Gold has been a cornerstone of human commerce and wealth preservation for thousands of years, its allure rooted in its rarity, beauty, and immutable physical properties. Historically, gold served as the backbone of many early currencies, its value providing a stable foundation for trade and economic development. From the gold coins of ancient empires like Rome and Greece to the gold-backed paper currencies of more modern nation-states, gold’s intrinsic worth has been recognized and utilized in monetary systems across the world. In this article I will illustrate how gold should be viewed as a report card on how politicians and centrals banks are managing the economy and inflation.

A particularly illustrative example of gold’s enduring value as a store of wealth is the comparison of real estate prices in terms of gold over an extended period. Consider a house in 1900, which might have been priced at around 200 ounces of gold. This metric wasn’t just arbitrary; it reflected gold’s purchasing power relative to real assets. At the time, gold was approximately $20.67 per ounce, making the house’s value roughly $4,134 in U.S. currency.

Fast forward to today, and although nominal prices in fiat currency have surged due to inflation and other economic factors, when priced in gold, the value of real estate shows remarkable stability. For instance, if a similar house today is valued at $400,000 and the current price of gold is approximately $2,000 per ounce, this house would again be worth about 200 ounces of gold.

Gold’s role as a “report card” for the economic policies of politicians and monetary authorities is a compelling aspect of its significance in global economics. This perspective arises from gold’s unique position as a universally recognized store of value that is largely immune over the long term to the direct effects of monetary policy decisions, such as interest rate adjustments, quantitative easing, and fiscal stimulus measures. Unlike fiat currencies, whose values can fluctuate widely in response to such policies, gold retains its value over time, making it a reliable metric for assessing the health and stability of the economy.

Gold is traditionally seen as a hedge against inflation. When inflation rates rise, the purchasing power of fiat currency falls, but gold’s value tends to increase in terms of the goods and services it can buy. This makes gold a direct indicator of the public’s perception of a currency’s declining value due to inflation, which is often a result of monetary policies that increase the money supply. Large fiscal deficits and increasing national debt can erode confidence in a country’s currency. As governments borrow more, the temptation to inflate their way out of debt increases, making gold an attractive alternative for preserving value. The rising price of gold can signal investors’ concerns about a government’s fiscal health and its ability to manage debt without resorting to inflationary policies. Central bank policies that lead to currency devaluation also enhance gold’s appeal. When currencies weaken, gold prices in those currency terms tend to rise, reflecting gold’s role as a stable store of value compared to depreciating fiat currencies.

The increasing price of gold can be seen as a critique of economic management, suggesting that policies are leading to currency devaluation, inflation, or both. Because it acts as a barometer for policy effectiveness, a rising gold price can be unwelcome news for policymakers.

Mainstream economists often criticize gold for being a non-yielding asset, meaning it does not produce interest or dividends. In periods of economic growth and stability, when other investments are generating significant returns, gold’s lack of yield can be seen as a drawback. Gold’s significance challenges the principles of Keynesian and Modern Monetary Theory, which argues that countries controlling their currencies can sustain higher levels of public debt and deficit financing than traditionally thought. Gold’s traditional role as a safe haven and a hedge against inflation and currency devaluation stands in contrast to these mainstream ideas.

In summary, gold’s enduring value and its role as an economic “report card” reflect its capacity to store wealth reliably over time, transcending the immediate impacts of political decisions and monetary policies. This has made it a contentious asset in mainstream economic circles, where its implications can often seem at odds with contemporary economic strategies and theories.

This comparison highlights gold’s role as a measure of value that remains remarkably consistent over time, unlike fiat currencies that can fluctuate wildly due to inflation, government policy, and economic changes. It underscores gold’s historical and ongoing significance as not just a currency, but a fundamental store of value that provides a benchmark for the worth of goods and assets across centuries.

It’s a common misconception among us, the hardworking American people, that the mere act of exchanging money for goods and services throughout our lives equips us with a thorough understanding of what money truly is. However, this assumption leads us down a perilous path, inadvertently handing over immense control to those who actually do understand and control money’s value. Such a dynamic, needless to say, harbors the potential for catastrophic outcomes.

