The

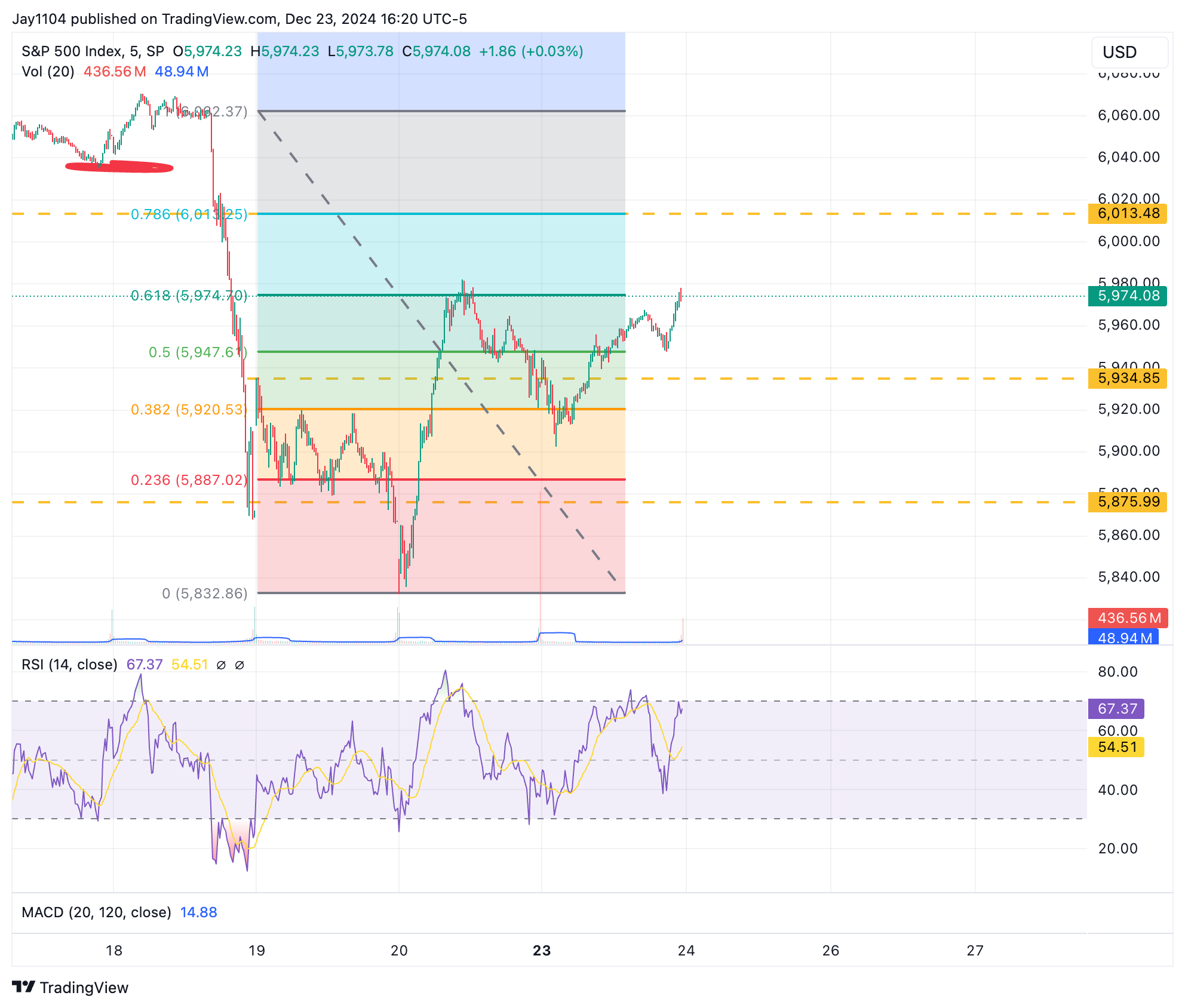

S&P 500

rallied by about 75 basis points yesterday, but it remains a market with weak breadth. Breadth was notably weak in the morning, though it improved slightly as the day progressed. According to data from the Bloomberg 500 Index, Nvidia (NASDAQ:

NVDA

) was the leading stock, contributing 34% of the day’s gains, while Broadcom (NASDAQ:

AVGO

) added 15%.

