In the shadows of economic history lies the subtle yet profound practice of currency debasement—a governmental tactic as ancient as money itself. From the clipped silver coins of the Roman Empire to the sophisticated monetary policies of modern central banks, the act of reducing a currency’s value has long been a tool used by rulers to solve financial problems at a great cost to society. “Currency Debasement: Economic Savior or Silent Thief?” explores this intriguing facet of economic manipulation, uncovering its origins, its evolution, and its impact on both ancient and contemporary economies.

It is my contention that you cannot understand wealth until you comprehend currency debasement.

Let me explain.

Most people think of wealth as money. Since I was a child, I dreamed of what it would be like to have one million dollars. However, wealth is not money. Genuine wealth is all the things that money can acquire. This distinction is vital to effective wealth building.

Imagine that I put you and your 10 best friends on a deserted and isolated island, and I give each of you one billion dollars. Are you wealthy? Your money cannot purchase anything in this situation. Until you either build infrastructure on the island or develop a means to communicate with the civilized world, your money possesses zero value.

This example isolates the idea of value in wealth creation.

The Austrian School of Economics, a branch of economic thought that emphasizes the subjective theory of value, individualism, and the importance of the entrepreneurial role, offers a distinct perspective on the concept of wealth. From the Austrian viewpoint, wealth is not simply equated with money; instead, wealth encompasses all the goods and services that money can buy, which contribute to human satisfaction and well-being.

In Austrian Economics, money itself is seen primarily as a medium of exchange. It facilitates the trade of goods and services but does not constitute wealth in and of itself. Wealth, rather, is derived from the value of these goods and services, which are subjectively valued by individuals based on their utility and the satisfaction they provide. This utility is determined by personal preferences and the relative scarcity of the goods or services.

Ludwig von Mises, a prominent figure in the Austrian School, emphasized that money should be understood as a tool that allows for the easier exchange of real goods and services, which are the true measures of wealth. The wealth of an individual, or a society, is therefore not measured by the amount of money held, but by the abundance and quality of consumable goods and services available that enhance life and well-being.

This approach contrasts with the mainstream materialistic views where wealth might be measured solely by monetary accumulation. Instead, Austrian Economics argues that the focus should be on the production of valuable goods and services and on the capacity of individuals to engage in voluntary exchanges to enhance their personal well-being and economic satisfaction. This perspective underscores the importance of productive capabilities and the role of entrepreneurship in creating real wealth—elements that money alone cannot generate but can only represent or facilitate in trade.

This distinction is crucial to comprehend because the most powerful position in today’s modern society is whoever controls the printing press where money is created. As long as the state is in control of money, we tend to believe that the State is the source of all value creation. When we disabuse ourselves of that notion we only then can recognize and understand that the State maintains its power through the control of the printing press. Traditionally anyone who challenges this control is perceived to be a threat to the state, and the citizenry.

The Austrian School of Economics views the state not as a creator of wealth, but rather as a potential impediment to economic prosperity. According to this perspective, true wealth is generated by individual entrepreneurs and businesses responding to market demands, not by state intervention. Austrian economists argue that the state’s role should be minimal, focused primarily on protecting individual rights, enforcing contracts, and maintaining the rule of law. They criticize government regulation and central banking, suggesting that these often lead to economic inefficiencies, distorted market signals, inflation and cycles of booms and busts. By advocating for less government intervention, Austrians believe that the natural dynamics of free markets will lead to optimal economic outcomes, driven by the decentralized decisions of individuals operating within a framework of voluntary exchange and private property rights.

Currency debasement refers to the intentional reduction in the value of a currency by a governing authority. Traditionally, this involved reducing the precious metal content in coins while maintaining or increasing the nominal value of the currency. In contemporary terms, debasement can occur through the excessive printing of money, leading to inflation, or through policies that dilute the value of currency relative to foreign currencies. Essentially, debasement is a form of economic manipulation used by states to decrease the intrinsic value of money held by the public.