Contemplate for a moment the very essence of money – a concept far more flexible than you might initially think. Picture this: the U.S. government could, should it so choose, declare the stocks of tech giants like Facebook, Apple, Netflix, and Google as legal tender. Indeed, any commodity has the potential to serve as currency, facilitating the seamless exchange of goods and services among citizens. History is replete with examples of various items serving this very purpose, each with its own set of challenges and limitations.

Allow me to illustrate with a compelling snippet from our nation’s storied past.

Richard Nixon closed the gold window on August 15, 1971, and officially severed the U.S. dollars ties with gold.

Consider this: on August 16, 1971, an ounce of gold was valued at $35. Fast forward to today, and it’s trading at an astonishing $2168. This marks an incredible increase of 6094%.

On that same day in 1971, the Dow Jones Industrials stood at 888.95. Today, it boasts a figure of 38,932. That’s a gain of 4280%.

Notably gold, the barbarous relic, reviled by mainstream economists, has outshone the Dow by 42%.

Upon hearing this, you might be quick to label me a mere ‘gold bug,’ but that would be a grave misjudgment. The reality, often overlooked, is the devastating deception and economic trickery that ensued following the shift to a fiat currency system.

Imagine, investing $10,000 in gold back in August 1971. Today, that investment would be worth an eye-watering $609,429. Conversely, had you placed that same amount in the Dow Jones, its value today would be $427,965.

While this discrepancy is nothing short of staggering, it underscores a fundamental truth lost on many: until August 15, 1971, gold and money were, for all intents and purposes, one and the same.

Politicians and monetary authorities hate gold because it acts as a report card on their handling of monetary affairs.

Let’s do a similar comparison showing the value of food to that of pre-1965 U.S. silver coinage, illustrating a point that resonates deeply with the fiscal prudence our nation once embraced.

Cast your mind back to 1960, an era when a simple loaf of bread—a staple of the American diet—could be acquired for a mere twenty cents, equivalent to two dimes.

Fast forward to today, and the shock sets in as we find that same loaf of bread commanding a price tag of nearly $3.90. This represents a staggering price escalation of 1850%. Yet, here’s where the tale takes an enlightening turn. Those very same two dimes from the pre-1965 era, comprised of 90% silver, embody an inherent worth of $1.83 each in today’s market, grounded in their silver content and melt value.

Cumulatively, these two dimes hold a value of $3.66, astonishingly enabling you to nearly replicate that original transaction—securing a loaf of bread with the same coinage. This striking example lays bare a profound truth: while the fiat currency system has witnessed a monumental 1850% surge in prices, the tangible, commodity-backed currency of yesteryears has nearly kept pace with the inflationary tide.

Once again, we’re confronted with irrefutable evidence of the intrinsic stability offered by asset-backed currencies, standing in stark contrast to the volatile whirlwind of fiat currency inflation. This, my friends, is a testament to the undeniable virtue of adhering to tangible value in our monetary system—a principle seemingly forgotten by our central bankers.

The reason this is so important today is that Gold recently broke out to new all-time highs. This is a major red flag. Particularly in an election year. As it did so, I was reminded of the fact that gold sometimes trades as a commodity, sometimes it trades like a currency and sometimes it trades as a safe haven. In preparing to write this article I undertook a great deal of research to try and better understand what was occurring. Here is what I think is occurring. Gold transcends its status as a mere commodity by embodying the characteristics of “true money” – durability, divisibility, portability, and acceptability worldwide. Its historical and intrinsic qualities have cemented its role as a universal medium of exchange and store of value, independent of any government’s fiat currency system. This timeless appeal of gold, rooted in thousands of years of economic transactions, showcases its unparalleled position as a bastion of stability and trust in the global financial landscape.

