In a bold move reminiscent of Congressman Ron Paul’s 2008 presidential campaign, which prominently featured the call to “End the Fed,” Representative Thomas Massie of Kentucky and Senator Mike Lee of Utah have introduced new legislation aimed at dismantling the Federal Reserve. Established by the Federal Reserve Act of 1913, the Federal Reserve was tasked with providing the nation with a safer, more flexible, and stable monetary and financial system. Over the past century, the Fed’s role has evolved to include managing inflation, regulating banks, and stabilizing the economy. However, the institution has faced strong criticism for its handling of monetary policy, particularly its reliance on fiat currency and quantitative easing. Critics argue that these policies have led to significant inflation, eroding purchasing power, and disproportionately benefiting the wealthy. Although the bill proposed by Massie and Lee is unlikely to pass, it underscores a growing recognition among legislators of the destructive impact inflationary fiat policies have had on wealth creation over the last six decades. This proposal, even in its probable failure, invites a crucial discussion on the need for a return to sound money principles and the potential benefits of a gold standard in fostering sustainable economic growth.

The affordability crisis gripping the world today is a stark indicator of the economic challenges facing consumers everywhere. Essentials like food, travel, insurance, housing, childcare, transportation, and energy have become increasingly unaffordable, pushing what was once considered a normal existence out of reach for many. Since the Federal Reserve took charge of the economy, the prices of these basics have grown exponentially, leaving families struggling to make ends meet. This inflationary pressure is not just a temporary blip but a persistent issue that has eroded purchasing power and widened the gap between the wealthy and the rest. Critics of the Fed claim that the Federal Reserve is the source of Wealth Inequality. The rising costs have forced many to forgo necessities, leading to a lower quality of life and heightened financial insecurity.

Despite its profound impact on the economy and daily lives, the Federal Reserve remains shrouded in a lack of transparency and accountability. The institution has never been subjected to a comprehensive audit, raising critical questions about how it manages monetary policy and its true impact on the economy. How can we allow the most powerful financial institution in the world to operate without thorough oversight? The lack of accountability from the Fed is troubling, especially given its role in shaping economic policies that directly affect affordability and wealth distribution. It’s imperative that we demand greater transparency and scrutiny to ensure that the Federal Reserve’s actions are aligned with the broader public interest and not just the interests of a privileged few.

The reason I welcome legislation to ‘End the Fed’ is I contend they have been horrible stewards of the economy. In this article, like a good country lawyer, I will build the case that Fed is completely ineffective and incapable of managing the economy and under their stewardship economic life has gotten much worse.

One of the key questions which I have focused upon throughout my adult life is, how do you define a healthy economy? On the surface this question sounds very easy to answer. Most educated people would define a healthy economy by using words like more, abundance, greater, plenty. On the surface these answers are correct but by themselves they are very misleading.

Let me explain.

According to the U.S. Census Bureau there were roughly 100,000 millionaires in the United States in 1960. Today, in 2024 there are roughly 24.5 million millionaires.

Sounds impressive, doesn’t it? If we just compare one number to the other, we would equate “more” with great effectiveness and abundant prosperity. The problem here is that anytime you discuss price and quantity of money you are dealing with a moving target. To be able to have this discussion we must be able to measure the purchasing power of $1,000,000 in 1960 and compare it to the purchasing power today. Any unwillingness or lack of awareness to do this will create financial propaganda. Then we also must recognize the population of the United States has doubled in the last 64 years.

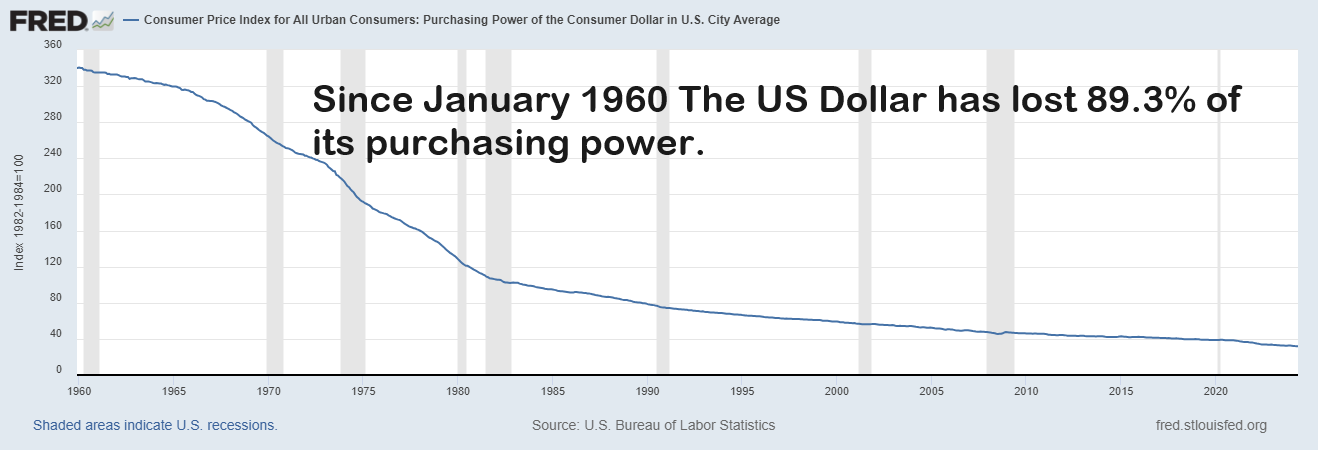

The Federal Reserve provides us with detailed history of metrics like purchasing power of the US dollar on their website. When I look at the graphic below the very first thing, I think of is that economic literacy requires that we understand the implications of a world where our currency, the reserve currency of the world, has lost 89.3% of its value in the last 64 years.

