Over a decade ago, Warren Buffett, the legendary investor with a no-nonsense approach to money, dropped a bombshell on CNBC. In an interview with Becky Quick back in 2011, Buffett, in his signature folksy yet razor-sharp style, suggested a bold and unconventional fix for America’s ballooning deficit. He proposed a simple but powerful legislative move—one that would light a fire under Congress and force them to take responsibility for managing the nation’s finances the way they should.

source: Wikipedia

“I can end the deficit in five minutes. Yeah, you just pass a law that says anytime there’s a deficit of more than three percent of GDP, all sitting members of Congress are ineligible for re-election. Now you’ve got the incentives in the right place, right? So, it’s capable of being done. And they’re trying to use the incentive now that we’re going to blow your brains out, America, in terms of your debt worthiness over time. And that’s being used as a threat. A more effective threat would be just to say, ‘If you guys can’t get it done, we’ll get some other guys to get it done.'”

As the conversation unfolded, Buffett broadened his critique, directing attention not only toward Washington but also toward corporate America. He issued a clear challenge to the business community, urging them to push for greater fiscal responsibility at the national level. Buffett underscored the critical importance of safeguarding the nation’s creditworthiness, drawing a compelling analogy between personal and national financial habits. Just as individuals face repercussions—such as damaged credit scores—from missed payments, Buffett warned that the consequences of fiscal mismanagement on a national scale could be catastrophic. A country, like an individual, cannot afford to gamble with its reputation in the global credit market.

Buffett’s statement, delivered with his usual mix of humor and straight talk, resonated deeply with many Americans. His message was clear: there’s an urgent need for fiscal responsibility and tying lawmakers’ incentives to the nation’s long-term financial health could be a game-changer. But even Buffett recognized the irony. The very people who would need to pass such a law are the ones who’d be putting their own careers on the line, creating a massive conflict of interest that’s tough to overcome.

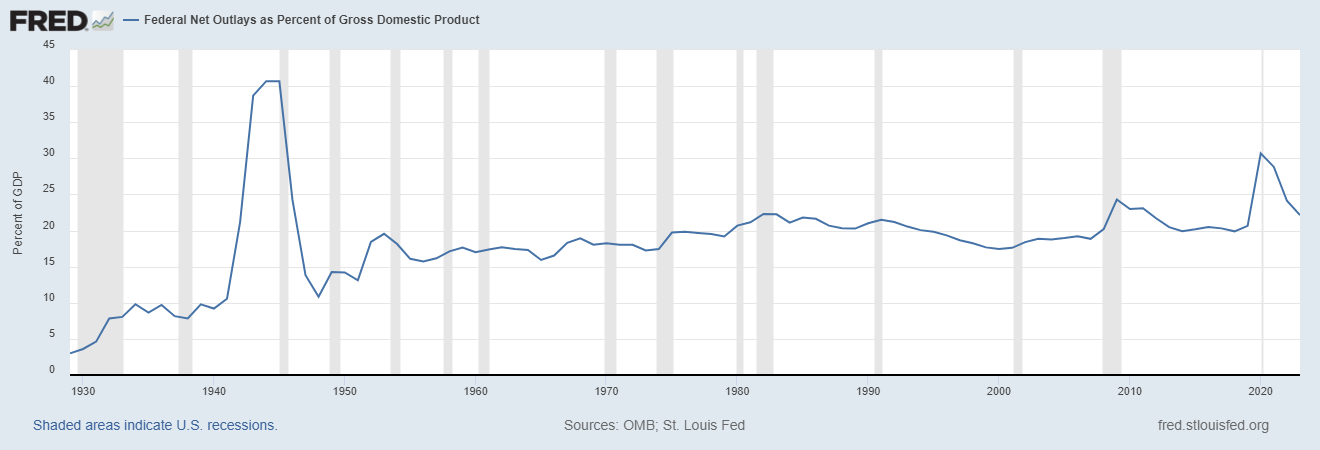

Here is a chart maintained by the St. Louis Fed which shows the level of historic government spending as a percentage of GDP. Observe how historically government spending has stayed between 14% to 40% of GDP.

