GBP/USD and FTSE 100 Analysis and Charts

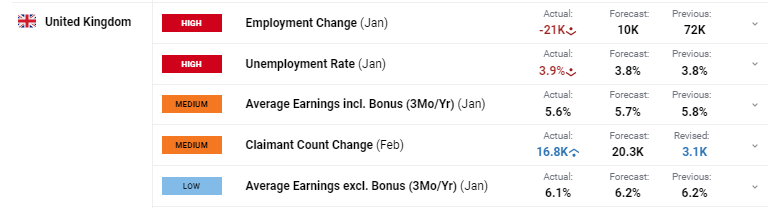

- UK unemployment rises to 3.9%.

- Data unlikely to move the dial on future interest rate cuts.

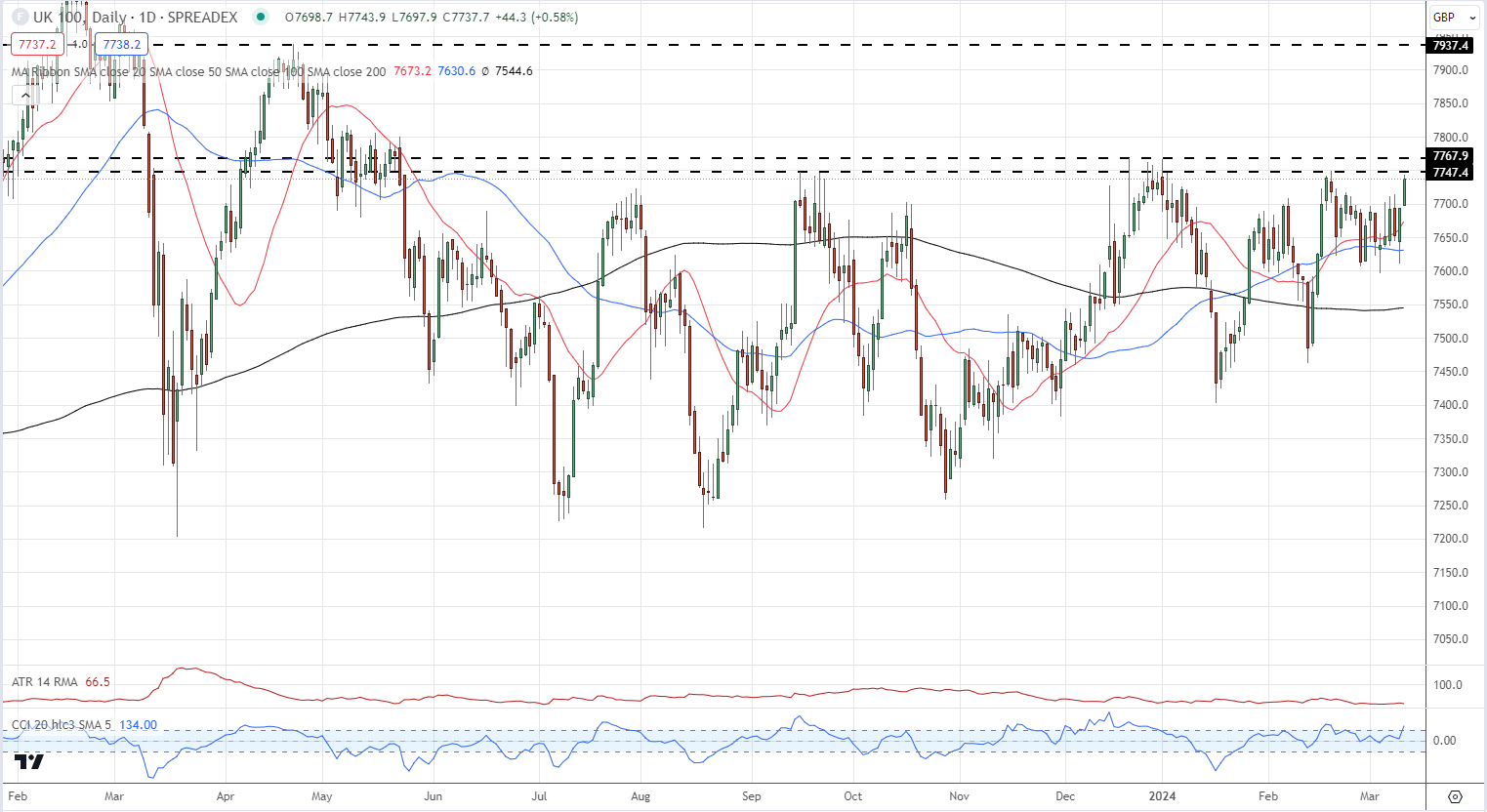

- FTSE 100now pressing against a zone of multi-month resistance.

Most Read: Markets Week Ahead - Gold Soars, Rate Cuts Near, Nasdaq and Nvidia Wobble

The latest Office for National Statistics jobs and wages data shows the UK labor market starting to cool with wages slipping and the unemployment rate nudging higher. Both moves were marginal and while today’s report will have buoyed the Bank of England, UK rate cut expectations are little moved and still point to the August MPC for the first Bank Rate cut.

