Inflation is the hot topic everyone’s yapping about, yet hardly anyone gets it. Our politicians in D.C. talk about inflation like it’s some dreadful, uncontrollable force—like a hurricane, an invasion, or a pandemic. They’re always pledging to “fight” it—if only Congress or the public will hand them the “tools” or “a tough law” to get the job done.

But here’s the simple truth: our political leaders have cooked up this inflation mess themselves with their reckless money and fiscal policies. They’re waving their right hand to battle the very beast their left hand unleashed.

Inflation, my friends, is always and everywhere driven by one thing: an increase in the supply of money and credit. That’s right, inflation *is* the increase in money and credit. Crack open the American College Dictionary, and what do you find? The top definition for inflation is “Undue expansion or increase of the currency of a country, especially by issuing paper money not redeemable in specie.”

So, next time you hear a politician blabbering about fighting inflation, remember this: they’re just promising to clean up the mess they made.

I’ve been trying to simplify my thoughts on inflation for quite a while. This is what I have produced. Whether you are a consumer, investor, trader, manufacturer, business owner you are always and persistently confronting the following formula.

Let’s solve for X.

The numerator of X is the goal or desired asset.

I am going to make this super simple for everyone to understand. If the value of $ is reduced by 10%, all things being equal what must happen to X?

It almost doesn’t matter what “X” is, the price of X must go up. This is not because “X” has become more valuable, it is simply because the value of the denominator has been reduced. It takes more $ to acquire the same amount of X. It doesn’t matter whether we are talking about bubble gum, or a Rolls-Royce or the stock market.

Where this simple formula becomes complicated is when the US dollar is compared to other fiat currencies. The argument is always made that the US dollar is the reserve currency of the world and it is stronger than other currencies. While that is true, we always need to compare the currency to what it can purchase in terms of goods and services.

This unfortunately is the formula used by the Fed to manage the economy and debase the currency. It sounds overly simplistic, but it is highly accurate and effective.

The global expansion of bureaucracy has spun a web so tangled even the world’s best spiders would be envious. This bureaucratic bloat has spawned a myriad of problems, the biggest being that the state’s operations have become so opaque, tedious, nuanced, and ridiculously technical that only a handful of people can, or even care to, keep track of what’s happening.

Take the Federal Reserve, for example. Established in 1913 when the U.S. was still on a gold standard—a quaint concept by today’s measures—the Fed’s link to gold was slowly eroded until Richard Nixon finally shut that door in the 1970s. But even after that, interest rates were still tied to the system’s reserves.

Fast forward to 2008, a year that the Fed decided to rewrite the rulebook entirely. They severed the link between the money supply and interest rates so thoroughly that it’s as if they tossed the old playbook out the window. And guess what? This seismic shift flew under the radar. The media barely blinked, the Fed clammed up, and the public got numb thinking about it. Meanwhile, the world keeps turning, blissfully unaware of the ticking time bomb.

