Gold continues to march higher from the $2550 buy zone, and Silver is beginning to look like the short-term leader of the precious metals pack.

The first leg of the rally saw gold rush to $2720, and the re-emergence of the Chinese PBOC as a monthly gold buyer could be the catalyst for the next one.

On the one hand, five tons is a small number, but most previous purchases were only in the range of 10-20 tons. The bottom line:

It’s more about the PBOC action as a catalyst and confidence booster for Chinese citizens and fund managers; it’s a sign that the gold market sentiment froth is gone, and investors can feel good about purchasing gold.

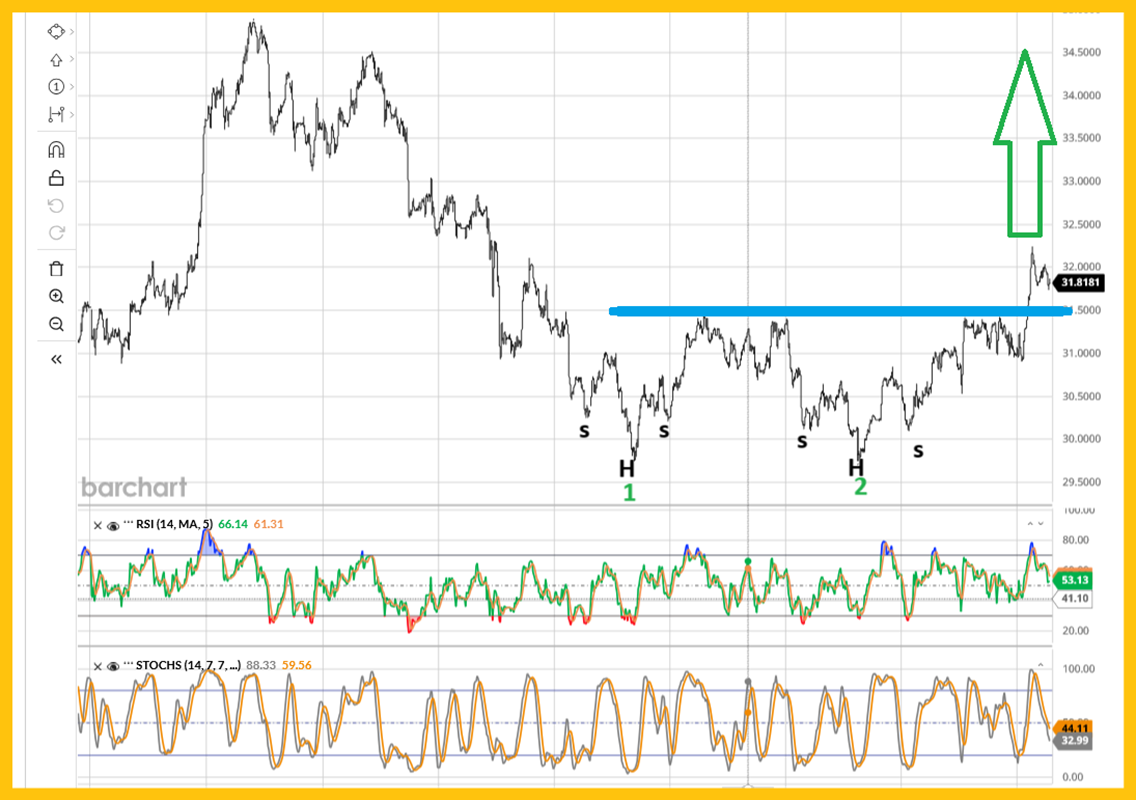

The enticing silver price chart. There’s a beautiful double bottom pattern in play and…

It’s “spiced up” with twin inverse H&S patterns too!

The target of the double bottom is about $33.50, but the size and aesthetics of the pattern make a surge to (and possibly beyond) $35 a realistic projection from here.

The Chinese government has also announced more stimulus measures.

This time, the measures are purposed to “increase growth” rather than simply move municipal government debt into the hands of the federal government there.

There’s a huge (but currently under pressure) love & celebration trade for gold in China.

A move above $38 on this FXI stock market chart would likely see that trade fully resurrected.

In 2025, the Trump administration and the Chinese government are likely to create wild stock market volatility with their tit-for-tat tariffs… and both governments are likely to push their central banks to lower rates to manage the mayhem.

