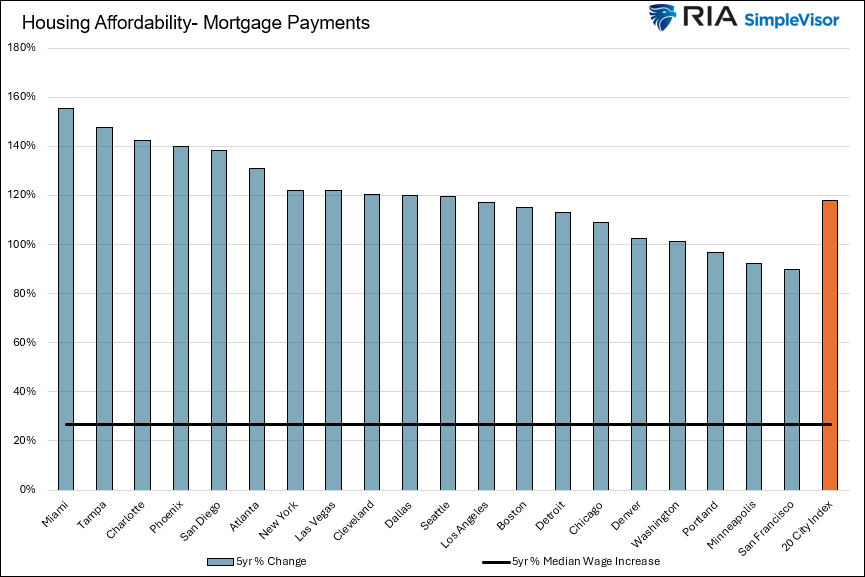

Housing affordability helps explain why residential real estate transactions have reached a standstill. Over the last five years, housing prices have surged. Per the Case-Shiller 20 City Home Price Index, home prices from 20 of the largest cities have risen between 33% and 80%. Over the same five-year period, mortgage rates jumped from 3.68% to 6.81%. Wage growth has helped to offset the higher prices and mortgage rates. However, with the median wage growth of 26% over the last five years, it has been woefully lagging.

We share the graph below to help contextualize the housing affordability problem. It highlights how much mortgage payments have risen over the last five years compared to wages. Consider that in 2019, a monthly mortgage payment for a $100,000 house in Miami, Florida, was $460. Today, with home prices in Miami up 80% over the last five years and mortgage rates much higher, the monthly payment would be $1,173. The weakest housing market, San Francisco, has seen the average payment increase by 90%, dwarfing the 26% median wage growth.

Based on housing affordability, or should we say “inaffordability”, it’s hard to see how the number of residential real estate transactions increases without much lower

mortgage rates

and or home prices.

