One of the chief obstacles facing traders is understanding risk. This challenge arises from the inherent uncertainty and complexity of financial markets, where numerous factors can influence asset prices and market movements. Traders must not only recognize the potential for loss but also comprehend the varying degrees and types of risk associated with different trading strategies. Market risk, credit risk, liquidity risk, and operational risk are just a few examples that traders must consider. Each type of risk requires a distinct approach to assessment and management, making the task of understanding risk multifaceted and demanding. Without a clear understanding of these risks, traders are more likely to make ill-informed decisions that could lead to significant financial losses.

While there are numerous tools to assist traders in understanding and managing risk, every trader must eventually develop their own effective means of defining and measuring risk. This personalized approach is crucial because each trader’s risk tolerance, investment objectives, and trading style are unique. Developing a robust risk management strategy involves setting clear risk parameters, diversifying portfolios, and continuously monitoring market conditions. By finding an effective means of defining and measuring risk, traders can navigate the financial markets with greater confidence and precision, ultimately enhancing their potential for success while mitigating the inevitable uncertainties that come with trading.

Recently in my research I stumbled across some news that I found rather troubling and explains the times we are all living through. The market is on fire with speculation reaching unprecedented levels. We’re witnessing option trading volumes surpassing actual stock trading volumes! That’s right, folks, this fever pitch has driven 40% of options to be those zero-dated, ultra-aggressive bets that expire the same day they’re issued. The frenzy doesn’t stop there. The S&P 500’s performance is heavily skewed, dominated by the colossal tech titans. Nvidia, Microsoft, Meta, and Amazon alone have contributed a staggering 45% to the market’s gains this quarter. The landscape is intense, and the stakes are high. We’re in the thick of a highly speculative market period. The average stock is lagging far behind the stellar performance of a handful of popular names. In times like these, it’s no wonder that traders start to seek out alternative strategies and tactics. One of the most effective means of managing risk in markets like this one is through the effective use of options credit spreads.

In this article I am going to highlight how to exploit these excesses to your advantage with capped risk using credit spreads.