This metric serves on how effective the Fed has been at managing the economy.

Losing 89.3% of purchasing power means that the value of the currency has decreased to 10.7% (100% – 89.3%) of its original value.

To find out how much prices have increased, you need to determine the factor by which prices have multiplied. This can be calculated using the inverse of the remaining purchasing power.

In this case, the remaining purchasing power is 0.107 (10.7% expressed as a decimal).

A price increase factor of approximately 9.35 means that prices have increased by about 835% from their original level.

Therefore, the cost of living has increased by approximately 835% if the currency has lost 89.3% of its purchasing power.

I think one metric that would determine the “health” of an economy is a metric that showed over the same time frame being measured how many people in the population had their incomes grow by a similar or greater level.

Such a metric does not publicly exist, although it should as it is the foolproof way to determine if real progress is occurring in the economy.

The point I am making is that if your portfolio were worth $1,000,000 in 1960 it would have to be worth $9,350,000 today for you to be at break-even when compared to its 1960 purchasing power.

Regardless of how you slice it that is a massive amount of currency debasement. The illusion of wealth is being created because you have more dollars, but a lot less purchasing power.

In January of 1960, the country bid goodbye to Dwight Eisenhower as President and ushered in John F. Kennedy as the new Commander in Chief. In January 1960, the atmosphere in the United States was charged with a sense of optimism and renewal as John F. Kennedy was sworn in as President. The youthful energy of JFK’s administration, coupled with his inspiring call for public service in his inaugural address, ignited hope and a spirit of unity among Americans. Amidst the Cold War tensions and civil rights struggles, Kennedy’s leadership promised a new era of progress and change, resonating deeply with a nation eager for a brighter future.

How would you quantitatively measure that brighter future? My answer after years of pondering this question is that you would have to use a more stable unit of measurement. It could be ounces of gold, barrels of crude oil, a number of cows or chickens, etc. But the only way you could provide an effective report card on the stewardship of an economy is by comparing the cost of living in US dollars against the cost of living in a commodity-based currency.

The simplest and most profound means of measuring wealth and economic health is by equating it to an increase in purchasing power which promotes economic stability.

In Austrian Economics, price is understood as a ratio of exchange , reflecting the relative valuation of goods and services in the marketplace. This ratio is not fixed but dynamic, influenced by individual preferences, scarcity, and subjective valuations. The numerator in this ratio represents the amount of money or goods offered in exchange, while the denominator signifies the quantity of goods or services received. This perspective emphasizes the importance of understanding that prices emerge from the voluntary interactions of individuals seeking to maximize their utility, rather than being centrally determined.

The main dangers of a fiat currency include inflation, government overreach, and loss of trust. Inflation can erode the purchasing power of money, as fiat currencies are not backed by physical assets and can be printed in unlimited quantities, potentially leading to hyperinflation if mismanaged. Government overreach is another challenge, as fiat currencies allow for greater control over monetary policy, which can be manipulated for political purposes, resulting in economic instability. Lastly, a loss of trust in the currency can occur if people believe it no longer holds value, leading to reduced economic confidence and potentially severe financial crises.

To delve deeper, consider the numerator in the exchange process, which could be money or other goods that one is willing to part with. This represents the resources or efforts that an individual or business is prepared to sacrifice to acquire something else. The denominator, on the other hand, is what one receives in return—be it a product, service, or asset. In economic transactions, focusing solely on the numerator (what you give up) can be misleading. True wealth generation and economic efficiency hinge on maximizing the value of the denominator (what you receive) . Thus, a thorough evaluation of the worth and utility of what you receive is crucial in assessing the overall benefit of the exchange.

Building wealth effectively, therefore, necessitates a keen focus on the denominator of your exchanges. By concentrating on increasing the value and utility of what you acquire in transactions, you enhance your overall economic position.

To make my point eloquently and memorable, I thought it would be fun and entertaining to illustrate the case of returning to a gold standard from the perspective of a simple country lawyer who is bringing a legal case against the Federal Reserve for damages incurred from loss of purchasing power. As a simple country lawyer, I will make the case for returning to the gold standard and abolishing the Federal Reserve because, at its core, common sense tells us that the true measure of economic well-being is the purchasing power of our money. A gold standard ensures that our currency retains its value over time, protecting individuals and families from the hidden tax of inflation. Additionally, without the Federal Reserve’s manipulation of interest rates and money supply, we would have a more transparent and stable economic system, where the value of our hard-earned money is preserved and not eroded by excessive money printing.

