On August 15, 1971, when President Nixon slammed shut the gold window, effectively severing the U.S. dollar from any hard commodity backing, the #1 song on the Billboard Top 100 was “How Do You Mend a Broken Heart” by the Bee Gees. I mention this slice of rock and roll history because, in my view, the “Nixon Shock” stands as the most significant economic act of any administration in the last century. Nixon’s move to decouple the dollar from gold didn’t just shake the financial world—it tore apart a monetary system built on the solidity of tangible assets, ushering in the volatile era of fiat currencies. This decision allowed governments to print money without limits, eroding the individual’s capacity to safeguard their wealth and undermining the very concept of economic freedom. It’s a moment that, to this day, I reflect on, wondering how different our world might look had Nixon chosen another path.

Had Nixon not closed the gold window, we’d be living in an economic landscape marked by lower, more stable inflation rates, slower yet more sustainable growth, and stronger global confidence in currencies. The gold standard’s constraints would have curbed unchecked monetary expansion, mitigating the risk of runaway inflation and crippling debt. While growth might have been slower, the trade-off would have been a more stable global economy, with fewer financial crises and better preservation of economic freedom through the protection of individual wealth—albeit at the cost of reduced flexibility in navigating economic challenges.

Fiscal dominance is a term that carries weight in economic circles, especially when dissecting the tug-of-war between government fiscal policies and the sway they hold over monetary policy decisions. At its core, fiscal dominance arises when a government’s fiscal agenda—its borrowing and spending habits—begins to steer the course of monetary policy. This often pushes central banks to prioritize the government’s financial needs over their traditional goals, such as controlling inflation and managing the money supply.

Imagine it like a household that consistently spends more than it earns, forcing it to borrow continuously just to keep up. Picture a piggy bank that’s supposed to be for saving, but instead, it’s raided frequently, with the family constantly seeking loans from friends to buy more and more toys.

In the context of a country, when the government outspends its income from taxes, it mirrors that overextended household. The government must keep borrowing to cover its expenditures. When this becomes a pattern, those who manage the nation’s money—like the central bank—might feel compelled to step in, making borrowing easier for the government, even when it’s not the wisest long-term strategy. This is fiscal dominance at play: the government’s insatiable need for funds begins to dominate and dictate the country’s monetary policy decisions.

To grasp this fully, it’s crucial to distinguish between fiscal and monetary policy. Monetary policy is the domain of the central bank—in the U.S., this means the Federal Reserve—focused on managing the nation’s money supply and interest rates. This includes actions like adjusting interest rates and altering the size of the central bank’s balance sheet.

Fiscal policy, on the other hand, falls squarely under the government’s control, dealing with tax collection, public spending, and issuing government debt.

Ideally, these two policy areas operate independently, but when fiscal dominance takes hold, the balance shifts. The government’s fiscal needs—whether from excessive spending, tax choices, or heavy borrowing overshadow the central bank’s efforts to stabilize the economy. This leads to conflicts that strain overall economic health, as fiscal dominance tips the scales, allowing government fiscal policy to overshadow and heavily influence monetary policy, often at the expense of broader economic goals.

What is of greatest concern to investors and traders who are trying to preserve their wealth is that when fiscal dominance occurs the Central Bank and the government who were originally created to be a check and balance on one another, will work together to prioritize the governments short term needs. In other words, there is no counterbalance to excessive government spending which historically ushers in an era of excessive currency debasement to meet the governments funding needs.

To determine whether we’re living under fiscal or monetary dominance, we need to ask: Is the central bank’s top priority keeping inflation in check, or is it more concerned with enabling government spending?

When fiscal dominance takes the lead, we often see inflation spiral out of control—and in extreme cases, even tip into hyperinflation, where prices soar at an alarming rate.