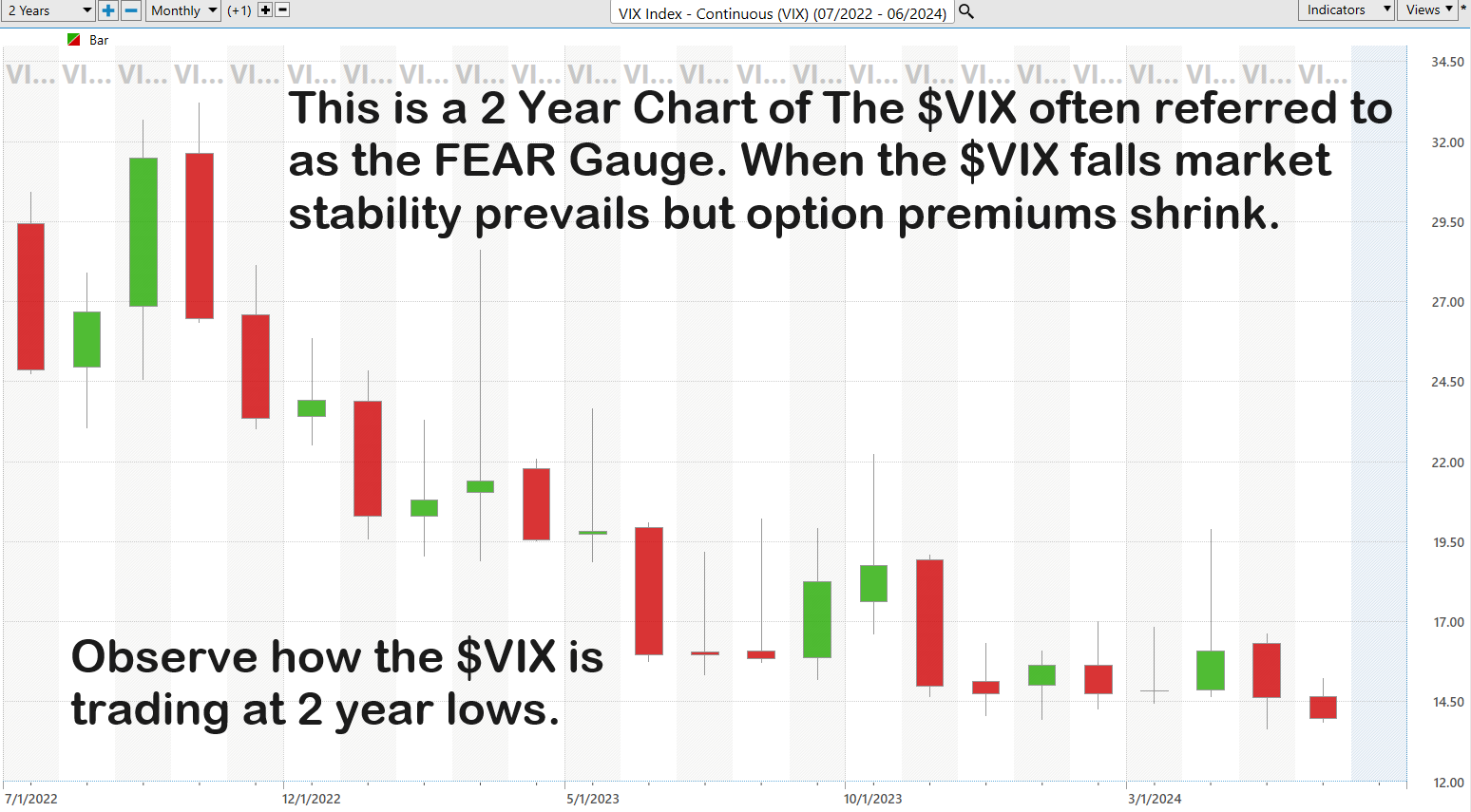

The VIX, or Volatility Index, measures market risk and investor sentiment by reflecting expected volatility in the stock market over the next 30 days. When the VIX rises, it indicates higher expected market volatility and investor fear, often during periods of economic uncertainty or crises. Conversely, a falling VIX signals lower expected volatility and greater market stability. Options traders use the VIX to guide their strategies, employing tactics such as buying put options for protection during high volatility, speculating on VIX movements, or using credit spreads in stable conditions to generate income while managing risk effectively.

Let’s break down the essence of options contracts in the simplest terms. An options contract is essentially an agreement between two parties, allowing for a potential transaction on a stock at a preset price, known as the strike price, before the contract expires. Think of it as locking in a future deal. When you buy an options contract, you’re securing a specific price for a stock you might want to buy or sell later. Imagine it like making a reservation at your favorite restaurant; you’re securing your spot whether you decide to go or not.

Options come in two main types: Call Options and Put Options.

– **Call Options**: These give you the right to buy a stock at a fixed price. If you believe a stock’s price will go up, you might buy a call option. It’s like saying, “I believe the price of this stock will rise, so I’ll lock in this specific price and pay for it later.”

– **Put Options**: These give you the right to sell a stock at a predetermined price. If you think a stock’s price will drop, you might buy a put option. This is akin to saying, “I expect this stock’s price to fall, so I’ll agree to sell it at this price even if I do it later.”

Options trading is a game-changer because it adds a layer of flexibility to your trading toolkit. Unlike simply buying stocks, options allow you to make money whether the market is climbing, dipping, or moving sideways. Plus, they can be a powerful tool to hedge against potential losses, adding an extra layer of protection to your portfolio. It’s all about strategy and foresight in this dynamic market arena.

Options trading unlocks a whole new world for traders, whether you’re aiming to speculate on stock price movements, hedge your portfolio, or generate steady income, mastering options is a game-changer for your investing toolkit.

But let’s be clear: options trading requires a bit of education to understand the myriad strategies at your disposal. Today, I’m diving into the strategy of credit spreads, an intermediate-level tactic. To fully grasp this concept, it’s crucial that you understand the basics of options trading, which I’ve covered extensively on this blog.

I recommend studying these four basic strategies to develop mastery of this exciting subject matter:

Buying Call Options

Buying Put Options

Selling Call Options

Selling Put Options

Dive into these strategies, get comfortable with the basics, and you’ll be well on your way to mastering the powerful world of options trading.

