S&P 500, Nasdaq News and Analysis

- S&P 500 gaps lower, lead by moves lower in Apple, Tesla and AMD. Nvidia holding firm

- Massive sales drop adds to negative sentiment after Apple fined $2 billion

- Tesla sinks after the EV maker experienced poor Chinese sales and a factory fire

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

S&P 500 Gapped Lower, Lead by Apple, Tesla and AMD

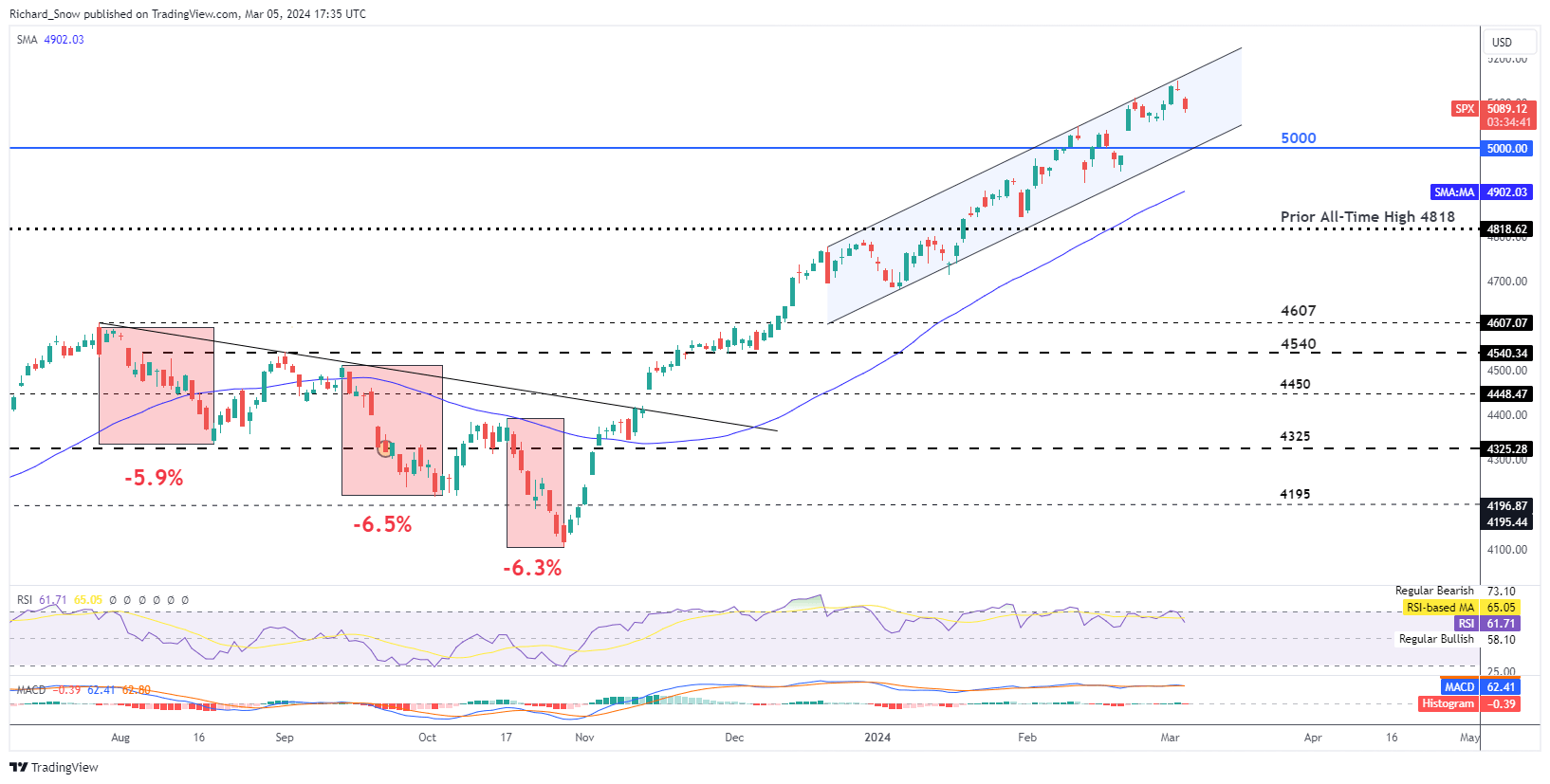

The S&P 500 gapped lower today after Apple was hit with a fine yesterday and Tesla’s Chinese sales dropped by 25%, sending tech stocks lower. However, the index remains within the broader bull trend denoted by the blue upward sloping channel which encapsulated the majority of price action since the turn of the new year.

