I watched the Federal Reserve’s announcement yesterday of a 50-basis point rate cut and was dumbfounded by the language I was hearing Fed Chairman Powell use to describe the U.S. economy. As I listened very attentively to the narrative that was being created, I found myself questioning my most cherished economic perceptions. Let me share with you the concerns I have about what I heard and what my expectations are moving forward.

One of the things that I pride myself on is having a strong propaganda detector. This skill was developed over many years. Deception often hides not in what is said, but in what is deliberately left unsaid . To uncover the truth, one must examine the gaps, the implications, and the subtle omissions in a narrative. What is presented may only be a partial reality, while the key details are hidden in the shadows of what’s implied. In seeking clarity, it is essential to question the silence as much as the spoken words.

Yesterday, Fed Chair Powell opened the press conference with this statement:

“Our economy is strong overall and has made significant progress toward our goals over the past two years.” (emphasis mine)

Right out of the gate, I’m scratching my head and asking the most basic of all questions.

How do you define strong?

Since when does the Fed cut interest rates in a strong economy?

Traditional economic thinking teaches that the Central Bank lowers interest rates when the economy is weak.

So, what’s really going on?

First off, it’s an election year and while the Fed is not supposed to be a political creature it most certainly is. It would be considered the highest political crime to have a monetary authority claim that the economy is weak, 7 weeks before a Presidential election.

One of the things I’ve noticed in the buildup to yesterday’s meeting is that in the past, particularly since the Great Financial Crisis, a cut in interest rates was referred to as Quantitative Easing. Over the past few months QE has been nowhere to be found in the Fed’s vocabulary.

Quantitative Easing (QE) is a monetary policy tool used by central banks to inject money into the economy by purchasing large amounts of government bonds and other financial assets. This increases the money supply, lowers interest rates on longer-term securities, and encourages lending and investment to stimulate economic growth. Essentially, QE expands the central bank’s balance sheet to provide liquidity and boost demand.

Cutting Interest Rates is another monetary policy tool where the central bank reduces the benchmark interest rate, typically the federal funds rate in the U.S. This makes borrowing cheaper for consumers and businesses, leading to increased spending and investment. Lower interest rates also reduce the cost of servicing existing debt, freeing up more cash flow for other economic activities.

Both QE and interest rate cuts are designed to stimulate economic growth by making money more accessible and encouraging borrowing, lending, and investment.

Both actions are typically implemented when the economy is weak, to combat slow growth, high unemployment, or deflationary pressures.

In these situations, the Federal Reserve aims to boost economic activity by making money cheaper to borrow, increasing liquidity, and encouraging investment. During a strong economy, the Fed would not cut interest rates because doing so would lead to inflation, excessive risk-taking, and financial bubbles.

In a thriving economy, the Fed typically raises interest rates to cool down inflation and prevent overheating. In a weak economy, the Fed is doing QE and cutting interest rates.

My read of the markets is that the Fed has been engaged in QE in the Treasury market for the last 5 months. They have been buying all the bonds to fund the US Treasury. Yields on the 10-year Treasury Note have dropped 118 basis points since mid-April and are currently trading at around 3.67%. So long before yesterday’s press conference it was very clear that the Fed was engaged in lowering interest rates through QE in the Treasury market. The issue appears to be that the Fed is doing QE but we are not calling it QE any longer. That is such a Great Financial Crisis term.

The relevance here is Treasuries have been the worst performing investment class over the last 3 years.

Why? This pesky little thing called inflation. It makes no sense to invest in an instrument that yields 4% when inflation was at 9%.

But there is another larger problem at play. I call it de-dollarization. U.S. Treasuries were once regarded as the safest investment, often called the “gold standard” for savings due to their reliability and stability. However, growing concerns over U.S. debt levels, inflation, and excessive money printing have led to increased skepticism about holding U.S. dollar-denominated interest-bearing assets. Despite the U.S. dollar’s status as the world’s reserve currency, many investors are wary of its long-term purchasing power and stability, raising questions about future risks in the global financial system.

