Most Read: US Dollar Falls Further After US NFP Beat but January Number Revised Sharply Lower

USD/JPY extended losses and sank to its lowest level since early February on Friday, supported by speculations that the Fed may be closer to getting greater confidence that inflation is on a sustained path towards the 2.0% target to start reducing borrowing costs.

The dollar's lackluster performance before the weekend was compounded by the February employment report, which revealed a spike in the unemployment rate to its highest level in two years. This raised concerns about potential cracks appearing in the U.S. labor market.

However, the main factor behind USD / JPY 's retreat was likely the media leak that the Bank of Japan is warming up to the idea of ending negative rates at its March meeting , spurred by expectations of substantial pay raises in this year's annual wage discussions between unions and big businesses.

Curious about what lies ahead for the Japanese yen? Find comprehensive answers in our quarterly trading forecast. Claim your free copy now!

Previously, we contended that a lasting yen recovery seemed unlikely and not imminent, at least until the BoJ finally pulled the trigger and relinquished its extremely accommodative position. With that moment drawing nearer, the Japanese currency could be on the brink of a robust comeback.

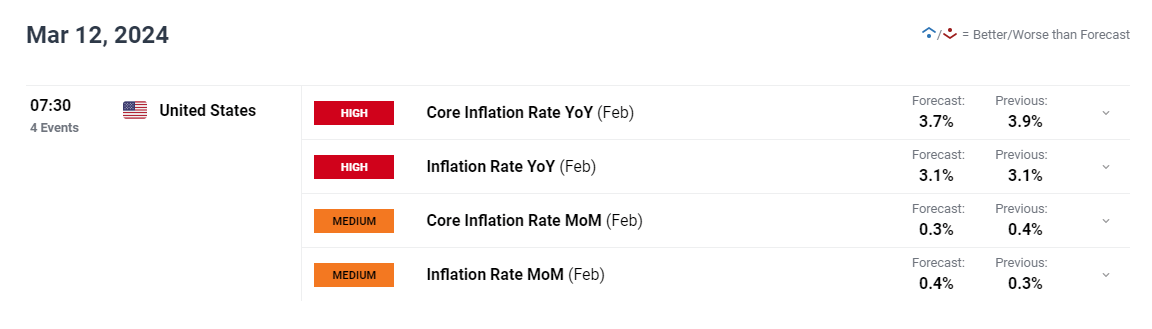

While the outlook for USD/JPY is starting to dim, its near-term fate is not yet decided. For example, if next week's U.S. CPI report surprises to the upside as in the previous month , there can be room for a brief rebound before a more sustained pullback later in the year. For this reason, traders should closely watch the inflation release.

UPCOMING US CPI DATA

Source: Economic Calendar

Interested in understanding how FX retail positioning may influence USD/JPY’s trajectory? Discover key insights in our sentiment guide. Download it now!

| Change in | Longs | Shorts | OI |

| Daily | -11% | -3% | -4% |

| Weekly | -18% | -3% | -6% |

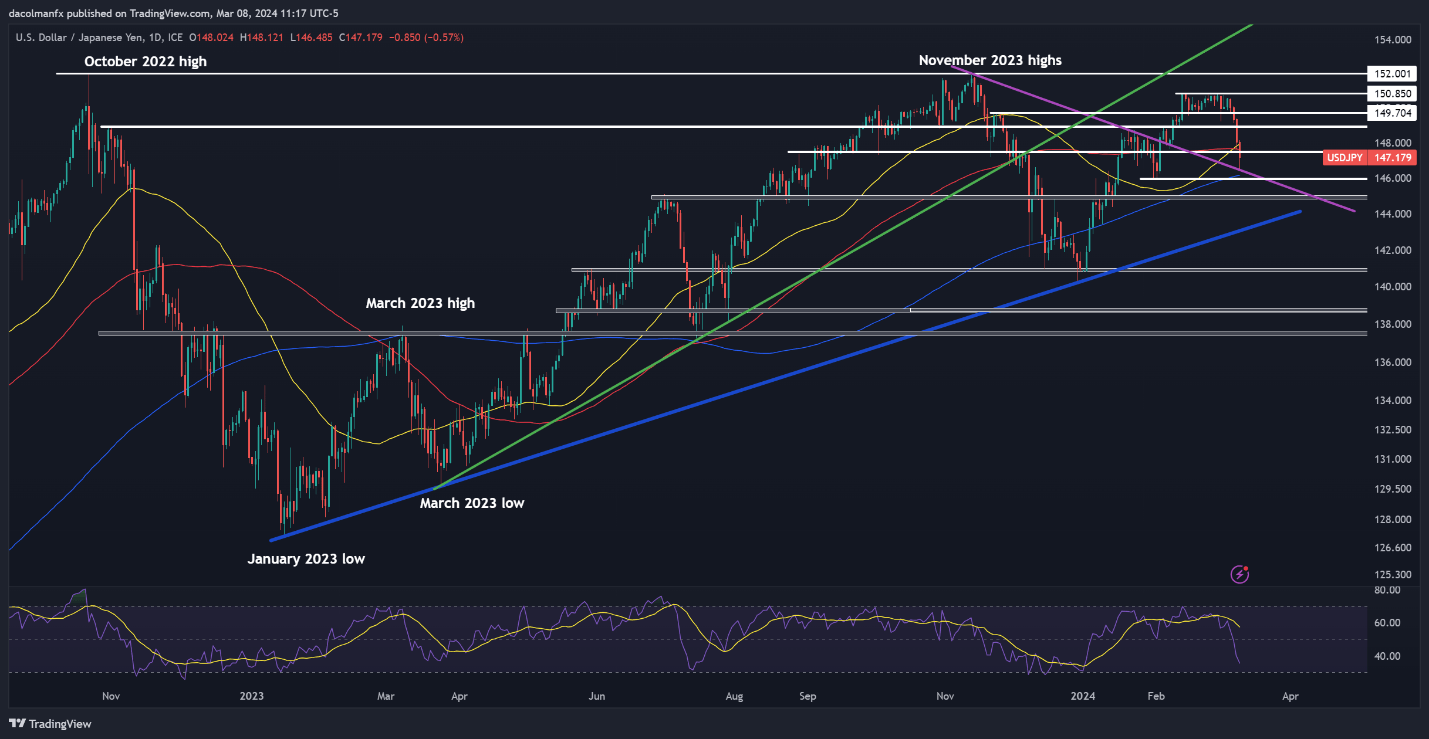

USD/JPY FORECAST - TECHNICAL ANALYSIS

USD/JPY retreated further on Friday, sinking below support at 147.85/147.50 and hitting its lowest mark in more than a month. If this breakdown is sustained, the next key floor to watch emerges at 146.60, followed by 146.10, the 200-day simple moving average. Below this area, all eyes will be on 145.00.

On the flip side, if buyers mount a comeback and spark a bullish reversal unexpectedly, resistance looms at 147.50/147.85 and 148.90 thereafter. On continued strength, market attention is likely to transition towards 149.70, followed by 150.90.

USD/JPY PRICE ACTION CHART