Ladies and gentlemen of the jury, today I stand before you to argue for the return to the gold standard—a monetary system where our currency is directly linked to the value of gold. I present to you a tale of inflation, devaluation, and the need for sound money, illustrated by the stark contrast between commodity prices from 1960 and today. As I present my evidence, I will share with you the price of these important commodities which make the world go round priced in US dollars and priced in GOLD. As consumers, we have been conditioned to view the world only in terms of U.S. dollars. However, when you view the world of these exact same commodities priced in Gold you will begin to understand how your purchasing power continues to be robbed.

In the past 64 years, modern society has achieved remarkable improvements that have fundamentally transformed the world. The end of the Cold War in 1991 dissolved long-standing geopolitical tensions and facilitated the spread of democracy, fostering global stability. The Civil Rights Movement of the 1950s and 1960s dismantled institutional racism in the United States, leading to significant legal and social advancements in equality. The formation of the European Union in 1993 established a unified economic and political bloc that has promoted peace, economic growth, and integration across Europe. China’s economic reforms since 1978 have lifted hundreds of millions out of poverty and positioned the country as a global economic powerhouse. The Internet Revolution of the 1990s has revolutionized communication, commerce, and access to information, connecting the world in unprecedented ways. These accomplishments collectively highlight the progress in promoting democracy, equality, economic development, and technological innovation in modern society.

What is mind numbing is that despite these social achievements that the value of our money continues to devalue. How in the world can that be a good thing? How can we allow this to persist? Where is accountability?

One of the massively frustrating things about economics is that “more” does not necessarily mean better. Everything that involves money and price needs to be adjusted for inflation to be able to determine equivalency. Most people will not do the math and simply assume that since they have more units of currency, they are better off. It is not until you try to understand why more units of currency are required to acquire the same good or service that you will begin to understand the implications of the silent tax and theft that inflation creates.

Let me present some evidence of how much more prosperous we could be if we adopted a gold standard.