Historically, currency debasement served as a critical financial strategy for monarchs and states facing economic crises, such as war, famine, or debt. By decreasing the metal content in coins, governments could mint more money from the same amount of precious metal, effectively funding immediate needs at the expense of long-term economic stability. This practice dates back to at least the Roman Empire, where emperors like Nero and Commodus infamously reduced the silver content in their denarii, leading to inflation and public distrust. Coin clipping was a fraudulent practice historically prevalent in societies that used precious metal coins as currency. Individuals would shave off small amounts of metal from the edges of these coins and collect the shavings to melt down into bullion or to produce counterfeit coins, thereby gradually and illicitly accumulating wealth. This led to widespread debasement of the currency, diminishing its value, and undermining economic confidence. The most powerful example of this occurred in England during the 17th century, culminating in the Great Recoinage of 1696.

In modern economies, debasement no longer involves physical alteration of coins but rather revolves around monetary policy. Central banks may increase the money supply rapidly, a direct descendant of ancient coin clipping, which can lead to inflation if done without corresponding economic growth. This method is often used to ease national debt burdens, stimulate economic growth, or manage employment levels, showing that the essential nature of debasement—sacrificing future stability for immediate financial relief—remains unchanged.

The contemporary relevance of currency debasement is evident in the challenges faced by modern economies in recent years, where excessive printing of money has led to persistent inflation. These modern examples underline the delicate balance required in monetary policy and highlight the potential consequences of its mismanagement. Furthermore, in a globalized economy, the impacts of debasement can extend beyond national borders, influencing international trade, investment flows, and economic stability worldwide.

Thus, understanding the historical and modern dynamics of currency debasement not only provides insights into past economic decisions but also offers valuable lessons for current and future monetary policies.

Understanding currency debasement becomes very real when you can view the process objectively and genuinely understand that what is occurring is your wages and buying are being reduced by government policy. Some people notice this immediately. Some never notice it at all. However, this is a silent tax which steals your wealth.

Let me explain.

According to the government statistics the U.S. dollar has been devalued at a rate of about 2% to 3% per year. This is how our monetary system has been designed. The effect of this persistent debasement is incredibly toxic. Many people never notice or understand the cause of it.

People see the prices rise of goods and services increase.

So, they think that the value of the currency is static, stable and the goods and services are being perceived as becoming more valuable.

This is the economic sleight of hand that is occurring.

For example, most people see the price of a house rising. They do not see the value of the currency decreasing which is what is causing the price to rise.

So, for asset owners they maintain the illusion that they are getting wealthier. After all the price of their home has increased 10-fold over the last 50 years. But the house’s increase in value is a product of more currency being required to purchase the same asset.

If you can view this objectively, no new wealth has been created. The only thing that has occurred is that the value of the house has gone up because the value of the currency has gone relative to the house.

What is systematically taking place is that your wages are being devalued by consistent currency debasement.

And here lies the great divide. If people understood that the government was reducing their wages, there would be riots in the streets. Instead, those asset owners are led to believe that they are becoming wealthier and that the monetary authorities are doing a great job.

Let me share a few examples with you, that once you see them you will be unable to UNSEE them.