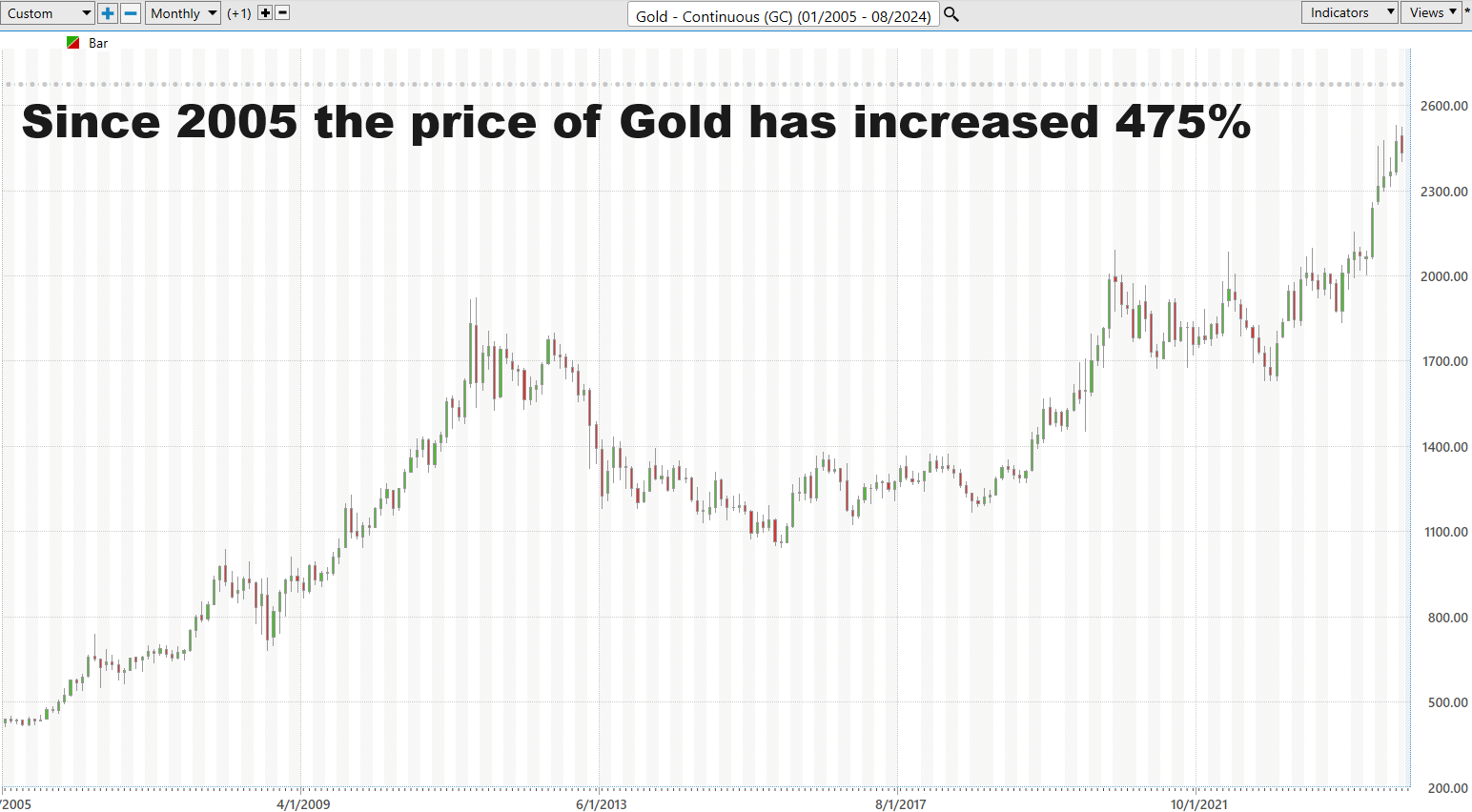

But here’s the kicker: financial markets aren’t so easily fooled. They sense the chaos brewing in monetary policy. Long before inflation hit its highest point in 40 years, gold prices started to rise. Now, with gold reaching all-time highs, markets are flashing a big, bright warning sign: they don’t trust central banks to manage money any better than they did in the past.