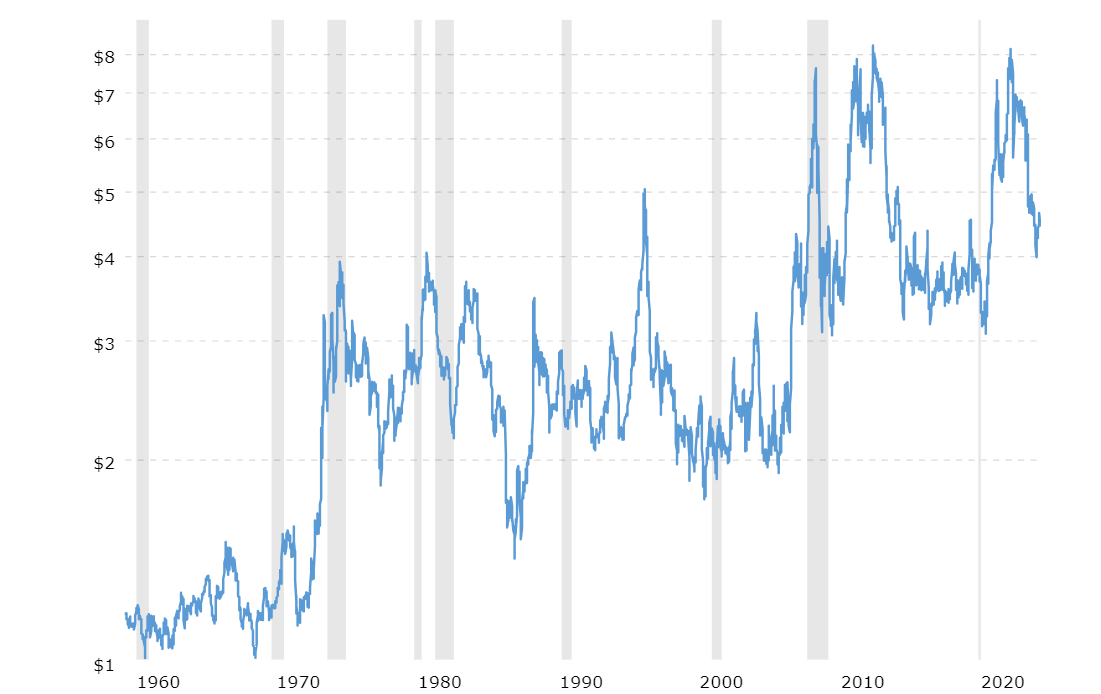

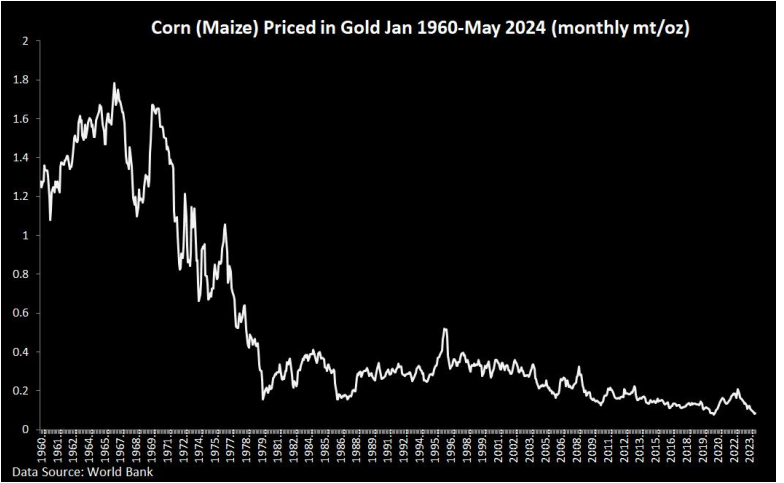

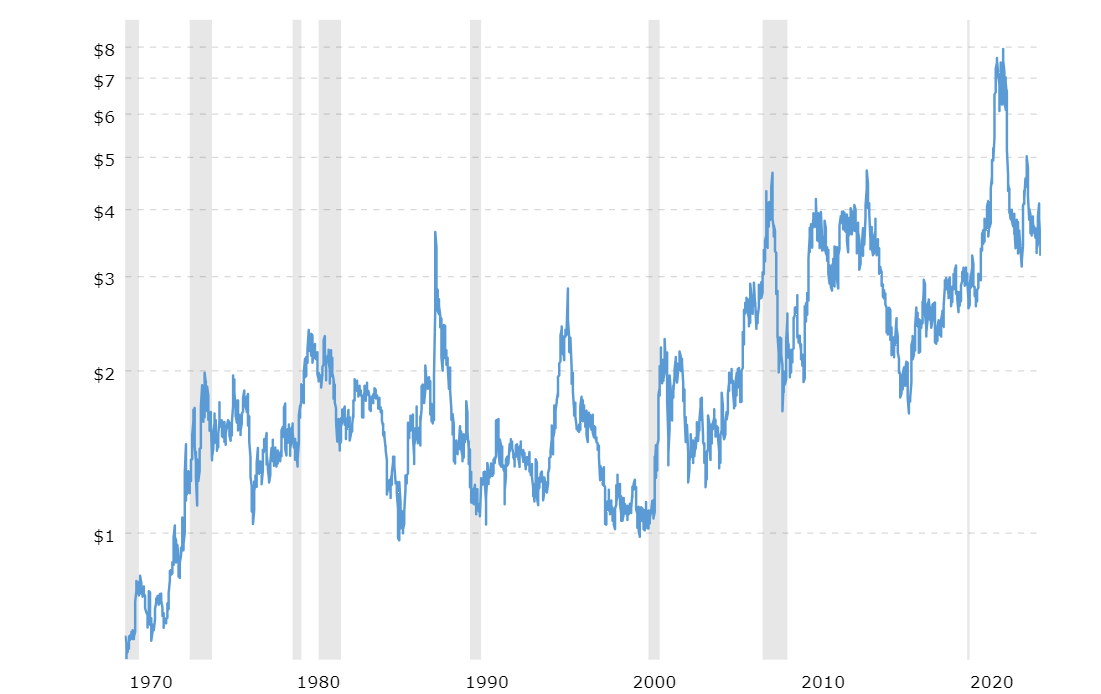

Exhibit A: Corn

In January 1960, a bushel of corn cost $1.00. Those were the good old days. Today, it costs $4.50. The price of corn has increased by 350%. This staggering rise is not because corn has become more valuable, but because our paper money has lost its purchasing power.

However, look at this second chart when Corn is priced in GOLD, how the price of Corn has dropped 92%.

As a consumer, if you buy this corn priced in US dollars it is $350% more expensive. If you purchase it with your gold savings it is 92% less expensive than it was in 1960.

Which would you rather do?