What To Watch Today

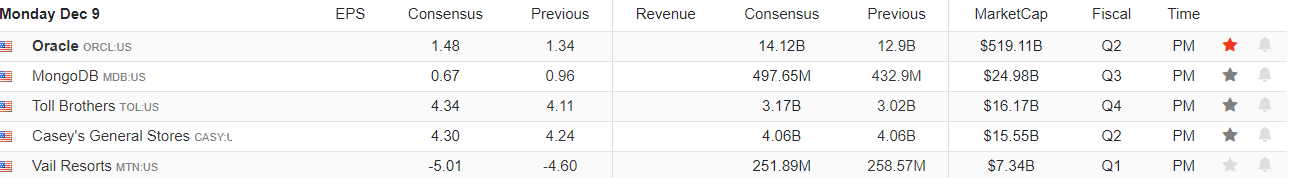

Earnings

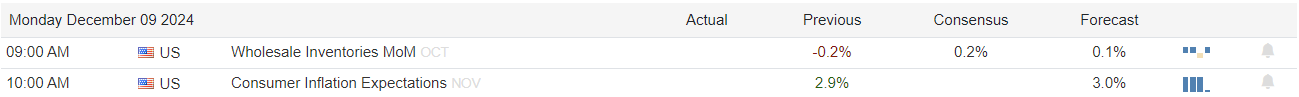

Economy

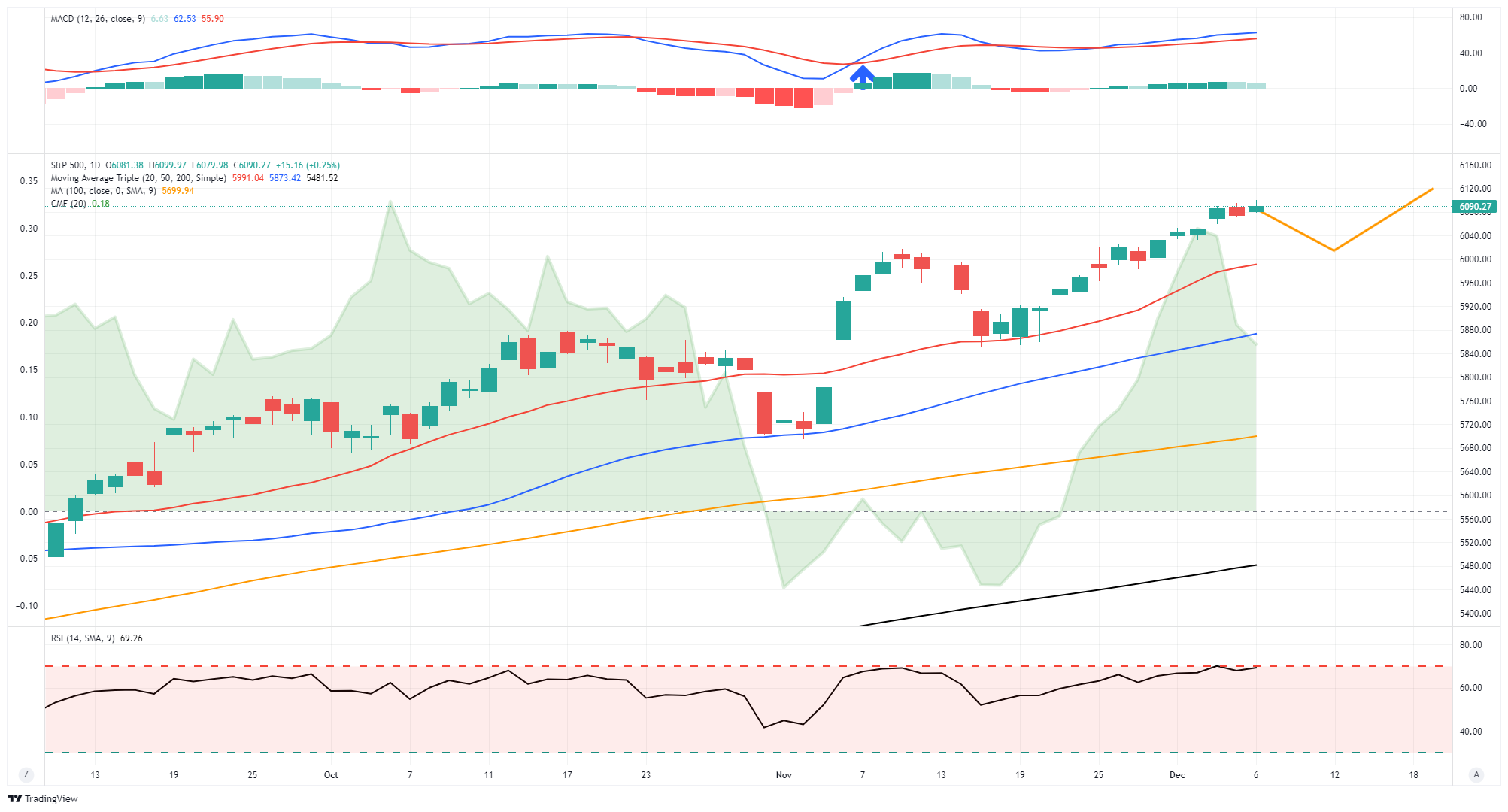

Market Trading Update

As noted on Friday , the market historically trades a bit weaker over the next two weeks as mutual funds rebalance portfolios and make annual distributions. With the S&P 500 rather deviated from the 50-DMA, a short-term consolidation or correction to either the 20 or 50-DMA would be unsurprising, with a slight uptick in volatility. Investors are currently very complacent with taking on excess risk, which typically precedes short-term reversals. However, with the end of the year approaching, any corrective action should be used to add exposure to equity risk as investment managers compete for assets for year-end “window dressing.”

Over the last few sessions, money flows have declined, typically preceding such corrective actions. I have mapped out an anticipated path for stocks over the next two weeks, representing the historical

“average”

performance for this time of year. Notably, that correction could be more profound, given that mutual funds may need to complete more extensive portfolio rebalancing. As such, manage risk accordingly.