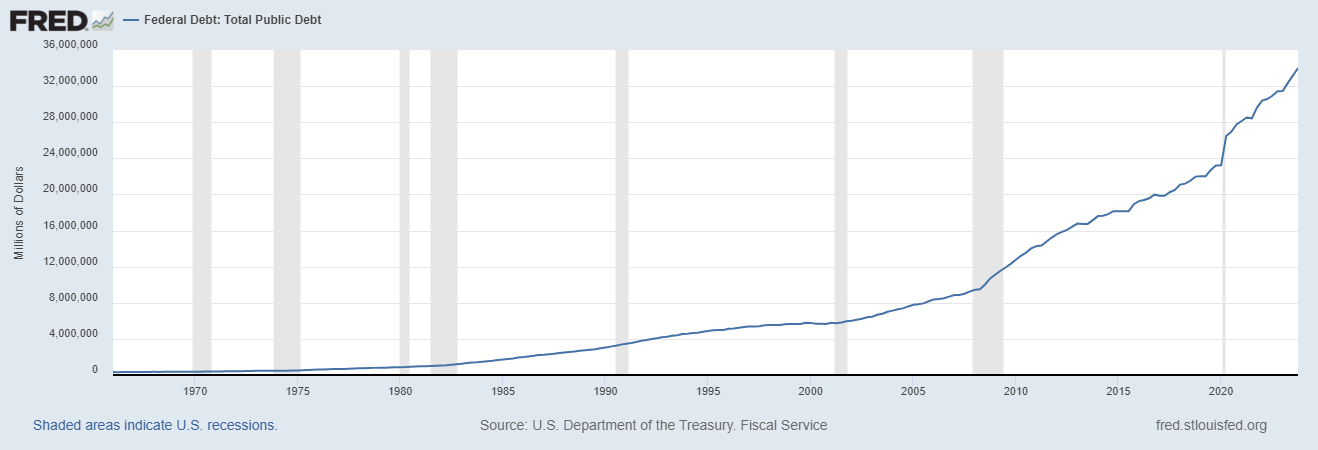

Since 1971, we have been indoctrinated to believe that the fiat system which replaced gold was workable. The notion that you can magically whisk away a towering debt crisis by simply piling on more debt, conjured up from nothing but thin air, is nothing short of fantasy. However, the entire world has operated on this idea with very dire consequences. This isn’t just an oversight; it’s a colossal miscalculation with profound consequences that can’t be swept under the rug indefinitely. And yet, what have our central bankers and the so-called guardians of fiscal policy been up to? Nothing more than a high-stakes game of delay, perpetuating a cycle of currency dilution that threatens the very fabric of our economic stability.

This approach is akin to trying to douse a fire with gasoline. It’s not just imprudent; it’s downright dangerous, offering a temporary illusion of calm while laying the groundwork for an inferno that could engulf us all. The actions taken by these financial “sages” amount to nothing more than a stopgap, a way to kick the can down the road while the underlying problem only grows more daunting. It’s high time we demand more than this endless cycle of monetary debasement.

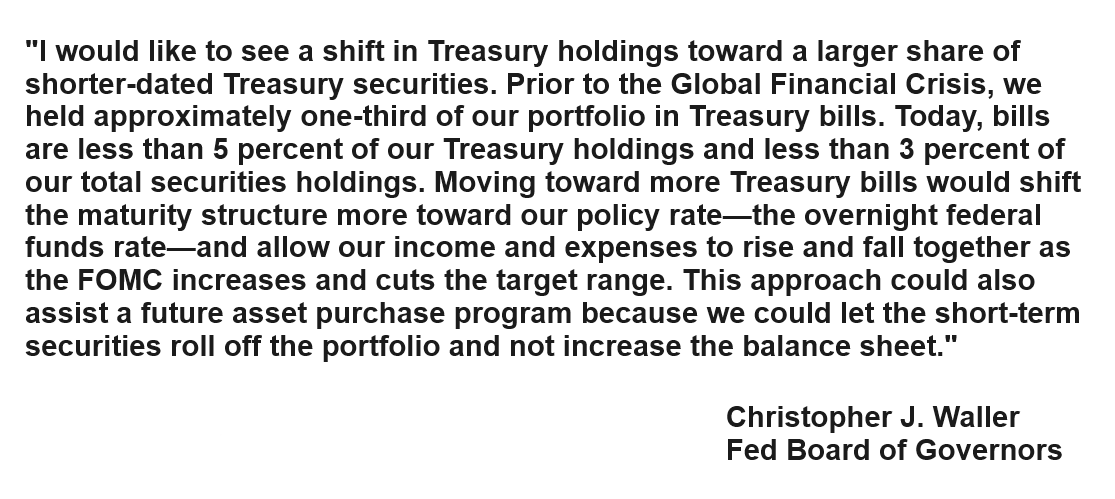

Last week, Christopher Waller from the Fed Board of Governors issues a speech in New York city where he made the following closing remarks:

The essence of his closing statement is a reference to more future quantitative easing.

