Two weeks ago, Federal Reserve Chairman Jerome Powell held a press conference to address concerns regarding the U.S. economy, particularly fears of stagflation. Powell confidently stated that there is “no evidence of stagflation,” emphasizing that the current economic indicators do not support such a scenario. He pointed to the robust job market and consistent economic growth as clear signs that the economy is not stagnating. Additionally, Powell highlighted the central bank’s ongoing efforts to manage inflation through monetary policy, aiming to keep it within the target range.

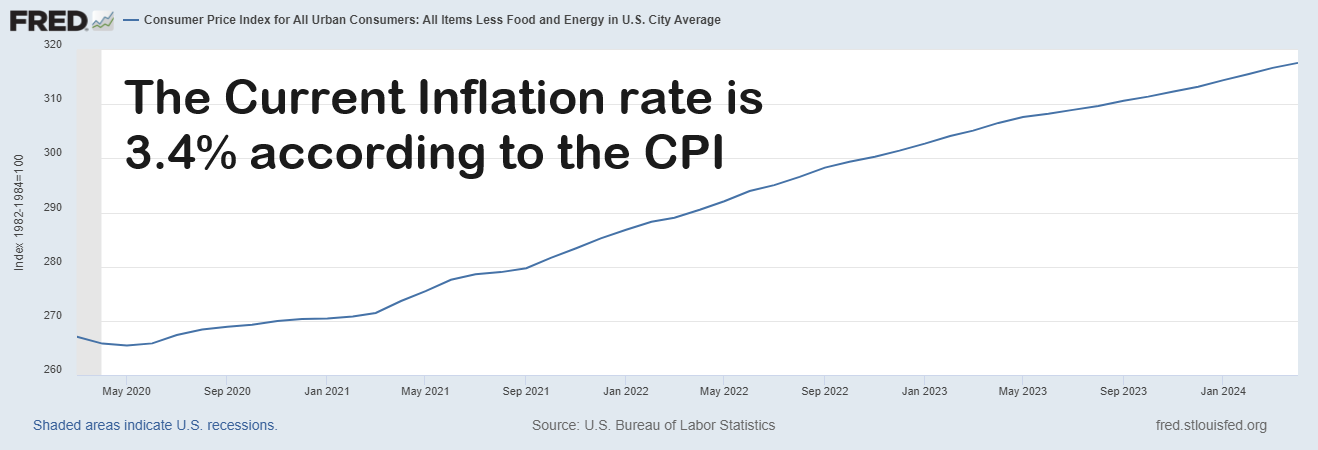

During the conference, Powell also discussed the recent CPI data, which showed a year-over-year increase of 3.4% as of April 2024. He noted that while inflation remains a concern, the Federal Reserve is closely monitoring the situation and is prepared to adjust its policies as necessary to maintain economic stability. Powell reassured the public and investors that the central bank’s tools are effective in combating inflation without hindering economic growth, underscoring the Federal Reserve’s commitment to fostering a healthy and dynamic economy.

My observation is that great traders are often contrarians. They are not easily swayed by authority and have the courage of their own convictions. In this article, I am going to take issue with Fed Chair Powell and elaborate that STAGFLATION is the economic environment and show the markets and trades that are confirming that reality. I hope this inspires you to do your own research and arrive at your own conclusions.

Over the years one of the truths, I have discovered about trading is the philosophical principle that “the questions you ask will determine the wisdom you find” underscores the importance of inquiry in shaping understanding and knowledge. This idea suggests that the depth, relevance, and framing of the questions posed directly influence the insights and wisdom that can be gleaned. In essence, the quality of one’s inquiries is a critical determinant of the quality of knowledge acquired. This principle is rooted in Socratic philosophy, where Socrates famously engaged in dialogue by asking probing questions to stimulate critical thinking and illuminate ideas.