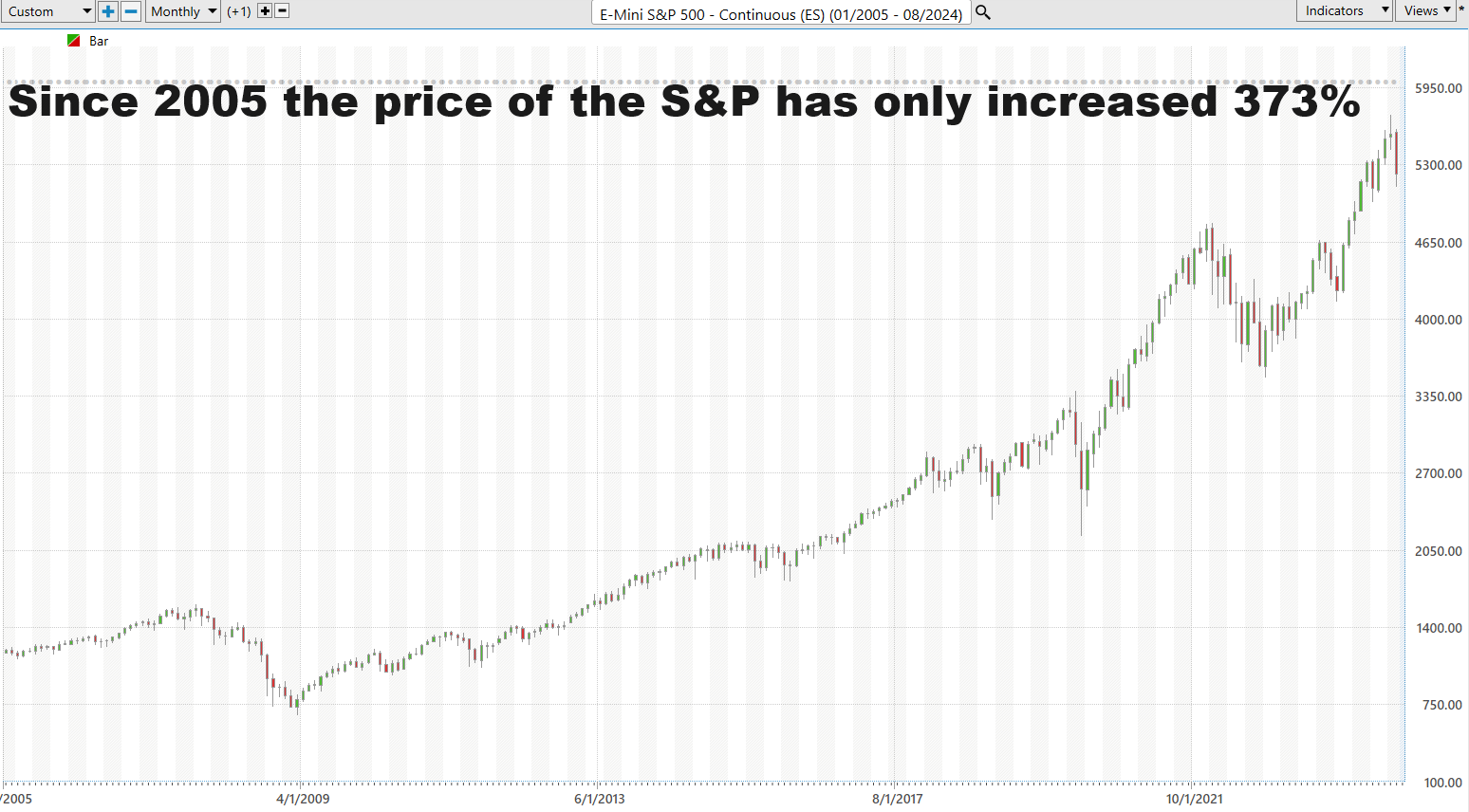

Compare the following two charts which tell the entire story far better than I ever could.

First off is a chart of Gold from 2005 to present –

Here is a chart of the S&P 500 over the exact same time frame –

So here we are, watching history repeat itself as central banks play fast and loose with monetary policy. Isn’t it comforting to know that despite all our advancements, some things never change?

What I find fascinating about that analysis is all that is being compared is GOLD, an asset that used to be money, to the S&P 500 which is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the United States. Around 60% to 80% of active fund managers fail to keep pace with the S&P 500 annually.

Like it or hate it, after all the shenanigans of Quantitative Easing, Quantitative Tightening, Stimulus etc., Gold is clearly the fastest horse in this race. Something every trader, business, and investor should evaluate carefully moving forward.

Isn’t this an indictment of the Fed and the US Treasury and their fiscal and monetary policies? After all, what used to money has massively outperformed the best stocks in the world.