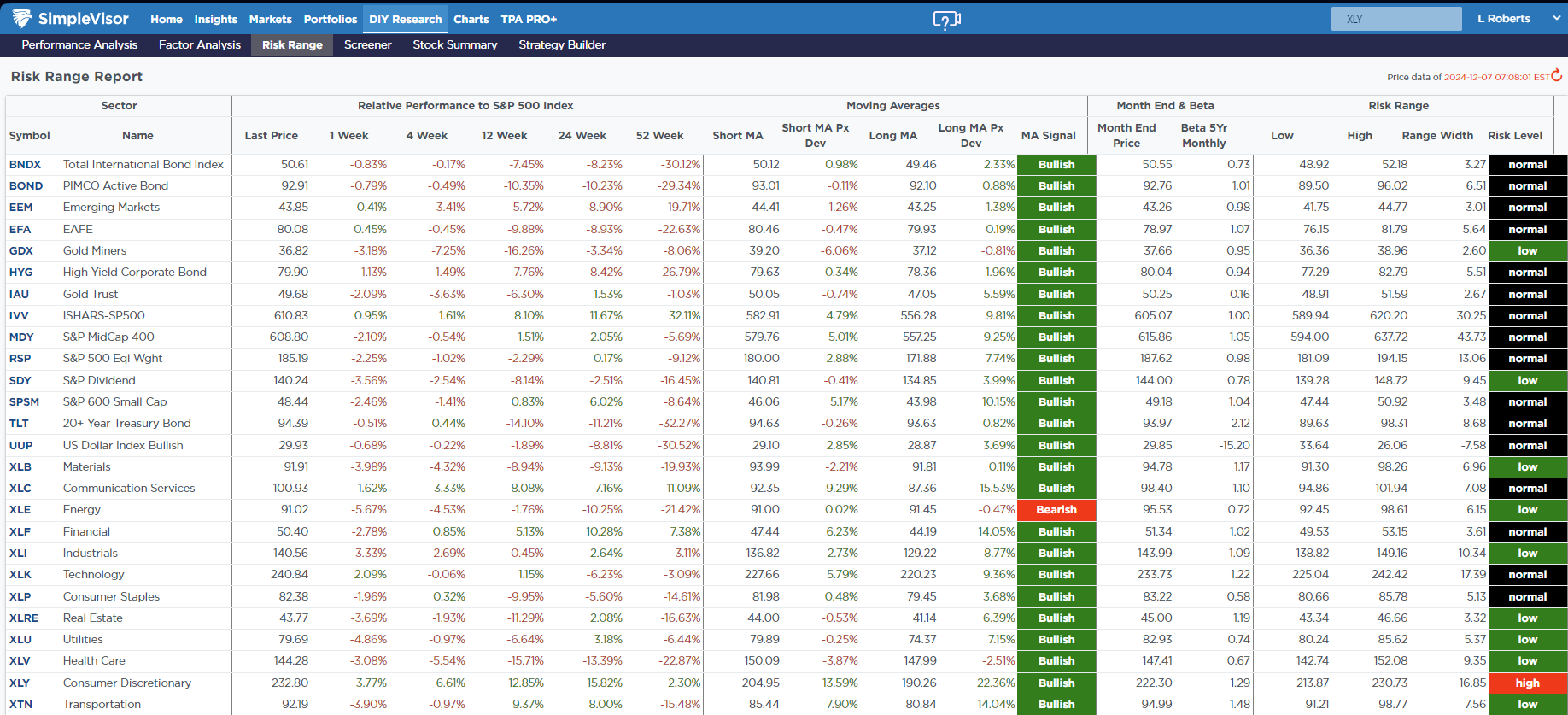

Last week, we launched the

“beta”

version of the Risk/Range analysis that we include in the weekly newsletter. This chart uses DAILY data versus the WEEKLY data in the newsletter, accounting for the potential difference in readings. We are working on some visual tweaks and sorting. However, the key takeaway is that every sector and market, except for Energy, are on

“bullish buy signals.”

More significant

“bear markets”

and

“crashes”

are extremely unlikely in such a case. However, if you monitor this report, the risk of corrections and bear markets increases when you see more sectors and markets becoming negative. This report will provide a leading indicator for reducing equity risk in portfolios.

The Week Ahead And Employment

The BLS employment report came in largely as expected. Last month’s meager gain of 36k appears to have resulted from the two hurricanes and the Boeing (NYSE: BA ) strike. November jobs grew by 227k, slightly better than expectations of 200k. The unemployment rate ticked up from 4.1% to 4.2%. However, it is .2% below the Fed’s year-end expectation.

