Gold has long been a contentious subject on Wall Street, eliciting a spectrum of opinions from renowned figures like John Maynard Keynes, who famously criticized it as a “barbarous relic,” to Warren Buffett, who has expressed skepticism about its productive value. Despite such high-profile disparagements, gold continues to be an important asset in the financial world, often seen as a hedge against inflation and a measure of uncertainty. However, when viewed through the lens of its relationship with central banking systems, particularly the U.S. Treasury and the Federal Reserve, gold takes on a different significance. It acts almost like a report card, assessing the health and policies of central planners. From this perspective, it’s clearer why gold might be less favored by those whose policies it implicitly critiques; it stands as a stark, unyielding indicator of economic stability—or the lack thereof—making it somewhat despised by central planners who would prefer to not have their motives or performance questioned.

Gold is often criticized by mainstream investors and financial analysts for its lack of direct yield, such as dividends or interest payments, which are typical features of traditional investments like stocks and bonds. This absence of cash flow means gold does not provide ongoing income simply for holding it, which can be a significant drawback during periods of market stability when other assets are appreciating and distributing earnings. Additionally, skeptics point to gold’s storage and insurance costs, along with its historical price volatility, as further reasons for its exclusion from portfolios. Critics also argue that gold’s value is largely speculative, reliant on investor sentiment rather than intrinsic economic productivity, which makes it less attractive compared to assets that generate measurable outputs or profits.