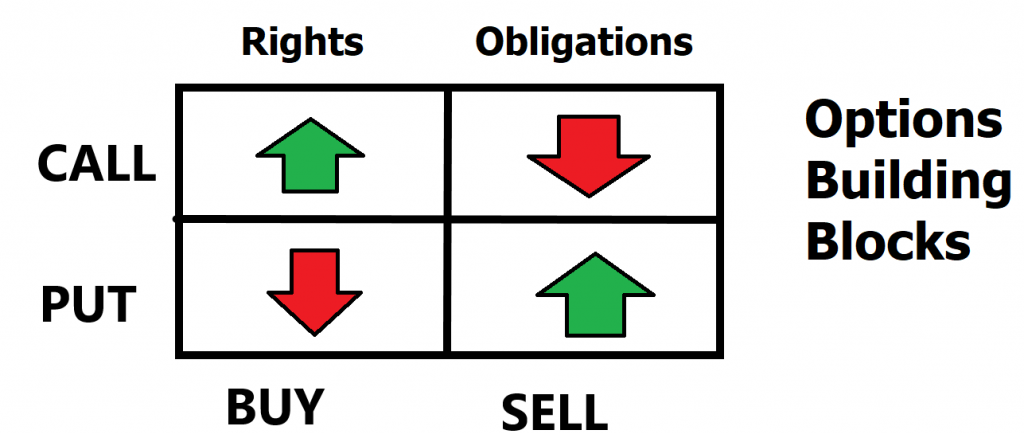

Options trading is very straightforward when you look at both sides of every trade. Option buyers always have the right but not the obligation to buy or sell the underlying asset at an agreed upon price between now and an expiration date. They create this right by paying the option seller a premium. On the other hand, option sellers, or creators, have the obligation to fulfill the terms of their contract. In other words, an options seller is required to buy or sell the underlying asset, at an agreed upon price. For this obligation they receive a premium from the option buyer.

This agreement is identical to the way regular insurance works. An insurance buyer wants protection, and they pay a premium to the insurance seller.

An insurance seller wants your premium and will manage the risk of their transaction once they receive your premium.

This foundational concept is crucial to understand because 80% of options expire worthless.

When you stop and think about this concept you will quickly come to appreciate that there is a tremendous amount of money that can be made by learning how to become the insurance company and not just the insurance purchaser.

Options trading opportunities are born when you understand that there are moments you only want to purchase options, there are moments when you only want to collect premium and sell options and there are times when you want to do both, always managing your risk.

This is why we suggest you spend enough time educating yourself on this foundational principle.

Most traders feel comfortable buying options due to their appeal, limited risk, and unlimited reward potential. On paper, it sounds like a dream—minimal risk with the chance for massive gains. But here’s the reality check: options are deteriorating assets. If you overlook this crucial aspect, you’re setting yourself up for failure as an options buyer.

Sophisticated traders know better. They’ve learned that by selling options, they can tilt the probabilities in their favor. The key here is to master the art of risk management. By carefully crafting strategies that offset potential losses, these traders turn the tables.

Now, let’s look at the basics. The diagram below highlights the four fundamental options strategies, showing their desired directionality and clarifying whether they represent a right or an obligation. By blending these tactics, traders can create strategies like credit spreads, which offer limited risk and high probability profit potential. It’s about combining knowledge with strategy to create a powerful, income-generating asset.

