In an age where digital innovation reshapes landscapes at a blistering pace, the realm of finance is witnessing a revolutionary shift. In this article I will explore this transformative journey, shedding light on how technology, specifically blockchain and cryptocurrencies, is dismantling traditional financial barriers and constructing a new global economic framework. This seismic shift towards a decentralized financial system promises to democratize access to financial services, empowering individuals around the world by granting them control over their economic destinies, irrespective of their geographical or socio-economic standing.

At the heart of this financial evolution is the concept of permissionless finance—a system that allows anyone with an internet connection to participate without the need for approval from traditional gatekeepers like banks or governments. This radical departure from conventional financial systems, where access and participation are often mired in red tape and bureaucratic hurdles, heralds an era of unparalleled inclusivity and freedom. With cryptocurrencies and decentralized finance (DeFi) platforms leading the charge, the barriers to entry for financial participation are being eroded, enabling a wave of innovation and opportunity that spans the globe.

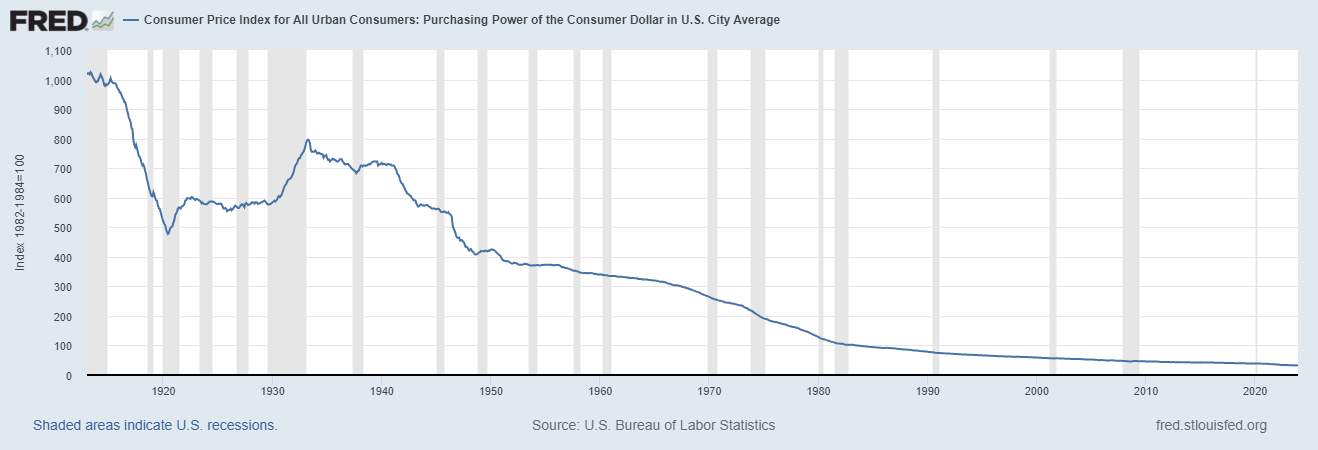

The history of fiat money is a tale of trust and belief—a trust in governments and central banks to maintain the value of currency without the backing of physical commodities like gold or silver. This system has flourished for decades, underpinning the world’s economies, and facilitating international trade. However, the very feature that has been its strength—the ability of central authorities to print money at will—has also sown the seeds of its potential downfall. In recent years, the rapid increase in debt across the globe, coupled with the use of quantitative easing as a band-aid for economic woes, has started to dilute the faith in fiat currencies. Years of unfettered money printing, soaring national debts, and the erosion of trust in financial institutions are converging to challenge the hegemony of conventional money. As nations grapple with these unprecedented economic pressures, the cracks in the fiat system are becoming too glaring to ignore, signaling a shift that could redefine the essence of money and wealth.

Yet, as we chart this unexplored territory, we must examine the complexities and challenges that accompany such profound change. From regulatory hurdles to the volatility of digital assets, the path towards a fully permissionless financial system is fraught with obstacles. However, the potential rewards—a world where financial services are truly accessible to all, fostering economic empowerment and innovation—present a compelling vision for the future. As we stand on the precipice of this new financial frontier, the article invites readers to contemplate the transformative power of permissionless finance and its potential to redefine our understanding of economic freedom and opportunity in the digital age. Our political leaders and monetary authorities have tried to convince us for the last 50 years that you can solve a debt problem by simply creating more debt. This premise stands at the center of current monetary and fiscal policy and its only result has been the creation of more debt and currency debasement.