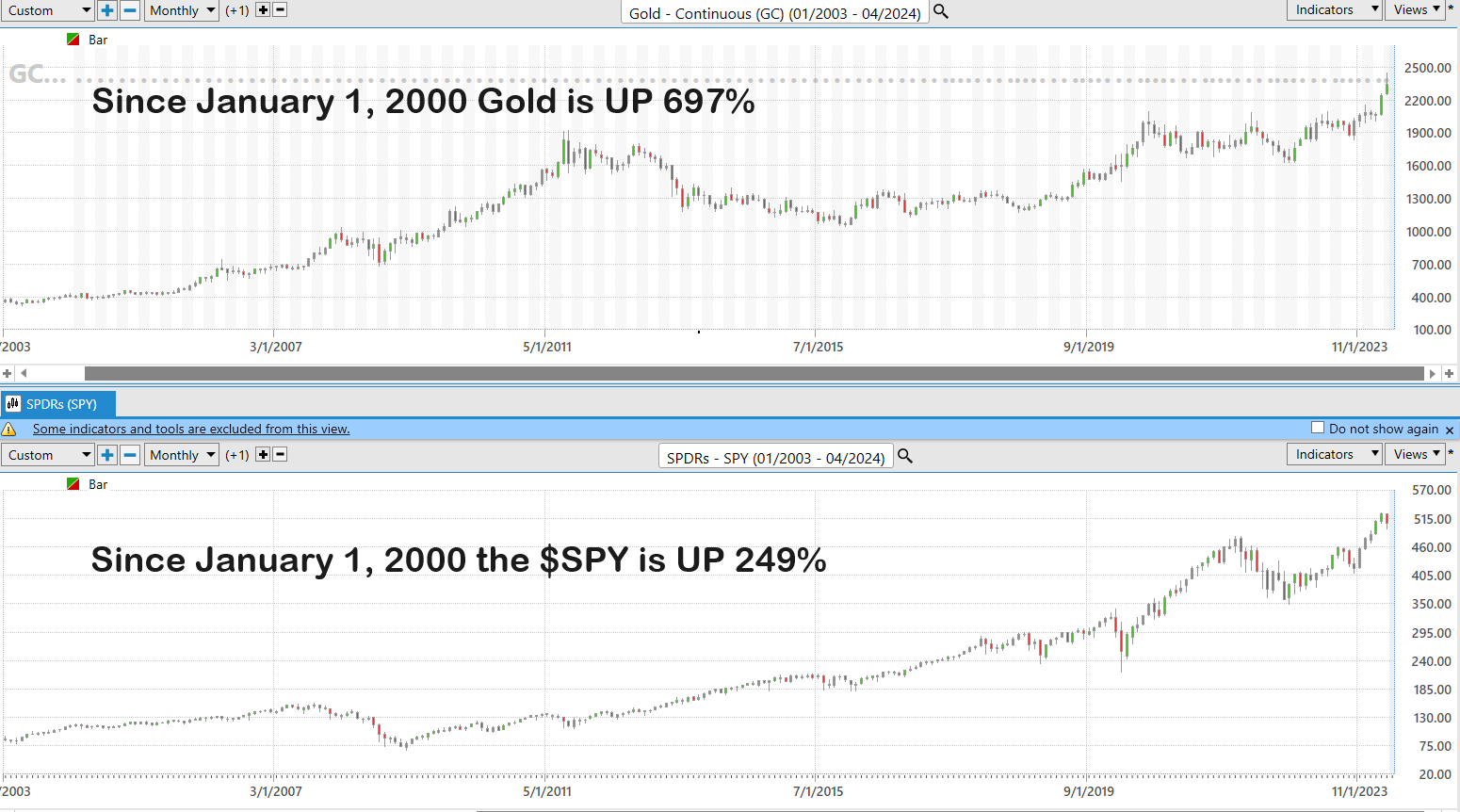

When in college, my favorite history professor always emphasized history could only be understood by recognizing that narratives change based upon what your starting and end points were. The interpretation of historical events—and indeed, the broader understanding of any series of events—hinges critically on the selection of starting and ending points. This principle is particularly poignant in the context of investing and trading, where the performance of an asset can appear dramatically different depending on the temporal boundaries chosen for its analysis. For instance, an investment that shows tremendous growth over a decade may appear less impressive or even unstable when viewed over a six-month period. Similarly, the significance and impact of economic policies, market crashes, or booms can be either magnified or diminished based on the historical window within which they are examined. This selection of time frames can thus fundamentally shape narratives and strategies in both historical scholarship and financial markets, underscoring the subjective lens through which all such analyses are conducted.

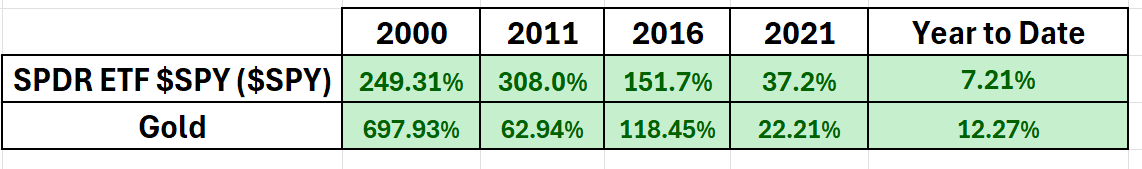

First let me share two graphics that quickly communicate a perspective that you will not hear much about in the financial media. Specifically, I am referring to a detailed multi-timeframe analysis of Gold compared to the stock market. My purpose in doing this analysis is to simply demonstrate that regardless of how much Central Banks and Wall Street revile Gold, it continues to be a tremendous store of value. This becomes obvious when you take a long-term perspective. The longer timeframe you take the more impressed you will be with Gold’s performance.

These metrics are a comparison of Gold to the SPDR ETF SPY ($SPY). The SPDR S&P 500 ETF Trust ($SPY) is an exchange-traded fund that tracks the performance of the S&P 500 Index, providing investors with broad exposure to large-cap U.S. equities. The measurements are from January 1 st of the year listed to present time.

One of the important lessons I’ve learned as an investor and trader is Gold’s outperformance during times of stock market turbulence demonstrates its value as a hedge against volatility and emphasizes the importance of portfolio diversification. Such trends highlight shifts in sentiment and the critical role of economic indicators in shaping investment psychology and investing strategies.

Most investors who buy into mainstream economic analysis are completely unaware of these metrics. I offer them to you so that they can challenge your understanding of performance and assist you in finding the best move forward.

Here’s a quick timeline of major economic events since January 2000 that have significantly impacted global markets. Clearly the financial markets have weathered numerous major financial storms.

**Dotcom Bubble Burst (2000-2002) ** – The burst of the dotcom bubble led to significant losses in technology stocks and a broader economic downturn, affecting many internet-based companies. This collapse wiped out billions of dollars of investment and led to widespread job losses, particularly in the tech sector.