What I love about Buffett’s idea is that for once it would create accountability from government.

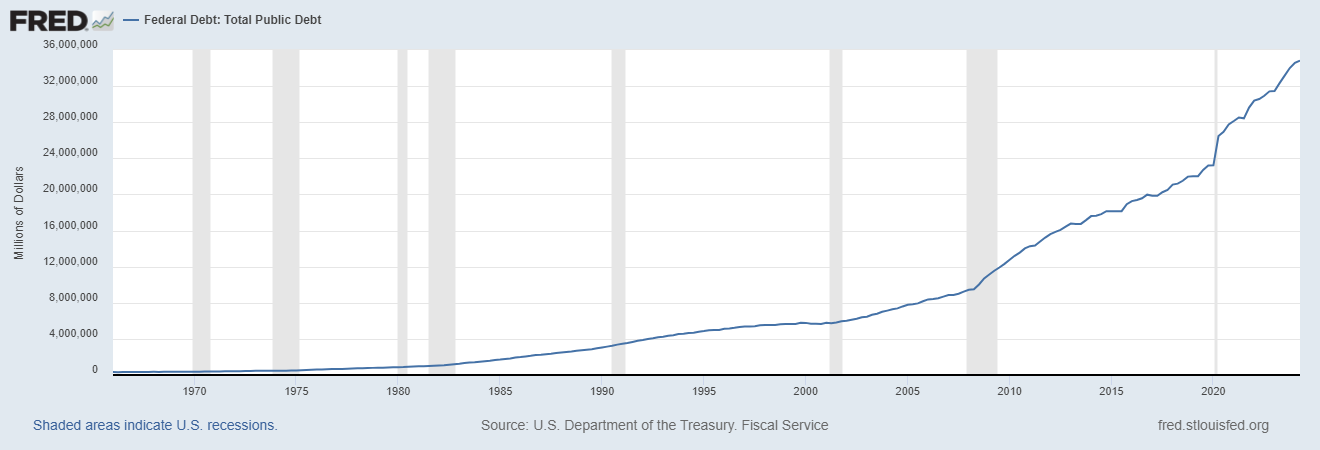

What is equally fascinating to me is that at the time Warren Buffet made those comments in 2011, our total government debt was considered to be threatening the solvency of the financial system when it stood at roughly $12 trillion.

source: fred.stlouisfed.org

One of the most important realizations I have ever had about finance and trading was that what is in the best interests of government finance is not usually in my best interest. It’s a real head scratcher!

Let me explain.

We’re constantly inundated with government reports that scrutinize every corner of the economy, tracking everything from employment rates to manufacturing output. Yet, when a problem arises, the response from policymakers is almost reflexive: throw more money at it. The implicit belief is that any issue—no matter how complex—can be fixed with enough financial firepower. This leads to a paradoxical approach where we

attempt to solve debt crises by incurring even more debt, despite a glaring lack of historical evidence this strategy works.

What’s even more troubling is the long-standing reliance on debt as a universal solution. The logic is simple: issue more debt today to pay for yesterday’s obligations. But this approach carries an inherent consequence that often goes unspoken. To sustain such a cycle, governments must eventually devalue the currency, making it easier to repay old debts with inflated dollars. This tactic, though hardly new, dates to ancient times when rulers would debase their currency to cover mounting liabilities. The playbook hasn’t changed—only the scale has.

For traders and investors, this dynamic is particularly concerning. We want a strong currency—one that reflects real demand and economic strength. High interest rates, in this context, are not the enemy but a sign of a healthy, vibrant economy. Yet, as the government piles on more debt, the inevitable result is a weaker currency, devalued in the pursuit of managing an ever-growing debt load. This fundamental clash between what the market wants and what the government needs to do to sustain its policies presents a significant challenge for anyone looking to preserve wealth in this environment.