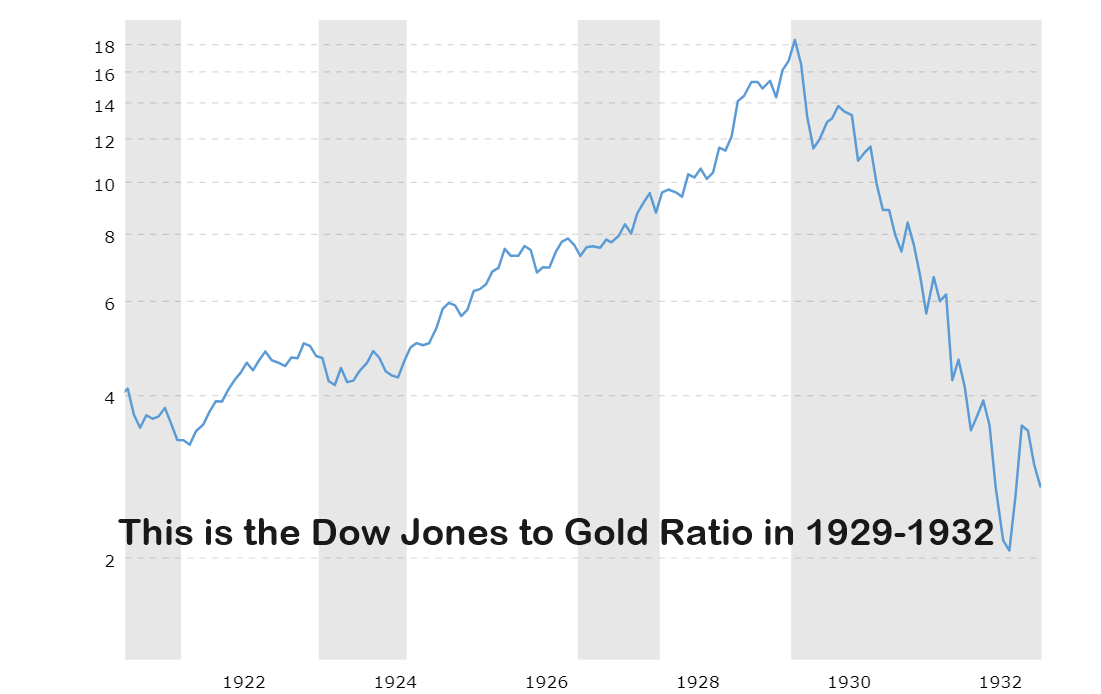

The 1929 stock market crash stands as the most catastrophic meltdown in the annals of our modern stock market, a prelude to the harrowing economic collapse of the Great Depression. On September 3, 1929, the Dow Jones Industrial Average soared to a dizzying height of 381.17 points , setting the stage for an unparalleled financial disaster. What followed was a relentless bear market, a prolonged agony that didn’t see a bottom until the Dow bottomed out at a mere 41.22 points on July 8, 1932 . From its peak, the market hemorrhaged an astonishing 89% of its value, erasing nearly nine-tenths of wealth and marking an era of economic despair that gripped the nation for years.

If you take this value of the Dow in 1929 ($381.17) and instead of looking at it in terms of dollars, price it in terms of Gold, which was $20 per ounce you have the Dow Jones Industrials average priced at roughly 19.05 ounce of gold.

The Dow Jones Industrial Average peaked on March 28, 2024, at a price of $39728. Gold was trading at $2,200. When you divide the Dow by the price of Gold the ratio today was roughly 18.05 ounces of Gold. Not a perfect correlation.

Gold has maintained its value relative to the Dow even after 95 years.

The U.S. dollar has not.

The DOW has gone up because the value of the currency has gone down.

macrotrends.com

Gold has seen a monumental rise, increasing seven-fold since the turn of the millennium. If the Dow Jones Industrial Average aimed to match this golden ascent, it would be perched at a staggering 70,000 points today—double its current stand! This striking comparison underscores a fundamental truth about our economy: the growth we’ve witnessed since 2000 pales in comparison to the robust expansion seen during the nearly two-decade post-1982 boom. Once tightly correlated with broader economic trends, the Dow’s performance now tells a tale of relatively subdued growth, a mere shadow of its former vigor. This divergence raises serious questions about the true health and direction of our economic system.

An average home in 1913 cost $3,000 or 150 ounces of Gold. Today an average home costs $340,000 or roughly 150 ounces of Gold.

Even one gallon of gasoline which cost 2 silver dimes when I was a kid, today those two silver dimes, based upon their silver content will still purchase one gallon of gas.

Historically, an ounce of gold could purchase a fine men’s suit. This measure of value has generally held true from the early 20th century through today, where an ounce of gold (currently valued at about $2,000) still buys a high-quality suit. In contrast, the number of US dollars needed to purchase the same quality suit has increased dramatically over the same period due to inflation.