Now for the gasoline on the fire. Did a Fed Governor imply more QE is in the pipeline?

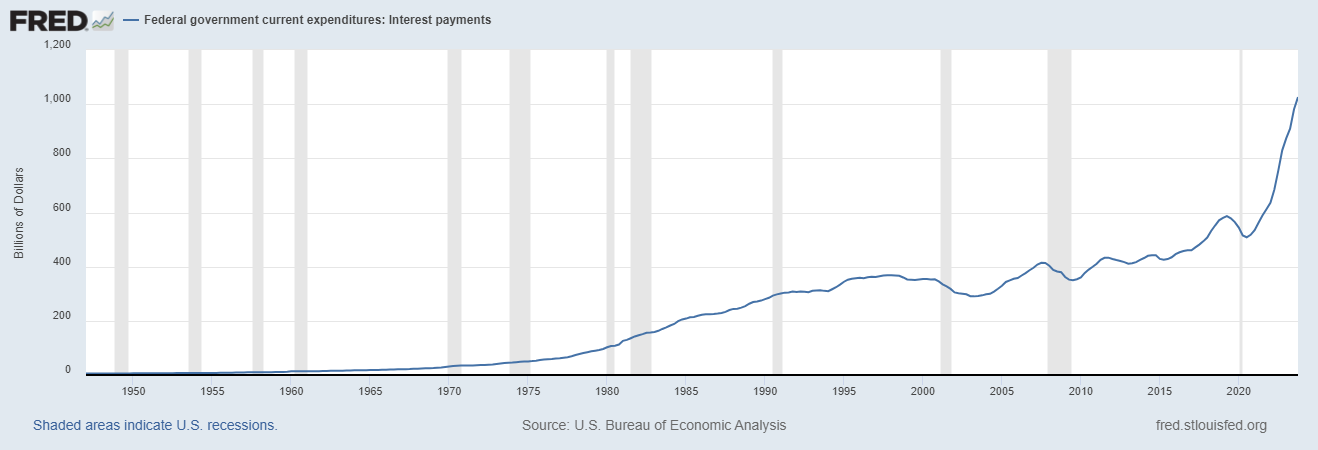

The United States has to rollover and refinance $10 trillion of U.S. Treasuries within the next 12 months . This fact terrifies the financial markets. Why? First off, the United States cannot afford to make interest payments on the current debt at current interest rate levels. Second, historically when a recession occurs, the Fed massively expands the amount of new money in circulation to try and ease the economic contraction. Combine these two factors and it is the recipe for massive currency debasement.

Let’s play a little game of FIAT monetary history. Let’s look at the 100 largest economies as judged by GDP. Run those economies on FIAT for the last 100 years, and 98 of the currencies will fail. The two survivors will be the U.S. Dollar and the British Pound which will have lost 98% of their purchasing power.

What a fun game!

I wish I were joking. But these are the historical consequences of fiat monetary systems.

Knowing this reality what the Fed and U.S. Treasury are trying to engineer at the present time is that they are offering the highest real interest rates in the world to draw as much money into the United States as possible. Next, will be the challenge of how they manage to rollover $10 trillion of Treasuries in the next year. The foundation is in place for much lower interest rates. In this environment gold thrives.

In February 2024, the Consumer Price Index (CPI) for All Urban Consumers in the United States rose by 0.4 percent on a seasonally adjusted basis. Over the last 12 months, not seasonally adjusted, the CPI increased by 3.2 percent. The index for all items excluding food and energy also saw a rise of 0.4 percent in February (seasonally adjusted), with a year-over-year increase of 3.8 percent. These metrics show that inflation is much hotter than what was anticipated.