Can you solve a debt problem by simply creating more debt? Solving a debt problem by creating more debt seems counterintuitive at its core, akin to trying to extinguish a fire by dousing it with gasoline. The logic behind this approach falls apart under basic scrutiny: if individuals could resolve their indebtedness by simply borrowing more, then the concept of financial responsibility would become moot, and the idea of having one’s personal printing press for money might not seem so far-fetched. Yet, this simplistic view overlooks the complex interplay of economic principles and practices in real-world scenarios. The strategy of leveraging debt to manage or mitigate existing debt burdens hinges on the conditions and strategies under which the new debt is undertaken, not merely on the act of borrowing itself.

However, the principles of Keynesian economics offer a perspective where, under certain conditions, increasing debt is not only seen as a viable solution but as a necessary tool for economic management. According to Keynesian theory, during periods of economic downturn or recession, government intervention through increased spending and borrowing can stimulate demand, jumpstart the economy, and ultimately lead to a scenario where the generated growth offsets the initial increase in debt. This framework posits that strategic debt, when used to fuel investment in productive sectors, can act as a catalyst for economic recovery and growth, suggesting that the issue is not debt itself but how and where it is employed.

Yet, the application of Keynesian principles in practice is fraught with challenges, including the risk of spiraling debt if the anticipated economic growth does not materialize or if borrowed funds are misallocated. The notion that societies can operate indefinitely by increasing debt relies on the precarious balance of growth outpacing the cost of debt—a balance that is not guaranteed. Moreover, the accumulation of debt with the expectation of future growth places a burden on future generations and can lead to long-term economic vulnerabilities. Thus, while Keynesian economics provides a rationale for the use of debt as a tool within a broader economic strategy, it underscores the importance of prudent, targeted, and effective application of this tool, rather than an indiscriminate increase in borrowing.

Let me post the problem in terms that a child could easily comprehend.

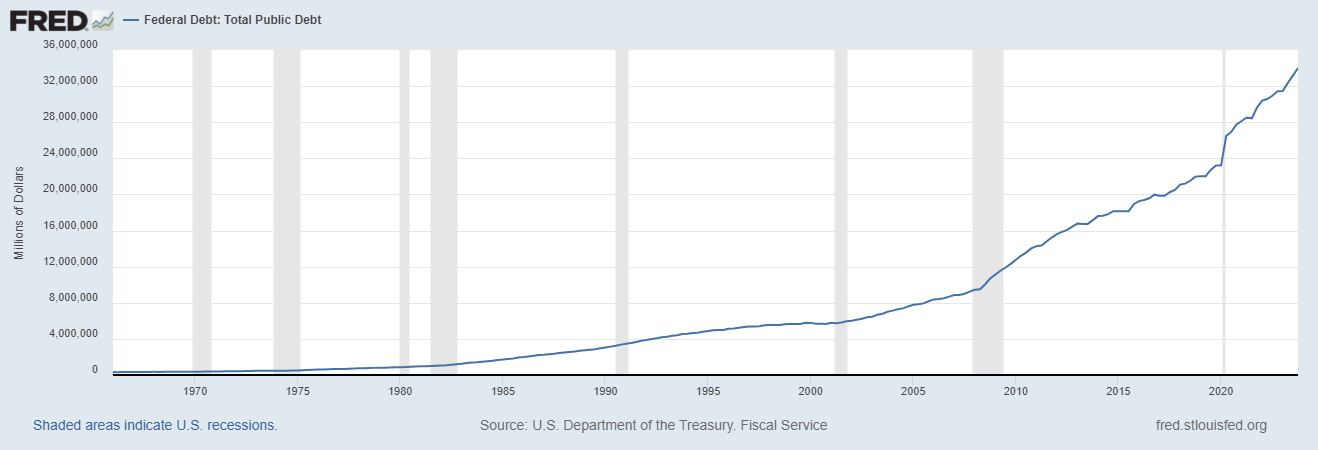

The US Debt currently stands at $34.6 trillion.

We are adding $1 trillion to that debt every 100 days .

That means that barring any additional deficits or monetary shortfalls the debt will grow by a minimum of $1 trillion times 3.65, which is $3.65 trillion annually.

Now simply compare that projected new debt of $3.65 trillion to the original debt of $34 trillion and you can see that total debt is growing by 10.7% per year.

