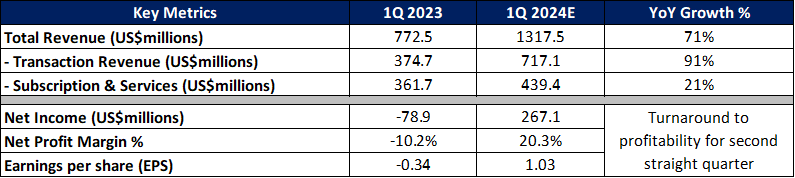

Coinbase (COIN) is set to release its quarter one (Q1) 2024 financial results on 2 May 2024, after the US market closes.

Coinbase’s 1Q 2024 results – what to expect

Expectations are for Coinbase’s Q1 revenue to register a 71% year-on-year (YoY) growth to US$1.3 billion, up from US$772 million a year ago. This will be the highest quarterly revenue growth since 4Q 2021, supported by a potential near-doubling of its transaction revenue from a year ago.

Earnings per share is expected to come in at US$0.97. This will mark the second straight quarter of profitability and a continued turnaround from its losses a year ago.

Green light for Bitcoin ETFs, the risk-on appetite may support higher trading volume

Since the US Securities and Exchange Commission (SEC) gave the green light for the first spot Bitcoin exchange-traded funds (ETF) in the US on 10 January 2024, the crypto market saw a renewed surge in interest to start the year. Bitcoin, which takes up around 29% of Coinbase’s transaction revenue, was up 69% during the first quarter of this year. Ethereum , which takes up around 13% of Coinbase’s transaction revenue, was up 60%.

Being the largest cryptocurrency exchange in the US, greater accessibility to cryptocurrencies through ETFs may translate to higher trading volumes coming through the Coinbase platform.

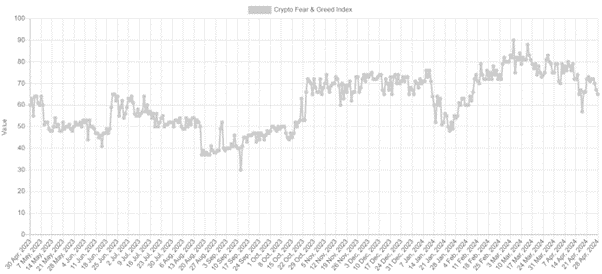

Broad expectations for improving macroeconomic conditions in 2024 have also uplifted market risk appetite and improved sentiments in the cryptocurrency space, which is known to be highly volatile. While the Crypto Fear & Greed Index has eased off its recent peak lately, it continues to hover in ‘greed’ territory around levels seen in late-2023.

Looking ahead, Hong Kong has given initial approval to its first spot Bitcoin and Ether ETFs on 15 April 2024, while Australia is also expected to follow in the footsteps of the US and Hong Kong, with chatters of approval for spot-Bitcoin ETFs by the end of 2024. The trend for wider adoption may potentially drive more traction across the cryptocurrency space, which has a positive knock-on impact on Coinbase.

Fee reduction to fend off competition on watch

Back in February this year, Coinbase announced fee reduction for high-volume traders to step up against its competitors and to boost its institutional business. High-volume traders can now get upgraded to lower fee tiers by providing proof of over $500,000 in monthly trading volume on other crypto exchanges.

In 4Q 2023, its institutional business represented 8% of Coinbase's transaction revenue, and institutional trading volume were up 92% quarter-on-quarter.

The upcoming 1Q results will offer a glimpse of any success in its fee-reduction move in terms of increasing its market share and whether the recovery momentum in its institutional trading volume can continue.

Subscription and Services Revenue to remain stable

For 1Q 2024, its subscription and services revenue, which accounts for 45% of its business, is expected to grow 21% from a year ago. Higher crypto asset prices may have a positive impact on its blockchain rewards revenue and custodial fee revenue, while higher average custodial fiat balances may support growth in interest income.

This may help to underpin the steady growth momentum for this segment, while eyes will be on several new products, such as Coinbase One, Prime Financing products and Coinbase Cloud, to see if they can gain traction.