Today the Produce Price Index report was released, and it too is showing much greater inflation than anticipated. The producer Price Index which measures the cost of raw, intermediate, and finished goods, jumped .6% on the month which was double the Dow jones estimate.

Conclusion: Inflation is back. Buckle your seat belts.

So far in this article I have priced a home in gold. I have priced a loaf of bread in silver, and I have compared the value of the Dow Jones Industrials to Gold from the date that Nixon severed the dollar from Gold. My reason for doing so is that it is an important exercise to price your wealth in something other than fiat.

Unless people do basic arithmetic, they can easily be duped by inflation.

Let me explain.

Imagine someone making $50,000 a year. When inflation comes in at 10%, they now have to be making $55,000 a year to maintain their purchasing power. The majority of workers do not keep pace with inflation. The majority of people do not comprehend this simplicity.

But when you look at financial markets that is an entirely different story.

As crazy as it sounds, the stock market has been a phenomenal hedge against inflation. Why?

The stock market is considered a viable hedge against inflation because, over time, most viable companies can raise the prices of their products or services in response to inflation, which can lead to higher profits and potentially higher stock prices.

This potential for stocks to maintain or increase in value even when the purchasing power of currency declines makes them an attractive option for preserving wealth in inflationary periods.

The problem with this scenario is one of defining a healthy or successful company. Inflation manipulates accounting success measures by altering the nominal values without necessarily reflecting real growth. For instance, a company selling 1000 units at $1000 each generates one million in gross revenue. With 10% inflation and a corresponding 10% price increase, the company could sell fewer units but report the same revenue, falsely suggesting stability or growth. This scenario highlights the need for inflation-adjusted accounting to accurately assess a company’s performance, separating real growth from inflation-induced nominal increases.

Gold’s value tends to rise when confidence in a nation’s fiscal and monetary policies wanes, reflecting concerns over inflation, currency devaluation, or economic instability. As governments print more money or accumulate debt, gold becomes a barometer, signaling investor skepticism towards the government’s ability to manage the economy effectively. In essence, a rising gold price can be interpreted as a negative “report card” for a country’s economic stewardship, showcasing the precious metal’s role as a safe haven during times of financial mismanagement.

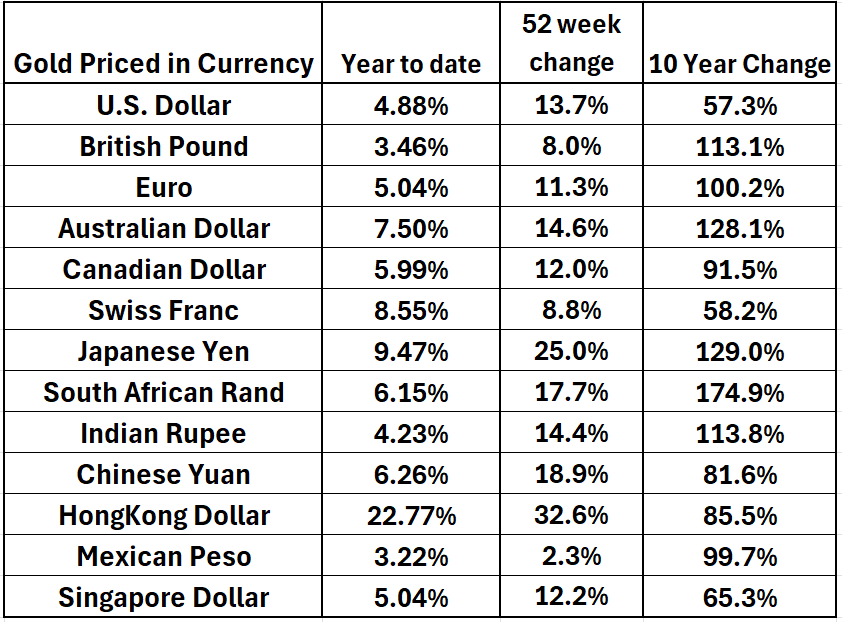

In preparing to write this article I priced gold in foreign currencies. What was remarkable to me was that gold was trading at new all-time highs when priced in almost all foreign currencies. The only exception I found was the Mexican Peso which has Gold priced at 18% below its all-time highs which occurred during the pandemic.