For anyone who can do basic arithmetic, this prospect is horrifying.

Why?

If debt is growing at 10.7% a year and the Gross Domestic Product is growing at let’s say 4%, the excess growth in the debt, in this case, 6.7% (10.7% – 4%), suggests that there is more money available in the economy than is required for the transaction of goods and services at current prices, creating upward inflationary pressure on prices. This example, while grossly simplified, illustrates the nature of the problem. Under the current system, debt perpetuates more debt.

This is the recipe for currency debasement that the U.S. has been operating under for the last 50+ years. If you ever wonder why EVERYTHING becomes more and more expensive, it is because currency debasement is always the flavor of the day for our political class. We continue to foster ideas that perpetuate the belief that the way we handle the current debt is by simply adding more debt to it. This is the monetary equivalent of “The Emperor’s New Clothes.” That story carries a profound message about the dangers of vanity, pride, and the fear of speaking the truth. It takes the innocent honesty of a child, who exclaims that the emperor is wearing nothing, to break the spell of collective denial.

The tale serves as a caution against the perils of succumbing to groupthink and the importance of individual integrity. It highlights how societal pressure, and the fear of judgment can lead people to conform to falsehoods or pretend not to see obvious truths. The story is a timeless reminder of the value of speaking truth to power and the need for critical thinking and personal courage in the face of collective deceit or delusion.

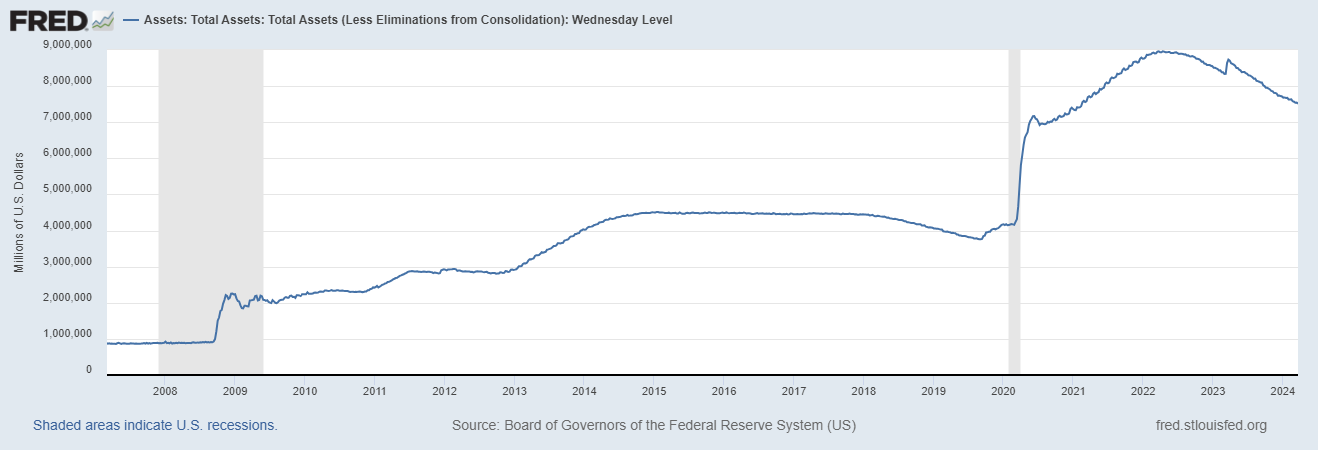

Does anybody remember the press conferences Fed Chair Ben Bernanke did during and after the Great Financial Crisis? He promised that there would be a ONE TIME only $800 billion infusion into the economy to rescue the “Too Big to Fail” institutions. That was 16 years, and $8.3 trillion dollars ago.

While you can see the effect of currency debasement in the G8 nations, it is patently obvious to witness the destruction of fiat currencies when you start looking at the smaller countries. Many of these countries have been completely obliterated over the past decade. As you look over the following 4 charts all of the G8 nation members keep in mind that you are looking at the value of their standard of living, their currency. If you had an investment manager who managed your retirement portfolio in a comparable manner, chances are you would not be too happy!

These losses are incremental in nature, meaning that the losses are not noticeable over short periods of time. That appears to be the skill of Central Bankers to master the slow erosion of the value of a currency.

But the real horror show occurs when you begin to look at the smaller countries’ currencies.