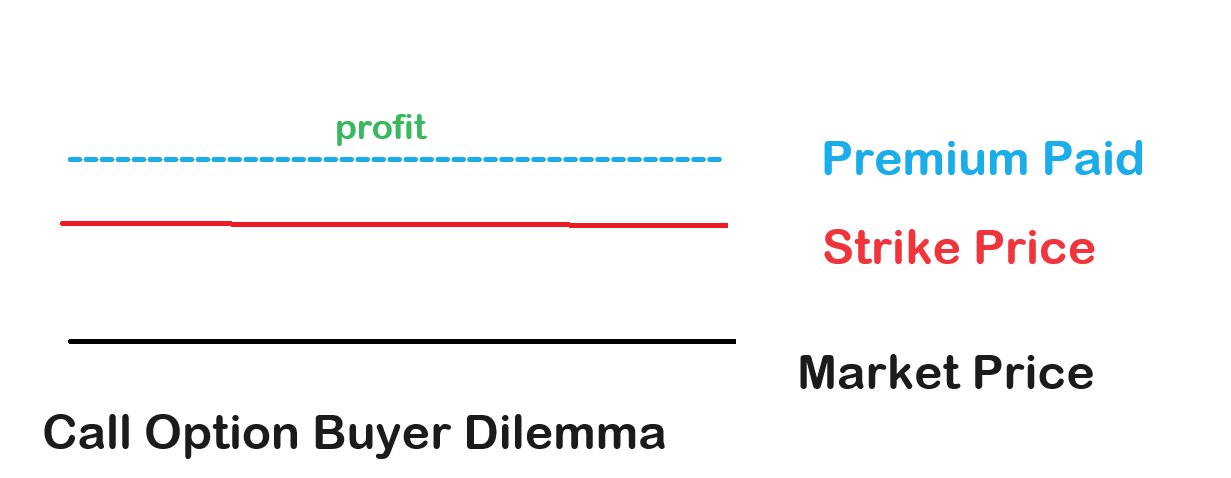

Most options traders get schooled trading options the hard way. They buy an option. They are excited by the limited risk potential of only being able to lose the premium they paid. They love the idea of the unlimited reward potential and dream of making a killing. What usually occurs is that the option expires worthless.

Here is a graphic which explains what often happens to a trader who buys a call option.

You can see that the call option buyer to be profitable must have the price of the underlying asset to rise ABOVE the strike price plus the premium they paid for the option for their trade to be profitable at expiration . The issue is not only the distance that the market must do, but that it must make that move before the options contract expires.

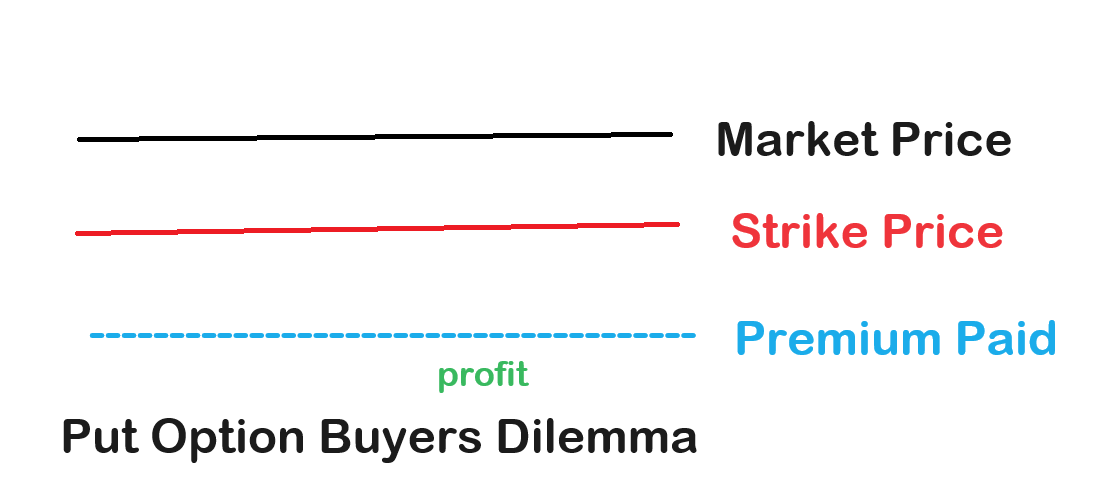

The same is true for a put option buyer. For a put option to be profitable at expiration it has to be trading lower than the strike price less whatever the premium that was paid for the option. These constraints often make option buying very risky.

What smart traders do after this type of initiation is ask themselves the question: what did I learn from that experience? After all, somebody made the money that I lost, what did they do different?

Enter stage right credit spreads…

An option credit spread is an options trading strategy where a trader simultaneously buys and sells options of the same class (calls or puts) but with different strike prices. The strategy involves selling an option with a higher premium and buying an option with a lower premium, resulting in a net credit (income) to the trader’s account when the trade is initiated. This net credit is the maximum profit that the trader can achieve from the spread. The ideal goal is for the options to expire worthless, allowing the trader to keep the premium received.

Credit spreads are effective and popular for several reasons:

1. **Limited Risk and Reward**: Unlike naked options, credit spreads have a clearly defined risk and reward. The maximum loss is the difference between the strike prices of the options minus the net credit received, while the maximum profit is the initial credit received. This allows traders to manage and limit their potential losses.

2. **Income Generation**: Credit spreads can provide a consistent income stream, especially in markets with low volatility. Traders can take advantage of the time decay (theta) of options, as the sold options lose value faster than the bought options.