Relating this principle to trading in the financial markets, the questions traders ask themselves can significantly impact their success and decision-making. For instance, rather than asking simplistic questions like “Will the market go up tomorrow?” A trader might ask, “What are the underlying factors driving market movements, and how are they likely to evolve?” This deeper inquiry can lead to a more comprehensive understanding of market dynamics. By asking the right questions, traders can uncover valuable insights into market trends, economic indicators, and investor sentiment, which are essential for making informed trading decisions.

In practice, this means that a trader who consistently questions their assumptions, seeks to understand the broader economic context, and evaluates multiple scenarios is more likely to develop a robust trading strategy. For example, instead of focusing solely on short-term price movements, a trader might explore questions about long-term economic trends, geopolitical events, and corporate earnings reports. This broader perspective can help traders anticipate market shifts and adjust their strategies, accordingly, leading to better risk management and potentially higher returns. Thus, the wisdom derived from thoughtful and strategic questioning is a powerful tool in the complex and often unpredictable world of financial markets.

When I watched Fed Chair Powells press conference he appeared to me as a leader who was looking at a completely different reality that what I am seeing in the financial markets. He also seemed very annoyed that a lot of mainstream economic thinkers and influencers were seeing stagflation. Instead of educating the masses, he simply asserted his authority to dictate that everyone else is wrong and we are not in a stagflationary economic environment. It is moments like these to always force me to sit up and take notice. It spells huge opportunity as a trader.

When tough markets arrive the most empowering question a trader can ask is, who is winning? Or… what is working? Another way of stating this truth is what is not working?

As a trader the only truth we are interested in is what price is doing. Price is what will make you rich or poor so our only loyalty must always be to the trend.

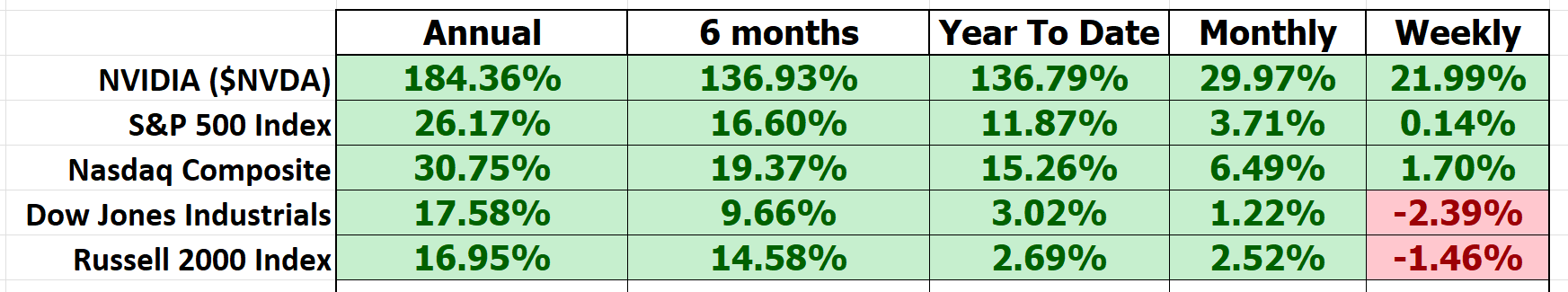

Yesterday, we published a rather optimistic outlook on NVIDIA. As I was compiling the research I created this graphic and immediately saw something that was potentially troubling. Do you see it?

I am referring to the year-to-date performance of the Dow Jones Industrials as well as the Russell 2000 Index.

According to the Fed and the Bureau of Labor Statistics the inflation rate as I write these words is 3.4%.

Whenever a market is not keeping pace with the rate of inflation it is important to be aware of that reality. In this regard, the Russell 2000 Index is a stock market index measuring the performance of approximately 2,000 small-cap companies in the United States, representing the smallest sector of the Russell 3000 Index. The Dow Jones Industrial Average (DJIA), on the other hand is a stock market index that measures the performance of 30 large, publicly owned companies based in the United States across various industries. The market capitalization of these two indexes represents $19.38 trillion.

The fact that these major stock market indexes are not keeping pace with the rate of inflation is noteworthy and worthy of every trader’s attention.