We’re in the midst of what I like to call financial revolutions. Every 80 years or so, this currency system hits the reset button, and boy, are we seeing it play out right before our eyes? Take a look back about 80 years ago, when the Bretton Woods agreement established the United States as the world’s reserve currency. Back then, the idea was to tie the dollar to gold, with other currencies pegged to the dollar. But fast forward to 1971, and we’re knee-deep in this fiat money system, this paper money system, and let me tell you, currencies are just crumbling all around us.

I mean, look at Zimbabwe, the Argentinian peso, Lebanon, Turkey, Argentina, Venezuela—you name it, they’re experiencing total meltdown. These currencies are tanking left and right. Now, don’t get me wrong, the dollar’s still holding up pretty well. It’s like the cleanest dirty shirt in a pile of dirty laundry, if you catch my drift. But even the dollar’s taking a hit and here’s the kicker—the dollar’s not immune either. It’s down 65% to the S&P 500 in the last 5 years, and 45% to the average real estate. So, yeah, it’s crashing too, folks.

But let’s dig into why this monetary system is having such major issues.

So, we’ve got three big problems staring us right in the face. First off, we’ve got this massive wave of deglobalization hitting us like a ton of bricks.

Then there’s the elephant in the room—massive amounts of debt that are dragging us down faster than a lead balloon.

And finally, we’ve got the trust factor, which, let me tell you, is the linchpin holding this whole thing together.

Last time I checked there were 9 nations that had nuclear weapons. The United States, Russia, China, France, the United Kingdom, India, Pakistan, Israel, and North Korea.

When the war started in Ukraine, The United States decided to impose economic sanctions on Russia and kick it out of the SWIFT banking system. Well, it’s been two years. Did it cripple Russia? More importantly, if you were a smaller nation and you saw that Russia was sanctioned by the United States, would that enhance your trust in the fiat monetary system or detract from it? It is my contention that the United States decision to impose those sanctions on Russia, destroyed TRUST amongst sovereign nations. The imposition of sanctions by the United States on Russia following the onset of Ukraine conflict significantly undermined trust among sovereign nations within the existing monetary order. These sanctions, often targeting key sectors of the Russian economy and individuals close to the Kremlin, reverberated across the global financial system, leading to heightened uncertainty and unease among nations. The unilateral imposition of such measures by a dominant economic power like the United States underscored the potential vulnerability of nations to external pressures and highlighted the fragility of the international financial architecture. This erosion of trust was compounded by concerns among other countries about the potential weaponization of financial systems for geopolitical ends, casting a shadow of doubt over the reliability and fairness of the global monetary framework.

The BRICS nations are a coalition of emerging economies comprising Brazil, Russia, India, China, and South Africa. Formed in 2006 with the inclusion of South Africa in 2010, this alliance represents countries distinguished by their significant influence on regional and global affairs, marked by rapid economic growth, substantial population sizes, and considerable natural resources. The primary aim of the BRICS nations is to serve as a counterbalance to the established economic order dominated by Western countries, advocating for a more equitable world economic system that enhances their trade and investment opportunities, and ensures their voices are heard in global governance.

Currently, the BRICS platform includes these five initial countries, but it has expressed openness to expansion, with an additional 51 nations showing interest in joining. A significant aspect of their collaboration involves the pursuit of de-dollarization, which is the process of reducing their reliance on the U.S. dollar in international trade and finance. This effort stems from a desire to decrease the dominance of the dollar, which gives the U.S. considerable economic and political leverage internationally. By promoting the use of their own currencies and considering alternative payment systems for trade among themselves, the BRICS nations aim to increase their financial independence, reduce their vulnerability to U.S. monetary policy, and enhance their economic stability.

Clearly the BRICS formed primarily to confront the economic notion that you can solve a debt problem by creating more debt. But there is another major issue which also compounds the lack of trust. I am referring to the U.S. Treasury market. U.S. Treasuries, once the belle of the ball, have taken a nosedive, shedding up to 46% of their value post-pandemic. Talk about confidence-inspiring, right? If that doesn’t scream ‘solid investment,’ I don’t know what does. Look at the chart below and ask yourself, does this look like a good buy trade? After all it is only communicating the health of the U.S. Treasury.