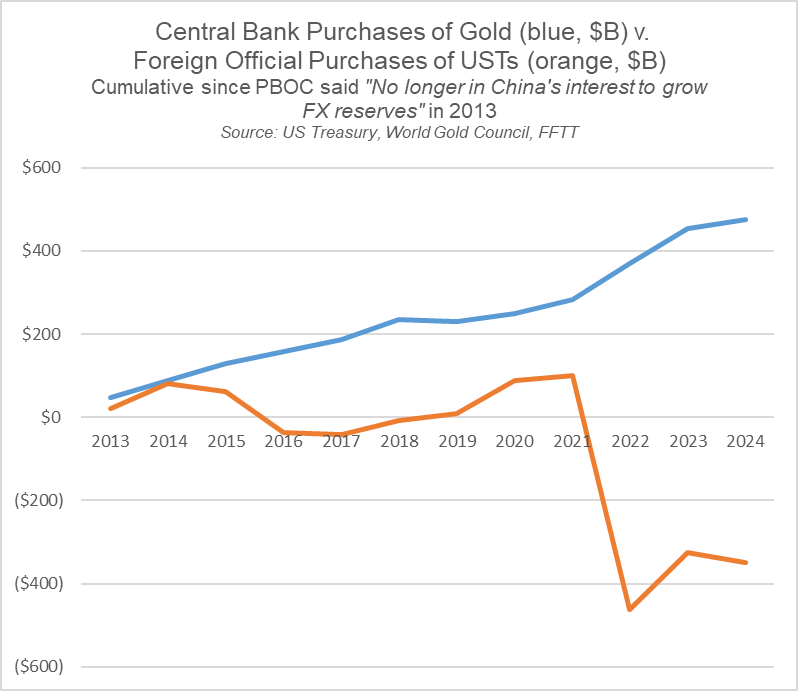

Look at the following chart which shows you a comparison of Central Banks investing in Gold versus the U.S. Treasury market.

When Central Bankers are buying gold hand over fist, and avoiding U.S. Treasuries, it takes incredible theatrical skills to open a Fed conference and claim that the economy is “STRONG.”

Even your own peers in the Central Banking community are hedging themselves against anticipated currency debasement.

I’ve written at great length about the importance of being an independent thinker if you are going to be a successful trader. On Wall Street narratives are written regularly which defy common sense and the most basic of logic. Often these narratives serve powerful interests.

One of the most toxic spins which has ever been popularized is that we need a weak currency to make our country strong. The notion that a weak currency strengthens a country by making its goods and services more affordable to foreign buyers is a dangerous and misleading economic idea. Proponents of this theme argue that by devaluing the currency, a nation can boost exports and stimulate growth. While it’s true that a weaker currency can temporarily make exports cheaper, it also erodes purchasing power domestically, increasing the cost of imports and leading to inflationary pressures. Moreover, this short-term boost can harm long-term economic stability as it weakens the currency’s value and investor confidence, creating greater volatility and uncertainty for the economy.

From a personal financial perspective, would anyone want to store their life savings in a currency that consistently loses value? If so, I would invite you to explore the recent fate of countries like Argentina, Venezuela, Turkey, and Lebanon who were all advocates of a weaker currency and lower interest rates. Each of their economies imploded under the weight of excessive debt due to this policy.

Here is a chart of the Argentinian Peso versus the U.S. Dollar over the long term.

I look at the chart above and always remind myself of the importance of saving in something that is truly strong and resilient.

A weak currency diminishes the value of savings, leading to reduced purchasing power and making it more challenging to build wealth over time. Imagine saving diligently only to find that inflation and currency depreciation have eroded your nest egg. This reality makes the idea of a weak currency as a long-term economic strategy not only unsustainable but also risky for both the individual and the broader economy.

Did you watch the Presidential Debate last week. Both Trump and Harris are huge proponents of a weaker U.S. dollar and low interest rates.

How is this a good thing?

Imagine the CEO of a major company trying to tell you that what is better for the company is a lower stock price because it will make the company stronger. What do you think would happen to that CEO? Would you invest in that company? I would fire them in a second. Yet somehow, we allow this same narrative to filter into our discussions on the value of the U.S. dollar.

Those Federal Reserve notes you have in your wallet and bank account are no different than stock certificates. Anybody who tells you that making them worthless is a good thing is either completely ignorant of basic economics or a fraudster.

I know it sounds harsh. But in an election season this is the nonsense we are hearing from both sides of the aisle.