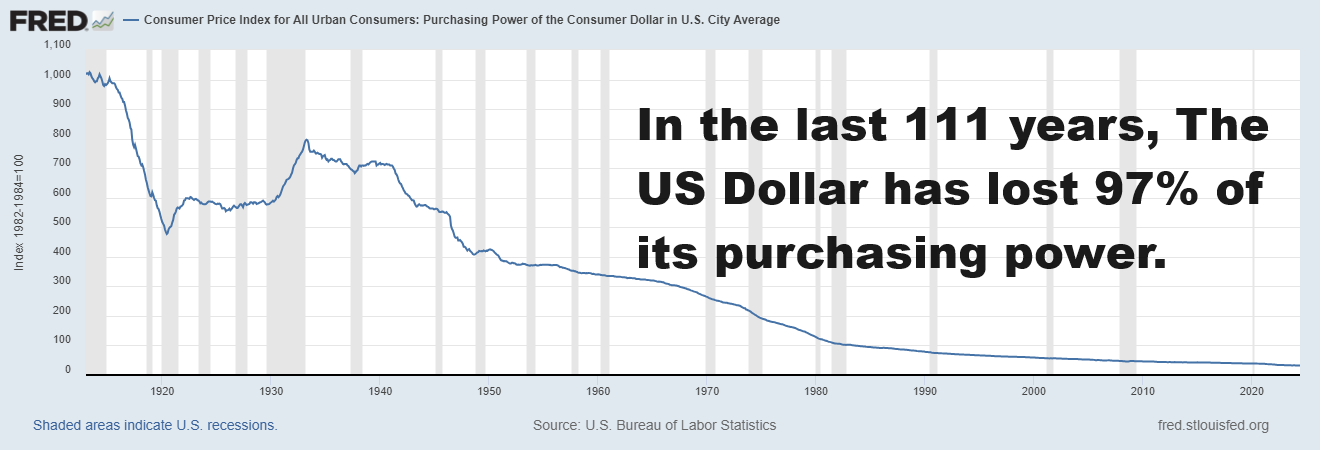

This simple analysis is the primary reason that I cannot take anything the Federal Reserve says or does seriously. In 111 years, they have destroyed the purchasing power of the US dollar by 97%. I find it humorous that anyone would request their counsel.

As we navigate the financial markets moving forward the challenge facing everyone is how do you save? If you plan on doing it in dollars you are asking for trouble because currency debasement is going to get much worse moving forward.

Let me explain.

US Debt just passed $35 trillion. It can never be paid back. The solution is the money printer.

We are in an election year. In election year the incumbent administration always seeks favor for its electoral base by running the money printer.

There are numerous proxy wars taking place around the globe. How are they being financed? The money printer is the solution that war hawks always go to.

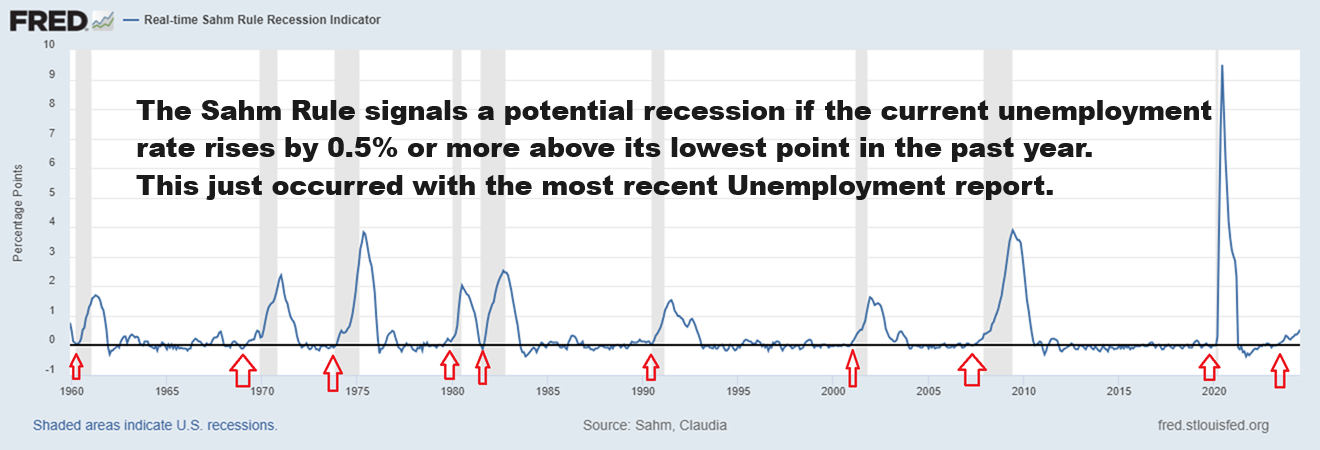

There is a very high probability that the US economy is already in a recession. Naturally, this has not been widely publicized. Let’s assume that this is accurate for the purpose of this discussion. In a recession does the government spend more or less? If you said more, go to the head of the class. Because historically in a recession the government spends much more.

Why do I think that we are in a recession already?

Have you ever heard of the SAHM RULE Recession indicator?