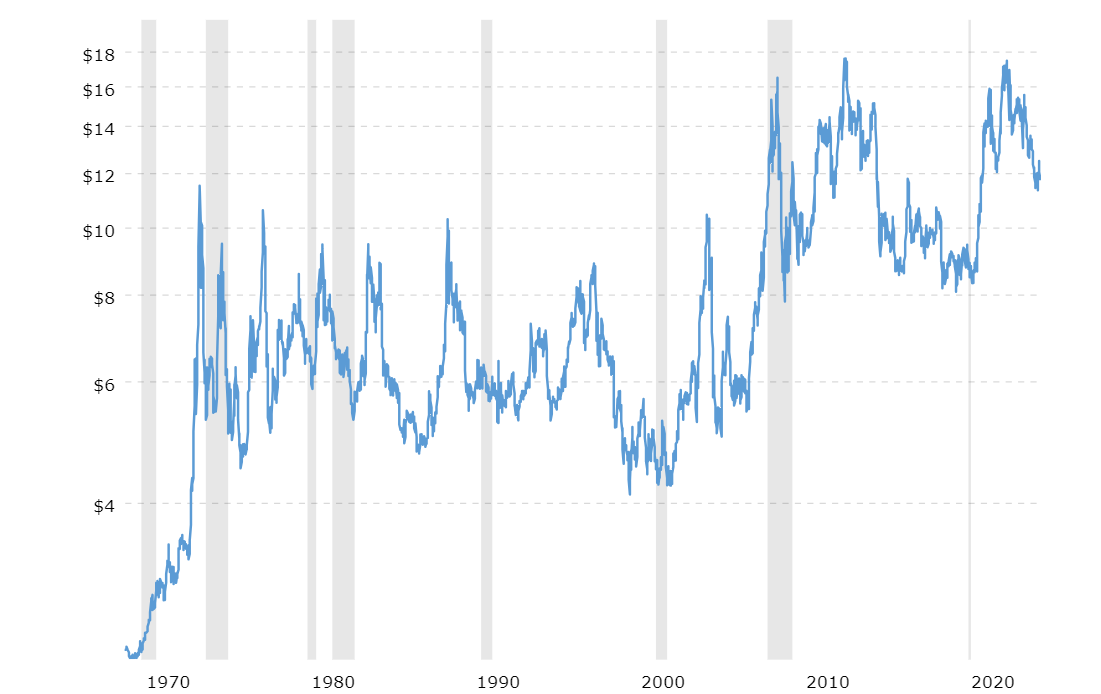

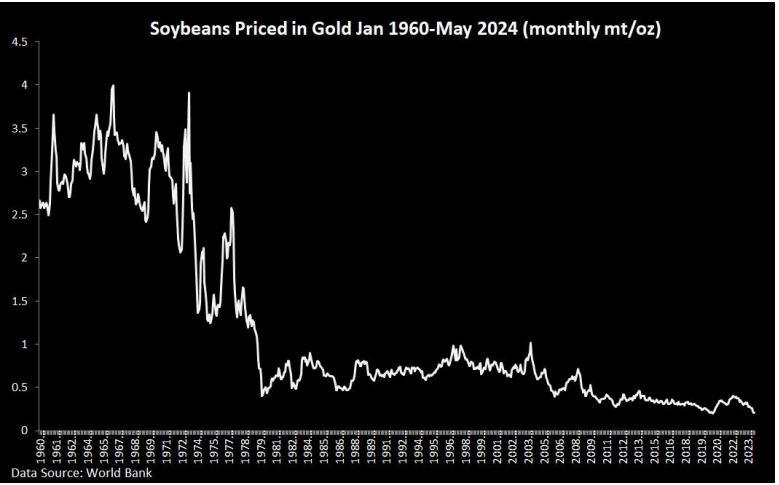

Exhibit B: Soybeans

Soybeans, once priced at $2.00 per bushel in 1960, now command $12.03. That’s a 501.5% increase. This drastic surge underscores the erosion of our currency’s value.

However, when these exact same soybeans are priced in Gold the price today is 90% less than what they were in 1960.

Simple question. As a consumer, would you rather pay 501.5% more than you were paying in 1960, or 90% less? Which purchase would demonstrate economic well-being?

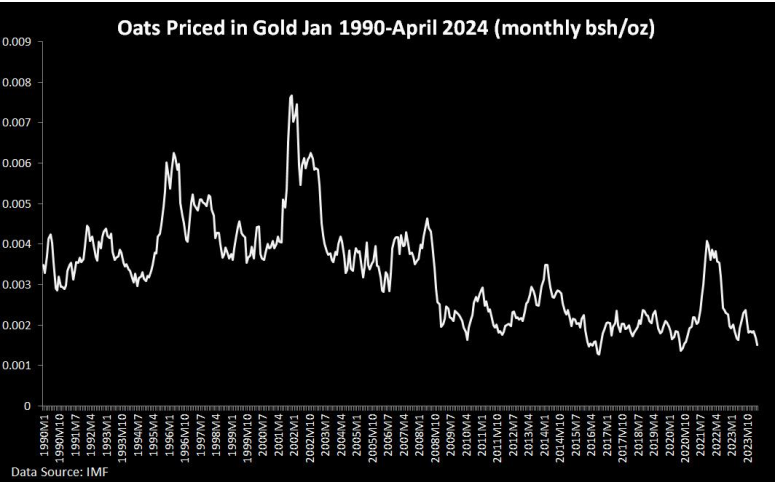

Exhibit C: Oats

Oats have jumped from $1.50 per bushel to $3.49. This 132.7% rise isn’t due to a change in oats’ worth but rather the depreciation of our paper currency.

However, when these same OATS are priced in Gold over the same time frame, the price of Oats drops almost 50%.

Let’s dive into something that should be as natural as breathing in a healthy economy: falling prices.

Yes, you heard me right! When an economy is working the way it’s supposed to, prices should actually be going down. Think of any electronic or computer item. Prices of computers today are 90% less than they were 40 years ago, and today’s computers are thousands of times more powerful.

Now, let’s talk about what really happens out there. We often see prices going up, and there are a few culprits behind this. One big reason is the imbalance between supply and demand. When demand goes through the roof, but supply can’t catch up, prices shoot up because there’s just not enough of what people want.

But the majority of the time it’s inflation , the classic too much money chasing too few goods scenario. When there’s an overflow of cash but not enough stuff to buy, prices naturally rise. And let’s not forget about the rising costs of production. When the cost of raw materials and wages soar, manufacturers pass those costs onto us, the consumers, to protect their margins.

But here’s the kicker. In an economy brimming with technological advancements, you’d expect prices to drop on just about everything, right? Because technology should make things cheaper. But what’s really happening? The money is broken! The savings from technology aren’t making their way into the broader economy because our currency is losing value faster than technology can make things cheaper.