A strong currency is typically characterized by high demand, higher interest rates, and a limited supply, which enhances its purchasing power on the global stage. Countries with strong currencies tend to have stable economies, robust financial policies, and attract foreign investment due to the appealing interest rate returns. Additionally, a limited or controlled supply of the currency helps prevent inflation, further boosting confidence in its value. Conversely, a weak currency is defined by abundant, often unchecked supply, low interest rates, and a lack of demand. When a central bank prints excessive amounts of money or keeps interest rates too low, it diminishes the currency’s value, leading to inflation and a loss of purchasing power. Weak currencies are often associated with unstable economies, making them less attractive to investors and prone to further devaluation.

Simple question. What is preventing the United States from having a strong currency and high interest rates?

Simple answer. It would bankrupt the Federal government.

The government can’t afford the current interest on the debt, so they only have one choice – devalue the currency by printing more of it.

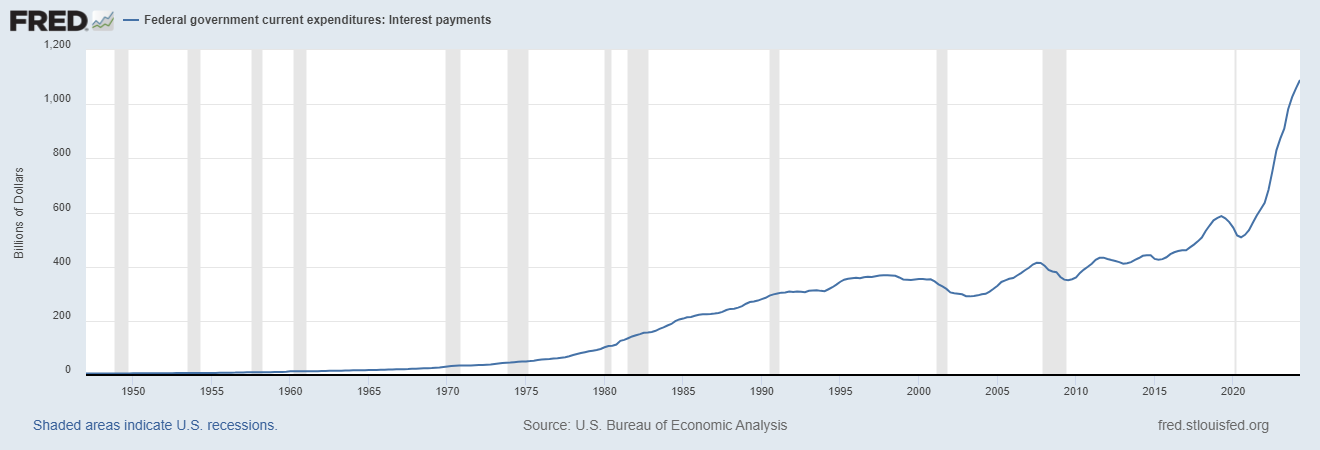

Look at the chart below of Interest payments on the U.S. debt, it has increased 111% since 2020. Interest on the debt has increased by over 3000% since President Nixon shut the Gold window on August 15, 1971.

Yes, interest payments on the U.S. national debt have indeed become the second-largest expenditure in the federal budget for fiscal year 2024.

