Disinflation has stalled recently, but economists are debating if this is a temporary blip that will soon give way to a softer trend. Tomorrow’s consumer price report for November will be widely read for an update.

The consensus forecast anticipates that the trend will more or less hold steady. The year-over-year change in headline consumer prices is expected to tick up to 2.7% for November vs. 2.6% previously. Core CPI will hold steady at 3.3%, according to Econoday.com’s survey of analysts.

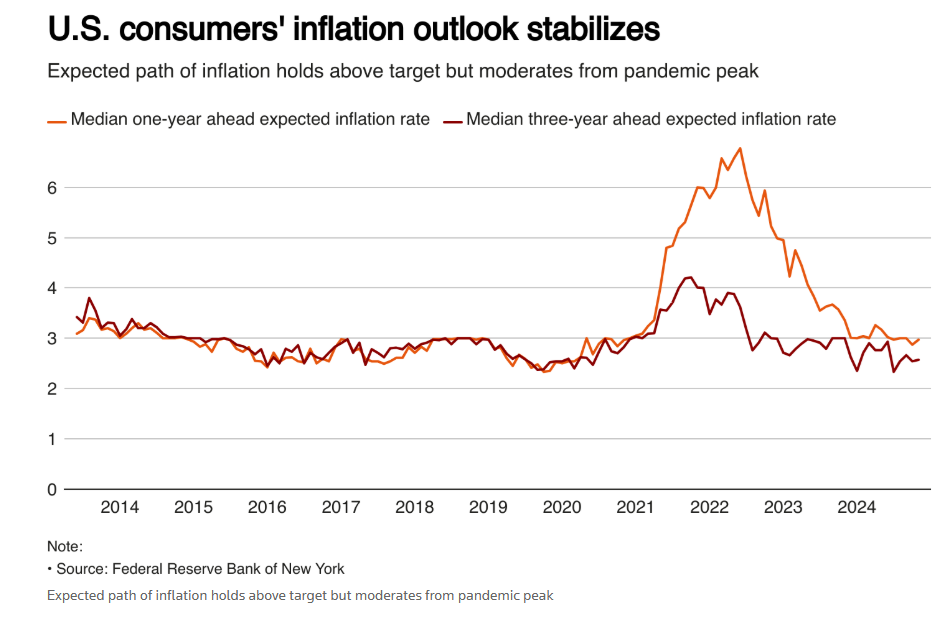

A similar outlook is reflected in the November consumer survey by the New York Fed.

Inflation

is expected to be roughly 3% a year from now, falling to 2.6% in three years. That’s in line with the outlook before the pandemic.

“To me, this just seems like it’s all a return to normality,” says Alan Detmeister, an economist for UBS.

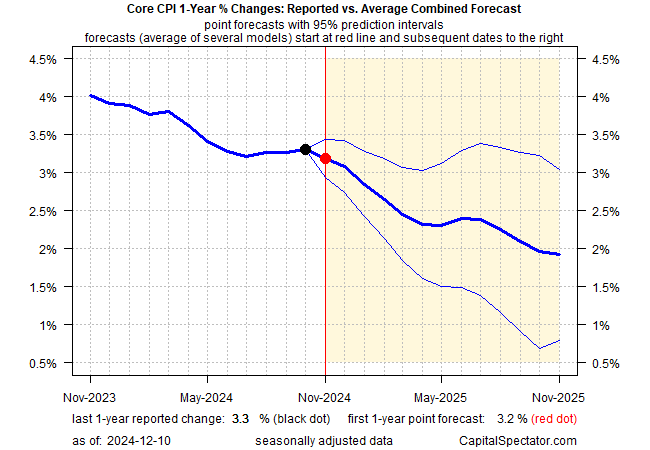

CapitalSpectator.com’s forecast for core CPI, based on the median of several econometric models, projects that pricing pressure will dip to 3.2% vs. 3.3% in October, based on the median.

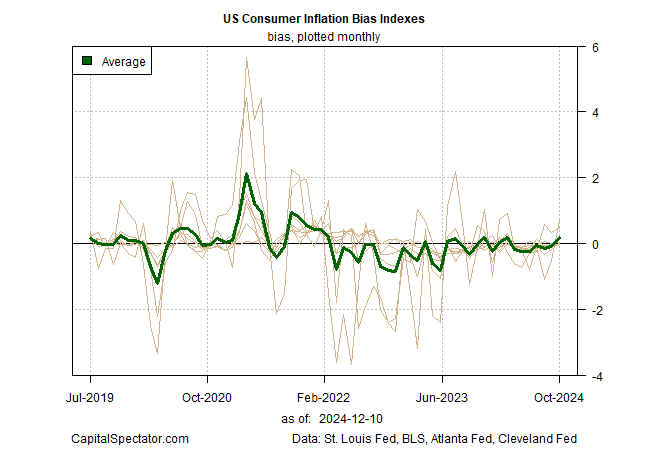

Another profile of inflation, using several alternative versions of CPI as well as the conventional versions, shows a renewed upside bias in pricing pressure in October—the first increase since March. This could be noise, but if the rise persists in the November data it will be harder to dismiss.

A Vanguard analyst expects that sticky inflation data will persist in November. A key factor is the ongoing influence of robust shelter prices. “We don’t really see any material softening of that until we get into next year,” says Josh Hirt, senior US economist at the fund manager.

Next (LON: NXT ) year may experience rising reflation risk due to policy changes by the incoming Trump administration. Notably, the president-elect’s campaign promises to raise import tariffs and deport millions of immigrant workers could lift prices, economists reason.

Rate cuts , however, are still on the table for the Federal Reserve at next week’s policy meeting. Futures are pricing in an 86% probability this morning for a 25-basis-points cut at the Dec. 18 FOMC meeting.

Meanwhile, Fitch Ratings predicts that “the risk of stronger inflation in the US is on the rise amid the threat of higher tariffs and still-strong consumer spending.”

The Fed seems to disagree, or so it appears, based on futures data. All eyes now turn to tomorrow’s CPI report for a possible attitude adjustment.