So, the next time you see prices going up, remember this: it’s a sign that our money is losing its worth faster than technology can save us. We need sound money to ensure that the benefits of technological progress reach us all. Let’s fix the money and watch those prices fall as they should in a truly healthy economy!

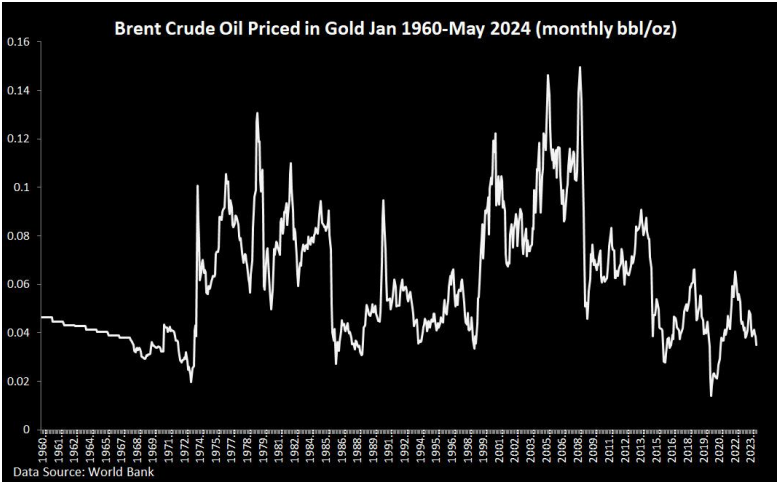

Exhibit D: Brent North Sea Crude Oil

Brent crude oil was $28.00 per barrel in 1960. Today, it stands at $84.50. The 200% increase exemplifies how inflation has permeated every facet of our economy.

Many would argue that Crude Oil has gotten scarcer. Some would argue that it is bad for the environment. But if we price that exact same Crude Oil in Gold look at how the price of Crude Oil drops. I thought there were massive geopolitical tensions in the world responsible for the price increases we have witnessed.

I could share thousands of examples of this type of evidence. Clearly FIAT currency is flawed and defective and does not offer value for the consumer. Our broken money forces us to transact in a medium of exchange that is perpetually deteriorating.

In a world of broken money, where the currency continually loses its value due to inflation, the price of everything inevitably rises, exacerbating the affordability crisis. As the purchasing power of money erodes, consumers find that their income buys less and less over time, leading to a higher cost of living without a corresponding increase in wages. This situation creates a vicious cycle where the essential goods and services—such as housing, healthcare, education, and food—become increasingly out of reach for the average person. The continuous price hikes not only strain household budgets but also widen the gap between the rich and the poor, deepening economic inequality and causing social unrest. In such an environment, financial stability is compromised, and long-term economic planning becomes challenging, making it difficult for individuals to save, invest, or even maintain a decent standard of living.