The anticipation of multiple rate hikes this year buoyed stocks and even when a robust US economy forced those expectations down, US stocks soldiered on, spurred by global AI mania and the rush for advanced computer chips used to power AI processes.

The S&P 500 now appears to have tested channel resistance once again and thanks to negative news from Tesla, Apple and AMD, has pulled back, even gapping lower at the open today. The 5,000 mark is the next level of support and loosely coincides with channel support, however, prices would still have some way to go before then and prior pullbacks have been extremely shallow.

S&P 500 Daily Chart

Source: TradingView, prepared by Richard Snow

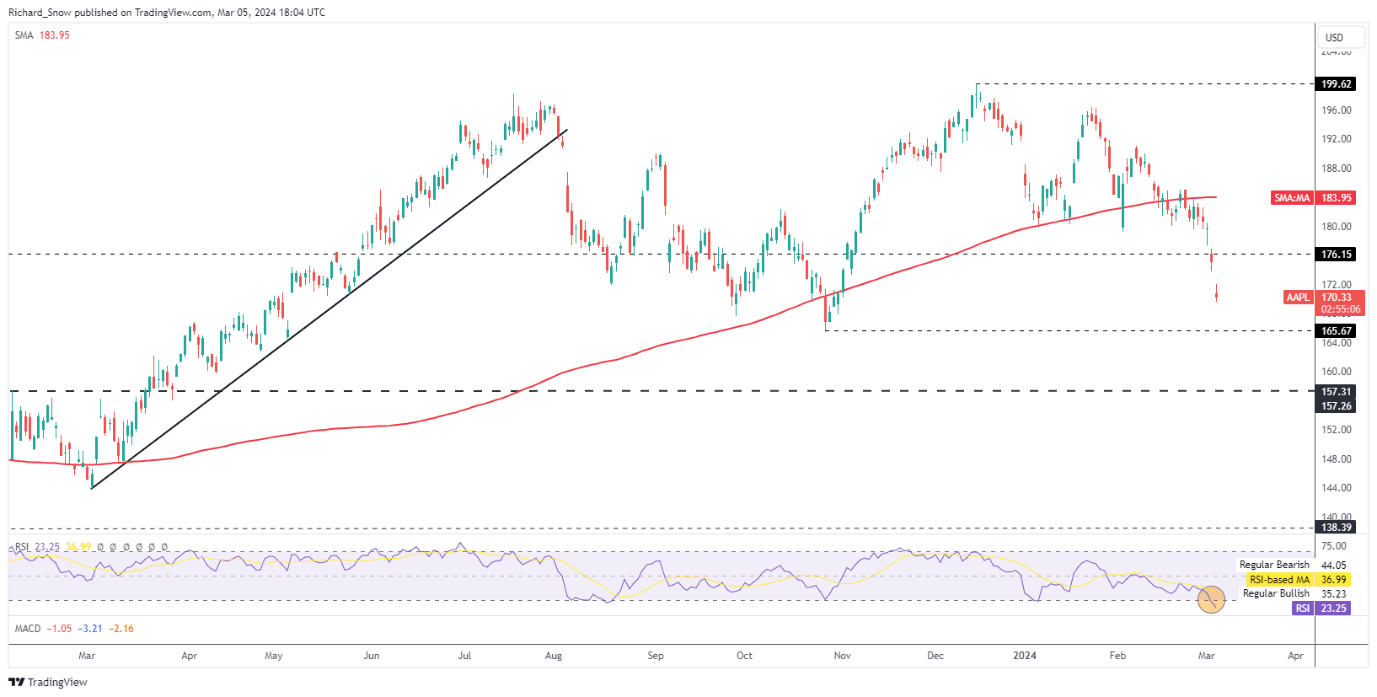

Massive Sales Drop Adds to Negative Sentiment after Apple Fined $2 Billion

Apple was fined by a European court for anti-trust breaches and its treatment of Spotify on its Apple iStore which was made worse by news that Apple sales in China plunge 24% as its competitor Huawei gains traction. The negative news surrounding the stock have exacerbated the existing decline that ensued early in 2024.

Now the stock has gapped lower two days in a row as the negative news filters in. Prices have breached the prior level of support at 176.15 and have 165 in sight but the RSI is oversold currently, meaning that the fast drop could slow in the coming sessions as things cool down.