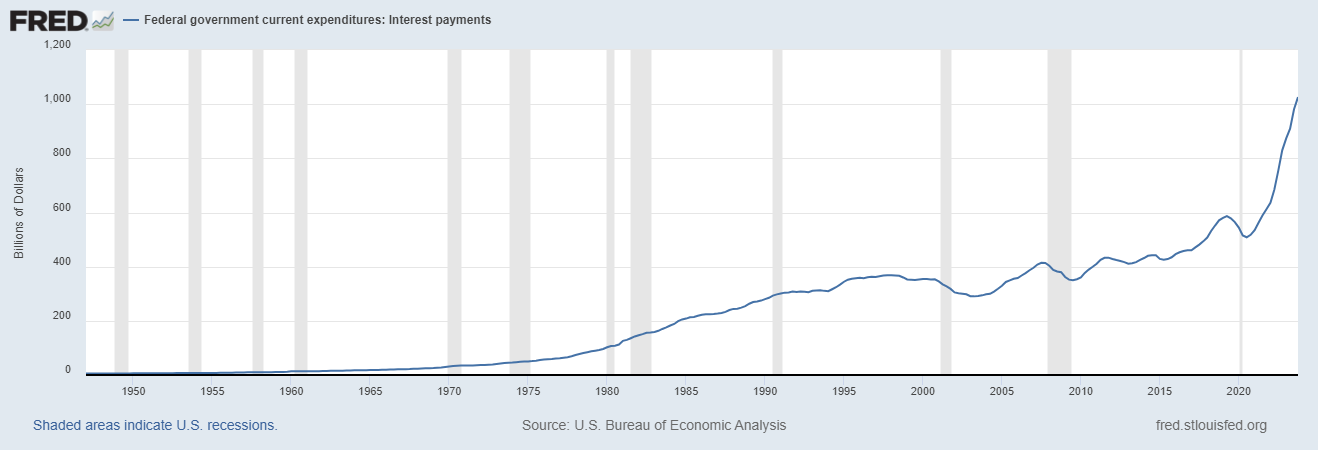

But here is the sticky problem laid out in black and white. In 2024, the U.S. Treasury needs to refinance $10 trillion of U.S. Treasuries which will expire. Those current debt obligations have an interest rate coupon of 3.2%. Why is this a problem? Well, the 5-year Treasury is currently yielding 4.2% which is 33% higher than the government’s current obligations. Also, inflation as of the last CPI report printed 3.6%. What incentive is there to invest in Treasuries when inflation could easily spike significantly higher? I suspect that the U.S. Treasury market will become the next casino. The market will no longer cater to long term savers but rather it will attract short term speculators who will speculate on short term treasury moves like a gambler in Vegas. I think it is highly likely that the US Bond market will see a tremendous rally to accommodate the demands of the Treasury.

The problem is that sovereign nations are not opening up their wallets to buy U.S Treasuries. Can you blame them? Massively increasing debt and higher than normal inflation are not exactly confidence inspiring.

Currency debasement in a fiat economic order represents a significant and inherent risk, primarily because fiat currencies are not backed by physical commodities but by the government’s promise. This system grants central banks the power to print more money at will, a temptation that has historically led to oversupply and, ultimately, devaluation of the currency. The consequence is inflation, or in extreme cases, hyperinflation, where the purchasing power of money plummets at an alarming rate. Such scenarios wreak havoc on savings, investments, and the overall economy, as witnessed in Zimbabwe in the late 2000s and Venezuela more recently. These countries saw their currencies become virtually worthless, leading to widespread poverty, shortages of basic goods, and a loss of public trust in the financial system.

Almost all fiat currencies have faced extinction to some extent, with many failing altogether. The Roman Empire, for example, continuously debased its coinage to fund wars and lavish public projects, contributing to its economic decline. In modern times, the German Mark experienced hyperinflation in the early 1920s, a period marked by severe economic and social turmoil. More recently, the Zimbabwean dollar became infamous for its hyperinflation episode in 2008, where the rate of inflation peaked at an almost incomprehensible 79.6 billion percent month-on-month, leading to the abandonment of the currency. These examples serve as stark reminders of the dangers inherent in a fiat currency system, where the temptation to print, money will lead to the erosion of value, undermining the economic stability and trust that are essential for a currency to function effectively.

Even the U.S. dollar has lost 98% of its purchasing power since the Federal Reserve Act was passed in 1913.

So, what is the solution to this perpetual currency debasement?

As I continue to confront this question, what strikes me as obvious is that if you define your wealth in a deteriorating asset it is perilous to say the least.