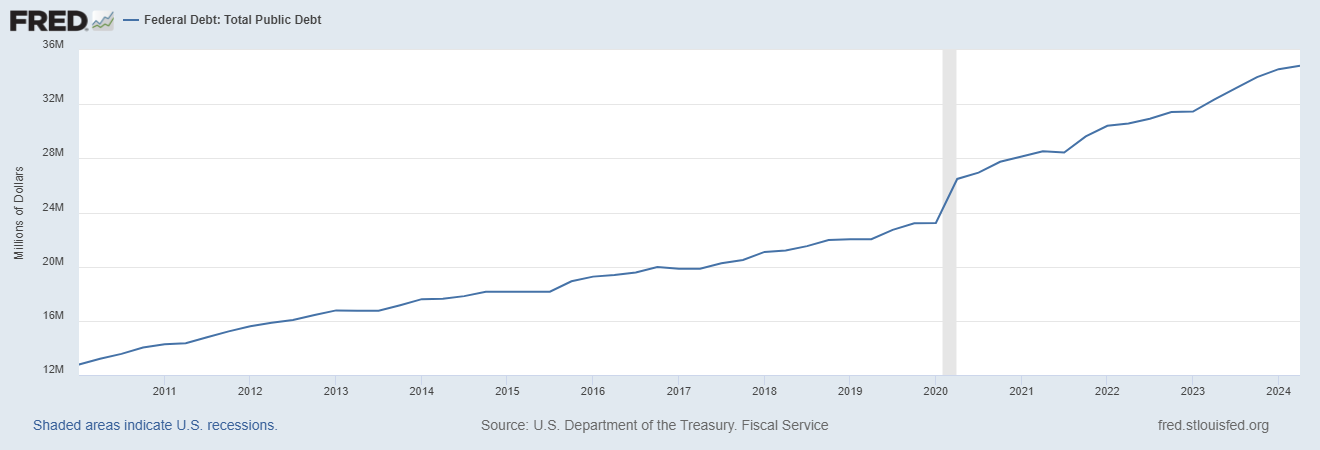

This dramatic increase in interest payments reflects the impact of rising interest rates and a ballooning debt load, which now stands at over $35 trillion. As interest rates continue to climb, the cost of servicing the debt becomes an increasingly larger burden on the federal budget.

The situation poses significant risks for the U.S. economy, as rising interest costs not only strain the federal budget but also limit the government’s fiscal flexibility. Without action to control the deficit and reduce borrowing, interest payments will continue to grow, making it harder to fund essential services and investments in the future.

If you think about that dilemma for only a little while you will quickly come to understand that your best interests and the government’s best interests are two totally different things.

For the government to survive they need a weaker currency. It’s impossible to align your personal financial interests with a weaker currency if you want to be successful.

When I study economics, I’m convinced authorities make it complex purposefully so that they can create all kinds of shenanigans. Currency debasement is the favorite flavor of monetary authorities.

Understanding currency devaluation in a fiat currency world presents unique challenges because the value of money is no longer tied to a tangible asset like gold. Instead, it is backed by the trust in governments and central banks. This creates a more abstract concept of value, one that fluctuates based on monetary policy, interest rates, and geopolitical events. In a fiat system, where governments can print money without a direct consequence tied to a fixed asset, devaluation can happen slowly and almost imperceptibly. This makes it difficult for individuals and even professionals to notice that their currency is losing value until they experience inflationary pressure on the prices of everyday goods and services.

The difficulty is compounded when major central banks around the world engage in coordinated debasement, often through policies like quantitative easing or lowering interest rates in tandem. With floating exchange rates, currencies are constantly adjusting against each other, so devaluation against one currency may be offset by simultaneous devaluation in others. This creates a misleading sense of stability because, relative to each other, currencies might seem stable. However, in real terms, they are all losing value against tangible assets like commodities or real estate. When all central banks participate in currency debasement, it becomes more challenging to discern which currency is weakening the most, as the debasement appears synchronized across the board.

The only concrete way to observe this gradual devaluation is by noticing how much less your currency can purchase in terms of real goods and services. This is where the effects of inflation become personal and undeniable. Whether it’s higher grocery prices, increased rent, or more expensive healthcare, the real cost of living exposes the declining purchasing power of the currency. While central banks may obscure this through complex monetary policies and technical jargon, the shrinking value of currency becomes most evident when individuals find their wages don’t stretch as far as they used to, revealing the slow-motion devaluation that is otherwise hidden by a floating exchange rate system.

I have studied and learned quite a bit from the implosions of other fiat currencies. One of the most shocking things I’ve learned is that when a currency is being debased, the value of goods and services priced in that currency rise in response to the debasement.

To comprehend what this means for financial markets one of the best-case studies is simply looking at the Argentinian Peso and the Argentinian Stock market the Merval Index.

Argentina’s economic story has long been one of high inflation, repeated debt crises, and a reliance on peso devaluation to boost exports and stimulate domestic demand. Governments, in their effort to maintain competitiveness, continuously slashed interest rates, hoping to spark growth. But here’s the problem: devaluing a currency without addressing deeper structural issues only leads to cycles of inflation, currency collapse, and, ultimately, widespread poverty. By 2023, the peso’s value had been gutted, leaving the economy in turmoil, as inflation spiraled out of control. The result? An economy trapped in a vicious cycle of eroding confidence and diminishing returns on any effort to stabilize.

