EUR/USD Prices, Charts, and Analysis

- EUR/USD edges back below 1.0900 after ECB policy decision.

- US NFPs are the next driver of EUR / USD price action.

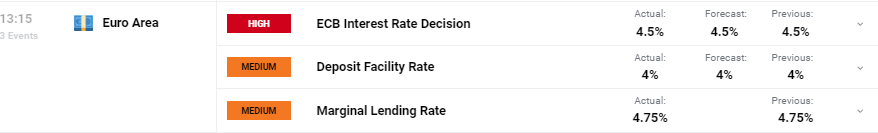

The European Central Bank kept all three key interest rates unchanged at today’s meeting, in line with market expectations. The central bank also released revised staff projections inflation and growth projections.

‘Staff now project inflation to average 2.3% in 2024, 2.0% in 2025 and 1.9% in 2026. The projections for inflation excluding energy and food have also been revised down and average 2.6% for 2024, 2.1% for 2025 and 2.0% for 2026… Staff have revised down their growth projection for 2024 to 0.6%, with economic activity expected to remain subdued in the near term. Thereafter, staff expect the economy to pick up and to grow at 1.5% in 2025 and 1.6% in 2026, supported initially by consumption and later also by investment.’

For all market-moving economic data and events, see the real-time Economic Calendar

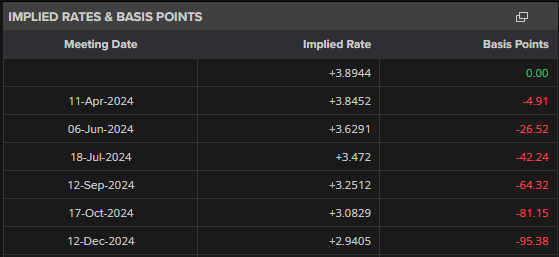

Market projections for the first ECB 25 basis point rate cut remain firmly centered on the June 6th meeting with a total of just under 100 basis points of cuts predicted in 2024.

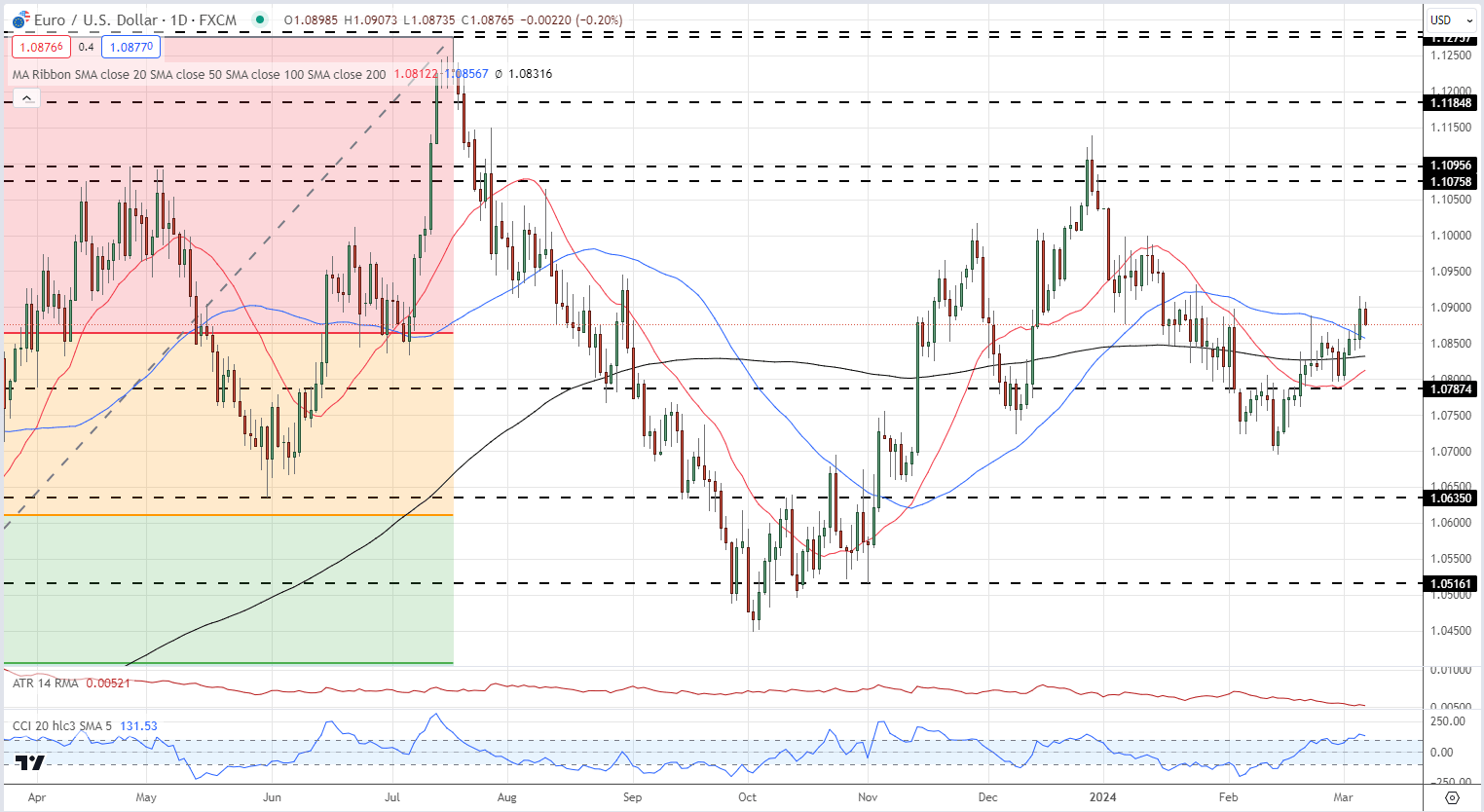

EUR/USD moved a fraction lower post-decision after having tested, and rejected, the 1.09 handle yesterday and today. A cluster of recent highs and lows, and the 50- and 200-day simple moving averages, guard the way back down to 1.0800, while a confirmed break above 1.0900 brings 1.0950 and 1.1000 into focus.

EUR/USD Daily Price Chart

Chart via TradingView

Retail trader data shows 42.38% of traders are net-long with the ratio of traders short to long at 1.36 to 1.The number of traders net-long is 1.91% lower than yesterday and 10.73% lower than last week, while the number of traders net-short is 4.39% higher than yesterday and 18.79% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

| Change in | Longs | Shorts | OI |

| Daily | 2% | -12% | -3% |

| Weekly | -2% | 11% | 2% |