Apple Daily Chart

Source: TradingView, prepared by Richard Snow

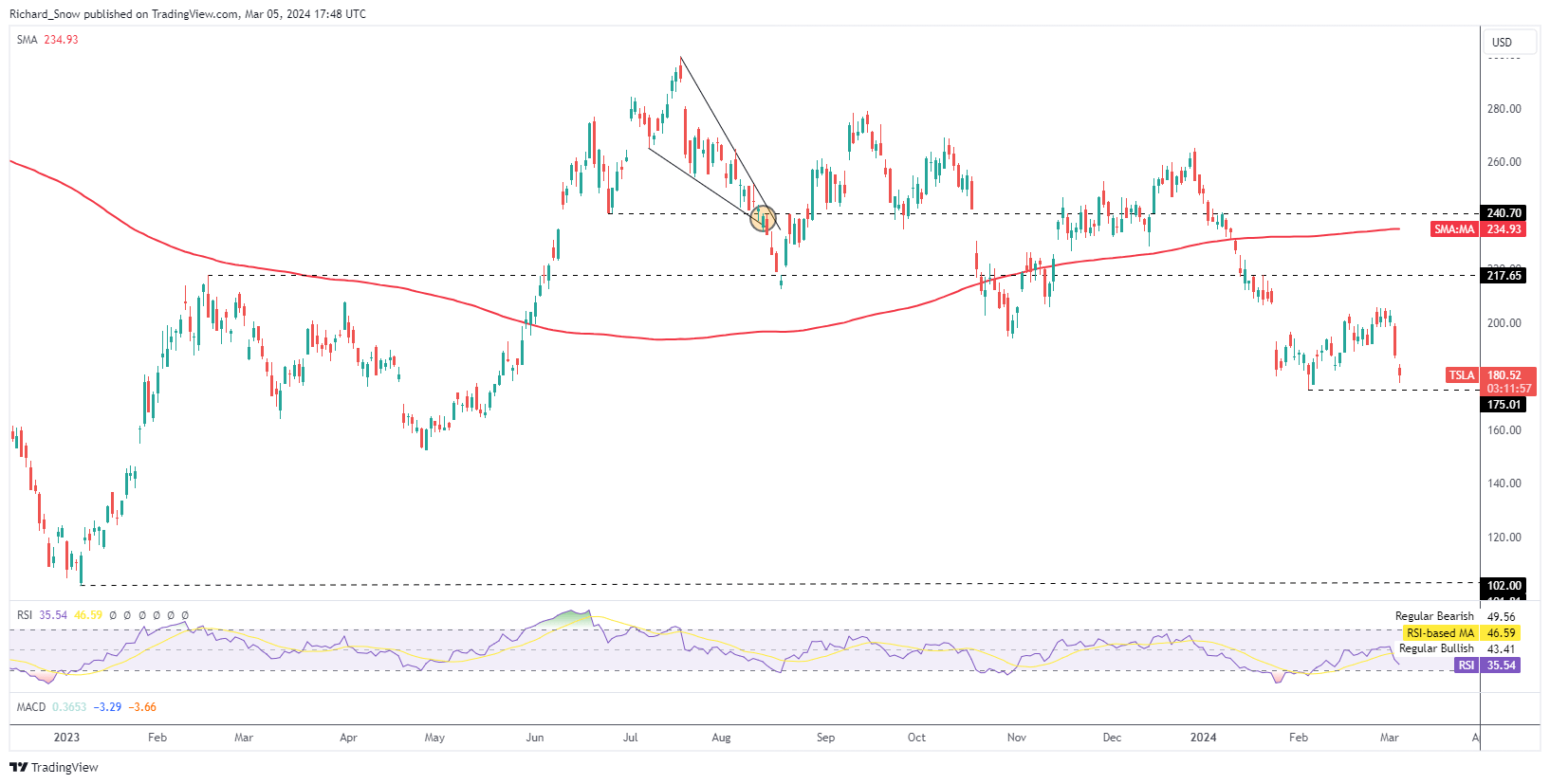

Tesla Sinks after the EV Maker Experienced Poor Chinese Sales, Factory Fire

Tesla, like Apple, has also fared rather poorly in the sales department as Chinese sales dropped to the lowest level in the past 12 months. In addition, a suspected arson attack at its German plant has halted operations with losses likely to be somewhere in the hundreds of millions (euros) according to Reuters.

Tesla has also witnessed a general move lower for some time with the recent negative news only accelerating it in recent sessions. Imminent support appears at the February low of $175 and with the RSI not yet in oversold territory, there may still be room for the bearish move to run. Resistance lies at the late Feb high of $205.60.

