Legal structure probably isn’t the first thing that comes to mind when thinking about decentralized autonomous organizations (DAOs), but it will likely draw more attention in the coming years.

A structure that protects members against killer lawsuits by offering “limited liability” will most likely be considered essential.

Consider that in 2022, venture capital powerhouse Andreessen Horowitz invested $70 million in (LDO) tokens issued by Lido DAO.

It followed Paradigm Operations, a crypto investment firm, which purchased 100 million LDO tokens in 2021 — 10% of total LDO tokens issued. Another venture capital firm, Dragonfly Digital Management, also bought $25 million worth of LDO.

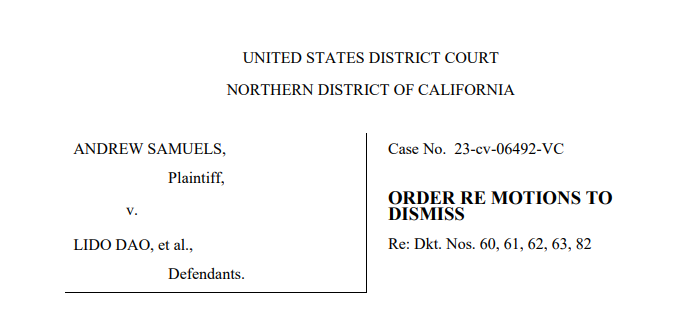

Fast forward two years. On Nov. 18, 2024, a northern California district court ruled that all three firms could be sued by an investor who lost money on his investment in LDO tokens. The ruling sent tremors through the DAO community.

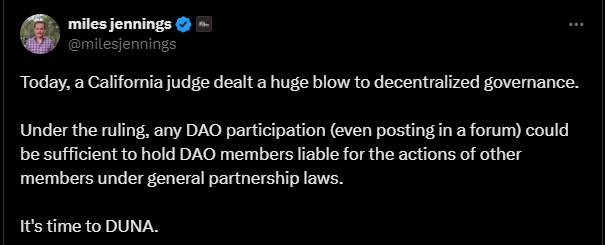

“Today, a California judge dealt a huge blow to decentralized governance,” posted Myles Jennings, general counsel and head of decentralization at a16z Crypto, a venture capital fund launched by Andreessen Horowitz, adding:

An exaggeration? Maybe not. Even though this ruling originated in a district court covering the northern part of a single US state, it may have ramifications worldwide.

VCs took an “active role” in DAO management

“It’s not terribly surprising, but it is significant,” Stanford University law professor Jeff Strnad told Cointelegraph about the ruling.

The three investment firms “took an active role” in Lido DAO’s management, acting like general partners, according to the Northern District of California court in Samuels v. Lido DAO , which meant they could be liable for potential losses — without limit.

Recent: Pump.fun’s memecoin freak show may result in criminal charges: Expert

This is clearly “a bad outcome for DAOs,” Strnad said. Venture capital firms won’t invest in enterprises like DAOs without the protection offered by “limited liability.”

“This ruling underscores the growing legal scrutiny of DAOs,” Kevin Owocki, co-founder of Gitcoin and author of the upcoming book, How to DAO: Mastering the Future of Internet Coordination , told Cointelegraph. “It signals that courts are willing to apply traditional legal frameworks to novel decentralized structures — often treating apples as oranges.”

The ruling could stifle DAO innovation if the “nuances” of its structure aren’t fully understood, Owocki added.

Most DAOs have no legal structure

There is a wide variety of legal structures used among the thousands of DAOs in existence. Some are structured as corporations, some as limited liability companies, others as unincorporated nonprofit associations and still others as offshore entities.

But most DAOs “do not associate with any form of legal entity” at all, noted Arina Shulga, a partner at law firm Nelson Mullins. By default, these DAOs are general partnerships and therefore, unincorporated associations, she wrote, adding:

“They still carry legal liability for the actions of their members, and since there is no limited liability shield, the group liability becomes the liability of each individual member of such DAO.”

Moreover, DAO projects are international. A DAO’s headquarters may be in California, but its members could be in Russia. A member in Russia could now sue VCs like Andreessen if it is understood that they are running things at an organization like Lido DAO.

Things could get complicated even for non-members. “If you write code, put it on GitHub, and some DAO picks it up, you have a potential liability problem,” Strnad said. Obviously, this sort of thing is a “threat to innovation.”

An impact beyond California

Still, maybe this court ruling has limited application for California alone?

“While the ruling technically applies within the jurisdiction of the Northern District of California, it has the potential to set a precedent for other US courts,” said Owocki, “so it’s worth paying attention no matter where you are.”

“The operations in question did not occur in the United States,” David Kerr, CEO of Cowrie, an advisory practice, told Cointelegraph. Legal action began in California only because some of the parties lived there. Indeed, the plaintiff may have identified this particular court as a favorable forum to bring suit, Kerr said.

Location may not matter so much for decentralized organizations. “From a practical standpoint, being nowhere is simply shorthand for being everywhere,” Kerr added.

That said, Kerr cautioned against going overboard while reacting to the court’s decision. Technically, this was just about a motion to dismiss a lawsuit. The California court did not actually find governance tokenholders liable.

Kerr said, “This is simply a step to include them in discovery because the court has determined that more inquiry is necessary.”

Are DUNAs the answer?

In Jennings’ post, cited above, the general counsel added : “It’s time to DUNA.”

In March, the US state of Wyoming passed a law that created a new legal entity for DAOs, the decentralized unincorporated nonprofit association (DUNA). A DUNA would not just enable DAOs to engage in legal contracts with other entities. It also provides legal protection for individual DAO members.

Owocki and Strnad agreed that DUNAs are a good solution for many DAOs’ legal vulnerabilities.

Still, the Wyoming DUNA is not a panacea for all actions, Kerr said. “Establishing solutions around a project’s facts and circumstances is always going to be the answer. The Wyoming DUNA is a tool that can help effectuate that end — but like all tools, if used improperly it may well result in a worse answer.”

“FIT21 has nothing to do with liability”

Does the California court ruling matter when many say the Trump administration will likely pass blockchain-friendly legislation within the year?

“Yes, there is likely a friendlier regulatory and policy regime on the horizon, but it’s not here yet,” Owocki said.

Until then, DAO builders should continue to work to ensure that they are well-positioned legally and operationally, while continuing to advocate for laws that are clearer, he added. “This focus will make DAOs resilient, regardless of changes in administration or policy.”

Strnad said there’s a “strong possibility” that a beneficial crypto market structure like FIT21 could pass during the Trump administration. FIT21 gives authority to the Commodity Futures Trading Commission (CFTC) as opposed to the Securities and Exchange Commission (SEC).

With the CFTC as its regulator, DAOs wouldn’t have to register or issue quarterly reports (as is required for SEC-regulated concerns). “But FIT21 has nothing to do with liability,” said Strnad.

‘A tragedy that’s avoidable’

In sum, the California district court ruling, part of an ongoing legal action, may still prove to be limited in its impact, but it nevertheless shines a light on an important question for all DAO operators and members: Do all actors have limited liability? This has nothing to do with market structure issues, as Strnad points out.

Recent: Tether’s $5B mint and political entanglements raise suspicion about industry

It’s more about matters like the size of fines that await DAO members if something goes awry. With limited liability, a fine would be roughly equivalent to an investor’s loss. With unlimited liability, on the other hand — the sort that venture capital firms may still face in Samuels v. Lido DAO — penalties could amount to $25 million, or some other enormous number.

In any event, if you’re a DAO, “you better do something to protect yourself from unlimited liability,” Strnad said. “That’s a tragedy that’s avoidable.”