The Sahm Rule Indicator is a tool that helps predict the start of a recession by looking at the unemployment rate. It works by finding the lowest unemployment rate of the past year and comparing it to the current rate. If the current rate is at least 0.5% higher than the lowest rate from the past year, it signals that a recession might be starting. For example, if the lowest rate was 3% and the current rate is 3.6%, the difference is 0.6%, which would trigger the Sahm Rule Indicator. This tool helps economists quickly see if the economy is slowing down, which can guide decisions to support the economy.

The Sahm Rule is a simple way to help figure out if the economy is heading into a recession. Imagine your school has a thermometer to check if anyone has a fever. If someone has a high temperature, it might mean they are sick. The Sahm Rule works similarly, but instead of checking temperatures, it checks the unemployment rate, which is the percentage of people who don’t have jobs but are looking for work. When the unemployment rate goes up quickly by a certain amount, it can be a sign that the economy is getting “sick” or slowing down, which indicates a recession.

The person who created this rule is named Claudia Sahm, an economist who wanted to find a simple way to spot early signs of economic trouble. According to the Sahm Rule, if the unemployment rate increases by 0.5% or more over the past three months compared to its lowest point in the last year, it’s a strong signal that a recession is starting. Just like a fever tells you to rest and take care of yourself, the Sahm Rule informs that the recent uptick in unemployment spells trouble ahead.

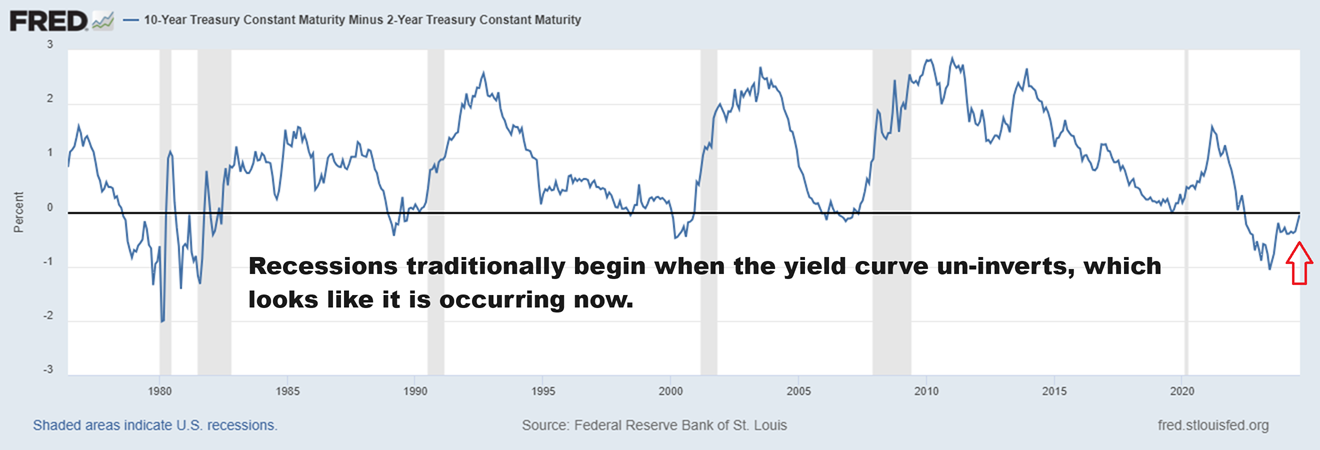

Lastly, let’s not forget the yield curve which inverted in July 2022. The yield curve is a graph that shows the relationship between interest rates and the maturity dates of different government bonds, like U.S. Treasury bonds. On the graph, the horizontal axis represents the time to maturity (ranging from short-term bonds, like 3-month or 2-year bonds, to long-term bonds, like 10-year or 30-year bonds), and the vertical axis represents the interest rates (or yields) on those bonds.

Under normal economic conditions, the yield curve slopes upward, meaning long-term bonds have higher interest rates than short-term bonds. This makes sense because investors usually expect to be compensated more for tying up their money for a longer period.

However, when the yield curve inverts, it means short-term interest rates become higher than long-term rates. This can happen when investors are worried about the future economy and expect interest rates to fall, so they are willing to accept lower yields on long-term bonds. An inverted yield curve is often seen as a warning sign of a potential recession, as it indicates that investors believe the economy will slow down in the future.