**September 11 Attacks (2001) ** – These terrorist attacks had profound and far-reaching economic impacts, including massive disruptions in global markets and long-term effects on the U.S. and global economies. The attacks also resulted in heightened security and defense spending, which shaped economic policies in the subsequent years.

**Enron Scandal (2001) ** – The bankruptcy of Enron, due to fraudulent practices, shook investor confidence and led to major regulatory reforms in financial reporting. The scandal highlighted significant flaws in corporate governance and accounting practices, resulting in the Sarbanes-Oxley Act.

**Global Recession (2001) ** – Triggered partly by the dotcom bust and exacerbated by the 9/11 attacks, this recession impacted many countries around the world. It was marked by a significant slowdown in manufacturing and the burst of the tech bubble, which led to a restructuring of the tech industry.

**Sarbanes-Oxley Act (2002) ** – In response to major corporate and accounting scandals, including Enron and WorldCom, this U.S. federal law was enacted to protect investors from fraudulent financial reporting by corporations. It introduced stringent new rules for corporate accountability and financial disclosures.

**Housing Bubble (2002-2007) ** – During this period, the U.S. experienced rapid increases in real estate prices, fueled by low interest rates, easy credit conditions, and speculative buying. The bubble’s burst led to the subprime mortgage crisis and contributed significantly to the financial crisis of 2008.

**Global Financial Crisis (2007-2008) ** – Originating in the collapse of the housing bubble in the United States, this crisis led to a severe worldwide economic crisis, with the collapse of Lehman Brothers in 2008 marking a significant point. It resulted in massive bailouts of financial institutions globally and a deep global recession.

**Quantitative Easing (2008 onwards) ** – In response to the financial crisis, central banks around the world, including the Federal Reserve, began quantitative easing to increase money supply and stimulate the economy. This policy was aimed at lowering interest rates and boosting investment and consumption.

**Bernie Madoff Arrest** – Bernie Madoff, a former President of NASDAQ and Hedge fund manager was arrested on December 11, 2008, for his role in what is considered the largest Ponzi scheme in history. His fraudulent activities led to billions of financial losses for numerous investors.

**European Sovereign Debt Crisis (2010) ** – This crisis emerged from a combination of complex factors, including the globalization of finance and the Great Recession, impacting several European countries. It led to significant financial bailouts and austerity measures in countries like Greece, Ireland, and Portugal.

**U.S. Credit Rating Downgrade (2011) ** – Standard & Poor’s downgraded the United States’ credit rating from AAA to AA+ for the first time, citing concerns about the government’s budget deficit and rising debt burden. This event caused turmoil in the financial markets and raised concerns about the sustainability of U.S. debt.

**Fiscal Cliff (2012) ** – This political-economic term described the dilemma that the U.S. government faced at the end of 2012, concerning expiring tax cuts and across-the-board government spending cuts. It was ultimately resolved by a last-minute agreement that avoided the potential large-scale tax increases and spending cuts.

**Chinese Stock Market Turbulence (2015) ** – A stock market crash that started in June wiped out nearly a third of the value of A-shares on the Shanghai Stock Exchange. The government intervened by implementing measures to stabilize the market and expand its role in global finance.

**Brexit Referendum (2016) ** – The United Kingdom voted to leave the European Union, leading to market volatility and economic uncertainty. This decision triggered complex negotiations to determine the future relationship between the UK and the EU.

**Repo Market Crisis (September 2019) ** – In September 2019, the financial markets experienced what is widely known as the “repo market crisis” or the “September 2019 liquidity crisis.” Although this event did not receive an official designation as a “crisis,” it is commonly referred to by these terms due to the significant disruption it caused in the short-term funding markets. The crisis was triggered by a sudden spike in overnight lending rates, primarily driven by a confluence of factors including large corporate tax payments and significant settlements of Treasury securities. These events collectively withdrew a substantial amount of liquidity from the market. The sharp increase in repo rates prompted the Federal Reserve to step in and conduct extensive repo operations, effectively injecting liquidity to stabilize and bring down the borrowing rates. This intervention was critical in restoring normalcy in the repo markets and highlighted vulnerabilities in the financial system’s infrastructure.