Credit spreads can be used in various market conditions. Bullish traders can use bull put spreads, while bearish traders can use bear call spreads. This versatility makes credit spreads a useful tool in different market environments.

Since credit spreads benefit from time decay and can be structured to expire worthless, they often have a higher probability of success compared to outright directional bets. Traders can choose strike prices that align with their market outlook, further enhancing the likelihood of a profitable trade.

Credit spreads typically require less margin compared to naked options, allowing traders to deploy their capital more efficiently. This lower margin requirement makes it easier for traders to manage their positions and potential risks.

These attributes make option credit spreads a popular choice among traders seeking to balance risk, reward, and the probability of profit in their trading strategies.

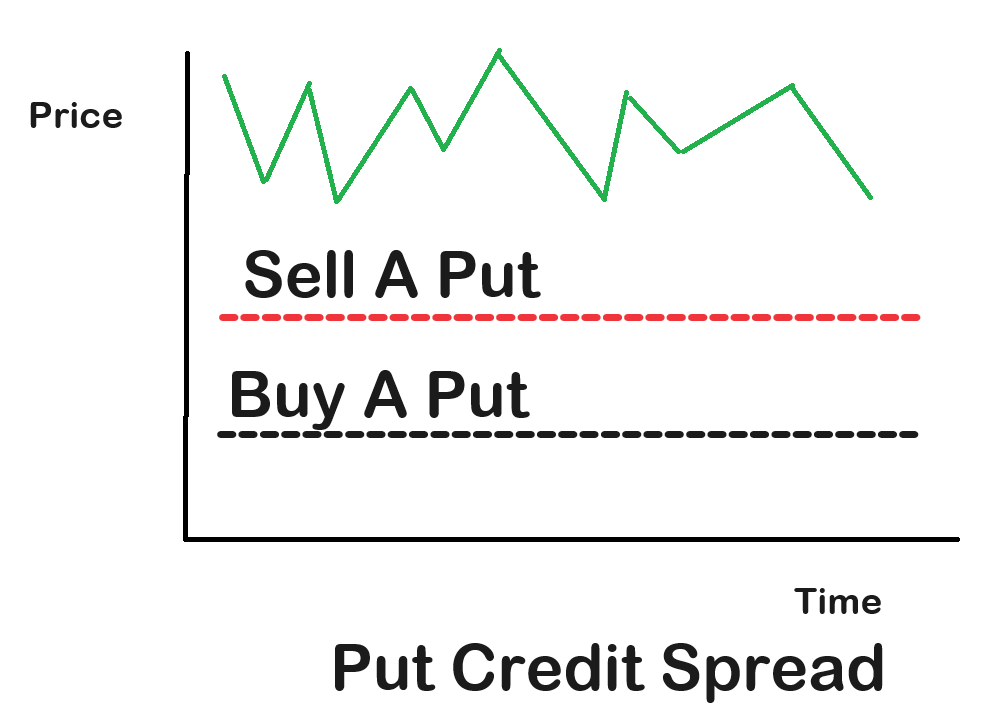

Here is what a put credit spread looks like.

The maximum risk is the difference between the strike prices, less the premium collected.

The maximum gain is the premium collected.

The put credit spread trader is obligating themselves to buy the stock at the higher price while they simultaneously have the right but not the obligation to sell the stock at the lower price. The risk is always capped as is the gain.

The ideal outcome is for all of the options to expire worthless and the put credit spread trade keeps the net premium received. This will occur if the stock at expiration is trading above the price of the PUT STRIKE price that was sold.