Imagine wealth tied up in a deteriorating asset is like owning a boat with a slow leak. At first, the leak might seem manageable, and the enjoyment and utility you get from the boat make it easy to overlook. You might even argue the boat is still valuable and functional, focusing on the good times it brings rather than its diminishing state. However, as time passes, the leak worsens. If you don’t address it, the water intake increases, and the efforts to bail it out become more frantic. Despite these efforts, the boat’s condition and value continue to decline, and the cost of repairs can escalate, possibly exceeding the boat’s worth or your ability to repair it.

This analogy mirrors the danger of having your wealth tied up in an asset that is losing value over time. Just like the boat, the asset might seem valuable and hold sentimental or perceived financial worth initially. However, as the asset’s value deteriorates, your net worth and financial security can similarly erode if you don’t act.

As traders we have been conditioned to define wealth in terms of U.S. dollars. But I find that proposition fraught with risk.

Let me explain.

When I was younger, I knew many elderly people who retired with life savings of $200,000. Their formula for living was to invest their life savings in Government bonds and live off their interest. Bonds would yield 9% and they would receive $18,000 from the Treasury to live off of. Those days are long gone.

I know many, many people today who have millions of dollars and are scared to retire. After all, the average home costs $400,000 today and generating passive income can be quite a challenge.

As hard as it might be to believe, most people need much more than a million dollars to be able to retire.

This reality forces us to rethink what wealth is.

When I confront that question, I come to understand that I don’t want money, I want all of the things that I can buy with money. Since money can be devalued by a government, or monetary authority, how can I find assets that are more immune to currency debasement and define my wealth in those assets?

In essence what we all need to do is define quality in a way that can be easily quantified.

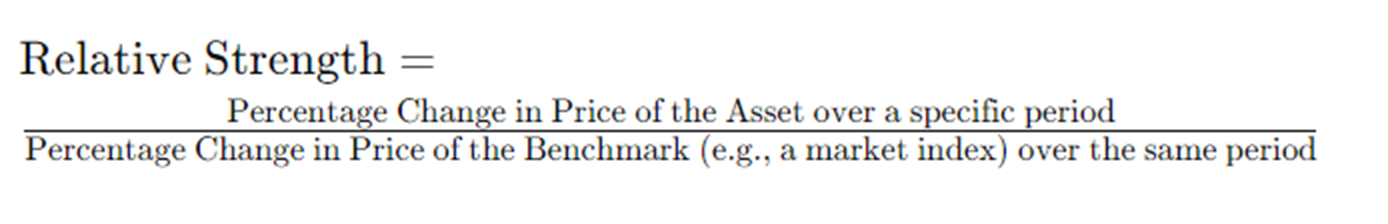

On Wall Street the way that quality was always defined was through the concept of Relative Strength. The concept of basic relative strength on Wall Street, as distinct from the Relative Strength Index (RSI), involves comparing the performance of one asset to another or to a broader market index over a given period. This method is often used to compare and identify assets that are performing better or worse than the market or their peers. The basic formula for calculating relative strength is straightforward:

– A **relative strength greater than 1** indicates that the asset has outperformed the benchmark over the selected period.

– A **relative strength less than 1** indicates that the asset has underperformed the benchmark.

– A **relative strength equal to 1** indicates that the asset has performed in line with the benchmark.

What this simple formula allows any trader or investor to do is compare returns of assets to one another in the hopes of avoiding losers and staying in the strongest trends.

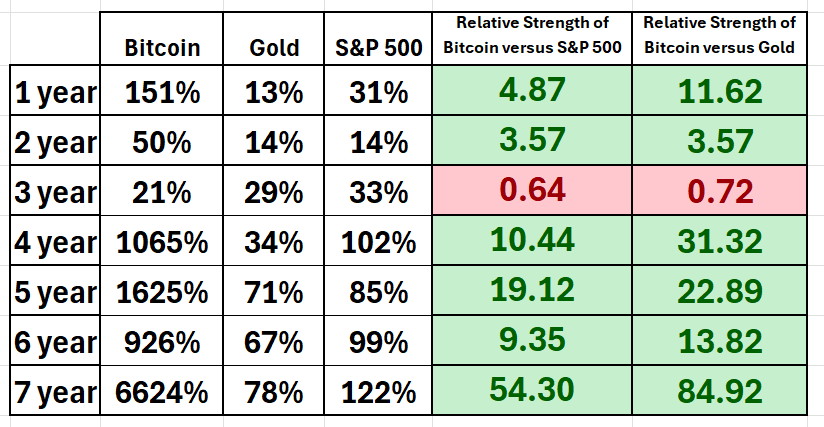

Here are the performance metrics on Bitcoin, Gold, and the S&P 500.