**COVID-19 Pandemic (2020) ** – The global outbreak of COVID-19 led to one of the biggest economic downturns since the Great Depression, with massive impacts on global markets, employment, and productivity. The pandemic accelerated shifts towards remote working and changed consumer behavior significantly.

**2020 Stock Market Crash (February-March 2020) ** – Triggered by fears of the widespread COVID-19 pandemic and oil price wars between Russia and Saudi Arabia, this crash saw the fastest fall in global stock markets in financial history and a sharp drop in oil prices.

**2023 Fitch Downgrade of US Treasury** – In 2023, Fitch Ratings downgraded the United States’ long-term foreign currency issuer default rating from AAA to AA+. This downgrade reflected concerns about the country’s fiscal deterioration, driven by rising deficits and debt levels that were not adequately addressed by long-term fiscal consolidation plans.

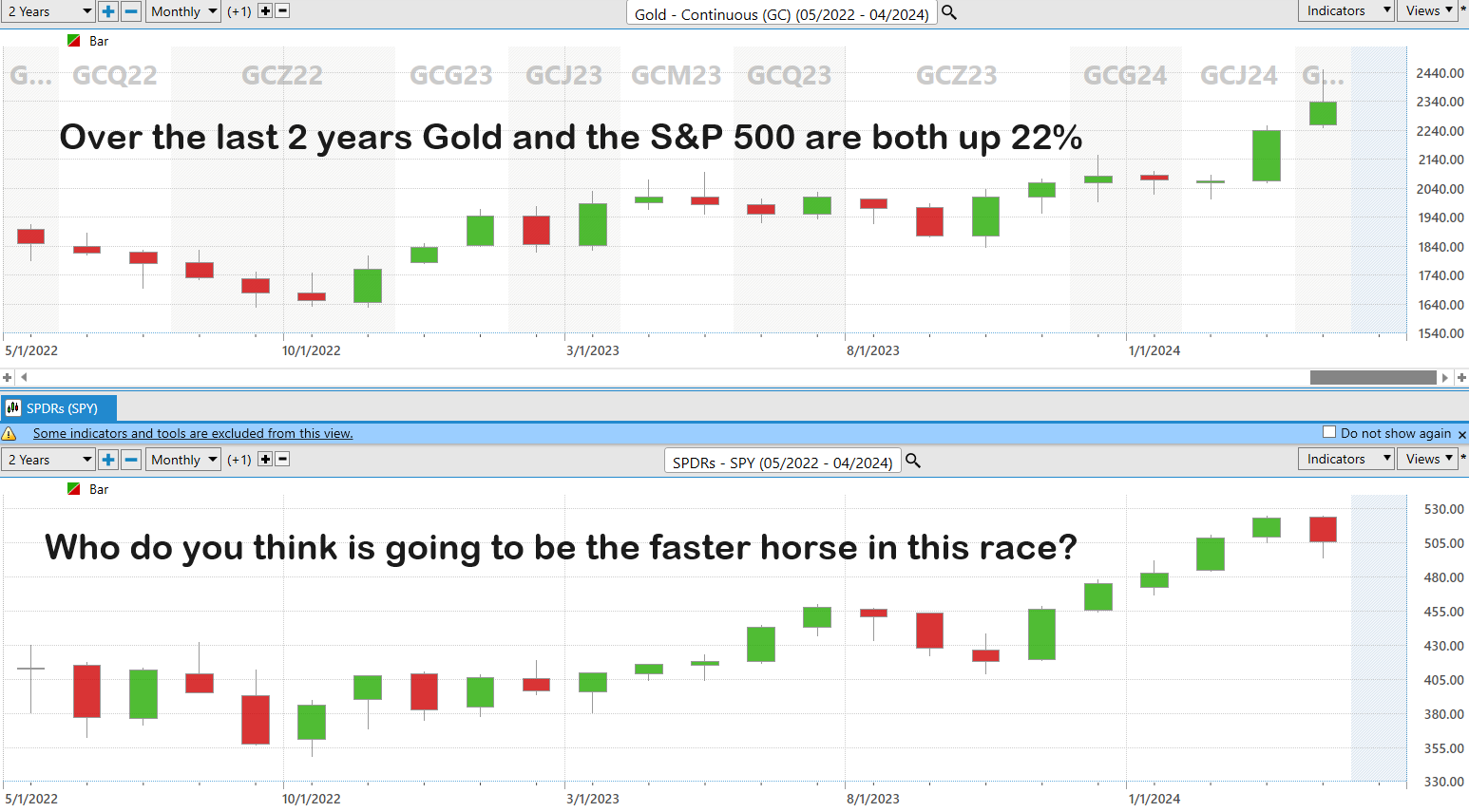

All of these events provide key insights into the challenges and transformations faced by the global economy over the past two and a half decades. Clearly the markets have weathered numerous storms. What often occurs when analysts analyze is that they take a very shortsighted perspective and measure performance from only one data point. I consider this myopic.

I challenge you to ponder the significance of how gold, which is often referred to as the “barbarous relic” by mainstream thinkers, is challenging investors and traders to re-evaluate their ideas based upon its stellar performance.