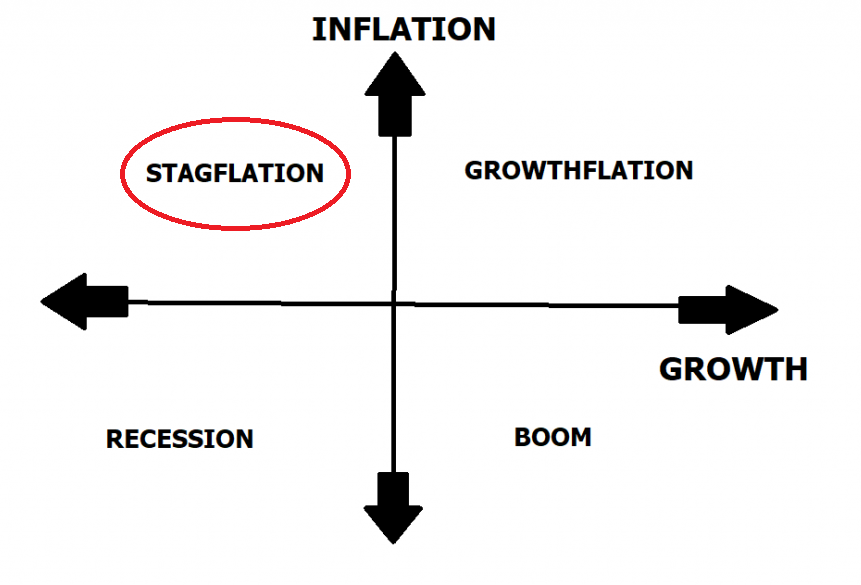

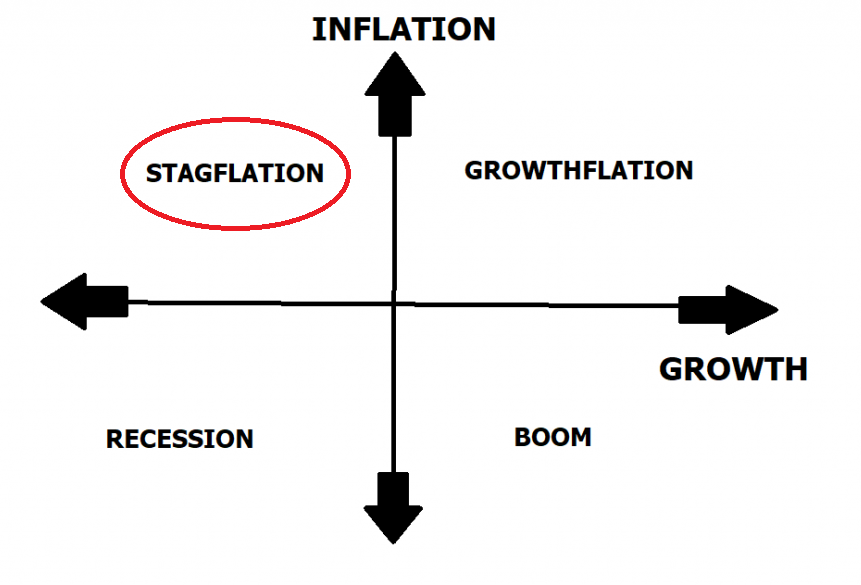

Instead of arguing with the FED about their perspective, I will share the evidence straight from the financial markets and you can decide what it means moving forward. Stagflation is an economic condition characterized by increasing inflation and decreasing growth, presenting a highly challenging environment for businesses and a defensive scenario for traders and investors focused on protection over growth. This dilemma, best illustrated by contrasting growth against inflationary pressures, can place the economy in one of four possible quadrants.

Stagflation typically occurs when a decrease in demand for goods and services coincides with an increase in the money supply, leading to higher prices and reduced purchasing power. As businesses hesitate to invest and expand, economic growth slows, exacerbating the negative impact on individuals and businesses, who find themselves earning less while spending more. In a stagflationary market environment traders are best served when they are defensive in nature.

