FOMC DECISION – MARCH MEETING

- The Federal Reserve leaves interest rates unchanged at the end of its March meeting, in line with expectations

- The 2024 policy outlook remains the same, with the Fed still signaling 75 basis points of easing for the year

- Gold prices head higher as the U.S. dollar and yields take a turn to the downside

Most Read: UK Inflation Falls to a Two-Year Low, GBP/USD Stable for Now

The Federal Reserve on Wednesday left its benchmark interest rate unchanged at its current range of 5.25% to 5.50% after concluding its March policy gathering, keeping borrowing costs on hold for the fifth consecutive meeting, in line with consensus estimates. In addition, policymakers made no adjustments to their ongoing quantitative tightening program, just as expected.

Focusing on the statement, the Fed maintained an upbeat view of the economy, noting that macroeconomic indicators suggest activity has been expanding at a solid pace and that the unemployment rate remains low. Turning to consumer prices , the central bank reiterated that inflation has eased over the past year, but persists at elevated levels.

In terms of forward guidance, the FOMC restated that it does not expect it will be appropriate to remove policy restrain until it has gained greater confidence that inflation is converging sustainably toward the 2.0% target. This message, echoing January's communication, suggests officials are seeking additional reassurance on disinflation before pivoting to a looser stance.

Source: Economic Calendar

Wondering about the U.S. dollar’s prospects? Gain clarity with our latest forecast. Download a free copy now!

FED SUMMARY OF ECONOMIC PROJECTIONS

GDP , UNEMPLOYMENT RATE AND CORE PCE

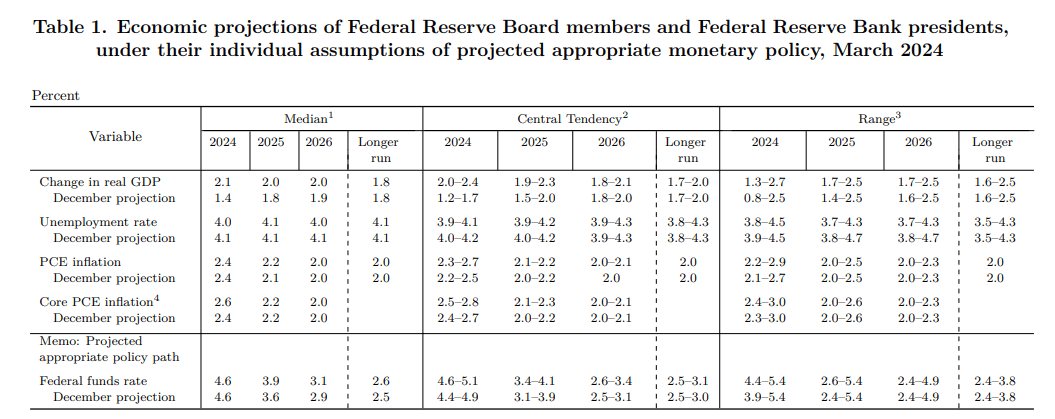

The March Summary of Economic Projections revealed important revisions compared to the quarterly estimates submitted in December of last year.

First off, GDP growth projections for 2024 were upgraded to 2.1% from 1.4% previously, pointing to increased confidence in the economy's resilience and its capacity to steer clear of a recession.

Turning to the labor market, the outlook for the unemployment rate for this marked down to 4.0% from 4.1%, suggesting the Fed doesn't anticipate widespread layoffs over the medium term.

On the inflation front, the Fed revised upwards its 2024 forecast for the core PCE deflator to 2.6% from the previous 2.4%, a sign that price pressures are expected to remain sticky for an extended period.

FED DOT PLOT

The dot plot, outlining Federal Reserve officials' expectations for the trajectory of interest rates over several years and the long run experienced notable changes compared to the previous version presented three months ago.

Back in December, the Fed projected borrowing costs to end 2024 at 4.6%, suggesting three quarter-point rate cuts for a total easing of 75 basis points. Today's iteration shows the same outlook, indicating policymakers may not be overly worried about firming inflationary pressures just yet.

Looking ahead to 2025, officials see rates falling to 3.9%, slightly above the previously forecasted 3.6%.

In addition, the central bank raised its projection for the long-run federal funds rate from 2.5% to 2.6%, perhaps reflecting structural shifts in productivity or enduring price pressures. This adjustment is slightly hawkish, but markets appear more concerned about the near-term outlook for now.