(BLOOMBERG)

Despite this, breadth on the S&P 500 started weak and ended the day with 275 stocks advancing compared to 225 declining, reflecting slight improvement.

Trading volume was extremely light, with the

S&P 500 futures

trading only 1.3 million contracts compared to its 20-day average of 1.46 million.

From a technical perspective, the S&P 500 remains below the intraday highs seen on Friday, hovering around the 61.8% retracement level. We’ll see what today brings.

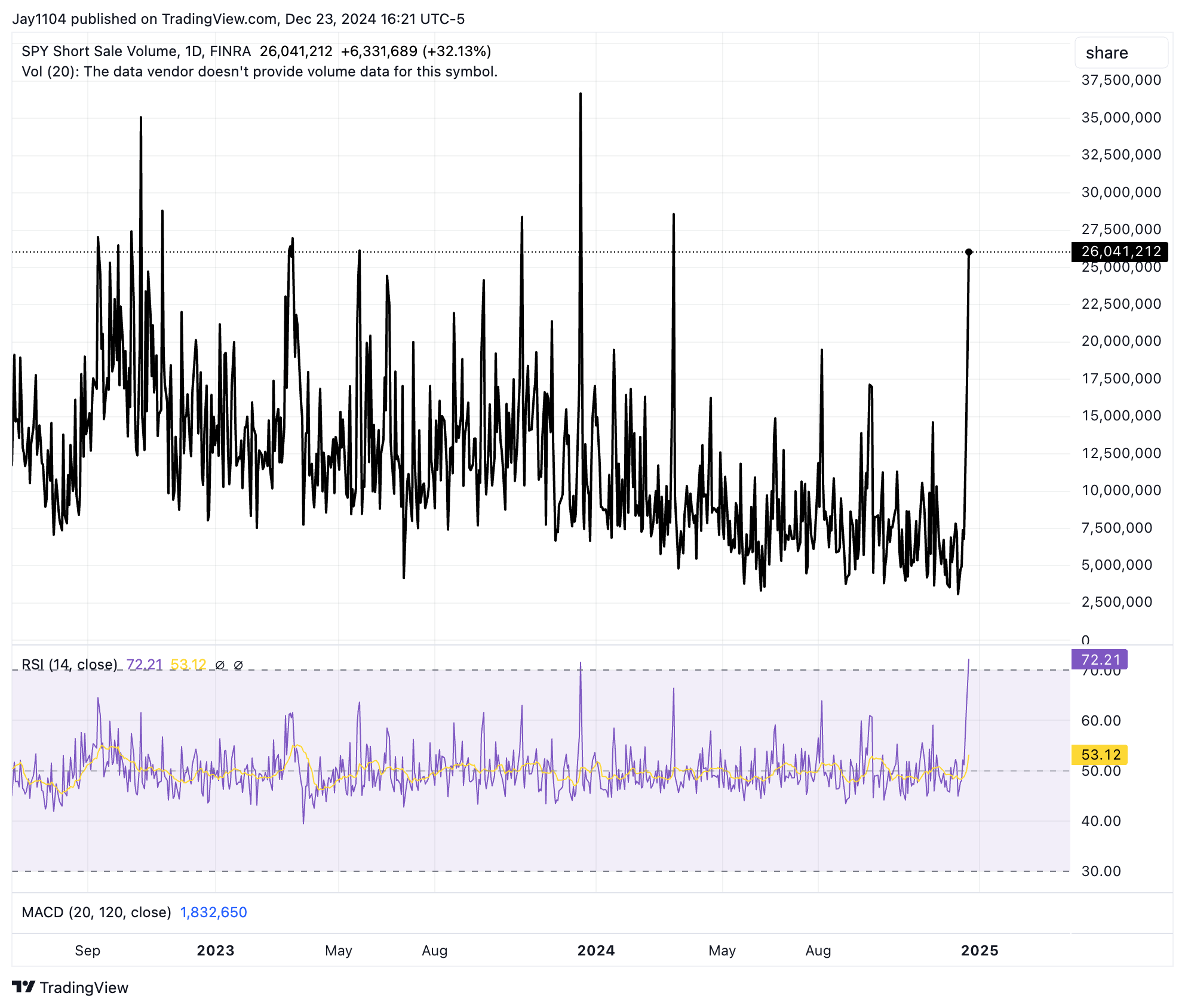

Notably, short interest volume on the

SPY ETF

has been increasing in recent days climbing to nearly 26 million shares on December 20th.