Instead, it is wise to take a very long-term perspective in comparing two competing asset classes. Doing so generates a clearer perspective of cause and effect in the financial markets and you can more clearly see and understand who the faster horse is in the ever-changing financial race.

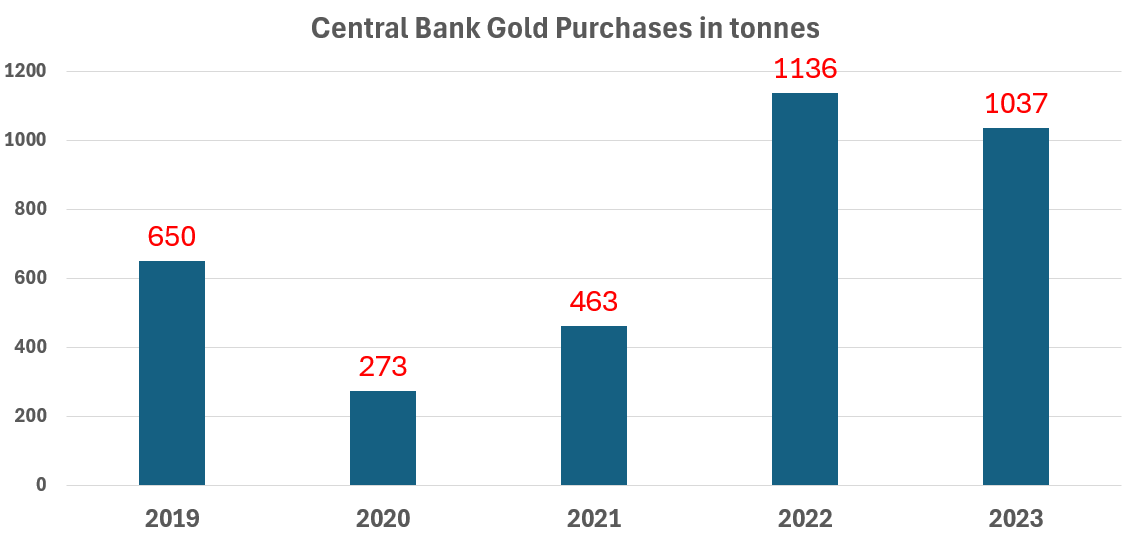

I have been thinking a lot about Gold lately because its most recent explosive rally should be viewed as a report card on the Fed and U.S. Treasury. What has bothered me tremendously is that over the past two years the biggest buyers of Gold have been the Central Banks. I find this reality to be quite dystopian. When central banks, armed with the capability to generate money at essentially no cost, turn to aggressively purchasing gold, it presents a curious economic paradox. Over the last two and a half decades, these banks have extensively utilized their ability to “print” money, injecting vast amounts of new currency into their economies. However, a shift toward panic-buying gold—a traditionally secure scarce asset scorned by most policymakers—signals a bizarre economic pivot.

The recent spree of central banks panic-buying gold can be likened to a classic case of moral hazard. Typically, moral hazard occurs when one party takes on excessive risk because another party bears the cost of those risks. In this scenario, central banks, driven by fears of economic instability or inflation, are aggressively accumulating gold reserves. While the banks’ intention is to safeguard their economies by diversifying their reserves and reinforcing financial security, their actions could ironically induce further volatility and risk in the global financial system, embodying the very essence of moral hazard.