The following table provides a summary of the Federal Reserve's updated macroeconomic projections.

MARKET REACTION AND IMPLICATIONS

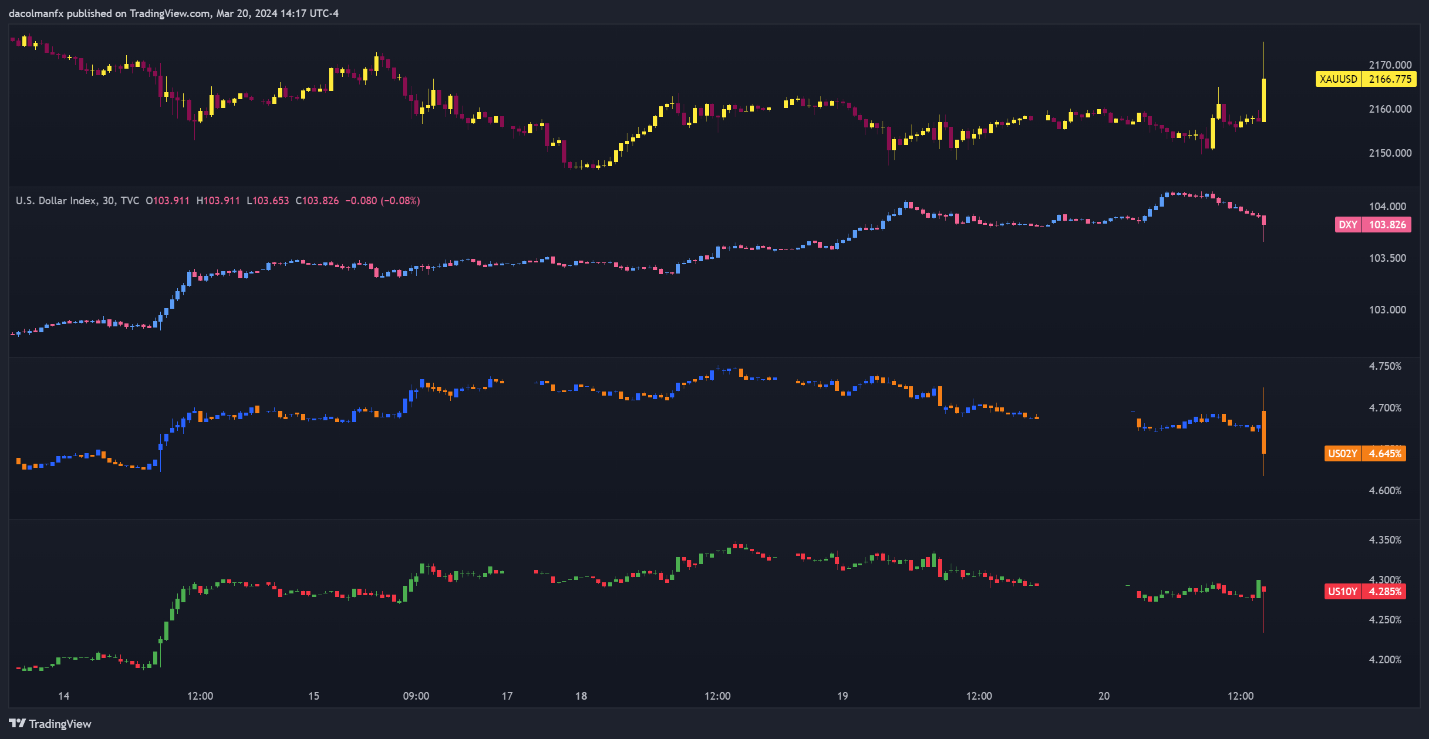

Shortly after the Fed's decision was announced, gold prices pushed higher, propelled by the pullback in the U.S. dollar and yields. The indication that the Fed is still intent on delivering three quarter-point rate cuts this year is having a bearish effect on the greenback at the time of writing. For a clearer understanding of the Fed's monetary policy outlook, however, traders should attentively monitor Chairman Powell's press conference. In any case, today’s reaction could still reverse given the upside revision to the long-term equilibrium rate.

US DOLLAR, YIELDS AND GOLD PRICES CHART

Source: TradingView