The reason that 11 ETFs for bitcoin were recently approved is that bitcoin is clearly the fastest horse in the race. Everybody on Wall Street uses Relative Strength to define quality and in the realm of relative strength comparison, Bitcoin is undeniably the front-runner, outpacing its competitors soundly. It’s not even close.

This method can help investors identify asset and make decisions about reallocating their investments towards assets showing stronger performance relative to the market or a selected benchmark. It’s important to note that while relative strength can highlight past performance, it does not guarantee future results. But performing a relative strength analysis is done to primarily find and focus on assets that are outperforming the broader stock market indexes and steering clear of laggards. Relative strength is a very important way to define quality, particularly when you are comparing assets over multiple time frames.

Investing in Bitcoin offers several compelling reasons. Firstly, Bitcoin is decentralized, meaning it operates independently of any government or central authority. This characteristic can protect investors from political instability and manipulation that might affect traditional currencies. Additionally, Bitcoin has shown significant potential for long-term growth, with its limited supply of 21 million coins driving up demand and value over time. Furthermore, its borderless nature allows for easy transfer of funds across international borders, making it appealing for individuals seeking to diversify their investment portfolios and hedge against inflation or currency devaluation in their home countries.

Moreover, Bitcoin is increasingly being recognized as a store of value akin to digital gold. Its scarcity, combined with growing adoption by institutional investors and mainstream financial institutions, suggests it could serve as a hedge against economic uncertainty and inflation. Furthermore, the underlying blockchain technology offers transparency and security, reducing the risk of fraud and manipulation compared to traditional financial systems. Overall, investing in Bitcoin offers the potential for significant returns, portfolio diversification, and protection against geopolitical and economic uncertainties.

Bitcoin represents a groundbreaking advancement in the realm of finance as a permissionless system, offering unparalleled accessibility and inclusivity. Unlike traditional financial systems that require intermediaries such as banks or payment processors to facilitate transactions, Bitcoin allows anyone with an internet connection to participate in financial activities without needing approval from a central authority. This permissionless nature democratizes finance, granting individuals worldwide the ability to send, receive, and store value securely, regardless of their geographic location, socioeconomic status, or identity.

Moreover, Bitcoin stands as the most technologically sophisticated form of money ever created , primarily due to its underlying blockchain technology. The blockchain serves as a decentralized and immutable ledger that records all transactions in a transparent and verifiable manner. This innovative technology ensures the integrity and security of the Bitcoin network, mitigating the risks of fraud, censorship, and manipulation that plague traditional financial systems.

Furthermore, Bitcoin’s technological sophistication is evident in its deflationary economic model and predetermined supply schedule, which sets it apart from fiat currencies prone to inflationary pressures. With a maximum supply cap of 21 million coins, Bitcoin’s scarcity fosters trust in its value over time, making it a reliable store of wealth and a hedge against the debasement of fiat currencies. In summary, Bitcoin’s permissionless design and technological prowess redefine the landscape of finance, empowering individuals with unprecedented control over their financial assets and paving the way for a more inclusive and resilient global economy.

Bottom line: You can’t solve a debt problem by simply creating more debt.