FIAT currency debasement is the flavor of the day at the world’s central banks and gold is acting like a safe haven and a report card. Once we learn to diagnose the problem from a longer-term perspective the toxicity is obvious.

The table above shows the price of gold in each currency. When the price of gold rises dramatically across different currencies worldwide, it typically indicates widespread concern about the stability of the global economy or financial system. This phenomenon often reflects collective worries about inflation, currency devaluation, and geopolitical uncertainties, leading investors globally to seek refuge in gold. Gold’s universal value and acceptance as a safe haven asset make it a popular choice during times of economic turmoil, as it retains value when confidence in traditional currencies and financial instruments wanes.

One of the most fascinating contradictions related to money is that central banks who manage fiat currency are traditionally the biggest buyers of gold. Holding gold reserves is a strategic move to diversify assets, ensure liquidity in times of crisis, and instill confidence in the central bank’s ability to continue to manage its country’s currency and economic health. This contradiction underscores gold’s enduring value and trust as a universal asset, even in the era of digital and fiat currencies.

The conclusion I make from these realities is that you cannot solve a debt problem with more debt. Our political leaders and monetary authorities will never admit to that simplicity which is why the United States is running a $9 billion a day deficit.

Traders, listen up. This isn’t just another Election Year; it’s the golden hour for those in power to polish the economy’s image, and their own, to a blinding sheen. Before reading this article, you were probably unaware that gold is trading at new all-time highs against almost all foreign currencies. Use that as your filter when you listen to all of the political dialogue running up to the election.

You know my mantra: deep economic analysis without bias. But here’s the kicker—I don’t let it dictate my trades. No sir. I bring in the big guns: artificial intelligence. It’s not just about making decisions; it’s about making the smartest ones. Let’s not just play the game; let’s stay ahead of it.

In the fast-paced world of trading and investing, Artificial Intelligence (A.I.) trading software has emerged as the ultimate safe haven for market participants seeking a reliable and objective ally. Unlike human traders, AI is not ego driven. It doesn’t succumb to emotions, pride, or fear, which often cloud judgment and lead to irrational decisions during volatile market conditions. A.I.’s relentless pursuit of data-driven insights ensures that it remains solely focused on one objective: identifying the best move forward to optimize returns while minimizing risks.

Moreover, A.I. possesses the invaluable ability to self-correct. It learns from its mistakes and adapts its strategies in real-time, allowing it to stay agile and resilient in ever-changing market landscapes. Human traders may become entrenched in their biases and convictions, leading to costly errors, while A.I. constantly refines its approach based on incoming data and market dynamics.

In essence, A.I.’s sole purpose is to stay on the right side of the right trend at the right time. Its unwavering commitment to objective analysis and continuous improvement makes it an indispensable tool for modern traders and investors. As we navigate an increasingly complex and interconnected global financial system, A.I. stands as the beacon of reliability and consistency, offering a safe haven for those who seek to thrive in the unpredictable world of finance.

Artificial intelligence trading software , it’s a game-changer because it learns from its mistakes, remembers them, and keeps forging new paths to find solutions. That’s the feedback loop that’s built fortunes for every successful trader I know. It’s a simple yet powerful concept, and here’s the kicker: A.I. applies mistake prevention round the clock, every day of the year, toward solving the problem at hand.

A.I., with its advanced pattern recognition, crunching mountains of data, spots the highest probability trades – and that’s invaluable. We may not always understand the “why” behind market movements, but we can ride the wave. So, keep your eyes on what IS happening, not what SHOULD happen, because in these uncharted waters, PRICE is king, and artificial intelligence is your guiding light.

Intrigued? Visit with us and check out the A.I. at our Next Live Training.

Learn how our a.i. trading software can help you navigate the tumultuous financial landscape ahead.

Remember, it’s not magic.

It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.