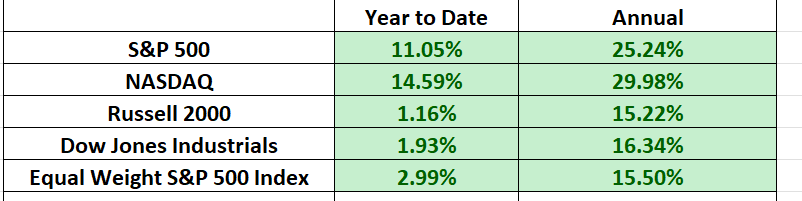

First off here are the year to date and annual performance metrics for the major stock market indexes. Things have looked pretty good over the last 52 weeks but year to date the broader stock market is being supported by the top 10 tech stocks.

There are a handful of stocks responsible for the gains in the S&P 500 Index. Look at the equal Weight S&P 500 Index which is up on 2.99% year to date.

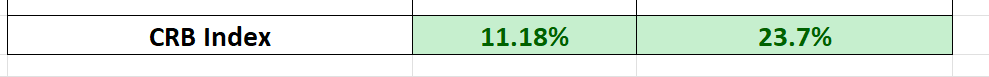

In a stagflation, commodity markets benefit. The best way to measure the growth or contraction of the commodity market is through the Commodity Research Bureau Index ($CRB).

Year to Date Annual

The Commodity Research Bureau (CRB) Index, created in 1957, is a vital gauge for tracking the price movements of a broad range of commodities, providing insight into overall economic health. This index covers key sectors like energy (crude oil, natural gas, heating oil), agriculture (wheat, corn, soybeans), metals (gold, silver, copper), and softs (coffee, cocoa, sugar, cotton).

Understanding the CRB Index is crucial because it serves as a barometer for inflationary pressures and economic activity. Rising commodity prices within the index often signal increased demand and potential inflation, while falling prices can indicate economic slowdowns. Investors use the CRB Index to make informed decisions and hedge against inflation, while policymakers analyze it to shape monetary and fiscal policies. The CRB is up 23.7% over the last 52 weeks and up 11.18% since the beginning of the year.

I am very critical of policy makers and bureaucrats who proclaim a strong and resilient economy when we see food prices rising faster than the stock market. We have the CRB Index in a neck and neck race with the S&P 500 Index and NASDAQ. That is not exactly an indicator of economic strength!

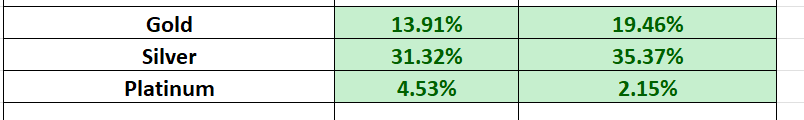

Next let’s look at the performance of the Precious Metals complex:

Year to Date Annual

The metals tend to move higher when there are geo-political tensions as well as concerns of accelerated inflation and currency debasement. As a long time, observer of the precious metals complex, my observation is that the financial news media is very slow to admit when metals outperform stocks.

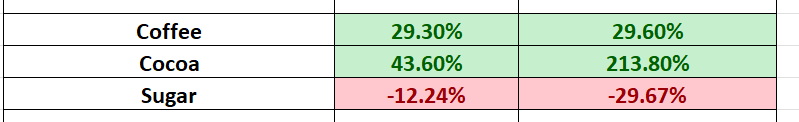

Next look at some of the basic commodity foods:

Year to Date Annual

The evidence is not unanimous but clearly rising prices outweigh falling prices.