Since I came to recognize that the government’s best financial interests are at odds with my financial interests it has changed my perspective dramatically on how I define opportunity and my understanding of financial reality.

Here’s where things stand.

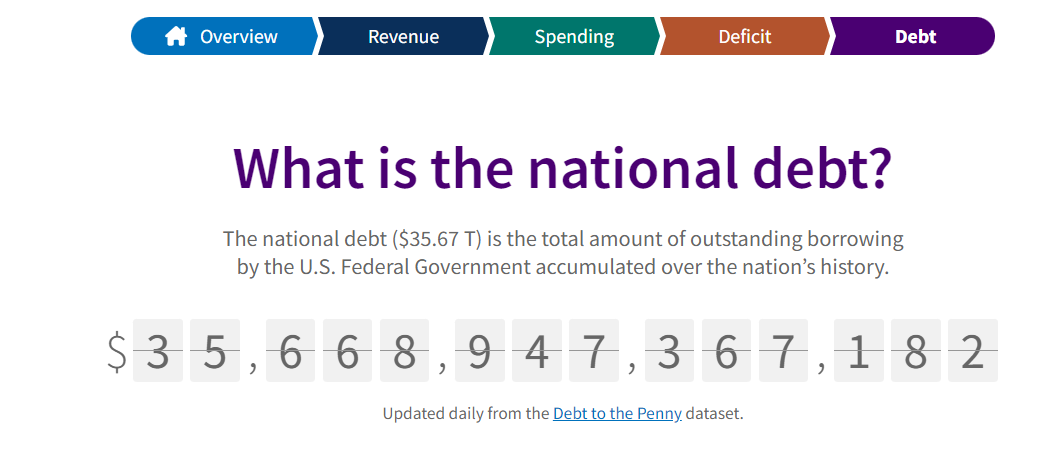

According to data from the U.S. Treasury, the federal government is now $35 trillion in debt. The interest payments on this massive debt load are, unsurprisingly, a growing concern. As the government continues to borrow more, those interest obligations only swell. And it’s not just a theoretical problem—these payments are made to a wide range of creditors, including foreign nations like Japan, China, and the U.K. But it doesn’t stop there. The debt is also held by the Federal Reserve, large financial institutions, pensions, corporations, wealthy families, and individual investors—anyone holding U.S. government bonds. The ripple effects of this debt reach far and wide, raising critical questions about sustainability and financial stewardship.

Well, let me tell you, this story starts with the U.S. government’s national debt crisis, and it’s like watching a snowball roll downhill—it’s only getting bigger, and faster. And believe me, it’s going to get worse. Not just worse, but exponentially worse. I wish I had a cheerier way to put it, but I’ve thought long and hard about this, and that’s the term I’m sticking with: exponentially. You don’t have to take my word for it, though—you can see for yourself. Here’s the chart straight from the Treasury’s website. Over the past 100 years, we’ve racked up debt like a kid at a candy store, and now we’ve crossed $35 trillion in 2024. That’s trillion, with a ‘T,’ folks. You don’t need a Charlie Munger to tell you this isn’t good news. But hey, there it is in black and white—proof that we’ve been running up the tab like it’s someone else’s credit card.