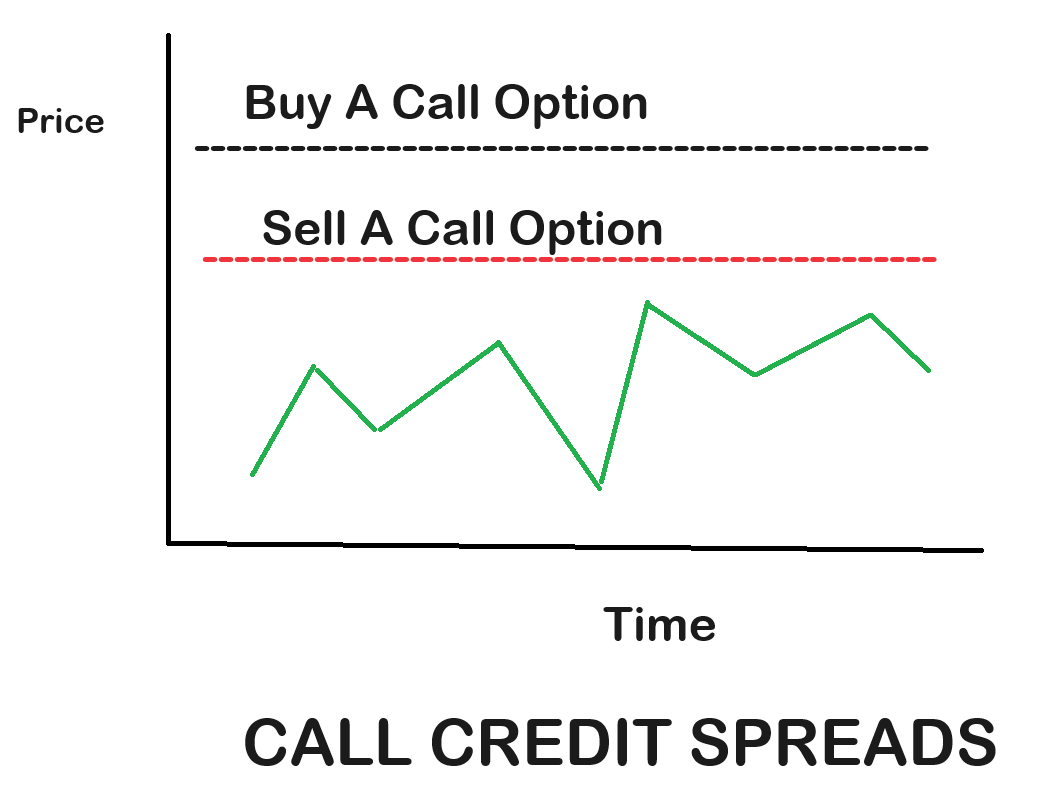

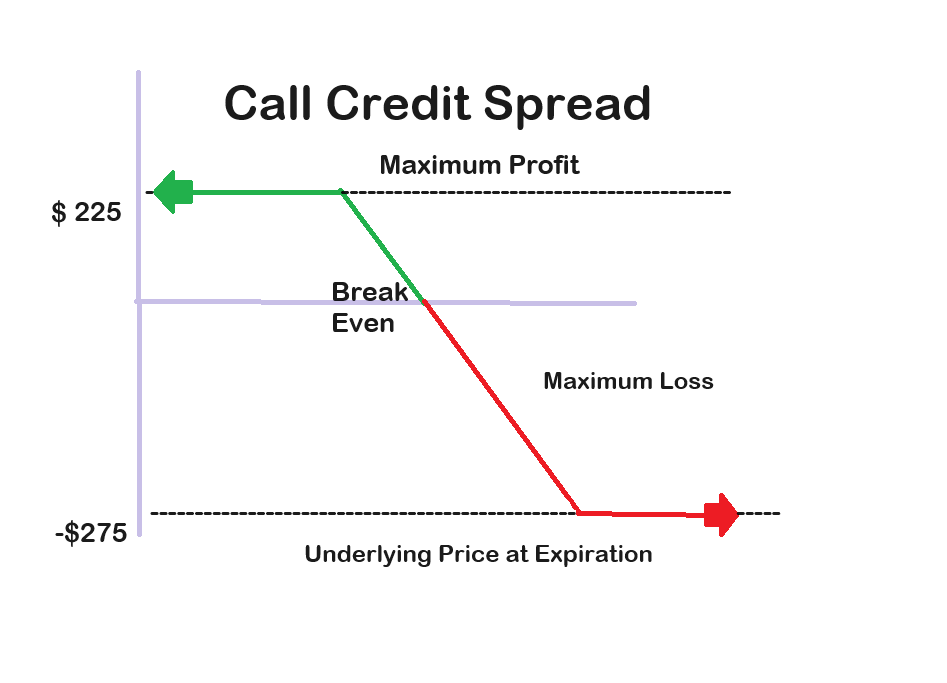

Here is what a call credit spread looks like:

In a call credit spread the maximum gain is the premium received on the spread.

The maximum loss is the difference between the strike prices less the premium received.

The call credit spread buyer will make the net premium received if the stock is trading at any price lower than the call option that was sold.