Recessions traditionally occur when the yield curve uninverts because this process often signals a shift in economic conditions. An inverted yield curve, where short-term interest rates are higher than long-term rates, typically indicates that investors expect economic slowdown and lower interest rates in the future. However, when the yield curve uninverts—meaning long-term rates rise above short-term rates again—it usually reflects the Federal Reserve’s actions to lower short-term rates in response to emerging economic weakness. This policy shift can lead to tighter credit conditions and reduced consumer and business spending, which in turn can slow down economic growth and trigger a recession. The uninversion of the yield curve thus acts as a confirmation of the economic downturn that the initial inversion had predicted.

When I evaluate the current economic scene, I’m convinced that the dollar has to be debased to keep the system going . Wars need to be financed. Debt needs to be refinanced. Plus, it’s an election year, which means we get to hear politicians tell us that they will give us a free lunch if we elect them. All the above lead to higher asset prices when priced in US dollars.

Ponder what the symbol above means and draw your own conclusions.

Let me refresh your memory to the most recent Fed soap opera drama. Last November, Federal Reserve Chair Jerome Powell indicated that the Fed might reduce interest rates up to six times in 2024. This expectation was based on the belief that inflation would continue to decrease, and that the economy would slow down enough to justify these cuts. Powell emphasized the importance of responding to economic data and the evolving economic outlook to ensure that any rate cuts support both price stability and employment goals.

Well, here we are 9 months later in August 2024, and the Fed has not officially lowered interest rates once. What has happened in the last 9 months is that the Fed has been very busy monetizing the debt and the media is trying to tell us that this will not be inflationary.

Curing inflation is all about tackling its root cause. Inflation happens because of one thing—an increase in money and credit. So, the cure? Stop increasing money and credit. Simple, right?

Well, not so fast. While the principle might be as simple as turning off a faucet, the decisions to make it happen are anything but straightforward. Let’s start with the Federal budget. Keeping a heavy deficit is like begging for inflation because that deficit will probably be funded by—you guessed it—printing more money. Massive government spending isn’t inherently inflationary—if it’s covered by tax receipts or real savings. But once spending hits a certain level, cranking up the printing press becomes the go-to move.

And even if we match those massive expenditures with equally massive taxes, it disrupts production and puts a wrench in the gears of free enterprise. So, the real solution? Halt reckless spending, don’t just slap on more taxes.

On the monetary front, the Treasury and Federal Reserve need to quit making money artificially cheap by holding down interest rates. The Fed shouldn’t revert to buying government bonds at par, because keeping interest rates low just encourages more borrowing, which pumps up the money and credit supply. This cycle feeds on itself—more borrowing means more money and credit, which keeps rates low. When the Fed buys government bonds at a set rate, they’re basically printing more money, a process lovingly known as “monetizing” the public debt. And inflation keeps rolling along as long as this charade continues.

And let’s be honest, the world won’t escape this inflationary era until we return to the gold standard. The gold standard automatically checks internal credit expansion, which is precisely why bureaucrats ditched it. It’s a safeguard against inflation and the only system that’s ever provided an international currency equivalent.

Now, the real question isn’t how to stop inflation, but whether we want to. Inflation redistributes wealth and income, benefiting some at the expense of others. This creates vested interests in keeping inflation alive.

Inflation, in a nutshell, is the increase in money and bank credit relative to goods. It’s harmful because it devalues the monetary unit, raises living costs, imposes a tax on the poorest at the same rate as the richest, wipes out savings, discourages future savings, arbitrarily redistributes wealth and income, promotes speculation over thrift, undermines confidence in free enterprise, and corrupts public and private morals. But let’s not kid ourselves—it’s never inevitable. We can stop it overnight if we genuinely have the will to do so.

Since 2020, the cumulative inflation rate in the United States has been approximately 21.39%, according to the Consumer Price Index (CPI). This means that overall, prices have risen by about 21.39% from January 2020 to June 2024.

The broad simple truth is that inflation is not a bug in the monetary system, it is its main feature. Inflation will persist as long as the system prevents competing currencies from entering the mainstream financial ecosystem.

Friedrich von Hayek and Ludwig von Mises were prominent Austrian economists who deeply influenced the understanding of free-market economics. Hayek, particularly in his later work, argued passionately for removing money control from government hands, advocating for a system of competing private currencies. He believed that government monopoly over money led to inflation and economic instability, undermining individuals’ ability to save and invest wisely. Hayek’s vision was to allow market forces to determine the value of money, thereby providing a more stable and reliable medium for economic transactions. This idea was rooted in his belief that competition would lead to the best outcomes, as it does in other areas of the economy.