Tesla Daily Chart

Source: TradingView, prepared by Richard Snow

If you're puzzled by trading losses, why not take a step in the right direction? Download our guide, "Traits of Successful Traders," and gain valuable insights to steer clear of common pitfalls:

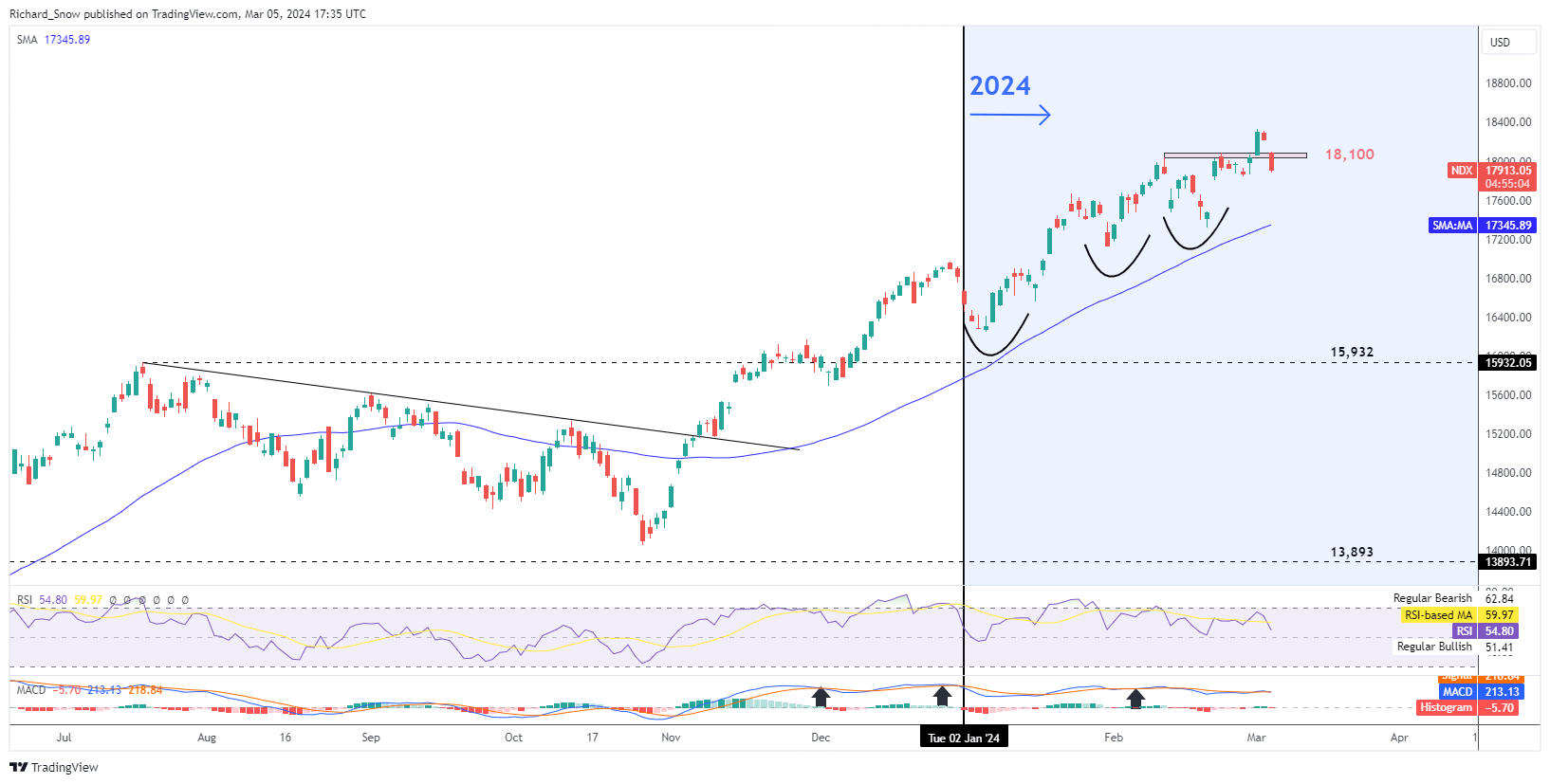

The Nasdaq Sees Notable Gap Lower, Surpassing Prior Support Zone

The tech-focused Nasdaq 100 Index sank below the prior zone of resistance which offered up some support ahead of the open today at 18,100. In the end it didn’t prove to offer much support and prices continue to trade well below it but the key is to see a close below the zone if we are to see a potential continuation towards the 50-day simple moving average (SMA).

The Nasdaq is still at elevated levels thanks to the outstanding performance of Nvidia and the positive outlook for the company for Q1 2024. Nvidia appears to be trading flat on the day at the time of writing and may resist the general declines seen elsewhere as investors may see the pullback as a time to take profits.

Nasdaq 100 Daily Chart

Source: TradingView, prepared by Richard Snow

Powell in focus tomorrow and Thursday, then the ECB decision and finally on Friday, markets will all be focused on the NFP data and whether we will see a more moderate rise in the jobs market for February.

--- Written by Richard Snow for .com

Contact and follow Richard on Twitter: @RichardSnowFX