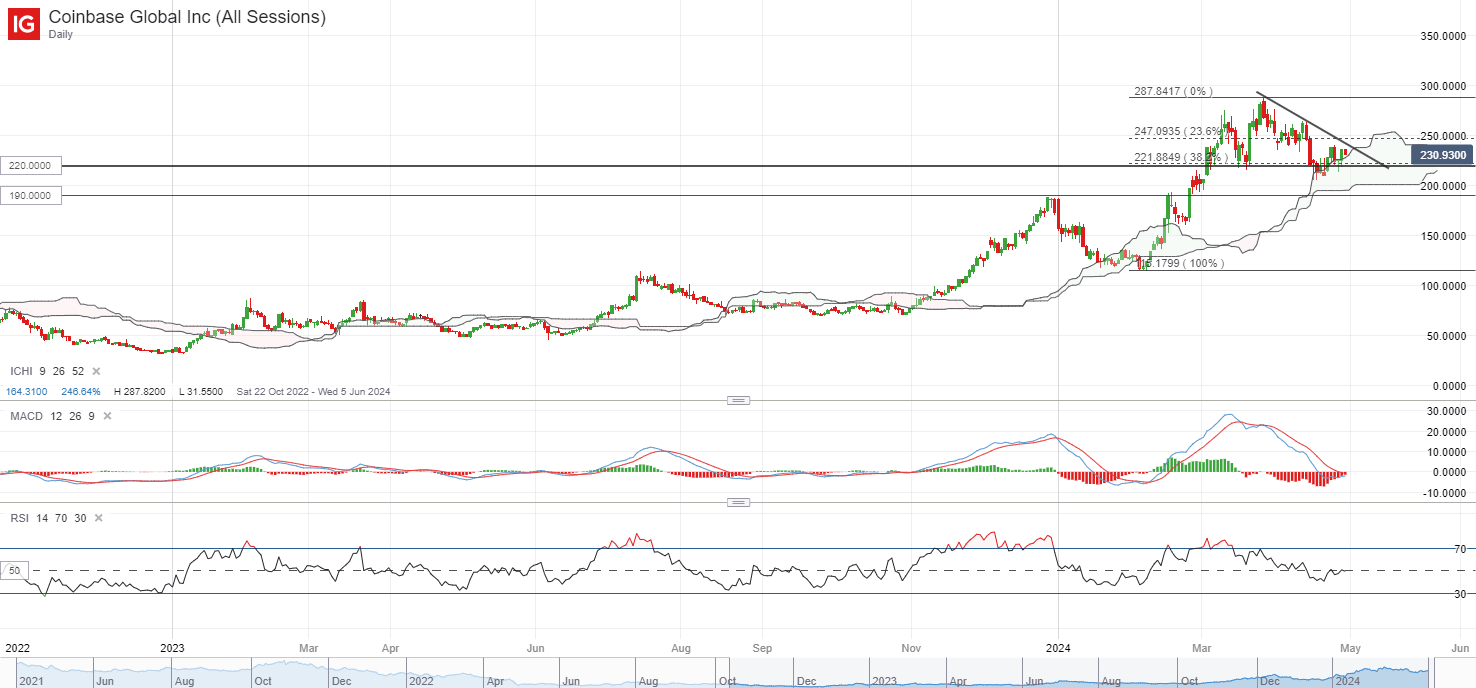

Technical analysis – Coinbase’s share price back to retest Ichimoku cloud support

Coinbase’s share price has retraced as much as 27% from its March 2024 peak but is attempting to stabilise lately at the upper edge of its daily Ichimoku cloud support around the US$220.00 level. For now, a downward trendline resistance may still be in the way, which will require buyers to break above the US$250.00 level in order to signal greater control. Its daily relative strength index (RSI) is hovering back at its key 50 level for now, which points to a more neutral balance.

On the downside, failure of the share price to sustain above the US$220.00 level may pave the way to retest the US$188.00-$200.00 level next, where the lower edge of the cloud support stands.

Source IG Charts