This is not a flashy, or sexy strategy. To be honest, most of the time it is like watching paint dry.

Let me provide some real-world numbers to give a better idea of the dollars involved.

Let’s assume a $XYZ stock is trading at $110. Look at the two primary aspects of this strategy to highlight an understanding of risk.

SELL to OPEN the $120 CALL $3.00

BUY to OPEN the $125 CALL $.75

These are the two legs of the credit spread.

Worst case scenario is always the difference between the strike prices.

The only remaining factor is how much premium was received for putting on this spread. In this instance the spread received a net credit of $2.25. This means that the worst-case situation will ALWAYS be the difference between the strike prices which is $5, less the $2.25 premium received. RISK is capped at -2.75. This will occur at any price above $125 at expiration.

So, to review the maximum gain is $225. The maximum loss is $275.

- The strategy will make money if the market goes up gradually but not past the $120 strike price.

- The strategy will make money if the market goes down.

- The strategy will make money if the market stays the same.

You can now understand why this is a high probability trade. Because this call credit spread strategy will only lose money if the market moves substantially higher quickly.

While the gains are not huge, they are consistent. Why because when you learn to sell options you learn to offset risk by neutralizing the zealousness of a bullish outlook against the negativity of a bearish perspective.

Many options traders only use this tactic to consistently generate regular income for their portfolios.

Let’s explore this exact same tactic by applying it to puts.

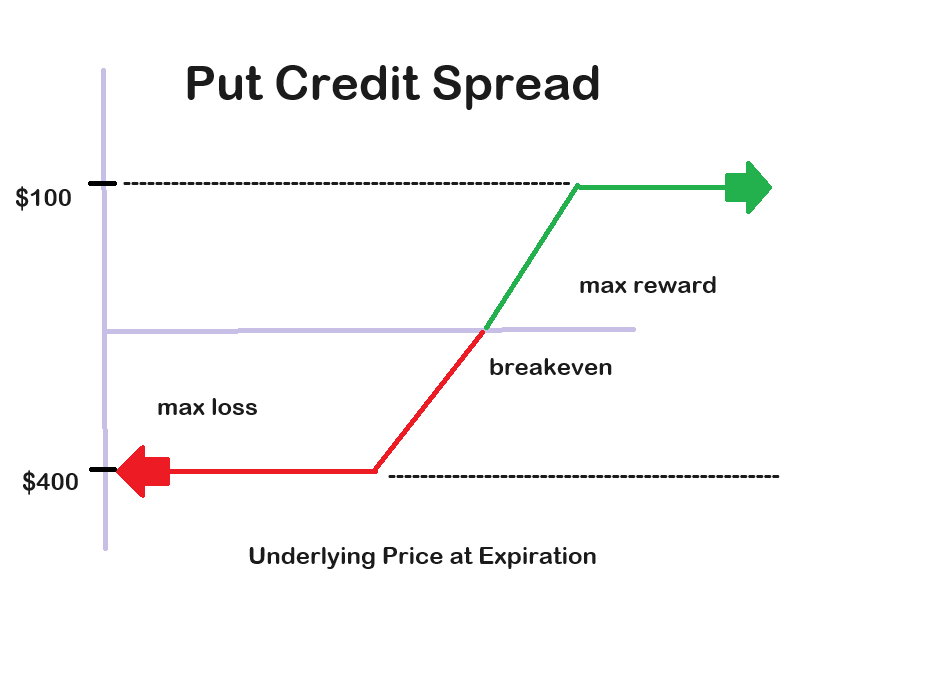

Let’s assume the market in $XYZ is trading at $110. The two primary aspects of this strategy highlight an understanding of risk.

SELL to OPEN the $100 PUT

BUY To OPEN the $95 PUT

Here’s the deal: In the absolute worst-case scenario with $XYZ, if it tanks to zero, you’re on the hook to buy $XYZ at $100. But don’t sweat it too much because you also have the right to sell $XYZ at $95. That means the most you can lose is the $5 difference between the strike prices, minus the credit you got when you set up the trade. That’s it. No surprises. Hard stop.

Now, let’s talk about the best-case scenario. If $XYZ stays above $100, and it is now trading at $110, all those options expire worthless. In this situation, your maximum profit is locked in. It’s simply the difference in the premium you paid versus the premium you received. Pure and simple. Maximum profit, always. Hard stop.

