Yesterday’s market activity was predictable, with the

S&P 500

closing flat. Futures volume reflected the holiday mood, with just 840,000 contracts traded. Given that it was the day after Christmas, this light trading session was expected, and today may follow a similar trend.

Treasury Yields Show Surprising Strength Amid Strong Auctions

Rates climbed during the morning but eased after a robust

7-year Treasury

auction. This week has seen consistently strong auctions, which is noteworthy considering the growing U.S. debt levels. Investors seem attracted to current rates, helping the

10-year yield

, which peaked at 4.64%, close lower at 4.59%.

The

30-year yield

presents intriguing technical formations, including a potential double bottom (January 2024 and September 2024 lows) and an inverse head-and-shoulders pattern (June, September, and December 2024 levels). A breakout above 4.82% could push the 30-year yield back above 5%, signaling a continued yield curve normalization.

10-2 Yield Curve Holds Steady

The

10-2 yield

curve remained relatively flat at 25 basis points, holding steady for several days.

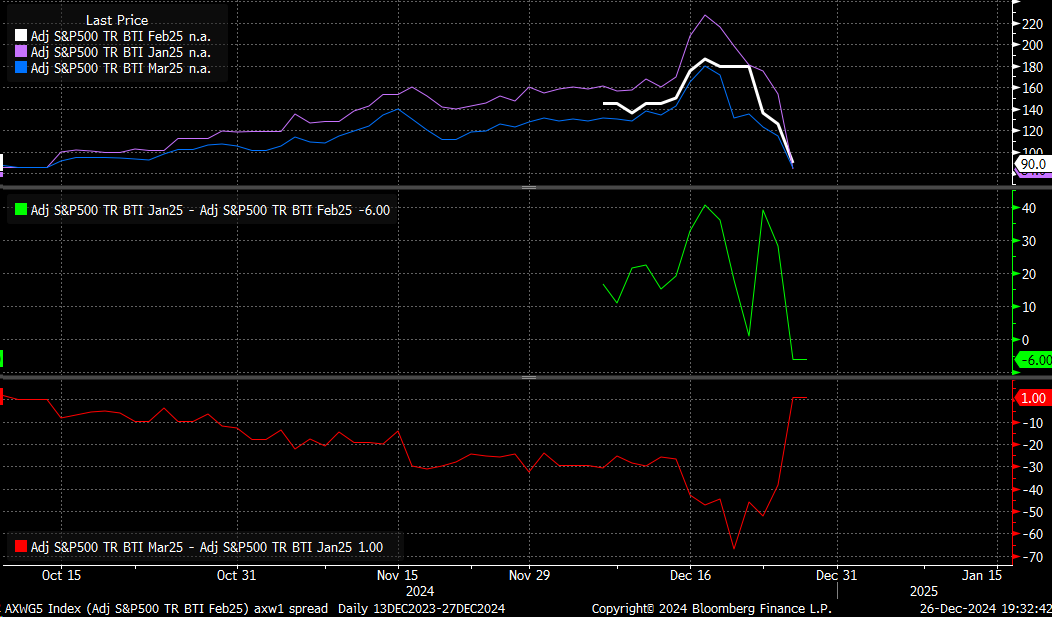

Equity Financing Costs Experience a Significant Drop

Equity financing costs, specifically the

S&P 500

BTIC rollover contracts, saw a sharp decline. January contracts, which hit 227 basis points on December 17, have dropped to 84 basis points. February contracts are trading at 90, and March at 85. This suggests reduced demand for leverage, possibly influenced by year-end factors or a broader market trend.

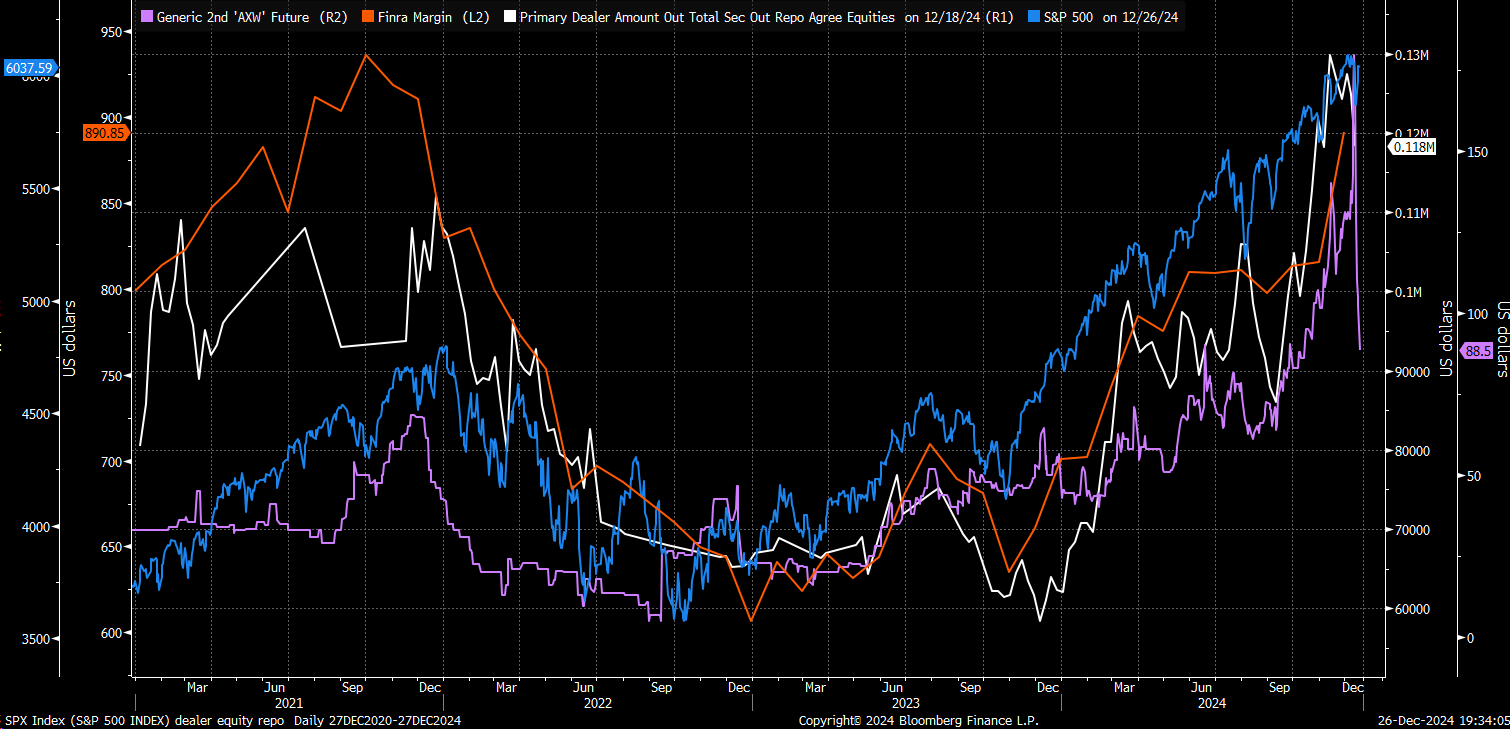

Decline in Repo Activity for Equity Securities

Repo activity in the overnight funding market for equities has also fallen sharply. This decline aligns with reduced equity financing costs, indicating lower demand for margin and leverage. Whether this shift is due to year-end dynamics or a sign of broader risk repricing remains uncertain.

Market Outlook

With fewer anticipated Fed rate cuts next year, markets may be reassessing risk and reducing leverage levels. These developments could shape trading dynamics as we head into the new year. We just have to continue to monitor.

Original Post