“Well, you know, it’s so funny because financial crises percolate for years but they blow up in weeks. That’s kind of the history of them, right? And so for me, this election becomes one of those seminal points where all of a sudden, let me really think whether this proposition that the U.S. government is making me, is something that I actually want to participate in.”

– Paul Tudor Jones CNBC interview 10/22/2024

Today, we’re diving into the world of ‘kayfabe,’ a term freshly minted in the economic lexicon by none other than Paul Tudor Jones during his recent CNBC appearance .

In this pivotal election year, it’s a breath of fresh air to witness a titan of finance, Paul Tudor Jones, speak truth to power. I strongly encourage you to watch his enlightening interview on CNBC, where he delves into the complexities of market dynamics and the economic implications of our political choices. Don’t miss this rare opportunity to gain insight from a man who understands the pulse of our economy and the stakes of the upcoming election.

It’s a fascinating choice of words, borrowed from the glitzy, melodramatic universe of championship wrestling. In that world, kayfabe denotes the tacit pact between wrestlers and their audience, an agreement to believe in the spectacle of ferocity and rivalry despite knowing it’s all staged. As we unpack Jones’s declaration that we are living through an “economic kayfabe,” it becomes essential to understand how this concept of orchestrated reality from the wrestling ring translates into the financial markets we navigate daily. Just like in wrestling, where the action is real, but the outcomes are prearranged, our economic environment might be prompting us to question which parts of the performance are genuinely spontaneous and which parts are skillfully scripted.

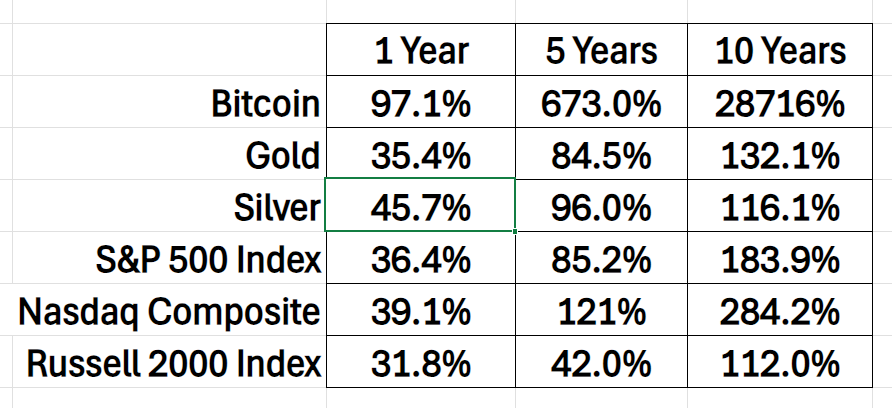

Before we delve into the implications of an “economic kayfabe,” let’s take a step back and examine the performance of major investment vehicles over the past 1, 5, and 10 years. It’s crucial to ground our discussion in concrete data, giving us a clear, macro-level perspective on which vehicles have been leading the charge. By analyzing these trends, we’re not just looking at numbers; we’re scouting the champions of the investment arena. This broader view will help us understand the lay of the land, identifying where the real growth has occurred and where, perhaps, appearances may be deceiving. This comprehensive look at the winners will provide the foundation we need to really get to grips with the concept of kayfabe in our economic narrative.

As you study these returns above, ask yourself the very simple question of why are the winners winning and why are the losers trailing as this is the TRUE narrative of our time.

Jones’s views are particularly sought after, given his historical knack for navigating tumultuous financial waters successfully. During the interview, he discussed a range of topics from market dynamics, the impact of global policies on investments, to the sustainability of current market trends. Known for his candid and insightful commentary, Jones’s use of “economic kayfabe” to describe the market conditions highlights his belief that the true state of the economy and markets is often obscured by surface-level narratives. He emphasized that massive economic problems could fester for years under the guise of stability before erupting suddenly, a view that aligns with his cautious approach to investment. His discussion serves as a critical reminder of the complexities and subtleties involved in financial markets, where understanding what lies beneath superficial metrics can be the key to sound investment decisions. This interview not only reinforced his status as a thought leader in economic strategy but also offered valuable insights for investors navigating today’s unpredictable financial landscapes.