Look closer at the Argentine stock market, and you’ll see the illusion at play. The MERVAL Index—Argentina’s benchmark for publicly traded companies—soared more than 80% in nominal terms during periods of financial distress, including 2018. But while these numbers appeared promising on paper, the peso itself was in freefall, losing over 50% of its value. For investors measuring wealth in a depreciating currency, the seeming gains were little more than a mirage. Inflation masked the underlying instability, making nominal gains in the stock market utterly meaningless as the currency’s value collapsed, wiping out any real wealth.

In local currency, in percentage terms the value of the MERVAL Index is up several thousand percent! But when compared to a stronger currency it is a complete illusion and a disastrous loss. All smoke and mirrors because the leaders followed the road of debasing the currency and lowering interest rates.

For the average Argentinian, the pain was immediate and severe. Inflation outpaced wages, imports became unaffordable, and savings evaporated. The stock market’s superficial rally meant little to those whose daily expenses were skyrocketing. And for international investors, the truth was even clearer: while stock prices rose in peso terms, their value in stronger currencies like the U.S. dollar plummeted. Capital fled the country, seeking more stable environments. This dynamic exposes a critical truth in economics—no matter how high assets rise in a weak currency, true wealth evaporates along with the currency’s value, leaving behind an economic landscape of false gains and deep financial ruin.

I share this perspective with you, because I feel that the U.S. economy is following a similar path. However, in the U.S., since we are the reserve currency of the world, it will occur in slower motion.

The phrase “number go up” during a currency debasement cycle refers to the artificial inflation of asset prices as the purchasing power of a currency declines. This phenomenon is often seen as a favored strategy by economic authorities when inflation or excessive money printing takes hold. As the currency is devalued, the nominal prices of stocks, real estate, and other assets tend to rise, giving the appearance of wealth creation. However, this is largely an illusion. The “number go up” effect doesn’t reflect real gains but is instead a byproduct of a depreciating currency. Economic authorities may quietly rely on this during debasement cycles because rising asset prices can mask deeper issues like inflation and declining purchasing power, offering temporary relief and political stability. While asset holders might see nominal gains, the value of those gains erodes when measured against hard assets or real-world purchasing power, further compounding the long-term financial instability.

I am concerned about this because the U.S. dollar is currently making new 52-week lows. When the reserve currency of the world is weak and getting weaker, I can assure you what is taking place in financial markets around the world is “number go up, because currency value is going down.” Lower interest rates are ‘hopium’ and allow traders and investors to get excited by the prospects of exponential growth created by depreciating the currency.

All these concerns are leading me to increase my allocations to hard assets like Gold, Silver, and Bitcoin. This isn’t investment advice; I’m merely sharing my opinion and actions for education. Primarily my interest in these assets is because it is harder for the government to debase them. But in a declining interest rate environment hard assets shine.

But start thinking about measuring your wealth in ounces of Gold…

Or in ounces of Silver.

Or in Bitcoin owned.

Let me explain.