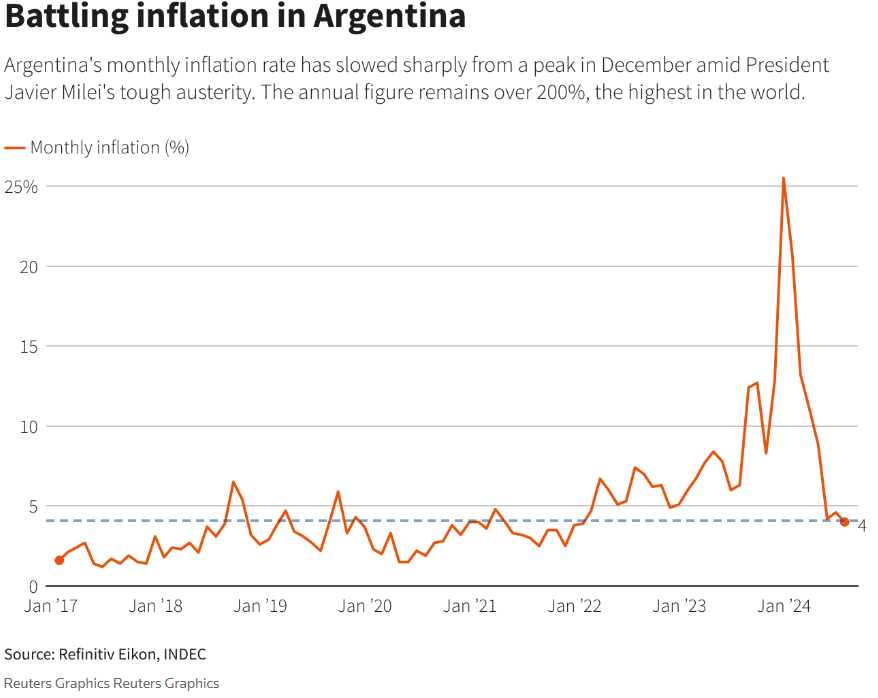

Argentina is the epitome of fiscal dominance. To cover its fiscal deficits, the Argentine treasury churns out bonds, which the central bank snaps up. This debt monetization has unleashed crippling inflation, with the 12-month rate skyrocketing to a staggering 276 percent in February. As of August 2024, Argentina’s inflation rate is still sky-high, hovering around 263% annually. This staggering number underscores the persistent economic woes, fueled by currency devaluation and fiscal deficits that the central bank keeps financing. While inflation has eased slightly from its peak earlier this year, it remains a serious problem, driven by ongoing debt monetization and deep-rooted macroeconomic imbalances.

Japan is often brought up in discussions about fiscal dominance, but its situation is a far cry from that of countries like Argentina. Fiscal dominance typically means that a country’s fiscal policy is calling the shots, with central banks financing government deficits, usually leading to runaway inflation. While Japan has indeed embarked on massive fiscal stimulus, pushing its public debt-to-GDP ratio to over 260%, it hasn’t faced the high inflation usually associated with fiscal dominance.

Japan’s case stands apart for several reasons. The Bank of Japan (BoJ) has kept interest rates low and rolled out large-scale quantitative easing to counter deflationary pressures and sluggish economic growth. Despite the towering government debt, Japan’s inflation has stayed in check, thanks to strong domestic savings, high demand for government bonds from local investors, and structural factors like a shrinking population and low productivity growth.

So, while Japan’s fiscal and monetary policies are deeply intertwined, it doesn’t fully fit the mold of fiscal dominance where inflation spirals out of control due to central bank financing of government deficits.

The reason the international financial markets suffered a severe shock two weeks ago is primarily because Japan had raised interest rates to combat a currency that was quickly losing its value. The threat of fiscal dominance looms large in Japan, and everyone is aware of it because the debt to GDP ratio is Japan is 255% and 43% of the debt is owned by the Bank of Japan.

For traders and investors, grasping the concept of fiscal dominance is not just important—it’s essential. In today’s interconnected world, smart traders and investors are acutely aware of the risks that fiscal dominance poses on a global scale.