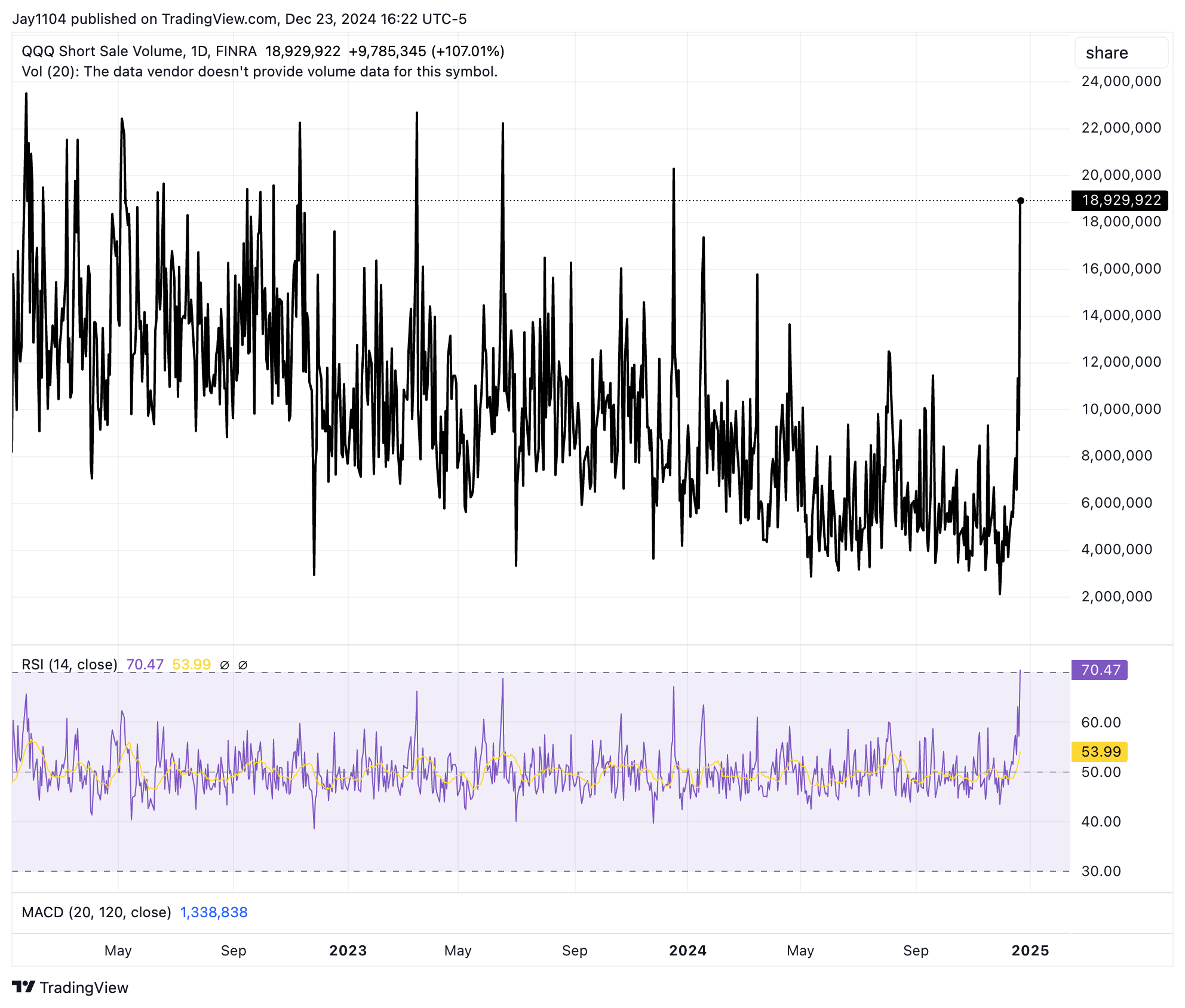

Similarly, on the

QQQ ETF

, short volume rose to 18.9 million on the 20th. These levels are among the highest seen since December 2023 and, for SPY, since March 2024. It’s unclear if this increase is tied to options expiration, but it stands out compared to recent activity.

