- Geopolitics in the spotlight, gold fails to materially benefit.

- Dollar loses ground, but stocks in buoyant mode.

- China data disappoints; RBA meets tomorrow.

Syrian Developments Fail to Significantly Boost Gold

Another data-rich and eventful week begins, as the market adjusts to changes in the geopolitical scene. The fall of the Assad regime in Syria is altering the dynamics in the Middle East, uniting former antagonists like Turkey and Israel. While the full impact of this development has not been felt yet, there is a possibility that this area could continue to generate uncertainty and experience violent flare-ups.

Meanwhile,

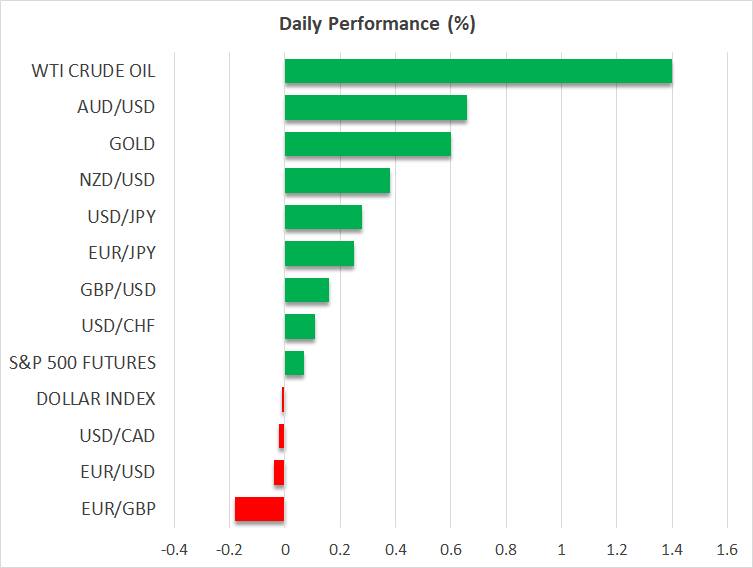

gold

traders remain calm, with the precious metal hovering inside the $2,600-2,670 range. There are growing expectations that President-elect Trump is determined to solve the ongoing conflicts, particularly the Ukraine-Russia war, which could prove a strong headwind for gold. Until this takes place though, gold investors might take solace from the fact that the PBoC is active in the gold market again, after almost six months of absence.

The US Dollar Is on the Back Foot

The US dollar has started the week in the red against key currencies, partly reversing Friday’s price action. Despite the solid nonfarm payrolls figure and the upside surprise in the average earnings growth, the market initially focused on the higher unemployment rate, pushing the dollar lower and increasing the chances of a December Fed rate cut.

However, this move quickly reversed on the back of Fedspeak and the stronger University of Michigan consumer sentiment index. Ahead of the usual blackout period, which is in effect since Saturday, Fed members continued to publicly debate about the outcome of the next Fed meeting. The hawks support a pause in anticipation of Trump’s second term, with the doves arguing that a rate cut is necessary now that the labour market is easing.

The next key data release is Wednesday’s US inflation report, with both the Fed doves and the market eyeing a downside surprise in the core CPI indicator to cement the December Fed rate cut. Any other outcome would only prolong the uncertainty until December 18.

At least, stock indices remain upbeat. Both the S&P 500 and Nasdaq 100 indices recorded new all-time highs on Friday, capitalizing on another strong weekly performance from the technology sector . Interestingly though, the consumer discretionary sector led last week’s rally with a 5.5% gain. This could be another indication of the health of consumers’ finances.

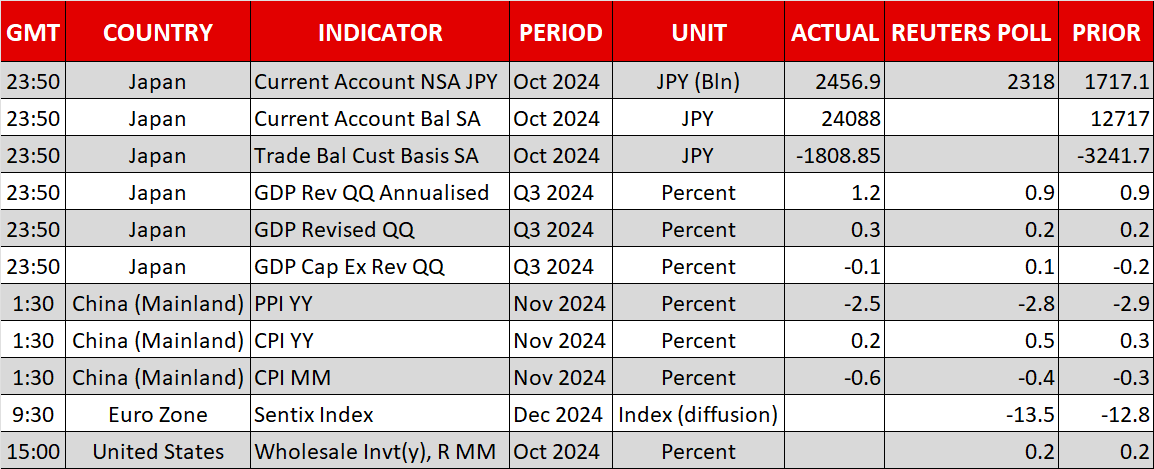

Chinese and Japanese Data in the Spotlight

A flurry of Chinese and Japanese data has captured the market’s attention. In Japan, the GDP report for the third quarter of 2024 was revised higher, but it failed to boost the Japanese yen . Despite the overall skepticism about the Japanese economy, the chances for a 25bps BoJ rate hike on December 19 are probably higher than the 30% probability currently priced in by the market.

On the other hand, concerns about the health of the Chinese economy remain potent. The November CPI report showed another slowdown in inflationary pressures, confirming the lack of consumer demand and prompting negative commentary from both the Fitch Ratings and certain investment houses. The statement after Monday's Politburo meeting was positive, but actions matter more at this stage.

Could the RBA Soften Its Hawkish Stance?

This Chinese situation continues to cast a doubt over the broader Asian region. The RBNZ has already cut rates by 50bps in late November, with the RBA holding its final meeting for 2024 tomorrow (06.30 GMT). While the chances of a rate cut remain very low, there have been some signs of weakness in economic data as the Q3 GDP report coming in weaker than expected and monthly inflation continuing to ease.

The RBA may acknowledge this trend, potentially softening its rhetoric.