Graphically it looks like this:

So, with a put credit spread, a trader makes money when:

- The market goes down gradually but not past the top strike price which is sold.

- The market stays the same.

- The market goes up.

- They will only lose money when the market moves down substantially before the expiration date.

A Put Credit Spread Seller is neutralizing the pessimism of a BEAR with the pervasive optimism of a bull.

Yes, there is risk involved here, but it’s crystal clear and straightforward.

Now, here’s the kicker: the percentage return on this strategy is off the charts compared to the margin requirement. Most brokers will want you to have $500 (the difference between the strike prices) in your account to set this up. If you pull in $100 on that in just 30 days, you’re looking at a 20% return on margin. Annualize those figures, and you’ll see why credit spreads are a favorite among savvy traders. This is why so many folks love this strategy.

Credit spreads, much like all options strategies, carry inherent risks. The primary concern here is the potential for maximum loss if the market moves unfavorably beyond the strike price of the sold option. It’s essential to understand that, theoretically, you always have more risk than potential reward. However, the good news is that this risk is capped and always very clearly defined. This makes it a strategy where you know exactly what you’re getting into.

Power Traders use VantagePoint’s A.I. verified Support and Resistance zones to provide guidance.

Here is a Vantagepoint chart of TESLA ($TSLA) over the last few months with the verified support and resistance levels clearly isolated. Wanna bet that credit spread traders are exploiting this strategy on $TSLA.

Since options expire on daily, weekly, monthly, quarterly, and longer-term times frames there is an abundance of opportunity here.

Here is a chart of Microsoft with the same verified support levels.

The lesson to be learned here is that when you learn how to sell options you always have to cap your risk. But learning how to neutralize the bullishness of an optimist with the bearishness of a pessimist is a proven strategy to make bank.

Credit spreads in options trading involve simultaneously buying and selling options of the same class (calls or puts) with different strike prices. Credit spreads in options trading offer an abundance of opportunity because the risk and reward are always clearly defined, making it easier to manage and predict potential outcomes. This clarity allows traders to make informed decisions and strategically place trades with a high probability of success. Additionally, the limited risk inherent in credit spreads provides a level of security, while the potential for consistent income generation enhances their appeal in various market conditions.

- **Limited Risk and Reward** : By selling a higher-premium option and buying a lower-premium option, the maximum loss and gain are capped. This limited risk makes it easier to manage and predict potential outcomes.

- **Income Generation**: The primary objective of credit spreads is to collect the net premium received from the trade. Since the sold option has a higher premium than the bought option, the trader receives a net credit upfront. This credit acts as income if the trade expires worthless.

- **High Probability of Success**: In low volatility markets, prices are less likely to make large, sudden moves. This environment favors credit spreads, as the options sold are less likely to end up in-the-money, thereby allowing the trader to keep the premium received.

Options lose value as they approach expiration due to time decay (theta). Since credit spreads are net short positions, they benefit from this time decay, increasing the likelihood of the options expiring worthless.

Traders can place credit spreads at strike prices where they anticipate the underlying asset will not reach by expiration. By analyzing market trends and using technical indicators, they can set these spreads with a high probability of success.

Overall, when implemented correctly, credit spreads offer a structured approach to generating income with controlled risk, making them attractive in low volatility environments.

I want to personally invite you to our free “ Learn to Trade with A.I. ” Masterclass. In these sessions, we teach traders how to harness the power of artificial intelligence, neural networks, and intermarket analysis to pinpoint trading opportunities quickly and effectively.

The insights A.I. provides might just blow your mind.

This is how small traders can grow their accounts by consistently taking small, strategic bites out of the market.

Today, Artificial Intelligence, Machine Learning, and Neural Networks aren’t just tools—they’re essential for protecting your portfolio.

A.I. uses advanced pattern recognition, analyzes hundreds of thousands of data points, and performs millions of computations to find the highest probability trades. It’s indispensable for separating fact from fiction.

Now, like everyone, I have my opinions about what might happen next. But I never let my personal views overshadow what the A.I. is forecasting. Combining A.I. with options trading is how Power Traders learn to grow their portfolios.

This is how Vantagepoint artificial intelligence simplifies and empowers traders every single day!

Intrigued?

Discover why professional traders turn to artificial intelligence for less risk, more rewards, and guaranteed peace of mind.

Visit With Us and check out the A.I. at our Next Live Training.

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.