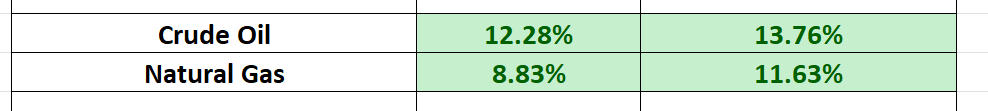

A quick glance at the energy complex confirms that energy prices are also rising across the board:

Year to Date Annual

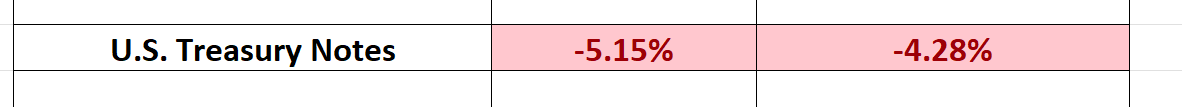

Lastly, let’s look at the gorilla in the room. I am referring to the U.S. Treasury market. It has been the worst performing asset class over the last several years.

Year to Date Annual

Does this 52-week chart of US Treasuries look healthy to you? The government is trying to refinance several trillion dollars of US debt this year. Who buys it? None of our allies want it. The only solution is for the FED to purchase it or the government to cut spending. If the Fed purchases it, the money printer will have to go ‘Brrrrr’ again and that will be wildly inflationary.

When it comes to navigating the treacherous waters of stagflation, it’s crucial to identify assets that historically perform well in this economic climate. The key is to stay grounded in reality—focus on what **is** working rather than what **should** work and keep your eyes on the financial scoreboard at all times.

The markets are telling you a completely different story than Fed Chair Powell.

Successful traders leverage real-time performance metrics to guide their decisions. In stagflation, traditional safe havens like gold and commodities often shine. Remember, the scoreboard tells the real story—always keep an eye on it to see where the victories are happening.