This behavior underscores a stark reality: by acquiring significant amounts of gold using fiat money, which costs nothing to produce, central banks are hedging against their own policies of monetary expansion . The old saying among history buffs, “he who owns the gold makes the rules,” takes on new significance under these circumstances. It suggests a strategic pivot where central bankers, traditionally dismissive of gold, now prioritize its acquisition, acknowledging its enduring value as a hedge against the very inflation and economic uncertainty their policies produce. This action should be seen as a tacit admission of the limits of fiat currency and a move to secure a tangible store of value, thus reinforcing their financial sovereignty in uncertain times.

I equate this to a medical doctor buying life insurance policies on his patients due to the horrible medical care he has provided them with. I know it sounds harsh but the entire reasoning for a gold standard is for money to be able to maintain its long-term store of value. When the institutions who evangelize the wonders of fiat currency start panic buying gold, we have to conclude that the financial environment is just plain bizarre.

In 2019, central banks globally added a substantial amount of gold to their reserves, purchasing approximately 650.3 tons. This level of buying was notable as the second highest in 50 years. However, what is even more notable is that in 2022 they purchased 1,136 tons, an all-time record which shattered their previous record by 74%! The expectations are that in 2024 these records will be decimated.

When you contemplate these figures remember that 2019 was pre-covid19, pre-Ukraine, pre-Gaza, pre-banking crisis, pre-BRICS nations and before de-dollarization. It is crystal clear that as geo-political tensions have increased Central Bank gold purchases have massively increased.

The escalating trend of central banks stockpiling gold has cast a shroud of uncertainty over the future implications for global finance, with analysts and economists divided on how this could affect exchange rates, inflation, and international trade. The move towards gold suggests a defensive strategy against perceived vulnerabilities in fiat currencies, yet the exact consequences on currency stability remain speculative. For international trade, the uncertainty grows as it’s unclear how gold accumulation might influence trade balances or shift reliance on traditional currency exchanges. Similarly, while some theorize that increasing gold reserves could offer a hedge against inflation, the broader effects are unpredictable, with potential for both dampening or exacerbating inflationary pressures depending on broader economic conditions. Overall, this strategic shift towards gold suggests a profound caution among central banks about the future economic landscape, although the precise impacts on the dynamics of global economics are yet to be clearly understood.

What’s important is what are you going to do about it?

Regardless of what your opinion are on this issue, I can guarantee that the only three things we have certainty on is Death, Taxes, and Currency Debasement.

As we navigate through the complexities of modern finance, marked by pervasive currency debasement and economic instability, the need for innovative trading solutions has never been more critical. Recognizing this, we are excited to announce an exclusive masterclass tailored for the general audience eager to understand the current financial climate and the transformative power of artificial intelligence in trading.

This master class will delve into how A.I. trading software can perform the heavy lifting in trading, helping you to stay aligned with the right trends at the optimal times. Given AI’s proven track record of outperforming humans in complex games like Go, Poker, Chess, and even Jeopardy, it’s time to explore its potential in financial trading.

Our A.I. trading master class is designed to demonstrate how A.I. can be your ally in navigating the tumultuous waters of the financial markets, from conducting sophisticated trend analysis to enhancing your trading decision-making processes.

Conducted by seasoned A.I. trading experts, this session will equip you with the necessary skills and insights to leverage A.I. effectively in your trading strategies. Whether you’re looking to safeguard your investments or capitalize on market trends, this A.I trading masterclass will provide you with the knowledge and tools to thrive.

Don’t miss this opportunity to transform your trading approach with A.I.

Elevate Your Trading Game: Whether you’re a seasoned trader or just starting out, this trading masterclass is your gateway to unlocking the full potential of Artificial Intelligence in trading. Gain insights into cutting-edge strategies, harness the power of data-driven decision-making, and embark on a journey towards consistent profitability. Secure your spot now and embark on a path towards trading success like never before! Don’t let this opportunity pass you by – reserve your seat today and embark on a journey towards trading mastery with A.I. at your side.

Join us for a FREE Live Training.

It’s Not Magic.

It’s Machine Learning.

Let’s Be Careful Out There!

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.