Gold Price and Analysis

- Gold ’s backdrop remains positive and may lead to further gains.

- Retail trader positioning is 50/50.

Last week’s rally saw gold post a fresh record high before a sharp sell-off left the precious metal relatively unchanged on the week. Last week the Federal Reserve gave markets a nudge that they are likely to shave 75 basis points off the Fed Fund rate this year, in line with prior messaging. The more positive tone taken by Fed Chair Powell gave the precious metal the impetus to post a new ATH before sellers appeared and pushed gold lower. The US dollar index turned higher Thursday, post-BoE policy meeting, as both the Euro and the British Pound weakened. This USD strength weighed on gold going into the weekend.

While the USD firmed, US bond yields continued to drift lower in anticipation of a lower Fed Fund rate. The rate-sensitive US 2 year ended the week around 14 basis points lower, while the benchmark US 10 year ended last week 11 basis points lower. While a short-term stronger US dollar will temper further gold upside, lower US bond yields may well push prices higher and see last Thursday’s ATH tested again.

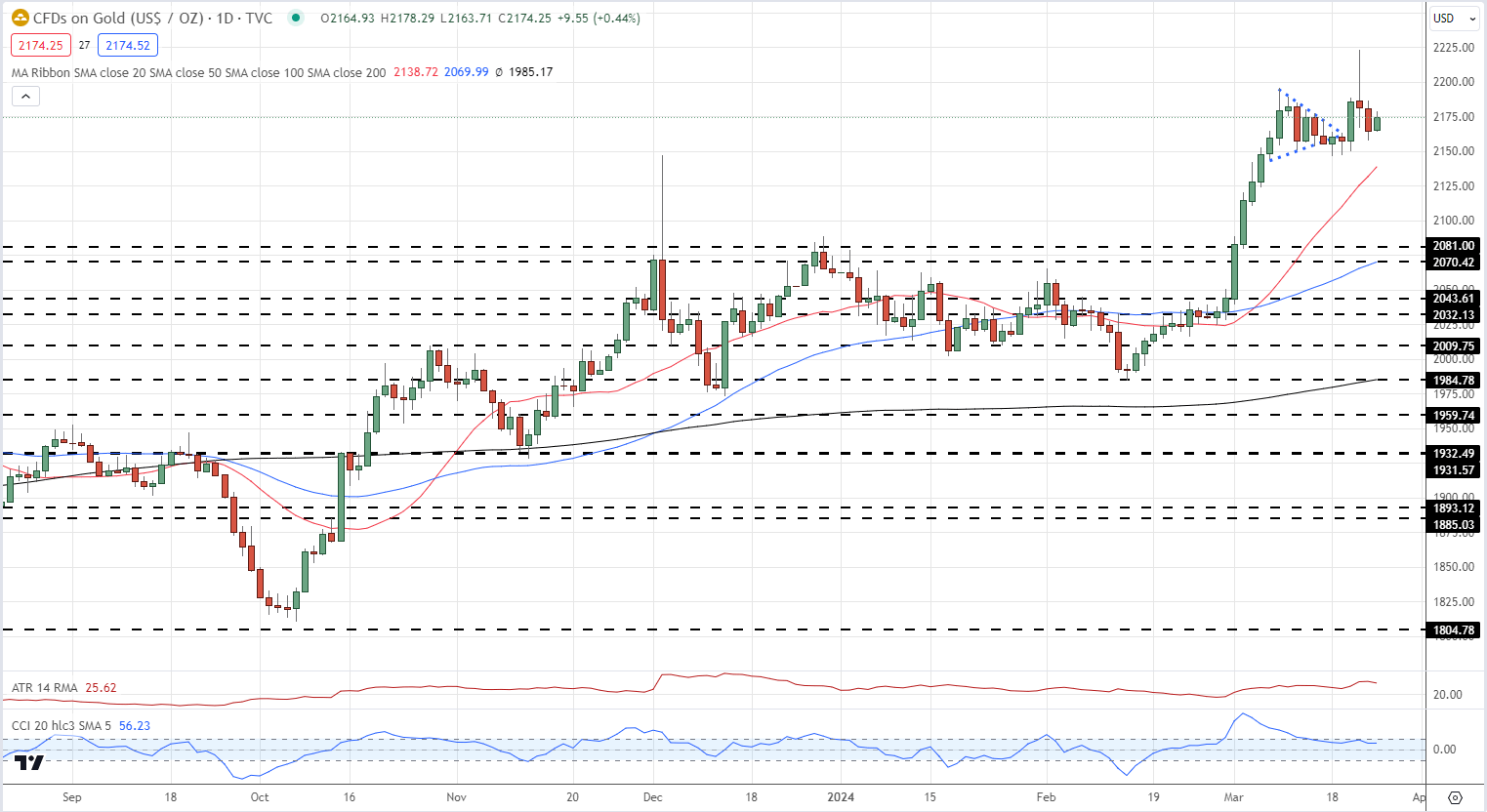

After completing a bullish pennant pattern last week, the daily gold chart is now looking to build another bullish set-up. The current sideways price action may turn into a bullish flag pattern, and this would likely see gold pushback above $2,200/oz. and test the ATH at just under $2,225/oz. Reasonable first-line support seen a fraction under $2,150/oz.

Gold Daily Price Chart

Chart via TradingView

Retail trader data shows 50.43% of traders are net-long with the ratio of traders long to short at 1.02 to 1.Traders have remained net-long since Mar 01 when Gold traded near 2,082.75, the price has moved 4.24% higher since then. The number of traders net-long is 11.14% higher than yesterday and 7.51% higher than last week, while the number of traders net-short is 6.18% higher than yesterday and 16.42% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall

| Change in | Longs | Shorts | OI |

| Daily | 7% | -7% | 0% |

| Weekly | 16% | -17% | -3% |