When one country’s economy stumbles, it can set off a chain reaction that ripples across the world. Fiscal dominance plays a direct role in shaping investment landscapes by influencing interest rates, currency values, and overall market stability. Take, for example, a heavily indebted government; it may lean on its central bank to keep interest rates low to ease its borrowing costs. While this might offer short-term relief, it often comes at the cost of higher inflation and eroded currency value, which can send shockwaves through every market sector—from bonds and stocks to commodities like gold.

Fiscal dominance represents the troubling scenario where government fiscal policy overshadows and takes control of monetary policy. In other words, when a government’s spending, taxing, and borrowing decisions become so overwhelming that they dictate the actions of the central bank, we’re looking at fiscal dominance in action. The dangers here are clear: it distorts economic decision-making, often leading to prolonged inflation and the misallocation of resources. Ultimately, fiscal dominance is a symptom of fiscal irresponsibility, where short-term political desires compromise long-term economic stability and health.

Fiscal dominance kicks in when a government’s need to finance its deficit or manage its debt starts driving the country’s monetary policy, often sidelining critical objectives like controlling inflation or managing employment. In such scenarios, the central bank might be pushed to keep interest rates low or to buy up government debt, even when these moves aren’t in the economy’s best interest. This creates a dangerous loop where monetary policy continually bends to fiscal pressures, eventually stoking inflation or leading to financial instability.

One of the most striking examples of fiscal dominance occurred in post-World War II Hungary. To cover war expenses and reparations, the Hungarian government resorted to printing money at an unprecedented pace, triggering hyperinflation. The central bank, dominated by the government’s fiscal demands, was powerless to control the inflation that skyrocketed to unimaginable levels, devastating the Hungarian economy and the standard of living for its people.

A similar story played out in Zimbabwe in the early 2000s. Under President Robert Mugabe, the government embarked on land reforms financed by printing money. This reckless fiscal policy overwhelmed any efforts by the central bank to manage money supply or inflation, leading to one of the worst cases of hyperinflation in history, where prices doubled every 24 hours, and the national currency became worthless.

More recently, Brazil in the last decade has shown signs of fiscal dominance. Following the global financial crisis, the government ramped up spending to gain popularity and stimulate economic growth. This led to a significant budget deficit, and the central bank was forced to maintain a loose monetary policy to help finance the government’s debt, contributing to inflation and eroding confidence in Brazil’s economic management.