These examples highlight a critical aspect of monetary economics: commodities or currencies with intrinsic value or limited supply tend to maintain their purchasing power over time. Fiat currencies do not. The US dollar, like many modern currencies, is subject to government monetary policy and inflation, which will erode its value over time.

The key realization is that the value of the asset is not going up in comparison to other real commodities. The value of paper money is going down.

If your employer were to reduce your wages the way that the government debases currency you would seek a new employer.

The examples go on and on.The U.S. dollar is a dishonest unit of measurement because it holds zero intrinsic value. The lesson to be learned is that the State requires us to trade and earn our wages in U.S. dollars, but we are well served to measure our wealth in something other than U.S. dollars and that has proven to be a good store of value.

Currency debasement can be understood as the decrease in the value of money itself, through the actions of government entities inflating the currency supply. This process is analogous to a reduction in real wages. When the currency is debased, it loses purchasing power, meaning that each unit of currency buys fewer goods and services than before. This is similar to receiving a pay cut, where the nominal value of the wage might stay the same, but its real value—the actual goods and services it can purchase—decreases. In essence, even if a person’s salary remains unchanged on paper, the decrease in the value of the currency means that effectively, their income buys less, reducing their economic welfare as if their wages were directly cut.

The effects of currency debasement often go unnoticed by the general public because they manifest primarily as rising prices, rather than explicit reductions in wage slips. As more money chases the same amount of goods, prices naturally rise—a phenomenon known as inflation. Most people perceive this situation only as a general increase in prices, not realizing that it’s also a reflection of the decreasing value of their money. Therefore, when individuals observe rising prices, it’s crucial to recognize this as a signal that their real income and purchasing power have been compromised. This hidden “tax” of inflation is one of the reasons why inflation is often considered as insidious, silently eroding savings and income without the straightforward visibility of a direct wage cut.

Inflation can be particularly insidious and toxic to society as it often disproportionately affects different socio-economic groups, contributing to greater wealth inequality. The impact of inflation is more severe on those with fixed incomes and less wealth. Lower and middle-income families, who spend a larger proportion of their income on necessities such as food, housing, and healthcare, feel the pinch more acutely as the cost of these goods and services rises. These households often have less capacity to absorb higher prices, leading to a reduction in their real standard of living.

On the other hand, inflation will benefit those who are asset-rich, as the value of tangible assets like real estate and stocks typically rise with inflation. Wealthier individuals are more likely to invest in such assets, which can act as a hedge against inflation. This dynamic can lead to an increase in wealth inequality: as inflation erodes the purchasing power of cash savings, those without significant investments in appreciating assets see their wealth diminish, while those with investments see their wealth potentially increase. This effect intensifies over time as the gap widens between asset owners and those whose main source of wealth is their labor. Inflation, therefore, not only acts as a “hidden tax” on the less wealthy but also as a mechanism that increases the financial disparity between different segments of society.

These issues create tremendous debate as to the health of an economy. If you are an asset owner with rising stock prices, rising real estate prices makes you feel wealthier. If you do not own assets, inflation robs you blind, little by little.