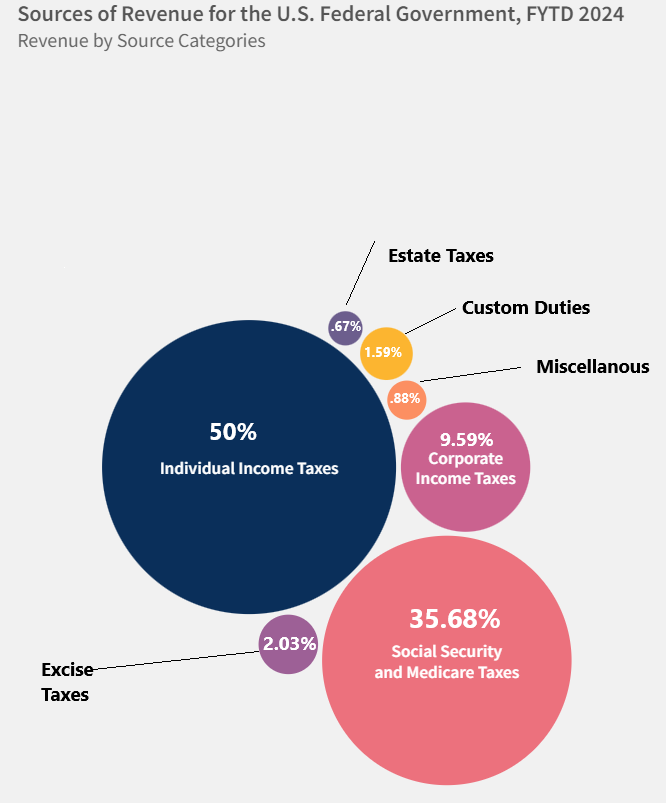

Alright, let’s connect the dots here. Why is this a crisis? Why is inflation going to get worse? Why can’t the U.S. government or economy afford a recession? And why will the government pick hyperinflation over deflation? Well, it all comes down to one thing: taxes. The federal government’s main source of income is taxes—plain and simple. The biggest chunk comes from individual income taxes, followed by Social Security and Medicare taxes, and then corporate taxes. Now, those other little bubbles you see—things like customs taxes and excise taxes—they’re barely a drop in the bucket. They’re about as useful as a screen door on a submarine when it comes to solving this problem.

The government needs to keep the money flowing in , and if the economy slows down, tax revenues drop. So, they’ll do everything they can to avoid a recession, even if it means turning up the inflation dial. And that’s the thing with inflation—it’s sneaky. Sure, it erodes your purchasing power, but it also helps the government pay off its debts with cheaper dollars. Hyperinflation might sound like a nightmare, but in a weird way, it’s the lesser of two evils from their perspective. Deflation, on the other hand? That’s like hitting an iceberg, and the government would rather bail water than go down with the ship.

For fiscal year 2024, the U.S. government has pulled in approximately $4.4 trillion in revenue—essentially the federal government’s income. By the end of the fiscal year, that number is expected to climb to about $5 trillion. But as it stands right now, here’s the bigger issue: government spending has already reached $6.3 trillion. That means the government has overspent by $1.9 trillion, a gap that will need to be filled by borrowing. In other words, the federal balance sheet continues to deepen its reliance on debt, widening the deficit as expenditures far outpace revenue.

So, when you do the math on the difference between revenue and spending you end up with over $1.9 trillion deficit so far in 2024.

And here is the inherent problem and risk. Who buys the Treasury Notes that fund the government? Recent Treasury auction results have exposed a troubling trend: the U.S. government has struggled to fully fund its debt obligations through regular market channels. In multiple instances, primary dealers or even the Federal Reserve have had to step in and purchase the leftover debt, often representing as much as 20% of the total auction. This is a signal of weakening demand from traditional investors, both domestically and internationally, raising concerns about the sustainability of current borrowing levels. When dealers or the Fed must absorb such significant portions of the debt issuance, it suggests deeper structural issues in the bond market and could lead to increased pressure on interest rates and inflation as the government becomes increasingly reliant on less organic funding mechanisms to cover its ballooning obligations.

For the government to stay afloat, they’re going to need a weaker currency—that’s just the brutal reality. But here’s the rub: if you’re trying to succeed financially, you can’t hitch your wagon to a declining currency. It’s like rooting for termites to hold up a house. You’re never going to align your personal interests with something that’s fundamentally working against you. In the long run, to paraphrase Charlie Munger “if you keep mixing raisins with turds, you’re still going to have turds.” The same goes for your financial strategy—if you’re banking on a weaker currency, you’re setting yourself up for failure.