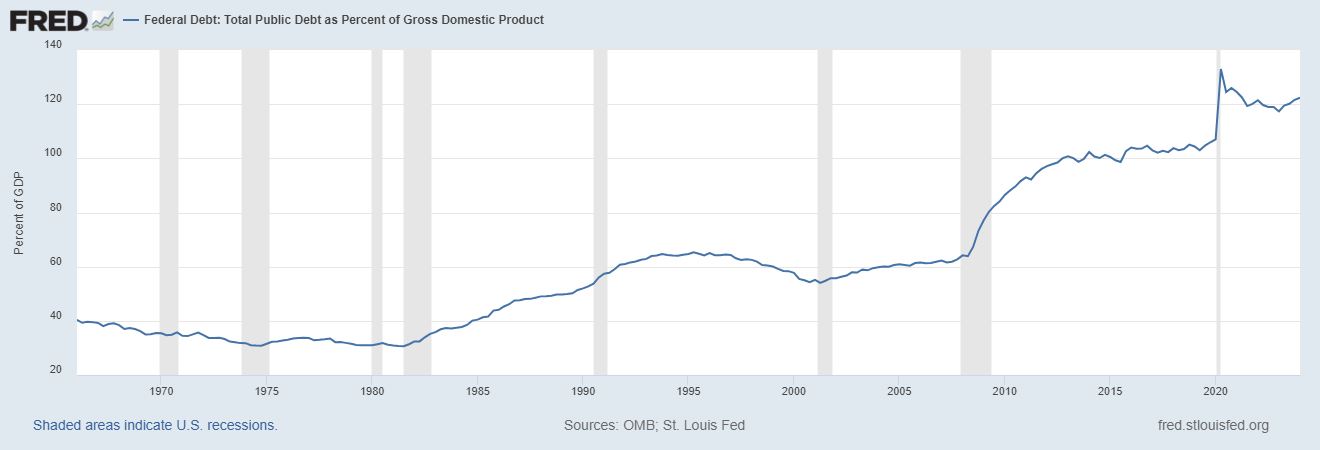

Fiscal dominance has a well-documented history of sparking severe inflation and driving economies into decline. With U.S. deficits reaching crisis levels, fueled by soaring entitlement spending, and the federal debt-to-GDP ratio surpassing its record high of 123%, the risk of fiscal dominance in the United States is growing. I believe we entered fiscal dominance before COVID-19, but many respected economists would strongly disagree with my assertion.

An escalating and unsustainable debt burden, coupled with high interest rates and a political climate resistant to cutting entitlement spending, is creating a perilous fiscal environment that will deplete U.S. fiscal space over the next 15–20 years.

These examples serve as powerful reminders that while fiscal dominance might offer short-term relief for government finances, it often sets the stage for long-term economic pain—manifesting in inflation, loss of central bank credibility, and diminished investor confidence.

Fiscal dominance can dramatically reshape bond markets, particularly when it comes to government bond yields. When a central bank falls under the sway of fiscal dominance, it might lower interest rates or buy up government bonds to help the government manage its debt. These actions generally push bond yields down, as increased demand drives up bond prices. While lower yields may reduce the government’s borrowing costs, they spell significant risks for bond investors. The primary concern is inflation, which can erode the real returns on bonds. Moreover, if investors start to see the central bank’s actions as unsustainable, confidence could crumble, sparking a bond market sell-off, with yields spiking abruptly and causing capital losses for bondholders.