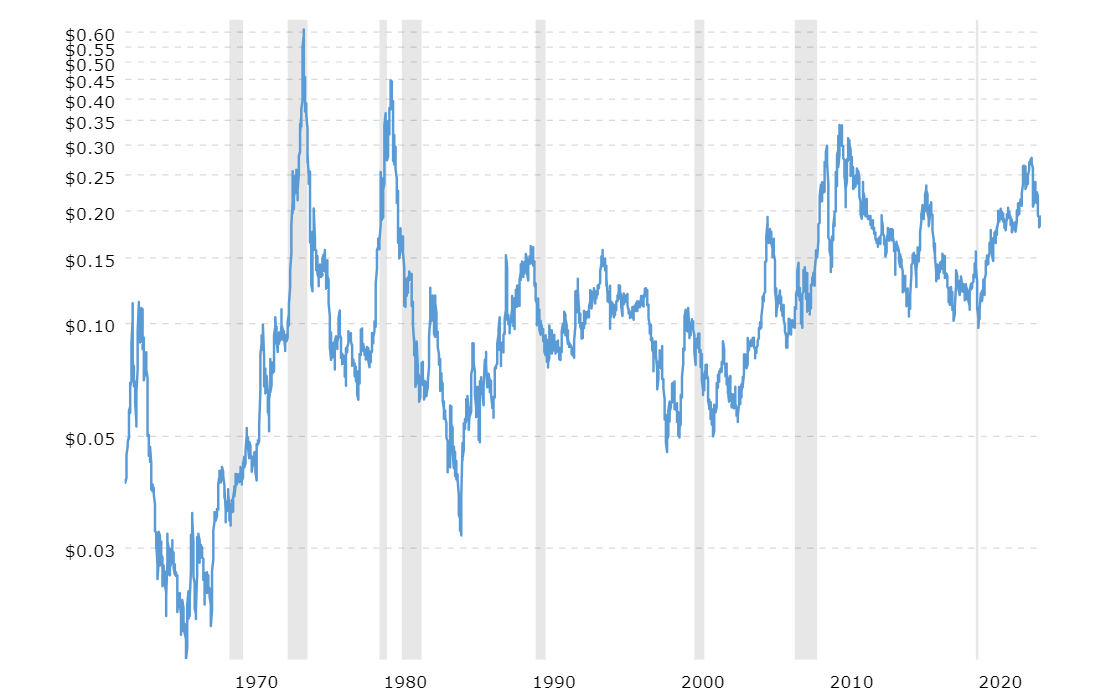

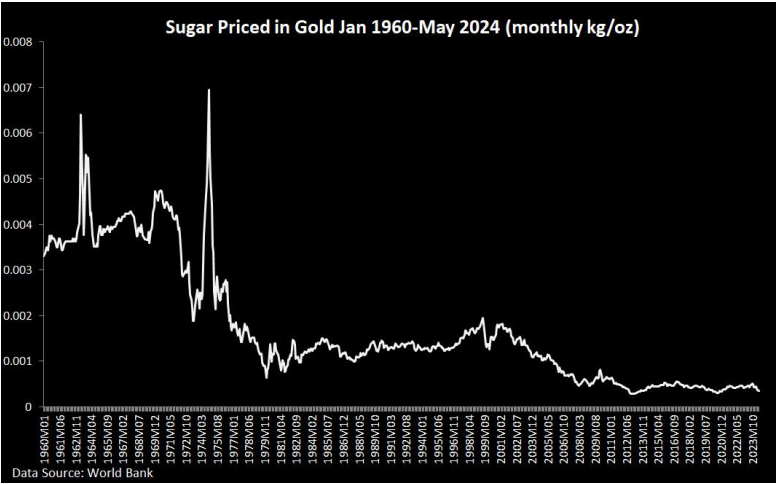

Exhibit E: Sugar

Sugar, a staple commodity, has increased from $0.05 per pound to $0.19. This 280% rise further strengthens the argument for the need for sound money.

But now price the exact same Sugar in gold and look at what occurs. That’s about a 75% savings for my sweet tooth.

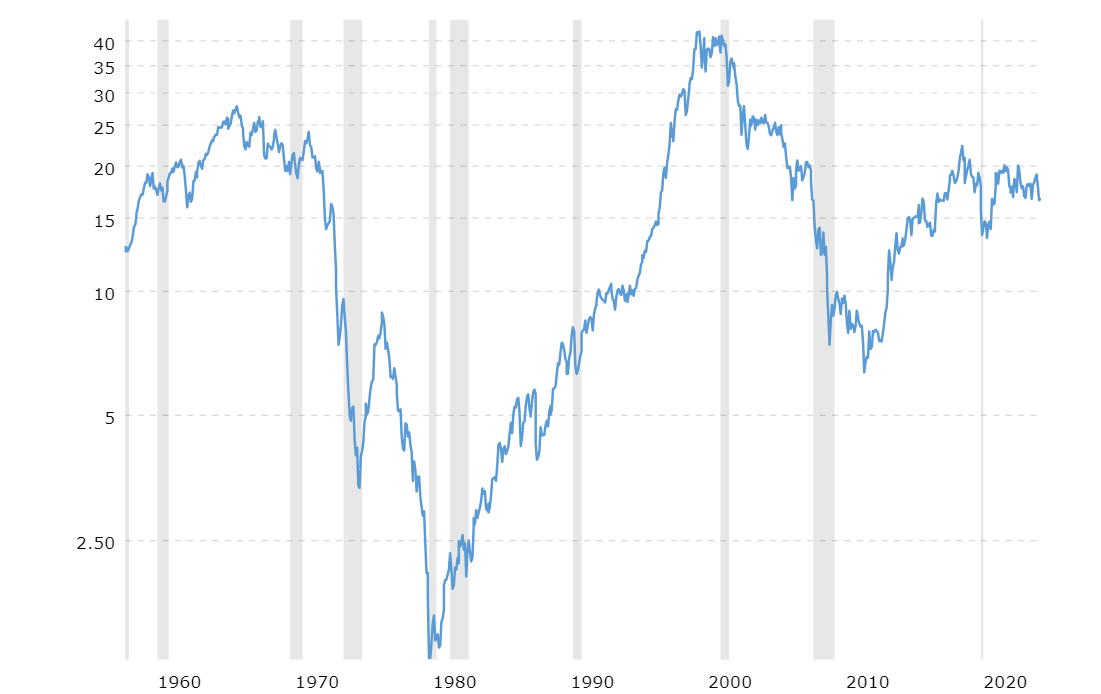

Exhibit F: The Dow to Gold Ratio

One of the most compelling charts which displays the case for sound money is the Dow to Gold Ratio. You can see from the chart below that over the last 64 years it is essentially flat. This means that huge gains in the top 30 stocks which comprise the Dow Jones Industrials average have been equivalent to the price increase in Gold. The implications of this reality are also quite profound because today most people are forced to speculate to preserve purchasing power. If our money were sound and maintained its purchasing power, we would witness falling prices for goods and services.

Even as I write those words, I recognize that it sounds like a fairy tale.

Closing Argument

Ladies and gentlemen, the evidence is clear and compelling. The government devalues our money by 89.3% over the last 64 years. This is a silent tax.

But since 1960, the price of Gold has skyrocketed 70-fold, underscoring its undeniable value as a store of value. Understanding the history and principles of monetary literacy is essential to grasp the profound effects of currency devaluation on our financial future.

An ounce of Gold in 1960 is still an ounce today and it continues to maintain its purchasing power. The dollar on the other hand, even though it is the reserve currency of the world, is wreaking havoc for anyone who is trying to save in it.