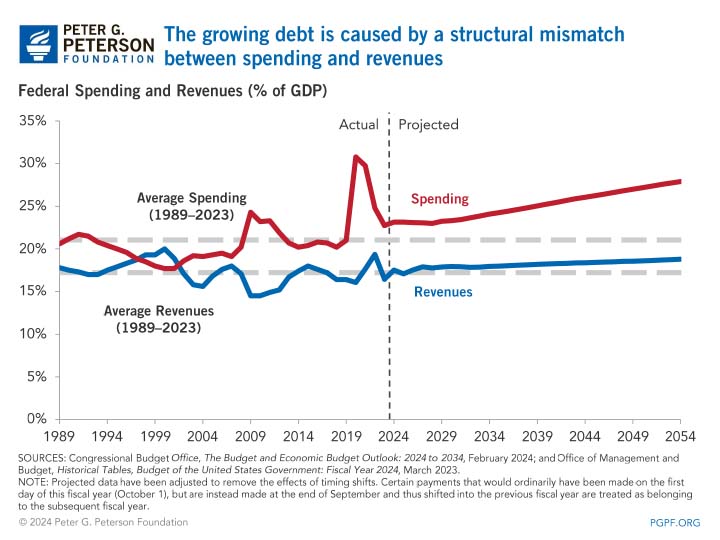

Take a good look at where we’re headed. The red line is government spending, the blue line is revenue—mostly tax collections. It’s simple math: if the government spends more than it takes in, it has to borrow more, and that means the interest payments just keep piling up. You see that dotted line? That’s 2024, and the projections say the government will keep overspending. No surprise there. Last week, they passed the continuing resolution—without a single spending cut. It’s the same old story.

Now, let’s be real—the situation is only going to get worse. That’s a given, and it doesn’t matter who’s in the White House—Trump, Harris, whoever. They’re all going to overspend like drunken sailors. Trump added a record amount of debt, more than Obama. Biden and Harris? They’re no different—they’ve piled on even more. This is not a political statement – it’s simple arithmetic.

The truth is, the national debt is going up no matter who’s in charge, and with it, the interest payments will continue to balloon. As I’ve said before, “The ship is heading toward the rocks, and the captain thinks it’s going faster that’s the problem.” But no one’s steering away from the real issue.

Alright, now let’s entertain a fantasy for a second—imagine the federal government figures out how to balance their budget. They cut spending, tighten their belts, and magically get their fiscal house in order. But let’s not kid ourselves—that’s never going to happen. Even if it did, what would the outcome be? The U.S. economy would spiral into a deep recession. You’ve got to remember; the federal government is the biggest employer in the country. So, what’s the plan? Massive layoffs? Cutting benefits across the board? The U.S. can’t afford that—too much pain. A deep recession or high unemployment would crush tax revenue, and guess what? We’d be right back where we started, with a giant deficit. The government would need to borrow more, and the debt spiral continues.