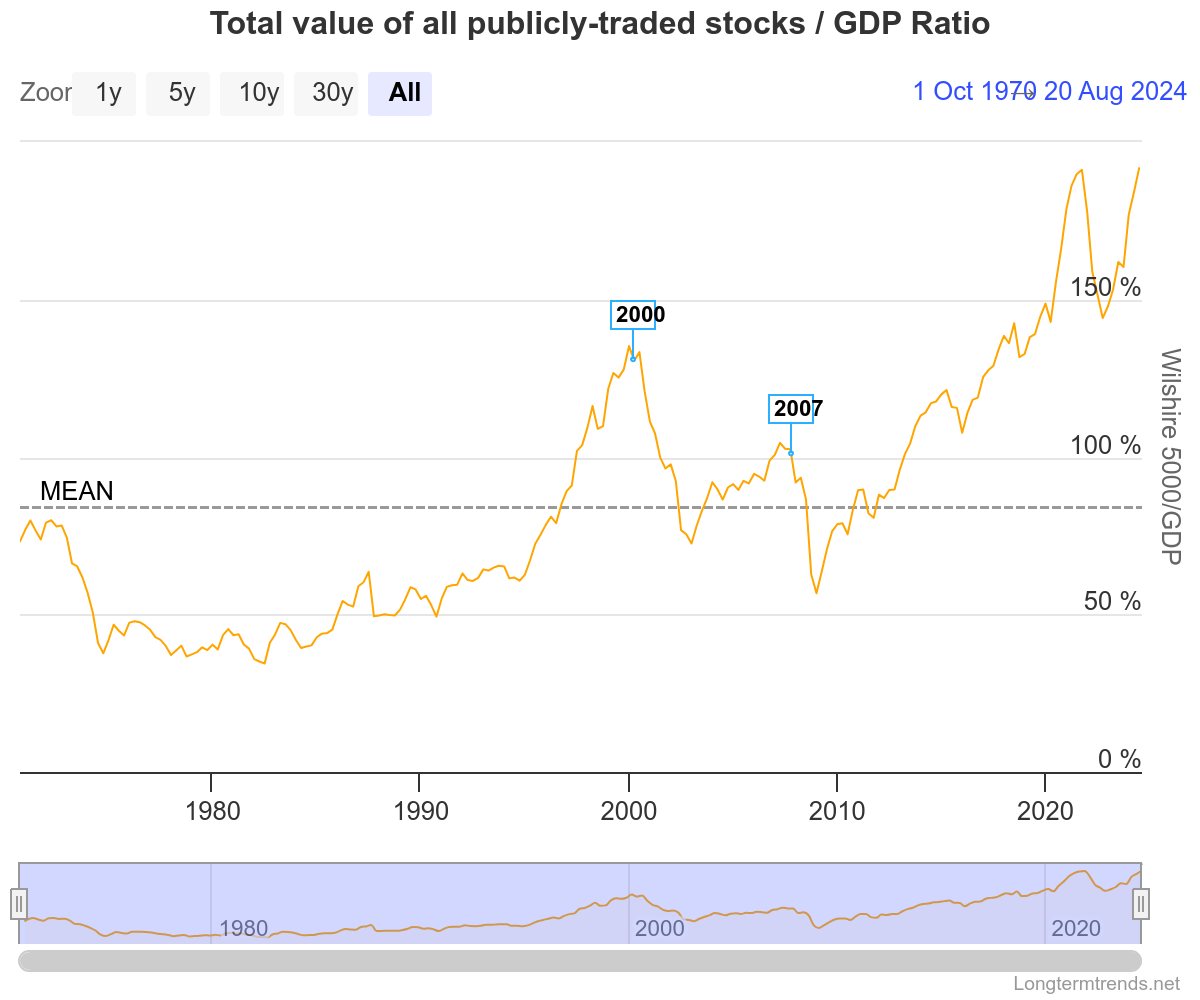

In the stock markets, fiscal dominance often breeds increased volatility and can have a profound impact on stock prices. Initially, lower interest rates and ample liquidity can boost stock prices, as companies enjoy cheaper borrowing costs and investors chase higher returns in riskier assets. However, this can also lead to inflated stock valuations disconnected from underlying fundamentals, creating potential bubbles. The effects vary by sector—financials might struggle with narrower interest margins, while industrials could thrive on increased government infrastructure spending. On the flip side, persistent high inflation or a crisis of confidence in fiscal policy could trigger sharp market corrections, sending stock prices tumbling rapidly.

This is particularly noteworthy currently, as the Fed appears to be the primary buyer of US Treasuries . There is huge demand for Treasuries up to 3 years in duration. But literally no one is buying longer term duration Treasury notes or bonds. This means that the entirety of the US government debt will be refinanced at the short end of the yield curve. Not exactly a healthy recipe for a vibrant economy.

The Treasury market has had a horrible performance over the last 3 years. When the Fed is forced to purchase

The government’s funding it is a strong warning sign that currency debasement is all but guaranteed moving forward. Treasuries have been the worst performing asset class for the last 3 years and have only begun to reinstall confidence amongst investors in the last few months.

No amount of balance sheet manipulation will allow the U.S. to print money indefinitely without facing serious consequences. If history has taught us anything, it’s that debt doesn’t matter—until it does. You can only “kick the can” down the road for so long before no one wants your “can” anymore. One of the clear warning signs of fiscal dominance is the presence of massive financial bubbles in stocks, commodities, crypto, real estate, and beyond.

Smart traders need to ask themselves: Are these markets rising due to strong economic fundamentals, or is the currency simply losing value? In a fiscal dominance scenario, the answer is clear—it’s because the currency is becoming worth less and less.

The perception of Treasury securities as safe assets is the bedrock of our entire financial system. U.S. policymakers must tread carefully and avoid worsening the current era of fiscal dominance that would destabilize and undermine the global standing of the U.S. dollar.

Fiscal dominance doesn’t just shake up traditional markets; it also ripples through commodities and alternative investments like gold and cryptocurrencies. Gold, a classic hedge against inflation and currency devaluation, often sees its value rise when expansive fiscal policies erode currency strength. Similarly, cryptocurrencies like Bitcoin, which operate outside traditional fiscal and monetary systems, can attract more interest as investors look for ways to hedge against inflation and diversify away from vulnerable fiat currencies.