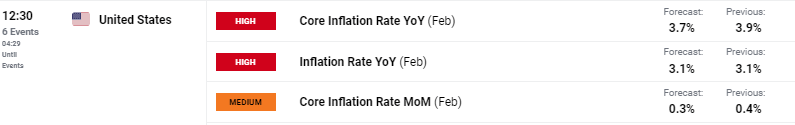

Later today -12:30 UK – the latest US inflation report will be released and this is set to be the main driver of price action in today’s session.

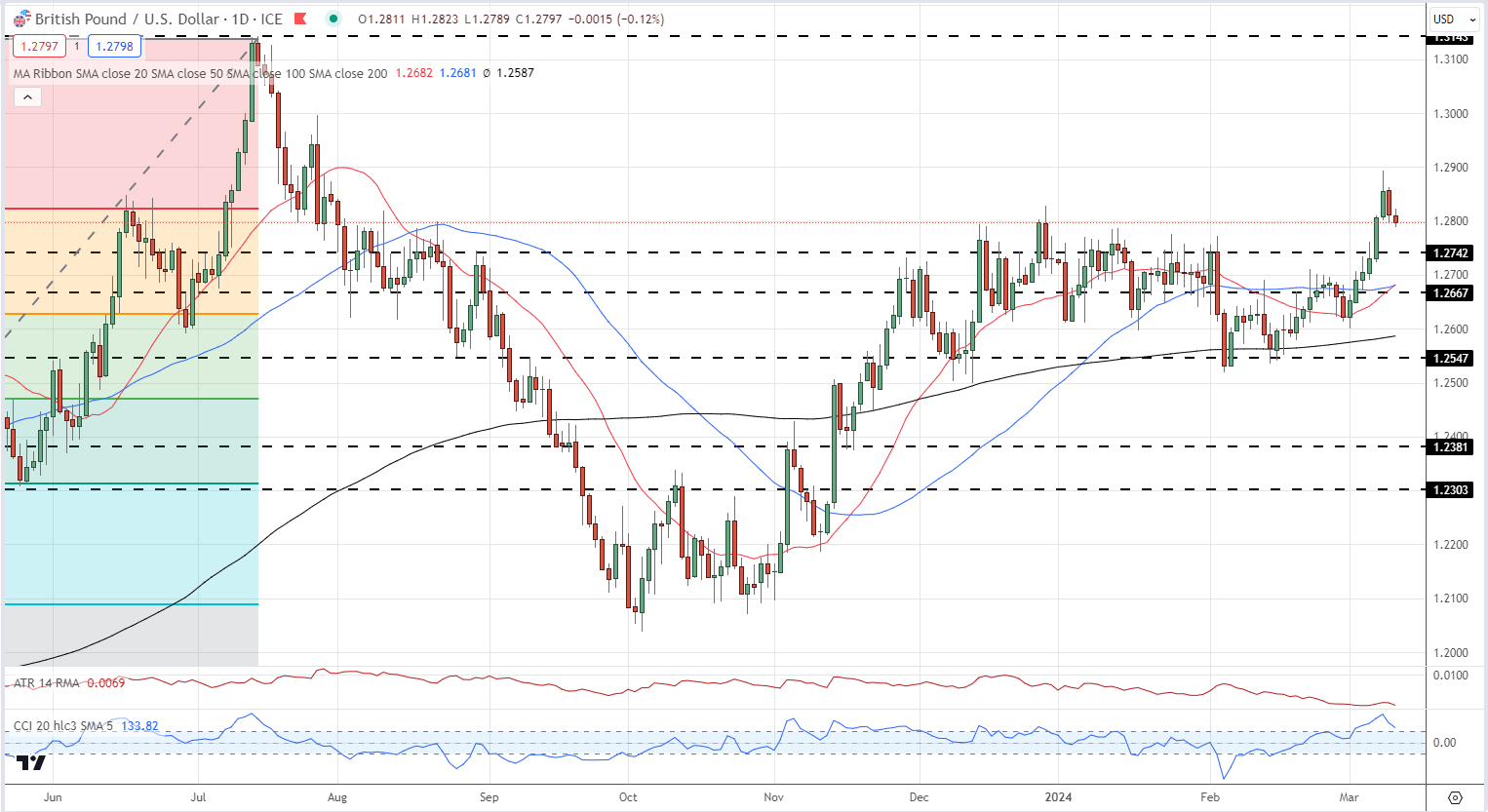

GBP/USD hit a seven-month high of 1.2894 last Friday and has eased lower since. Cable currently trades around 1.2800, just above a zone of support between 1.2740 and 1.2780. A move higher brings last Friday’s high back into play before a gap to 1.3000.

GBP/USD Daily Price Chart

IG Retail data shows 38.25% of traders are net-long with the ratio of traders short to long at 1.61 to 1.The number of traders net-long is 18.49% higher than yesterday and 6.35% lower than last week, while the number of traders net-short is 5.54% lower than yesterday and 9.01% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP / USD prices may continue to rise.

See How IG Client Sentiment Can Help Your Trading Decisions

| Change in | Longs | Shorts | OI |

| Daily | 0% | -9% | -4% |

| Weekly | 2% | -6% | -1% |

The FTSE 100 is pushing higher again today and is nearing a cluster of prior highs around the 7,750 area. Above this zone, there is little in the way of strong resistance until the April 2023 high at 7937. Tomorrow’s UK GDP data – 07:00 UK – may make or break a move higher.

FTSE 100 Daily Chart