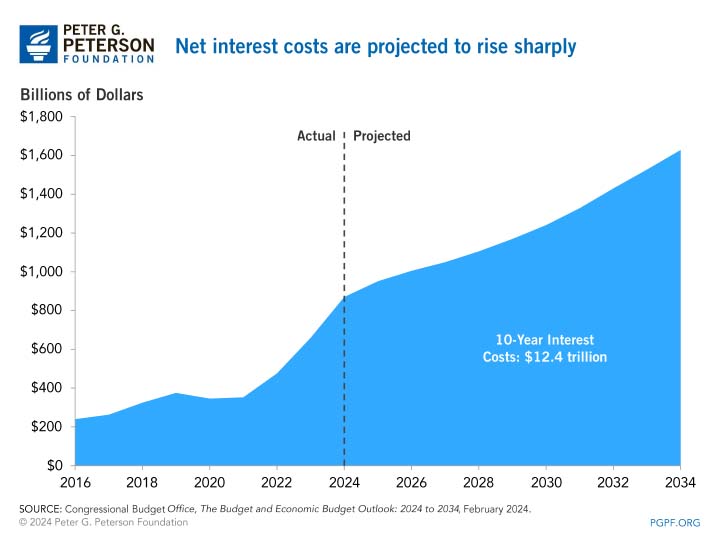

The chart below shows you the exponential debt growth of interest on the debt. My read on the situation is that Fed Chair Powell is cutting interest rates to kick the can down the road for the U.S. Treasury. The U.S. government can’t afford to have a strong currency and high interest rates so the solution will be currency devaluation brought about by massive problems funding the federal debt.

And don’t forget, in a deflationary environment, the burden of debt gets heavier—your pre-existing debts become more expensive to service. So, cutting spending or balancing the budget would just make the situation worse, not better. The reality is the U.S. government has painted itself into a corner. There’s no easy way out, and they’ve left us all in a tough spot. No good options here, folks—just degrees of bad. That’s the uncomfortable truth.

In the face of a looming sovereign debt crisis and the very real possibility of a currency collapse, it’s clear we need our brightest minds focused on finding solutions. Political band-aids won’t cut it anymore—if we let the current trajectory continue, the U.S. dollar could be headed for extinction. Relying on endless money printing to cover debts might offer temporary relief, but it’s like trying to drink your way out of a hangover—the long-term consequences will be devastating. Devaluing the currency is, in essence, stripping wealth from savers to cover the excesses of spenders, a policy that erodes trust in the system. And make no mistake, a country that consistently undermines its own currency is setting itself up for a disaster. Everyone sees the train coming, yet we act surprised when it derails. If we don’t address this now, we’re only accelerating toward a future where the dollar’s collapse becomes inevitable.

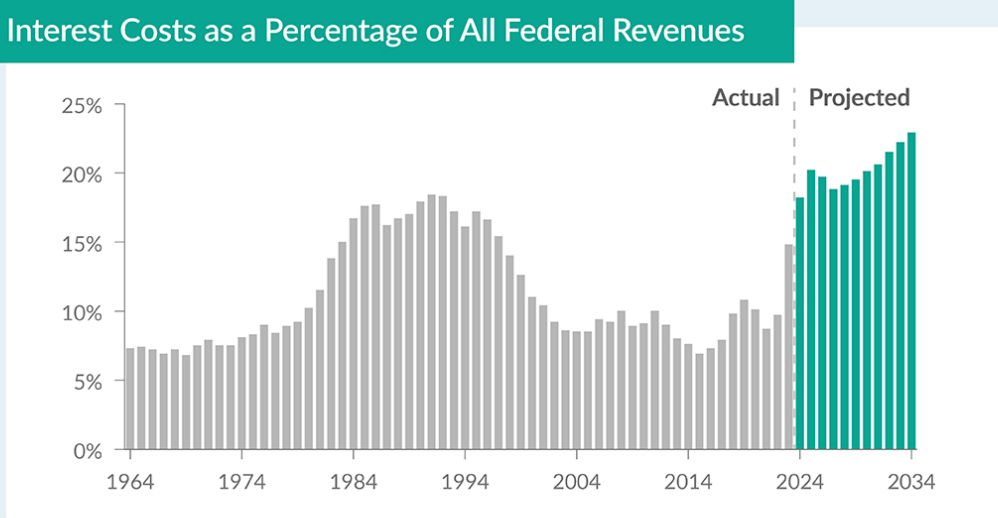

When you look at the Congressional Budget Office’s projection of trillion-dollar deficits over the next decade, you’re seeing the national debt climb exponentially. Now, to put this into perspective, it’s like a family running up credit card debt without any plan to pay it off. Sooner or later, the interest starts piling up, and that’s where things get tricky.

