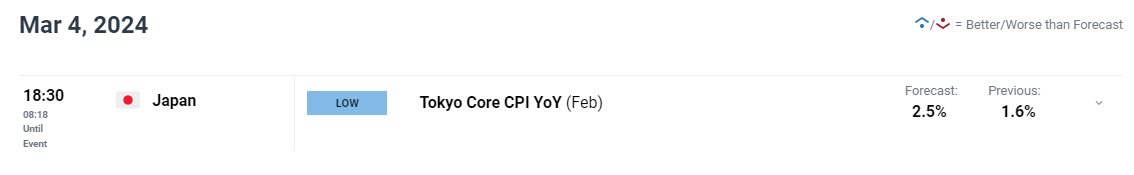

Tokyo's inflation report, a leading indicator for Japan's overall price trends, starts things off today. In terms of expectations, the core CPI gauge is projected to have accelerated to 2.5% y-o-y in February from 1.6% previously. A higher-than-anticipated print may prompt the Bank of Japan to rethink negative rates sooner, which could benefit the yen.

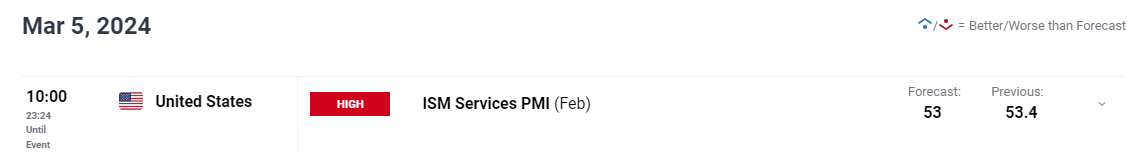

In the U.S., Tuesday's ISM services report will be a key focus. Analysts anticipate a modest decline in the February headline PMI index to 53.0 from the previous reading of 53.4. Traders should be aware that any significant deviation from this forecast could spark volatility by altering expectations surrounding the U.S. central bank’s policy outlook. The stronger the data, the better for the U.S. dollar .

Eager to gain clarity on the U.S. dollar's future trajectory? Access our quarterly trading forecast for expert insights. Secure your free copy now!

Wednesday brings Fed Chair Powell's Semiannual Monetary Policy Report to Congress. His testimony before the House Financial Services Committee will be closely scrutinized for insights into the timing of the first FOMC rate cut of the cycle. If Powell reaffirms his message that policymakers are "in no hurry to ease rates," we could see USD/JPY drift higher in the coming days.

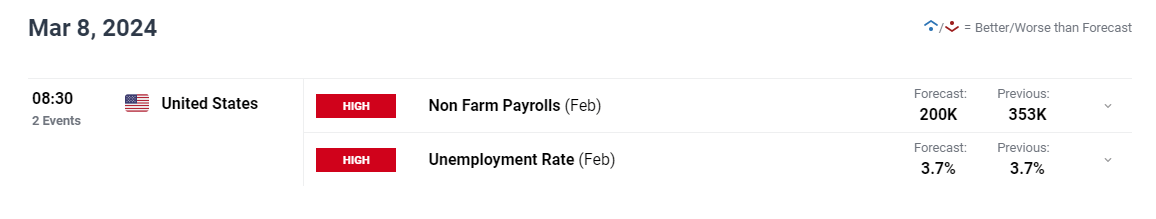

The week caps off with the all-important February U.S. nonfarm payrolls report. Wall Street ’s consensus anticipates 200K jobs added, but recent employment data has consistently outperformed expectations. That said, a notably strong report might indicate continued labor market resilience, potentially pushing back the Fed's rate-cutting timeline. This scenario should keep USD/JPY biased to the upside for now.

Want to stay ahead of the yen's next big move? Delve into our quarterly forecast for comprehensive insights. Request your complimentary guide now to keep abreast of market trends!

