Crude Oil Price and Analysis

- US Crude oil benchmark prices have stopped falling at their uptrend line

- The $79 level remains in play as the level at which the Washington may like to buy

- Apart from this the market is short of near-term positives

Crude oil prices got a lift on Thursday, reportedly on expectations that the United States could buy near current levels to replenish its Strategic Reserve.

The Reserve was depleted by an historic sale back in 2022 and Washington doesn’t want to pay any more than $79/barrel to top it up. The US crude market isn’t far from that point now.

Support from this quarter came none too soon for a market short of positives.

Prices were knocked this week by news of sharply rising US stockpiles and the prospect of a ceasefire between Israel and Hamas in Gaza. The Federal Reserve didn’t help oil bulls’ cause on Wednesday. It left borrowing costs alone, as was expected, but continued to worry aloud about the resilience of inflation. Now markets which had expected interest rate cuts to begin in the first quarter of this year will count themselves lucky if they see one by the fourth.

Of course, the economic resilience that has prompted the Fed’s caution is hardly in itself bad news for oil demand in the world’s largest economy. But such is the link between credit costs and everything else that oil markets took a dive anyway.

The major scheduled trading cue for oil this week will be much the same as for all other markets; the official US labor-market snapshot for April, released on Friday. It will include the headline non-farm payrolls count, with a chunky 243,000 gain expected. That or better will surely see rate-cut doubts increase further.

Closer to the oil market, the Baker Hughs oil-rig count is also coming up on Friday.

US Crude Oil Technical Analysis

Learn how to trade oil with our expert guide - it's free

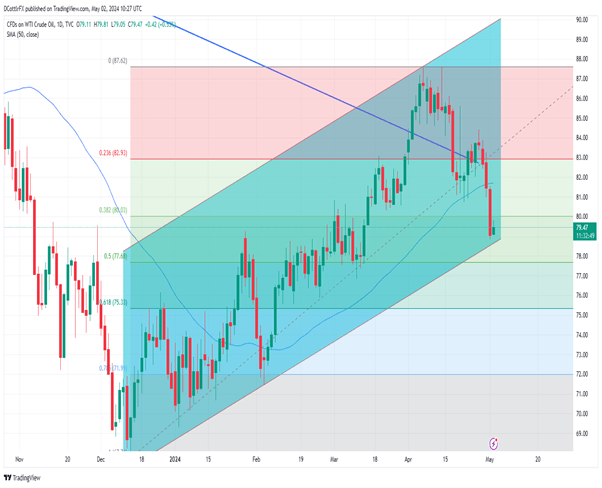

US Crude Daily Chart Compiled Using TradingView

The West Texas Intermediate benchmark price has bounced very close to the uptrend channel base which has been in place since early December. Before this week It hadn’t faced a serious test since February 5, but price action suggests that it remains relevant.

It now offers support at $78.55 with a retracement prop at $77.68 lying in wait to catch falls below that mark. Bulls will want to get back above resistance provided by another retracement level at $80.21. This is quite close to the current market. A durable rise above that level will allow those bulls to contemplate taking back this week’s heavy falls, but they’ll need to top psychological resistance at $83.00 to do so.

It will be fascinating to see whether the downtrend line from December 2022 can continue to cap the market. Prices have edged above that point this year but didn’t stay there for long. It now offers resistance at $82.45.