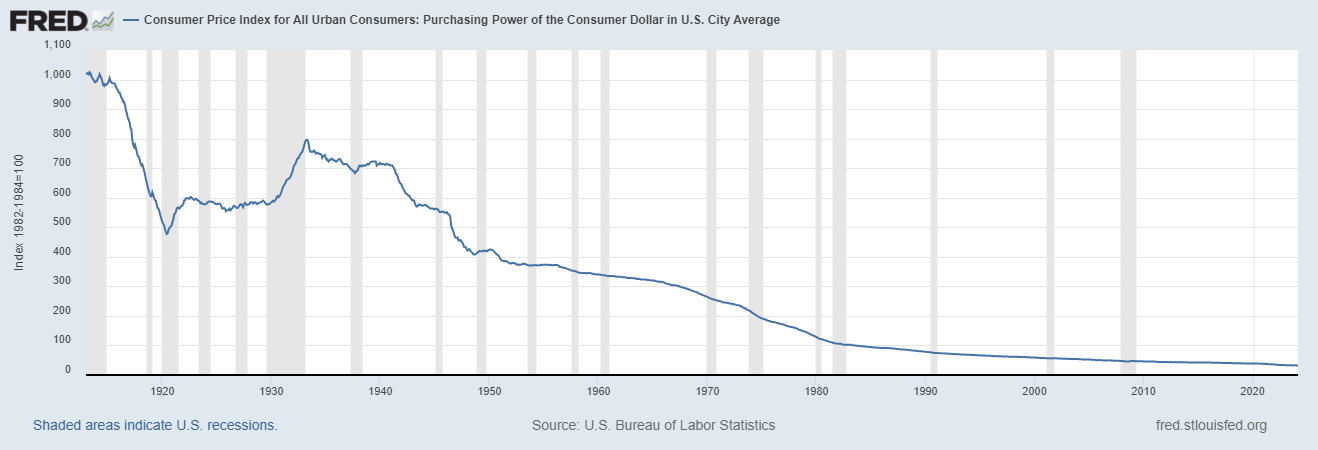

I would like you to ponder the power that any entity or organization has if they control the printing press. Then look at the following graph which illustrates the power of the Federal Reserve in managing the value of the U.S. dollar. Mainstream economic theory is designed to obfuscate this horrendous reality. If a money manager lost 98% of your wealth you would certainly give him the boot. Yet somehow in spite of this horrible record our media and politicians defer to the Fed to continue to manage our currency and economy.

This next chart simply shows the percentage of currency debasement annualized that has occurred in the Feds 111-year history.

Currency debasement has occurred 97.2% of the time since the Federal Reserve Act was passed. Want to make a bet if the currency will be debased further?

The Federal Reserve, as the most powerful financial institution in the world, wields substantial control over the U.S. economy through its regulatory and monetary policy powers. This level of influence underscores the necessity for regular audits, ensuring that such an influential entity operates with transparency and accountability. Audits are crucial not only for maintaining systemic stability and public trust but also for verifying that the Federal Reserve’s actions align with the public interest and are free from misconduct or inefficiency.

It continues to surprise me that the Fed has never been audited.

Moreover, auditing the Federal Reserve would enhance its credibility, both domestically and internationally, and provide essential feedback on the effectiveness of its monetary policies. It would allow Congress to perform its oversight functions more effectively, ensuring that the Fed’s operations contribute positively to the nation’s economic goals. Regular audits would thereby strengthen confidence among investors, policymakers, and the public, ensuring that the Federal Reserve’s immense power is managed responsibly and effectively.