The emergence of cryptocurrencies is a powerful testament to Friedrich von Hayek’s vision of decentralized and competing currencies. Hayek believed that taking control of money out of the hands of governments and allowing for a competitive monetary system would lead to better financial stability and trust. Cryptocurrencies like Bitcoin and Ethereum epitomize this concept by operating on decentralized networks, free from government control. These digital currencies offer an alternative to traditional fiat money, providing individuals with new means to save, invest, and transact. This aligns perfectly with Hayek’s assertion that competition in currency could prevent inflation and promote economic stability by removing the monopoly governments have over monetary policy.

For businesses, the advent of cryptocurrencies presents both challenges and opportunities. On the one hand, integrating cryptocurrency into payment systems can lower transaction costs and increase speed, providing a competitive edge. On the other hand, the volatility of cryptocurrencies poses a risk, making financial planning more complex. Regulatory uncertainties also add to the challenges, as governments around the world grapple with how to handle these new forms of money. Nevertheless, businesses that successfully navigate these obstacles will benefit from a more flexible and innovative financial landscape, potentially leading to increased efficiency and new market opportunities.

Investors face a similar dual-edged sword with cryptocurrencies. The potential for high returns attracts many, but the lack of regulation and the volatility can also lead to significant risks. For economic planning, the rise of cryptocurrencies necessitates a reevaluation of traditional monetary policies and economic models. Governments and financial institutions must adapt to a world where digital currencies will disrupt conventional economic practices. The opportunity lies in the ability to harness the innovative aspects of cryptocurrencies while developing new frameworks to manage and mitigate their risks. For investors willing to engage with this new asset class, cryptocurrencies offer diversification and the chance to be at the forefront of financial innovation, aligning with Hayek’s vision of a dynamic and competitive monetary system.

Cryptocurrencies are emerging as serious contenders to the US dollar for saving, as many offer decentralized, inflation-resistant alternatives that appeal to a global audience wary of traditional fiat currencies. Intelligent traders and investors should closely study this burgeoning industry to understand the potential risks and rewards, as well as the underlying technologies that drive these digital assets. As cryptocurrencies gain traction, those well-versed in their dynamics could significantly benefit from the opportunities and innovations this sector presents.

What is your denominator?

You will get an entirely different perspective of finance and markets depending on what you make your denominator for saving. Wealth is a relative concept that can vary significantly based on the denominator used to measure it. When you view wealth through the lens of gold, Bitcoin, silver, or high-quality stocks, it offers a different understanding compared to holding funds in US dollars. For example, while the value of the US dollar can be eroded by inflation and government policies, assets like gold, Bitcoin, and silver often retain or increase their value over time, providing a hedge against currency debasement. High-quality stocks, representing ownership in profitable companies, can grow in value and provide dividends, further enhancing wealth. Thus, by focusing on these alternative stores of value, one can potentially preserve and increase wealth more effectively than by solely relying on US dollars, which are subject to inflation and diminishing purchasing power.

Now, why do I keep harping on the Fed? Simple. How do you determine the health of an economy? You look at the strength of its currency against goods and services. Debase the currency, and presto! You’ve got yourself an illusion of prosperity. Asset prices go up, but all that really means is you need more of that debased currency to buy the same stuff.

If Gold, which used to be money, has outperformed stocks over the last 20 years, how can anyone be expected to believe the Fed on anything?

Experts might call me simplistic, but here’s the deal: a strong currency, in relation to goods and services, is a true mark of a healthy economy. It means more purchasing power, which translates to higher consumer confidence, increased spending, low inflation, and a better standard of living. Plus, it attracts foreign investment because of the perceived stability and strength of the economy.

On the flip side, a debased currency gives you a fake sense of wealth with rising prices for assets like real estate, stocks, and commodities. This so-called wealth isn’t based on real economic growth but on the shrinking value of money. While assets inflate, so does the cost of living, gutting the purchasing power of anyone whose income doesn’t keep up with inflation.