Jones’s use of “economic kayfabe” to describe the market conditions highlights his belief that the true state of the economy and markets is often obscured by surface-level narratives. He emphasized that massive economic problems could fester for years under the guise of stability before erupting suddenly, a view that aligns with his cautious approach to investment. His discussion serves as a critical reminder of the complexities and subtleties involved in financial markets, where understanding what lies beneath superficial metrics can be the key to sound investment decisions. This interview not only reinforced his status as a thought leader in economic strategy but also offered valuable insights for investors navigating today’s unpredictable financial landscapes. It is quite profound to evaluate his commentary that he refuses to own any fixed income, and he is looking to short the long end of the yield curve looking for much higher interest rates.

Last month, when the National Bureau of Economic Research removed 818,000 jobs that they had fictitiously placed on the jobs reports for the last two years. I wrote about it and commented that Dr. Lacy Hunt referred to the NBER jobs adjustment as a 5 sigma event. A 5 sigma event is comparable to getting 21 blackjacks in a row. It is either outright fraud or amazingly good fortune. You can read my analysis of that fiasco here.

Long-time followers of this blog will know I often view government economic reports with a healthy dose of skepticism, labeling them as little more than gaslighting or propaganda. At the heart of these reports is a nearly universal adoption of Keynesian economics, which holds the belief that debt accumulation and government expenditure are the foundations of a sustainably strong economy. This paradigm has spawned a dangerous myth: the notion that more debt is a panacea for all economic issues.

This belief in debt as the lifeblood of economic vitality is not only misguided but perilous, leading us into a relentless cycle of borrowing. Such a viewpoint has been entrenched in our economic policies since the inception of the Federal Reserve Act in 1913, promoting debt as a catalyst for growth across all economic strata, from individual consumers to the corridors of power in government. However, this dependency on debt often obscures rather than addresses underlying structural economic weaknesses, offering only ephemeral relief and postponing inevitable financial crises.

The fallacy that more debt can effectively resolve issues precipitated by excessive borrowing has set us on a precarious trajectory. This approach compromises long-term financial stability and undermines genuine economic health, making our economic system increasingly fragile and dependent on continual credit expansion, and leaving it acutely vulnerable to financial disturbances.

Let’s review the essentials.

On a quiet evening of August 15, 1971, as most of America settled in front of their television sets, President Richard Nixon delivered a proclamation that effectively changed the scenery of international finance. By shutting the gold convertibility window, Nixon severed the dollar’s golden anchor, setting it adrift on international waters where it has bobbed ever since, susceptible to the ebb and flow of governmental whims and economic tides. Today, the reverberations of that decision are felt in every wallet and every market, manifested as an unrelenting currency debasement that nibbles at our purchasing power.

Yet, curiously, in the endless chatter of financial punditry and the voluminous outpourings of economic analyses, there’s a glaring omission: the failure to juxtapose the soaring arc of gold prices against the stark backdrop of living costs and stock market valuations. This isn’t just about inflation charts and gold bugs; it’s about understanding a complex dance of decay—where every rise in market indices or gold ounces prices in not just growth but also the dilution of value in a world strangled by exponential debt. This storyline isn’t just a ledger entry; it’s the narrative of our financial lives, written in disappearing ink on the balance sheets of a global economy hooked on the drug of debt. Why, then, is this grand comparison so rare? Perhaps the truth of this financial saga, like any good mystery, lies buried under layers too uncomfortable to peel back.

Since August 15, 1971, the Dow Jones Industrials have climbed to a staggering 4,624%, which translates to a compounded annual growth rate of 7.7%.

Impressive? Perhaps, until you juxtapose it with the price of Gold.

Over the same period, Gold has vaulted an even more astounding 7,769%, reflecting a compounded annual growth rate of 8.76%.

This simple yet telling comparison reveals that what used to be money — Gold — has outstripped the performance of the world’s top 30 industrial stocks. If this analysis does anything, it should challenge your most cherished perceptions of the global financial landscape. Perhaps calling our current economic era a “kayfabe” is understating the matter. The theatrics involved might be more profound than the term suggests, underscoring a delicate dance between perceived value and real worth.

I’ve been captivated by the world of investing since childhood, and over the years, my understanding of it has evolved—shaped by the complexities of today’s financial landscape. It used to be straightforward: you’d identify a strong, reliable company, invest for the long haul, and watch as that investment grew, often exponentially, providing a pathway to a secure retirement for you and your loved ones. That formula, while not without risk, seemed clear and dependable. But today, the picture is far more nuanced, and frankly, a lot more unsettling.