Across the board, commodities have seen dramatic price increases, —not due to their intrinsic values rising, but due to the relentless inflation caused by our paper money system.

In a world of broken money, where the currency continually loses its value due to inflation, the price of everything inevitably rises, exacerbating the affordability crisis. As the purchasing power of money erodes, consumers find that their income buys less and less over time, leading to a higher cost of living without a corresponding increase in wages. This situation creates a vicious cycle where the essential goods and services—such as housing, healthcare, education, and food—become increasingly out of reach for the average person. The continuous price hikes not only strain household budgets but also widen the gap between the rich and the poor, deepening economic inequality and causing social unrest. In such an environment, financial stability is compromised, and long-term economic planning becomes challenging, making it difficult for individuals to save, invest, or even maintain a decent standard of living.

When the Bretton Woods Monetary Conference convened in 1944, attendees were acutely aware of the economic devastation that had contributed to the outbreak of World War II. Many delegates believed that the harsh terms of the Treaty of Versailles, which imposed severe reparations on Germany after World War I, had forced Germany into hyperinflation, leading to the collapse of its economy and the rise of extremist movements. This historical lesson heavily influenced the discussions at Bretton Woods, prompting a strong consensus in favor of establishing a gold standard. They aimed to anchor currencies to a stable value, thereby preventing the kind of rampant hyperinflation that had devastated Germany and contributed to global instability. Eighty years after Bretton Woods we have acclimated to persistent incremental inflation which is still quite toxic.

Our ancestors knew the value of sound money. By tying our currency to gold, we ensure stability, preserve value, and protect against inflation. It’s time to return to the gold standard and reclaim the true value of our hard-earned money.

Historically, in an industrialized market economy with a stable commodity money like gold, the natural tendency has been for general prices to consistently decline. This is due to advances in industrial techniques leading to a continual expansion in the supply of goods.

Now, let’s stop and think about the implications of this.

When the CPI is reported and pundits are applauding a 3.5% increase in inflation, isn’t that an admission that as a nation, our standard of living has declined by 3.5% year over year? This kind of economic chicanery is ever present today because our money is not anchored to anything real.

Remember: Price is a ratio of exchange. If you want to build wealth focus on acquiring real stores of value for your denominator.

In a heavily industrialized economy, enriched by technological advancements over the last century, shouldn’t we expect falling prices instead?

It’s time to say goodbye to the Fed . They have been horrible stewards of the economy, and we will never be able to unleash true wealth and prosperity in our world until we bid them farewell.

Gold is accountable.

Gold is transparent.

Gold has historically always proven its value, in even the harshest of economic environments. The same cannot be said of the Federal Reserve or the U.S. Dollar.

I rest my case.

When I look ahead, my core belief is clear: the Fed will inevitably unleash a tidal wave of new money to keep funding the government.

In today’s financial landscape, currency debasement isn’t just a passing worry—it’s a constant reality, quietly draining your purchasing power even as you read this.

Whether you like it or not, the financialization of the economy forces everyone to be a speculator since we all instinctively know that tomorrow’s dollar will be worth less than it was worth today.

This looming financial menace also presents a unique opportunity for strategic gains through cutting-edge technologies like Artificial Intelligence (A.I.) in trading. A.I. offers a decisive edge in this new normal, not just shifting our approach to market trends but fundamentally transforming our tactics in combating wealth erosion.

With this pressing need in mind, we’re thrilled to introduce an exclusive masterclass designed to demystify the current economic climate and reveal the transformative power of A.I. in trading . This event promises an illuminating journey for anyone eager to understand and navigate the complexities of today’s markets.

Join us as we dive deep into the capabilities of A.I. trading software —technology that has not only mastered intricate games like Go and Chess but is now redefining financial trading. Our A.I. trading masterclass, led by seasoned experts, will showcase how A.I. acts as a powerful ally in spotting and capitalizing on market trends, performing sophisticated trend analysis, and refining trading decisions. This session is crafted to empower you with the knowledge and skills to harness A.I. effectively, ensuring you’re well-equipped to protect your investments and seize market opportunities to their fullest.

Imagine thriving, not just surviving, even as the currency’s value falters under relentless printing pressures. Our advanced A.I. trading technology is designed not just to protect but to amplify your wealth through precise, swift market adaptations. It excels where traditional methods stumble, by instantly processing vast market data arrays and executing trades that capitalize on fleeting opportunities. This A.I.-driven trading approach is about more than staying afloat; it’s about turning the tide in your favor, leveraging top-tier technological advancements to not only detect but dynamically respond to market shifts, ensuring your investments stay robust and yield substantial returns.

To those ready to seize their financial destiny, this isn’t just an invitation—it’s a call to arms. Equip yourself with our A.I. trading system and turn potential threats into lucrative opportunities.

Join us for a transformative journey at our Live Online Free Masterclass on A.I. trading. Here, you’ll gain the insights to fully harness A.I.’s potential, turning the relentless challenge of currency debasement into a strategic advantage that not only preserves but multiplies your wealth. Embrace this opportunity to redefine your trading and investment strategy and step into a realm where financial foresight meets technological prowess.

I invite you to learn how to forecast the stock market at our Next Free Live Training.

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.