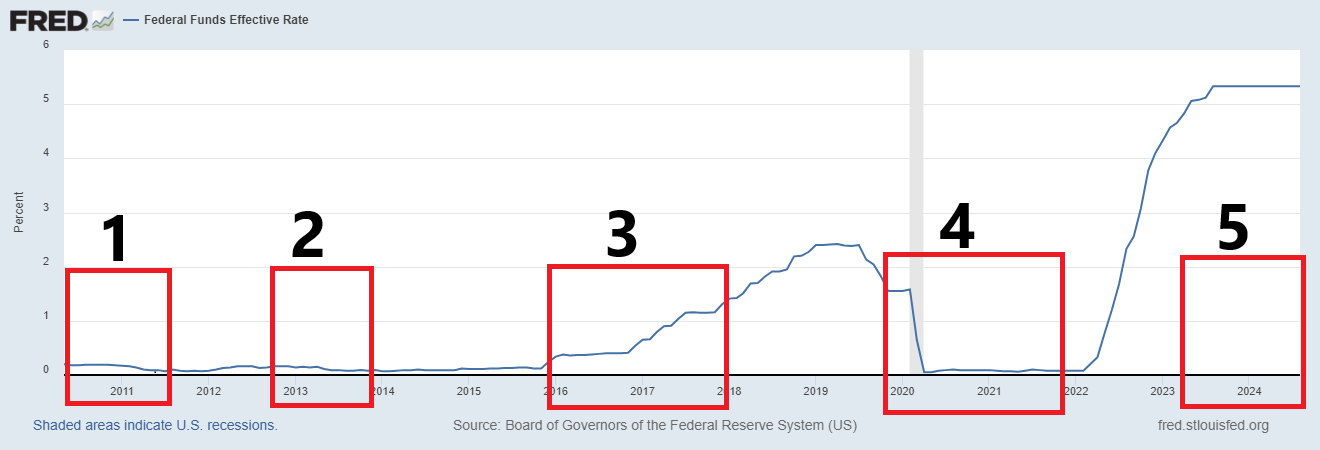

The chart below is the Fed Funds rate over the last 15 years. The red boxes are each bitcoin bull market. Notice how in 4 out of the 5 bull markets, interest rates were very much on the decline. Even the one time in box 3 when interest rates were rising, the increases were negligible and almost from the zero range.

Bitcoin has experienced several significant bull markets since its inception in 2009. Here’s a list of the major time frames when Bitcoin was in a sustained bull market:

1. 2010–2011 Bull Run:

– Time Frame: Mid-2010 to June 2011

– Price Movement: Bitcoin’s price surged from under $0.01 in 2010 to around $32 in June 2011, marking its first parabolic rise.

2. 2013 Bull Market:

– Time Frame: January 2013 to November 2013

– Price Movement: Bitcoin’s price jumped from about $13 in January 2013 to over $1,100 by November 2013.

3. 2016–2017 Bull Run:

– Time Frame: Early 2016 to December 2017

– Price Movement: Bitcoin rose from around $400 in January 2016 to an all-time high (at that time) of nearly $20,000 in December 2017.

4. 2020–2021 Bull Market:

– Time Frame: March 2020 to November 2021

– Price Movement: Bitcoin went from $3,800 in March 2020 to an all-time high of approximately $69,000 in November 2021.

5. 2023 Recovery and Bullish Sentiment:

– Time Frame: Early 2023 to present (speculative on future trajectory)

– Price Movement: Bitcoin recovered from the lows of $15,500 in late 2022 to highs of around $31,000 in 2023, fueled by optimism over potential regulatory clarity and ETF approvals.

Each bull market had distinct drivers, characterized by increased government spending, regulatory clarity, geopolitical instability, increasing inflationary pressures, lower purchasing power and growing fiat currency volatility. Not unlike the conditions we are experiencing today.

The recent interest rate cuts by the Federal Reserve are a clear signal that the underlying strength of the U.S. economy is faltering. When the Fed slashes rates, it’s often a move to stimulate growth during periods of economic weakness, not strength. The recent drop in the U.S. dollar to 52-week lows only reinforces this outlook, as a weakening dollar is typically a sign that confidence in the economy is declining. With inflation pressures still lingering and employment data showing signs of strain, the Fed’s actions confirm that it sees no other way out than to support a fragile economy through cheaper borrowing costs.

Do you think the government is going to cut government spending in this environment? Not a chance.