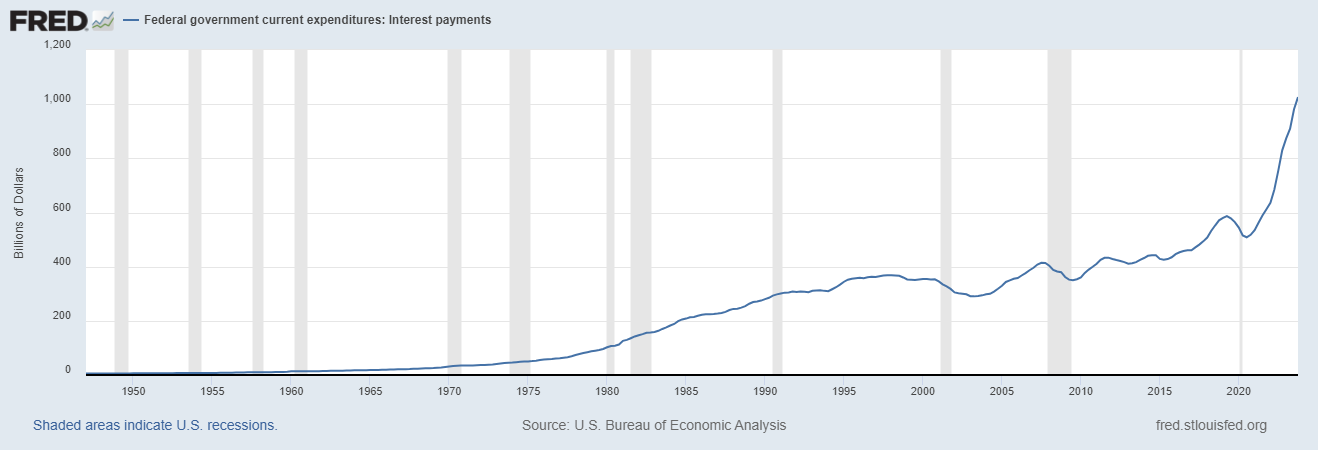

Consider the following, the Fed and the U.S. Treasury must refinance roughly $21 billion of Treasury bonds in the next 5 years. Rates today are literally 10 times higher than they were 4 years ago. Treasuries have been the most toxic investment of the last 4 years. Interest Expense for the U.S. government has gone parabolic.

How do they pull a rabbit out of their hat and get that job done? Particularly when just a few months ago, everyone believed the Fed would cut interest rates 4-6 times in 2024.

Imagine trying to sell Treasuries when INFLATION is increasing?

10-year T-Notes are yielding 4.5% and inflation according to the CPI is 3.5%. That means that a real rate of return of 1% is available for investors who are willing to lock their money up for 10 years. You have to believe that inflation will remain stable.

I say, no.

This dilemma is driving the entire economy and financial markets today. The MATH simply does not work. I anticipate that the Fed and the Treasury will debase the currency faster. The end result is that the HAVES will feel richer, and the have nots will not notice that they have had their wages cut, once again.

It is my opinion that the only way that the Fed and Treasury can make T-Notes look attractive is by making stocks look less attractive.

That allows the persistent currency debasement to continue.

More importantly, measuring your wealth in dollars is a mirage. As the currency is devalued the price of assets increases and asset owners believe they are getting richer.

If you’re aware of the current economic landscape, you’ll recognize that your money’s purchasing power is diminishing. This isn’t due to chance but rather a direct consequence of governments printing money at unprecedented rates, thereby devaluing currency. It’s like a stealthy thief, stealing from you incrementally. However, there’s uplifting news: you don’t have to be passive in this scenario.

Imagine a future where you not only cope but also prosper despite economic challenges. This is possible with the aid of Artificial Intelligence (AI) in trading. Our A.I. trading software is engineered with one goal: to ensure you’re always positioned advantageously in the market, making the most informed, timely, and profitable trading decisions.

This technology is at your fingertips, ready to empower you to take control of your financial future. Don’t let inflation diminish your hard-earned savings. Join the forward-thinking investors who are leveraging cutting-edge AI to transcend average financial returns.

Act now. Embrace the power of A.I., which continuously learns from its experiences to avoid past mistakes and improve future outcomes. This process isn’t just about avoiding errors; it’s about actively seeking out the most effective strategies in real time.

Excited yet? You should be because A.I. trading software is revolutionizing trading just as it has transformed games like Poker, Chess, Jeopardy, and Go. If AI can outperform humans in those complex arenas, imagine what it can do for your trading strategy.

Harness the sophisticated analysis that only A.I. can provide and step into a realm of higher probability, more informed trading decisions. A.I. doesn’t just offer insights—it offers the kind of actionable knowledge that can redefine your financial strategy. Don’t wait for the economic tides to change; take the helm with A.I.-driven trading tools.

You are cordially invited to an exclusive online Master Class : ‘Learn How To Trade With Artificial Intelligence .’ This groundbreaking session is led by seasoned experts in AI trading, ready to show you how AI can become your ultimate ally in understanding market trends, assessing risks, and pinpointing potential rewards. Discover how AI keeps you ahead of the curve by identifying the right trends at the right time.

Join us online for this transformative event that promises to arm you with critical insights and foresight in the financial market. Register now to secure your spot in this vital educational opportunity!

Join us for a FREE Live Training.

It’s Not Magic.

It’s Machine Learning.

Let’s Be Careful Out There!

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.