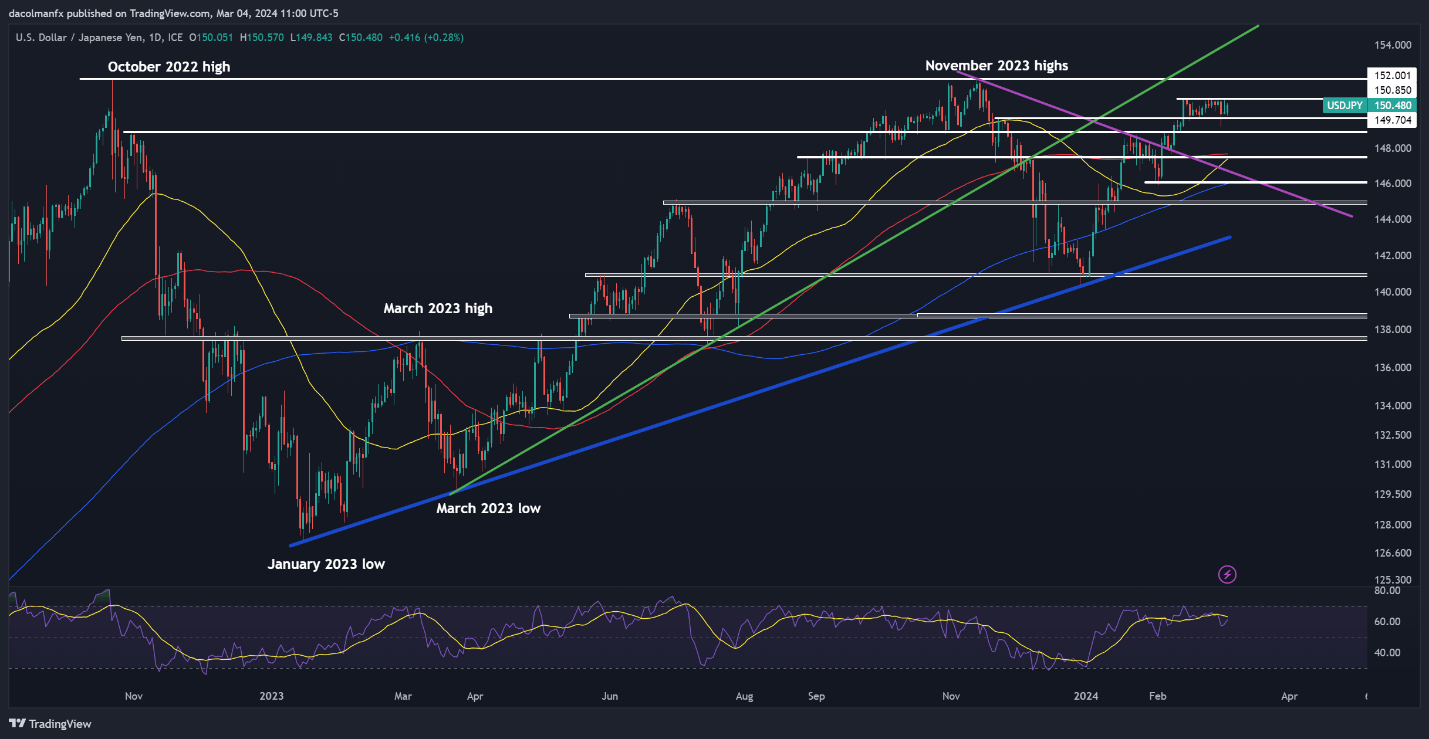

USD/JPY TECHNICAL ANALYSIS

After bouncing off technical support late last week, USD/JPY climbed further on Monday, steadily approaching horizontal resistance at 150.85. Bears must vigorously defend this ceiling to dampen bullish sentiment; a failure to do so may trigger a rally towards last year's peak around the 152.00 mark.

On the other hand, if sellers mount a comeback and push prices lower, support can be identified near 149.70. Below this key floor, focus would shift towards 148.90, and subsequently towards 147.50, coinciding with the 100-day and 50-day simple moving averages.

USD/JPY FORECAST - TECHNICAL CHART