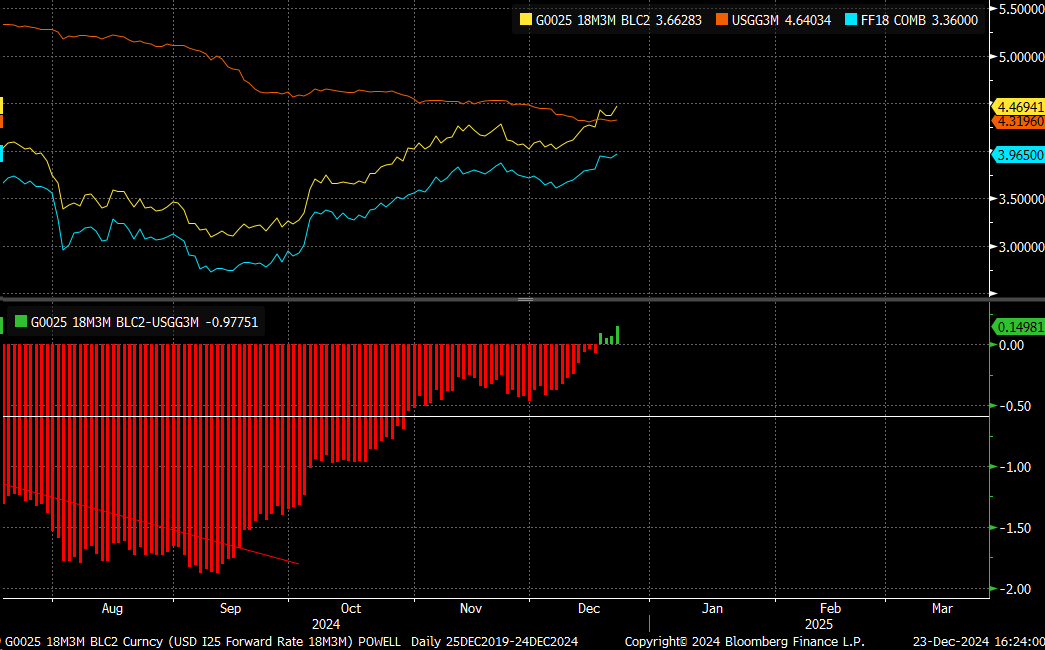

Elsewhere, the

10-year Treasury yield

rose six basis points to 4.59%, marking a new high since bottoming out on September 17. This movement steepened the yield curve, with the

10-2 spread

widening by four basis points to 25 basis points, surpassing the December 19 close of 24.7 basis points.

Additionally, the Powell indicator—the spread between the 3-month Treasury 18-month forward rate and the current

3-month Treasury yield

—closed at +15 basis points, its highest level since early November 2022. This suggests the market anticipates short-term rates to be higher 18 months from now, potentially reflecting expectations of future Fed rate hikes.

Key Terms:

1. Powell Indicator (3-Month Treasury Forward Spread) – The Powell Indicator refers to the spread between the 3-month Treasury yield 18 months forward and the current 3-month Treasury yield. It’s a tool for gauging market expectations of future interest rates, often reflecting predictions about Federal Reserve policy. A positive spread suggests that the market anticipates higher short-term rates in the future, which could indicate expectations of tighter monetary policy or economic growth.

2. Short Interest Volume – Short interest volume measures the total number of shares sold short (borrowed and sold in anticipation of a price decline) but not yet covered or closed out. It’s a key indicator of market sentiment, as rising short interest may suggest increased bearish expectations or hedging activity. Elevated short volume on ETFs like SPY (S&P 500 ETF) and QQQ ( NASDAQ 100 ETF) can signal broader market skepticism or heightened trading around specific events like options expiration.

3. Yield Curve Steepening – Yield curve steepening occurs when the difference (spread) between yields on long-term bonds, such as the 10-year Treasury, and short-term bonds, such as the 2-year Treasury , increases. This often reflects expectations of stronger economic growth and higher inflation, leading to higher long-term interest rates. In this context, the steepening of the yield curve highlighted a widening 10-2 spread, suggesting an improving outlook despite a recent history of flatter or inverted curves.

Original Post