CPI and PPI on Wednesday and Thursday will provide the Fed with the last bit of inflation data before deciding whether to cut rates on December 18th. CPI is expected to increase by .3% monthly and 2.7% yearly. Both figures are a .10% increase from last month.

The Fed enters its media blackout this week. Accordingly, we suspect that if they are leaning toward not cutting rates based on CPI, we should expect a Wall Street Journal article from Nick Timiraos to alert the markets. If you recall, that was how they prepped the markets when they increased expectations from 25 to 50bps when they first cut rates.

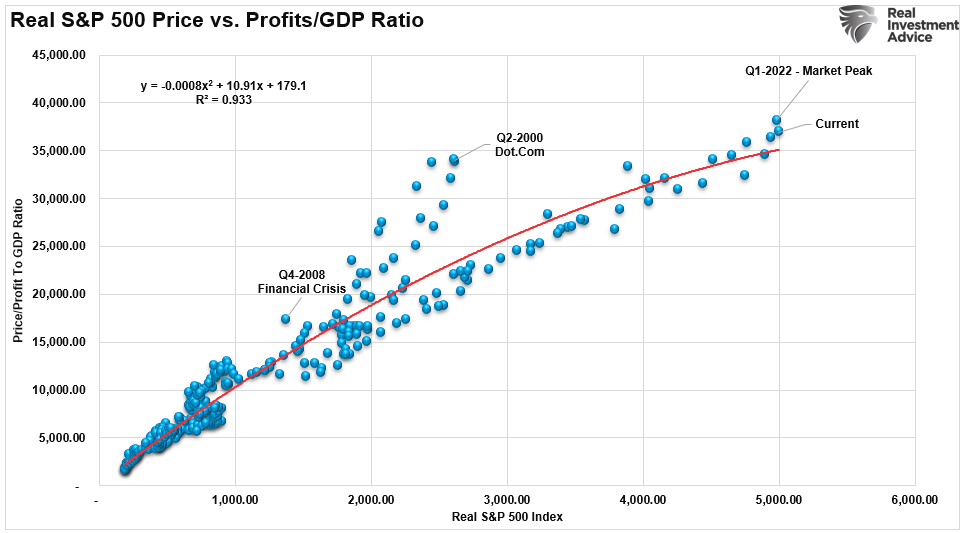

The Kalecki Profit Equation and The Coming Reversion

Importantly, as opposed to Yardeni’s more ebullient forecasts , as we addressed last week, history suggests that periods of high profitability are not indefinite. From a macroeconomic perspective, unsustainably high margins eventually face downward pressure from mean reversion. The Shiller P/E ratio, which adjusts earnings to a 10-year average, remains elevated, implying rich valuations without much margin of safety. In other words, any move toward fiscal restraint or consumer belt-tightening could usher in a profit decline.

As always, the future of corporate profits and market performance remains unpredictable, but understanding the forces at play provides an edge. Acknowledging the interdependency of government policy, household behavior, and corporate actions is crucial for investors. The coming years may test the resilience of today’s profit levels, and prudent investors should prepare for a range of outcomes.

READ MORE…

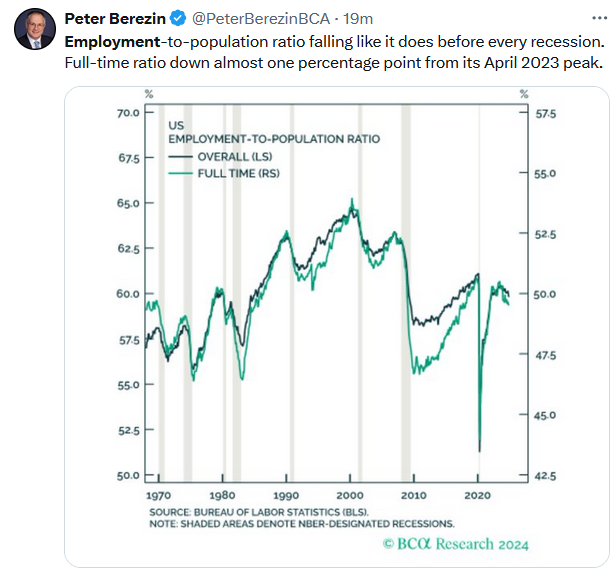

Tweet of the Day