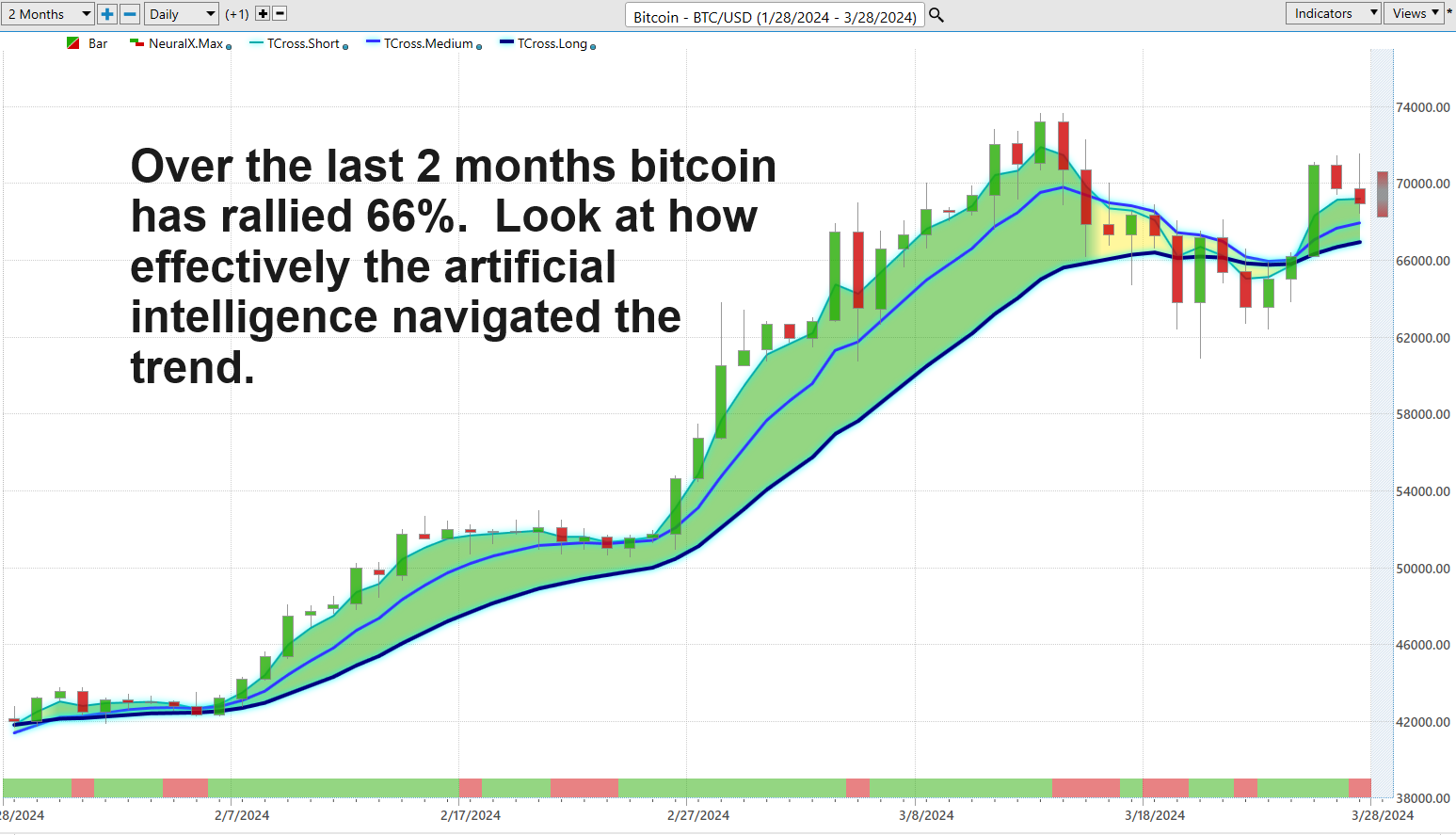

Are you ready to revolutionize your trading strategy and stay ahead of the curve in today’s dynamic financial markets? Join us for an exclusive online trading masterclass where you’ll discover how Artificial Intelligence can supercharge your trading performance like never before! Imagine having the ability to predict market movements with precision, staying on the right side of the trend, at the right time. Our AI-powered system has consistently delivered exceptional results, guiding traders through every twist and turn of the market landscape.

Witness the Remarkable: Take a look at the recent rally in Bitcoin, soaring an impressive 66% over the past two months! While others may have been left guessing, our AI trading software accurately called this monumental move, keeping traders on track to capitalize on every opportunity. Don’t miss out on learning the secrets behind this groundbreaking technology that could potentially transform your trading fortunes forever.

Elevate Your Trading Game: Whether you’re a seasoned trader or just starting out, this trading masterclass is your gateway to unlocking the full potential of Artificial Intelligence in trading. Gain insights into cutting-edge strategies, harness the power of data-driven decision-making, and embark on a journey towards consistent profitability. Secure your spot now and embark on a path towards trading success like never before! Don’t let this opportunity pass you by – reserve your seat today and embark on a journey towards trading mastery with AI at your side.

Intrigued? Visit with us and check out the A.I. at our Next Live Training.

Learn how our a.i. trading software can help you navigate the tumultuous financial landscape ahead.

Remember, it’s not magic.

It’s machine learning.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.