In 2023, the U.S. spent $658 billion just on interest payments. By 2034, that number could balloon to over $2 trillion. Think about that: we’re spending more on interest than we are on Medicaid and veterans’ benefits. Interest doesn’t buy you anything—it’s just the cost of having borrowed too much.

Now, here’s where it gets concerning. When you’re paying that much in interest, it crowds out spending on the things that really matter—education, research and development, infrastructure. These are the investments that create long-term value, just like a company reinvesting in its own growth. If you’re so deep in debt that you can’t fund the future, you’re in trouble.

Debt, when used responsibly, can be a tool for growth. But when it becomes unsustainable, it turns into a drag.

Three out of four voters understand this, and they’re right—national debt should be one of the top priorities for lawmakers.

Because just like any business, if the government doesn’t manage its balance sheet, it risks putting itself in a position where it can’t meet its obligations or invest in its own future.

As Warren Buffet always said, “The first rule of managing money is not to lose it.”

The second rule? Don’t forget rule number one. When it comes to managing the country’s finances, that wisdom holds true.

The chart below is of the U.S Dollar Index. Observe how it is testing its 2-year lows. Yet, our monetary authorities are telling us how strong a resilient our economy is.

One of the craziest ideas that’s gained traction is the notion that we need a weak currency to make our country strong.

The idea that you can somehow strengthen a nation by making its goods cheaper for foreigners is about as backward as it gets. Sure, a weaker currency might boost exports in the short run, but it also guts your purchasing power at home. Suddenly, everything you import costs more, and before you know it, inflation starts creeping in. This short-term fix is like patching a sinking boat with a piece of gum—it doesn’t hold up over time. In the long run, a weak currency undermines stability, damages investor confidence, and leaves you with more volatility. It’s a dangerous road to go down, and it’s amazing how many people are willing to buy into this nonsense without looking at the bigger picture.

In today’s unpredictable market, being on the right side of the right trade at the right time isn’t just important—it’s everything. And the traders who consistently win? They aren’t relying on gut instincts or outdated theories. They’ve embraced the future: Artificial Intelligence Trading Software.

Great traders don’t focus on making money—they focus on not losing it. In a market full of distortions and noise, the key to success is having a repeatable system for finding and following the most profitable trends. That’s why A.I., machine learning, and neural networks have become the secret weapon for the world’s most successful traders.

Let’s cut through the fluff—A.I. isn’t just another tool. It’s a game-changer. It learns from every misstep, adapts to every shift, and finds the trends that most traders miss. Combine

that with its ability to sift through oceans of data in real time, and you’ve got an edge that no human trader can match.

Here’s the reality:

If the Fed sticks to its current plan, stocks will eventually tank. But we’re not guessing here—A.I. doesn’t deal in guesswork. It deals in data. It identifies market patterns, aligns what should happen with what is happening, and helps you capitalize on the opportunities that lead to explosive profits.

The markets are unforgiving, and mistakes are costly. But for A.I., every mistake is a steppingstone to mastery. It remembers every loss, every misstep, and turns them into lessons. That’s the Feedback Loop—and it’s the secret to staying ahead in a zero-sum game where only the smartest traders survive.

While everyone else is drowning in market noise, A.I. cuts through the chaos and delivers precise, actionable insights. It’s already beaten humans in poker, chess, Jeopardy, and Go—do you really think trading is any different?

Here’s the bottom line: Artificial intelligence isn’t just a “nice-to-have.” It’s the must-have tool for any trader who wants to thrive in today’s global markets.

If you’re ready to stop trading on gut feelings and start trading with precision, then this is your moment. Join us at our Next Free Live Training and learn how A.I. can revolutionize your approach to trading—putting you on the right side of the right trend, every single time. Reserve your spot now.

It’s not magic.

It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.