In short, fiscal dominance creates complex dynamics across financial markets, impacting everything from bond yields and stock prices to the valuation of commodities and alternative investments. Each asset class responds differently to the pressures of fiscal dominance, underscoring the wide-reaching influence of government and central bank policies. Investors need to be mindful of these factors when building and adjusting their portfolios, especially in environments where fiscal and monetary policies are deeply intertwined.

Key Economic Indicators to Watch

Identifying signs of fiscal dominance requires a sharp eye on key economic indicators that reveal when a government’s fiscal policy starts to overshadow its monetary policy. The first and foremost indicator is the **debt-to-GDP ratio**—this figure shows just how much government debt is weighing against a country’s economic output. When this ratio is high or climbing fast, it’s a clear red flag. It signals that the government might be leaning too heavily on borrowing and could soon be pressuring the central bank to finance this debt, rather than pursuing responsible fiscal policies.

Another critical warning sign is the size of fiscal deficits. A fiscal deficit happens when a government spends more than it brings in, not counting borrowed money. When these deficits become chronic and large, the government could find itself overly dependent on debt. This can push the central bank into a corner, forcing it to keep interest rates artificially low or buy up government bonds to make borrowing easier. Keeping an eye on these indicators is crucial for understanding just how much strain fiscal policies are placing on the economy and whether we’re headed toward fiscal dominance.

When it comes to spotting fiscal dominance on the horizon, government policy decisions are a flashing red light you can’t afford to ignore. One of the biggest warning signs. Changes in the central bank’s mandate or any moves that chip away at its independence. If you see a government pushing through laws that force the central bank to focus on financing government deficits or managing debt, you’re looking at a classic case of fiscal dominance in the making. This could mean the central bank starts directly financing government debt or keeping interest rates artificially low, even when inflation is roaring—clear signs that the government’s priorities are taking over.

Another major clue is the rollout of **unconventional monetary policies** like quantitative easing , especially when it doesn’t line up with where the economy is. For example, if you see extensive quantitative easing during times of economic growth and low unemployment, it’s a strong signal that the real goal isn’t stabilizing prices or boosting employment—it’s about easing the government’s debt burden.

Traders and investors need to keep a close watch on these economic indicators and government policy shifts. Being vigilant helps you stay ahead of the curve, making smart moves in the market to protect your portfolio from the heightened risks that come with fiscal dominance. In a world where fiscal and monetary policies are tightly interwoven, this kind of awareness is key to navigating the financial landscape successfully.

Certain asset classes tend to perform better in a fiscal dominance environment, particularly those seen as safe havens or those less tied to the economic health of a single country. Gold and other precious metals often appreciate during times of fiscal uncertainty and can serve as a hedge against inflation and currency devaluation. Real estate may also provide a buffer if chosen wisely, particularly in markets that are not directly impacted by local fiscal issues. Additionally, equities in sectors less dependent on economic cycles, such as healthcare or utilities, can offer stability. Investing in high-quality corporate bonds or stocks in multinational companies that generate revenue outside of the affected economies can also be a prudent strategy.

When the Bee Gees sang “How Can You Mend a Broken Heart” in 1971 during the Nixon shock they certainly were not singing about economic freedom. However, now with 53 years of data in the rear-view mirror, we clearly see the disaster that ushering in an age of fiat currencies has meant for economic freedom. The ability to safely save your money with little to zero risk is at the very heart of economic freedom. This concept is synonymous with the idea that individuals should have the power to preserve their wealth and maintain their purchasing power over time. When people can save their money without fear of it losing value due to inflation or other economic forces, they are truly free to make financial decisions that align with their personal goals and aspirations.

Maintaining purchasing power is a primary indicator of economic vibrancy because it reflects a stable and healthy economy where the value of money remains consistent. In such an environment, people can plan, invest in opportunities, and support their families without the looming threat of eroded savings. This stability fosters confidence, encourages spending and investment, and ultimately drives economic growth.

When the risk of losing purchasing power is minimized, individuals can focus on building wealth rather than merely protecting it. This empowerment is what economic freedom is all about—having the security to make choices, take risks, and seize opportunities without the constant worry of financial instability. In essence, the ability to safely save and preserve wealth is not just a financial privilege; it’s a cornerstone of a vibrant and free economy.