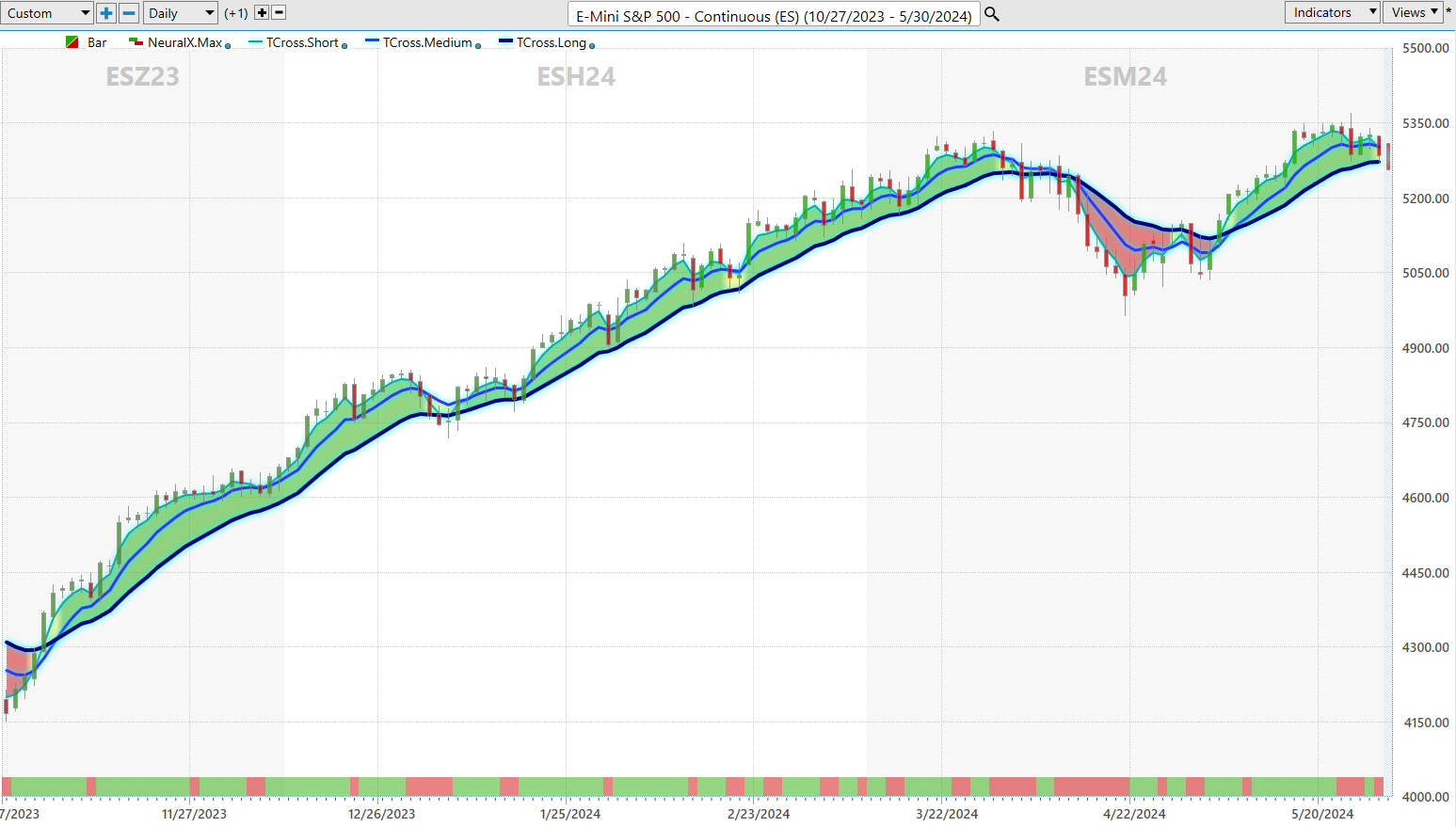

Next, I would also urge you to use artificial intelligence in your decision-making process.

Can you spot the markets with the best risk/reward ratios among the thousands of trading opportunities available? Imagine harnessing the power of knowledge—useful knowledge—and applying it with precision. This is exactly what artificial intelligence brings to the table.

Consistency is the holy grail of market success. Picture what your portfolio could look like today if you’d integrated A.I. trading software five years ago. With machine learning, identifying statistically sound trends with reduced risk becomes second nature.

The traditional indicators many traders rely on were crafted in the 1970s and 1980s. They fall short in predicting future market moves. But consider this: artificial intelligence has bested humans in Chess, Poker, Blackjack, Go, and Jeopardy. Why should trading be any different? Time and again, the machine outperforms the human.

What does this mean to you as a trader?

I’ve offered my opinion on why we are in stagflation in a presidential election year. Stocks have some extraordinarily strong fundamental headwinds ahead of them. I could be very wrong in my assessment. This is why I trade with artificial intelligence. The financial scoreboard cross referenced with artificial intelligence is the best move forward.

I am decidedly bearish on government finances, expecting debt to continue its exponential rise. Historically, such a scenario has paradoxically been bullish for stocks. More importantly, artificial intelligence currently signals a bullish trend for broader stock market indexes.

We find ourselves precariously balanced between stagflation and recession.

In such uncertain times, safeguarding your portfolio is paramount. In today’s volatile financial landscape, a pragmatic, repeatable system for identifying resilient trends, especially those that thrive during economic downturns, is essential.

What’s the optimal strategy for generating profits in today’s markets? The answer lies in Artificial Intelligence (A.I.). In an era where market unpredictability reigns supreme, A.I., Machine Learning, and Neural Networks have evolved from optional tools to indispensable allies in protecting your investments.

Let me be clear: I firmly believe we’re on the brink of a decline in stock prices. Yet, amidst this turmoil, my unwavering “North Star” remains the trends illuminated by the formidable power of artificial intelligence . Its guidance is priceless and allows me to embrace my opinions without adverse consequences.

Will you be prepared when the financial storm hits? By leveraging the analytical capabilities of A.I. and the predictive prowess of neural networks, you arm yourself with the precise tools needed to navigate the financial landscape with confidence. It’s about consistently aligning with the right trends at the right time.

In a high-stakes game where only the fittest survive, hesitation is not an option. To thrive, not just survive, it’s imperative to embrace innovative technology and intelligent trend analysis.

A.I.’s power lies in its ability to learn from failures, remember them, and pivot to find solutions. This Feedback Loop is the cornerstone of every successful trader’s fortune. Embrace it and secure your financial future.

Visit With US and check out the A.I. at our Next Free Live Training.

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.