The European Central Bank (ECB) has released its second progress report on the preparatory stage of digital euro issuance. Holding limits for the central bank digital currency (CBDC) and harmonization of laws were some of the questions addressed in the report.

Sticking points at the halfway mark

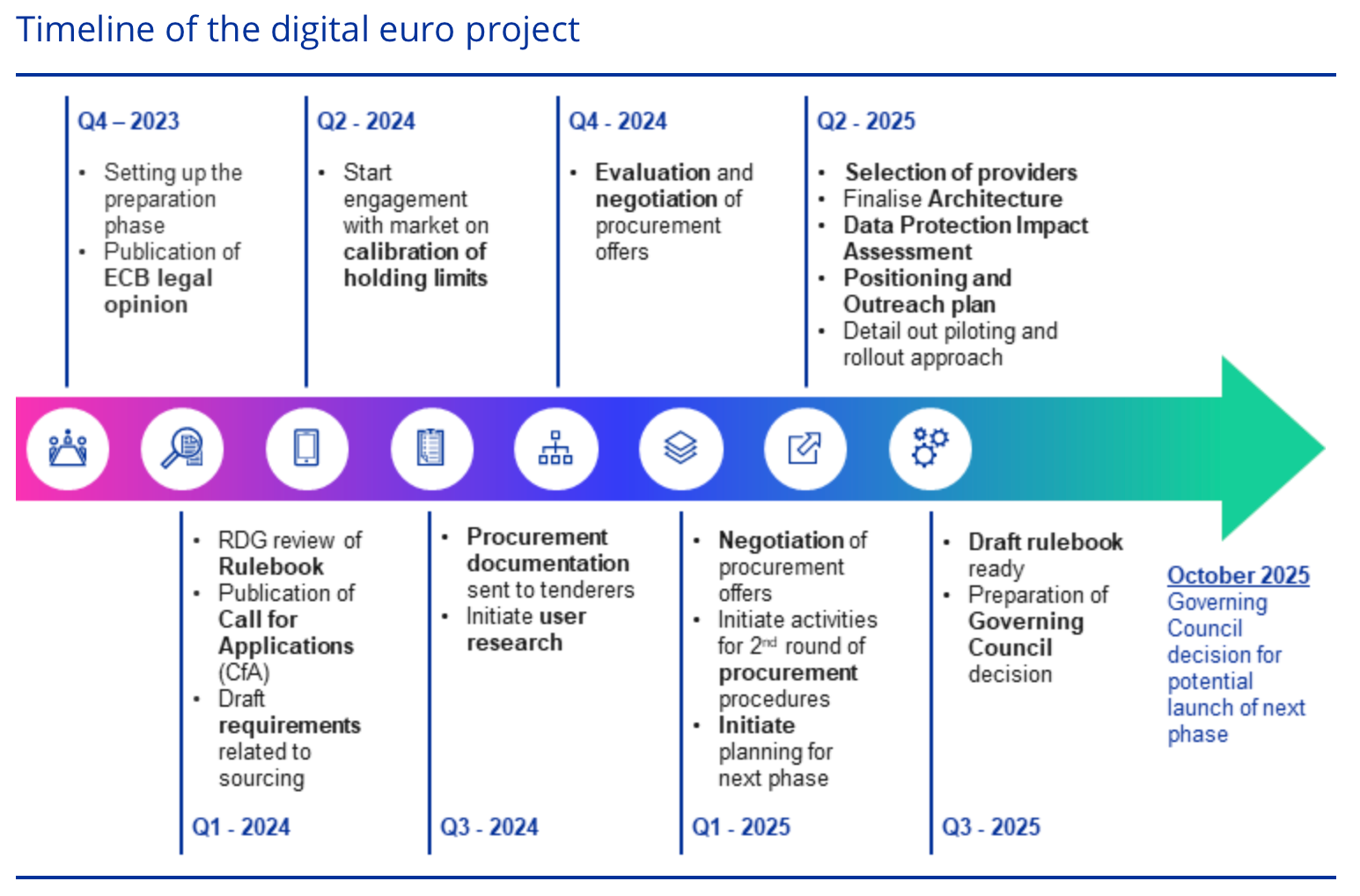

The ECB report represents a halfway point in the preparatory phase, which follows the investigative and design phases .

After a review of the developing digital euro rulebook, the Rulebook Development Group launched seven workstreams manned by market participants and central banks that will continue its development.

The rulebook strives to harmonize national laws to guarantee universal standards. A report on its progress was released in September, and another report will be released in July 2025.

Research is continuing on a digital euro user profile to identify the needs of likely users. That input will include user preferences on holding limits, which will be considered in technical research conducted with national central banks.

Politico reported in October that holding limits has become a point of contention between the ECB and national central banks.

One solution under consideration for maintaining an upper holding limit is a “reverse waterfall” that would automatically transfer excess digital euros to fiat in a linked bank account.

A solution for offline transactions is still being investigated, the report said, without adding many details.

Related: Digital money lag threatens international security

Keeping the euro European

A major topic in the report was competition in the financial market between European and non-European service providers and the need for more technical services, such as wallets. The report emphasized:

“Payment service providers (PSPs) would be able to use the digital euro infrastructure to create new payment services. […] A digital euro would also help regional and domestic European schemes to scale up the provision of their payment […] using the digital euro acceptance network.”

The report also indicated a “possibility of making a few improvements to the user experience of the digital euro so that citizens with a stronger privacy preference can benefit from cash-like privacy.”

In February, ECB executive board member Piero Cipollone promised that the digital euro will have a standard of privacy “higher in fact than what commercial solutions currently offer.”

Selection of technical service providers will continue, as will communications with the public and other stakeholders. The ECB will release the next digital euro progress report in the second quarter of 2025. The ECB Governing Council may make a decision on the launch of the European CBDC in October 2025.

Magazine: How the digital yuan could change the world… for better or worse