In the world of fiat currencies, we all become obsessed with trying to figure out how to preserve our purchasing power.It is no easy task.

I watch markets 24/7 and I can assure you the only way I can truly understand what is going on in the world is through the use of artificial intelligence trading software.

Here’s my take on navigating today’s trading landscape: dive deep into cutting-edge analysis of stocks, gold, and Bitcoin, using the power of artificial intelligence trading software to uncover the real opportunities.

In the fast-paced world of trading, your success boils down to three key factors: the size of your trades, how long you hold them, and most importantly, what you’re trading. The true skill of any top-tier trader lies in separating the wheat from the chaff—knowing the difference between what the market’s expected to do and what it’s doing and hitting that with pinpoint accuracy.

In trading, the only score that matters is how well you’ve predicted price movements. All the financial news, expert opinions, and market rumors? Just noise—background chatter to the main event.

While Wall Street fixates on every twist and turn in the news cycle, the savvy trader homes in on the insights A.I. brings to the table. These tools do more than just number crunching; they’re about reading the market’s true pulse, slicing through the noise, and focusing on what really drives market movements.

For traders, it’s all about knowing whether the market is going up, down, or sideways. Everything else? Just static. Navigating this terrain requires more than just gut instinct; it demands the sophisticated edge that artificial intelligence trading software offers. It’s not merely a tool; it’s your guiding light in the murky waters of market trends, sharpening your trading edge.

Let me show you how important this is. Study the charts below:

Gold, which used to be money is outperforming the S&P 500 which represents the 500 best run and managed companies in the market.

This is not a minor detail.

Number go UP because currency goes down.

Currency goes down because government uses money printer to devalue currency.

So, for those eager to believe the economy is on the mend and the stock market is flashing the all-clear, a word of caution: buyer beware. With the market value of equities now pushing 200% of GDP, we’re once again staring down the barrel of a wall built on excessive valuations.

The Fed has been the architect of asset bubbles that have ballooned to colossal proportions over the past two decades. From 1980 to 2002, we enjoyed positive real interest rates—a natural, healthy state of affairs. But for 17 of the past 21 years, we’ve been stuck in a world of negative real interest rates. The Fed’s balance sheet has exploded by $5 trillion, and the M2 money supply has ballooned by over $6 trillion between 2020 and 2022.

This flood of easy money has driven leverage in the financial system to new heights.

Just look at the numbers: global debt has surged to $307 trillion—340% of global GDP—up by a staggering $100 trillion in the past decade alone.

NOW think about your market performance post-pandemic. Got that number? Now, factor in a cumulative inflation rate of around negative -14%. What you’re left with is the real measure of your trading prowess in these turbulent times.

The race to debase is real, and everyone feels it. The question is: what are you going to do about it?

Where traditional financial strategies falter in the face of market turmoil, our A.I.-driven system thrives. It’s precisely calibrated to react instantly to market shifts, making split-second decisions to capture profits and avoid losses. The days of sleepless nights, worrying about your financial future, are over. Our software is your steadfast ally, guiding you through the complexities of the financial world with unmatched confidence.

For those of you keeping a close eye on the economic landscape, it’s clear—our currency is under attack. A relentless wave of government money printing is steadily eroding its value, quietly siphoning away your purchasing power. This silent thief might operate in the shadows, but here’s the good news: you don’t have to stand by helplessly.

Imagine a future where economic fluctuations aren’t a cause for concern but a gateway to wealth.

This is the power of our artificial intelligence trading software : to consistently place you at the heart of market trends, at precisely the right moment. A.I. isn’t just aiming for this—it’s laser-focused, continuously charting the best course forward.

We dive into these themes in our complimentary trading classes, where we teach traders how to harness the power of artificial intelligence, machine learning, and neural networks.

I invite you to learn how to forecast the stock market at our Next Free Live Training.

It’s not magic.

It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.