This mirage of prosperity from a debased currency can hide economic frailty and mislead investments into speculative rather than productive avenues. It also amplifies the real burden of debt, setting the stage for financial crises. In a nutshell, a strong currency is the real deal, indicating genuine economic health through better purchasing power and stable prices. A debased currency, on the other hand, is just smoke and mirrors, leading to long-term instability and economic headaches.

Ah, currency debasement. The timeless tradition of financial alchemy that’s been the darling of governments since Caesar first thought, “Hey, why not put less gold in these coins?” For centuries, we’ve watched with morbid fascination as leaders, in their infinite wisdom, diluted the value of money faster than a college student waters down cheap vodka. And surprise, surprise—today’s financial wizards are no different.

Cheap government debt promises a utopia of growth and prosperity but delivers a dystopia of instability and worthless currency. Wondering why your wages don’t stretch as far and why the middle class is on life support? Blame the money printers and their love affair with public debt. The illusion of cheap debt always comes with a steep price tag.

In today’s financial markets, we have three delightful archetypes: the investors, the speculators, and the enlightened ones who grasp the concept of government currency debasement.

Investors are those starry-eyed souls seeking long-term gains, hoping for stability and steady returns. They dream of fundamental value and growth, like a farmer nurturing crops, blissfully unaware of the monetary tornado on the horizon.

Speculators, in contrast, are the thrill-seekers. They ride the waves of market volatility, chasing short-term profits with all the grace of a cat on a hot tin roof. Their risk tolerance is as high as their attention span is short.

Then we have the third group – the realists, the cynics, the ones who see through the government’s fiscal shenanigans. They understand that excessive money printing and reckless fiscal policies are slowly turning their hard-earned dollars into Monopoly money. These savvy individuals invest in precious metals, cryptocurrencies, and other short-term hedges against inflation, bracing for the inevitable fallout.

As I accumulate more gray hairs and trading experience, I’ve come to appreciate the eternal verities of life: death, taxes, and the relentless debasement of currency. Because, let’s face it, the only thing more predictable than the government’s fiscal irresponsibility is the inevitability of it hitting us where it hurts – our wallets.

That’s why today I always recommend that traders, investors, and those keen on preserving their purchasing power learn to trade with artificial intelligence . Because the alternative is sitting idly while your money turns to confetti.

Picture a future where economic chaos doesn’t just knock on your door—it invites you to a wealth-building fiesta. This is the promise of A.I. in trading. Our A.I. forecasting software isn’t just another tool; it’s your golden ticket to market mastery, giving you the inside scoop on when and where to strike for maximum profit.

I know it sounds like hype. But look at the following chart of the S&P 500 over the last month. The goal of artificial intelligence is to keep you as a trader on the right side, of the right trend, at the right time. I can proudly say that as far as trend forecasting is concerned – the mission is accomplished.

While many watched their portfolios decline by 10% or more over the recent pullback, VantagePoint family members knew where the risk and opportunity were every step of the way.

Control your financial destiny with this technology at your fingertips. Don’t let inflation chew through your savings. Join the vanguard of traders using A.I. to not just beat, but utterly obliterate, average returns.

Act now. Embrace A.I.’s power, which learns from the past to dodge errors and seize future opportunities. This isn’t about avoiding mistakes; it’s about grabbing the best strategies by the horns in real-time.

Excited yet? You should be! A.I. trading software is revolutionizing trading just like artificial intelligence conquered Poker, Chess, Jeopardy, and Go. If A.I. can crush human champions in these complex games, think of what it can do for your trading portfolio.

Harness the unrivaled analysis only A.I. can offer and step into a world of higher probability, more informed trading decisions. A.I. doesn’t just give you insights—it hands you actionable intelligence to overhaul your financial strategy. Don’t sit around waiting for the economic tide to drown you; seize control with A.I.-driven trading tools.

You’re invited to an exclusive online Master Class: “ How to Know What to Trade With Artificial Intelligence. ” Led by seasoned A.I. trading experts, this session will show you how A.I. can become your best friend in navigating market trends, assessing risks, and spotting potential rewards. Discover how A.I. keeps you ahead by pinpointing the right trends at the right time.

Join us for a FREE Live Training.

We promise to arm you with critical insights and foresight in the financial market. Register now to secure your spot in this vital educational opportunity!

It’s Not Magic.

It’s Machine Learning.

Let’s Be Careful Out There!

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.