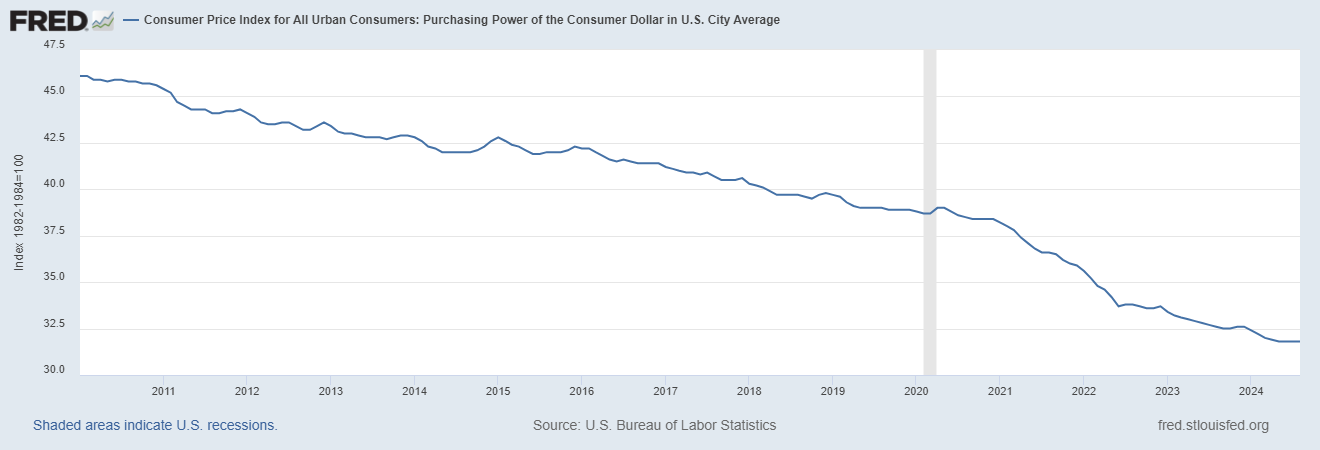

The real issue here is that this continuous lowering of rates signals debasement as far as the eye can see. Study the following chart from the Fed on the loss of purchasing power since the Great Financial Crisis.

It’s gruesome and lends itself to Fed Chair referring to a strong economy.

Fiat authorities are essentially inflating away the value of your money. Each cut erodes the purchasing power of the dollar, and without a strategic shift, it seems the solution to every economic hiccup will be more debasement. The worst thing you can do is be caught flat-footed in this environment.

Remember, this isn’t just policy—it’s your wealth at stake.

I anticipate that in the coming days, weeks and months you will hear the next act in the Fed playbook, they will tell you that a “soft landing” was engineered by Chair Powell.

Cue the music and dancing girls.

How much more proof do you need?

Alright, let’s cut through the fluff and get straight to what matters.

Listen, traders, this is why I always push you to leverage artificial intelligence in your trading. Why? Because it works, plain and simple. Before A.I. came along, we were all stuck in the mud—bogged down by outdated theories and rigid thinking. We tried to explain every move in the market with a “this causes that” mindset. That approach? Limiting. Small-minded. It’s like driving with the parking brake on.

If you really want to make money—real money—you need to get ahead of the herd. Find the trends, the *right* trends, and ride them for all they’re worth. And that’s where A.I. comes in. It’s a machine designed to sift through oceans of data, predict market moves, and drop you right where you need to be—on the right side of the right trend, at the exact right time.

Now, let’s talk about what’s looming on the horizon. Currency debasement. It’s not a question of “if,” but “when.” Fiat currencies are a ticking time bomb, folks. Gold? Silver? They’re solid. But the paper money in your wallet? That’s nothing more than a government IOU. And guess what? Central banks can print more of it whenever they want. What happens then? Inflation. Hyperinflation, if they really screw it up. And when that happens, your hard-earned cash turns into Monopoly money.

Remember Argentina a few years ago? Venezuela today? Those currencies became worthless. People lost everything. Savings? Poof. Investments? Gone. Economies collapsed under the weight of bad decisions and worthless paper. So, what’s your move? How do you protect yourself and stay ahead?

You embrace A.I. Let it be your guide in these uncertain times. It cuts through the noise, does the heavy lifting, and improves your decision-making tenfold.

Now, if you’re serious about leveling up your trading game, listen up. We’ve got an exclusive online A.I. trading masterclass coming up that’s going to flip your world upside down—in a good way. Imagine predicting market moves with surgical precision. Picture yourself riding the waves of the biggest trends with ease while the rest of the market plays catch-up. This system is the *real* deal. It’s not a gadget, it’s not a gimmick—it’s a game-changer.

Don’t miss this. The window’s open, but it won’t stay that way forever. Get yourself in our next live trading masterclass , and see how A.I. can transform your trading from ordinary to extraordinary.

Are you intrigued? You should be.

See you there.

Discover why professional traders turn to artificial intelligence for less risk, more rewards, and guaranteed peace of mind.

Visit with us and check out the A.I. at our Next Live Training Masterclass.

Let’s Be Careful Out There.

It’s Not Magic.

It’s Machine Learning.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.