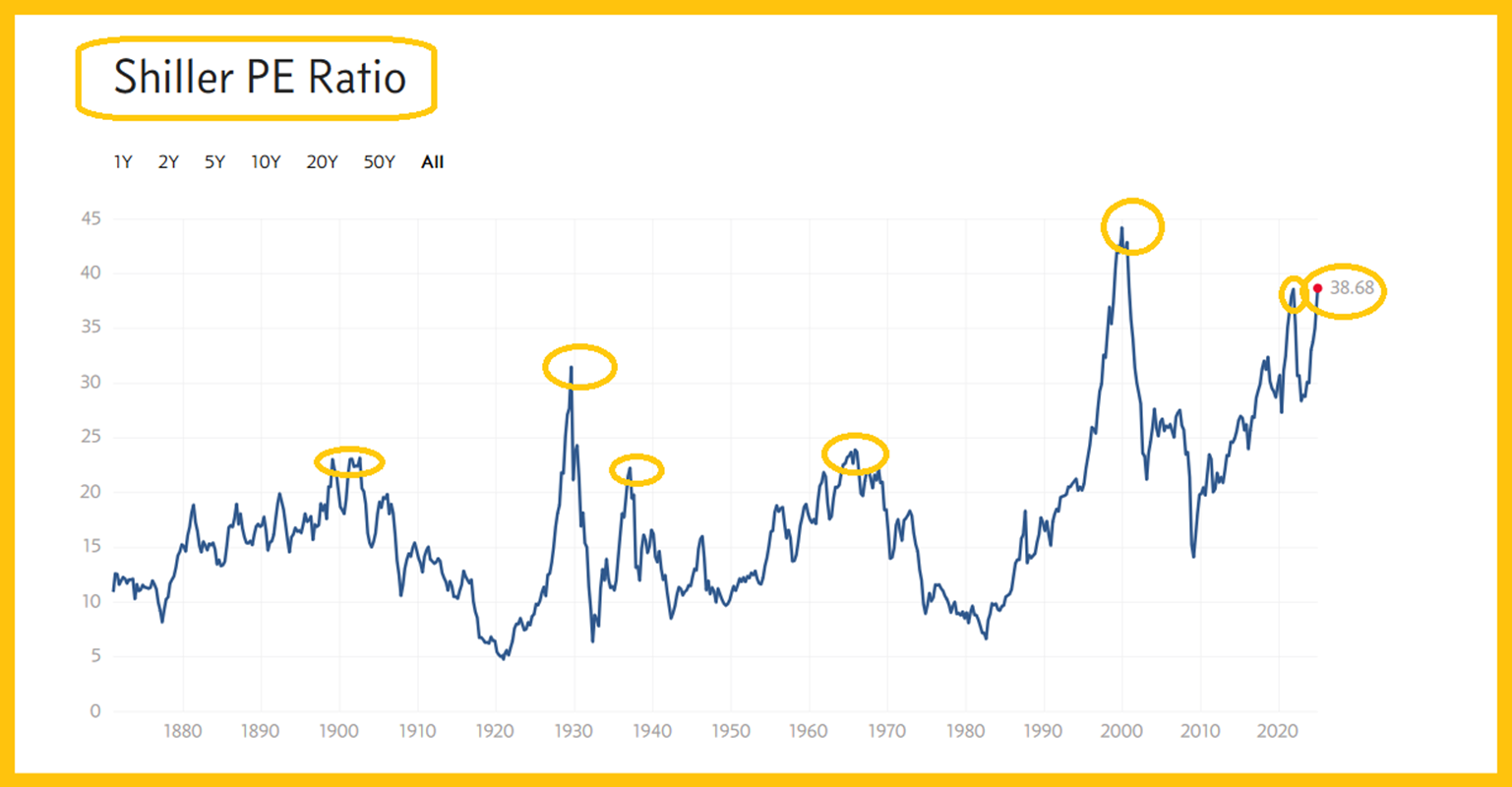

Basis the Shiller PE ratio, the US stock market is now the second most overvalued in the history of nation.

In contrast to the American market, the Shiller ratio for the Chinese stock market is close to all-time lows, sitting at about 15.

The bottom line: A tumbling US stock market is likely. A soaring Chinese stock market is likely…

And both events should be incredibly good for gold.

The target of the immense inverse H&S pattern on this weekly gold chart is $3300-$3400.

A powerful Elliott C wave is also in play. Investors can expect some market “noise” with this week’s CPI and PPI inflation reports, but that’s not going to change the big target zone at all.

What about the miners? The CDNX juniors index is bullish. There are multiple inverse H&S patterns in play and many individual miners on the CDNX are already in “blastoff” mode.

A move above 630 should see the CDNX surge very quickly to the 1000 zone, and many individual miners will be up 200%-500% when that occurs.

Not all gold bugs like the junior miners, but the CDNX is a reliable indicator of future price action for the intermediate and senior producers too.

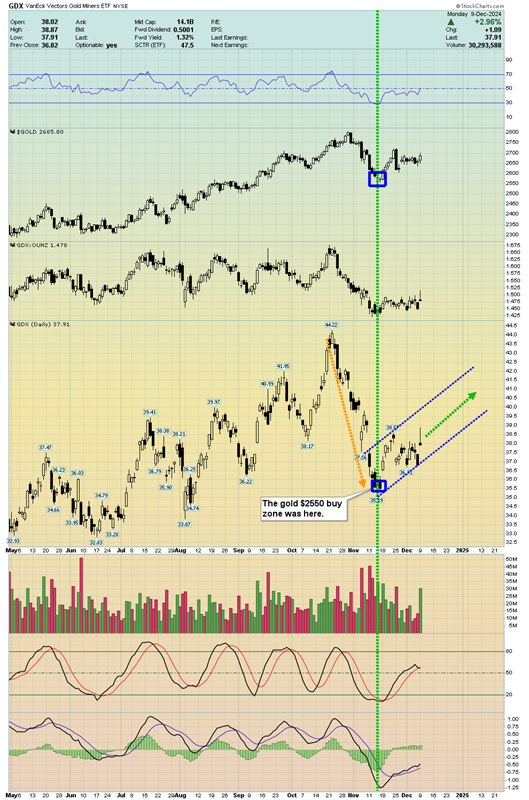

The GDX (NYSE:

GDX

) daily chart. Newmont is about 15% of the GDX ETF, and its Q3 reporting fiasco has weighed on the overall gold stocks rally from the $2550 buy zone for gold.

Regardless, GDX is still up from that buy zone rather than down! In time, the GDX managers may want to consider a more balanced mix of miners. The attempt to “Go big rather than go home” has backfired. The good news: Most gold stock investors are more focused on individual miners than the GDX, and the action of gold suggests this is a time to be fearless and bold!