We’re no longer just evaluating a company’s fundamentals or industry trends. Now, successful investing demands a closer look at the broader macroeconomic factors—particularly the health of our government, its escalating debt, and the persistent currency debasement that threatens to undermine everything. The growing disconnect between traditional financial strategies and the unchecked spending habits of governments means that investors not only have to bet on companies, but also on the stability of the very financial system underpinning their investments. The stakes have changed, and navigating this new environment feels more like threading a needle through a minefield. It’s no longer just about picking winners; it’s about surviving in an increasingly fragile financial ecosystem.

Paul Tudor Jones’s assertion that Bitcoin would be the “fastest horse in the race”, made in May of 2020 reflects his forward-thinking approach to trading, particularly in understanding the dynamics of emerging technologies and asset classes.

Since making that prediction, Bitcoin and the broader cryptocurrency market have experienced explosive growth, repeatedly validating Jones’s view of Bitcoin as a premier asset in a world grappling with monetary inflation and diminishing trust in traditional fiat currencies. His foresight into Bitcoin’s potential not only underscored its role as a hedge against inflation but also highlighted his ability to identify transformative trends early on. This perspective has not only proven accurate as Bitcoin reached new all-time highs but also serves as a thought-provoking stance on the future of digital currencies and their role in modern portfolios.

Beyond his cryptocurrency predictions, Paul Tudor Jones’s trading successes are numerous and highlight his adeptness at different market conditions. One notable example is his performance during the dot-com bubble and subsequent burst. While many investors were caught in the euphoria of tech stocks, Jones managed to navigate the volatility profitably, applying a mix of contrarian positions and timely exits to protect capital and capture gains. His trading strategy, characterized by a keen understanding of macroeconomic indicators and market sentiment, allowed him to profit from both the rise and fall of the market during this period — demonstrating his skill in not just predicting market movements but also in executing strategies that capitalize on these predictions.

Jones’s educational impact through his public discussions and philanthropic efforts, particularly in economic education, further solidifies his role as a thought leader in finance. His insights into market cycles, monetary policy, and risk management have not only influenced traders and investors worldwide but have also contributed to a broader understanding of economic principles among the public. His establishment of the Robin Hood Foundation, which focuses on alleviating poverty, extends his influence beyond finance, showing his commitment to using his understanding of economic systems to effect social change. In every facet, from predicting market trends like Bitcoin’s rise to managing through crises and advocating for economic education, Paul Tudor Jones has proven that his research and methods are not only successful but also incredibly relevant in today’s economic landscape.

In professional wrestling, “kayfabe” refers to the portrayal of staged events within the industry as “real” or “true,” specifically the portrayal of competition, rivalries, and relationships between participants as being genuine and not of a staged or predetermined nature.

Applying this concept to economics, as Paul Tudor Jones might suggest, an “economic kayfabe” occurs when the reality of the economic situation is masked or staged much like in wrestling. This can happen when governments, financial institutions, or the media present an overly optimistic view of economic conditions, obscuring underlying problems or instabilities. These issues might be downplayed, ignored, or hidden until they suddenly become too big to conceal, leading to rapid and often surprising corrections or collapses.

Jones’s quote, “Massive economic problems can fester for years but they blow up in days or weeks,” encapsulates this phenomenon well. It suggests that while significant economic issues can develop and worsen over a long period, unnoticed or masked by a facade of stability or growth (kayfabe), their eventual emergence can be abrupt and dramatic, catching many by surprise.

This sudden revelation can lead to rapid changes in market sentiments, like how wrestling storylines can shift dramatically once the reality behind the kayfabe is revealed.

Let me share one chart which caught my attention which fits into the “kayfabe” category. On September 18, 2024, the Fed cut interest rates 50 basis points and claimed we had had a strong and resilient economy. Yet since that date the yield on 10-year Treasury Notes have actually increased 50 basis points. Spin it any way you want, the Treasury market is not buying the Fed’s actions.

During this exact same time frame the S&P 500 has rallied 3.8% but the U.S. dollar has strengthened by 4.5%. Historically, a strong dollar does not bode well for the stock market.

But what convinces me that the economic kayfabe term is accurate is when our monetary authorities tell us that our economy is strong and resilient when I see evidence that is completely contrary to that perspective.

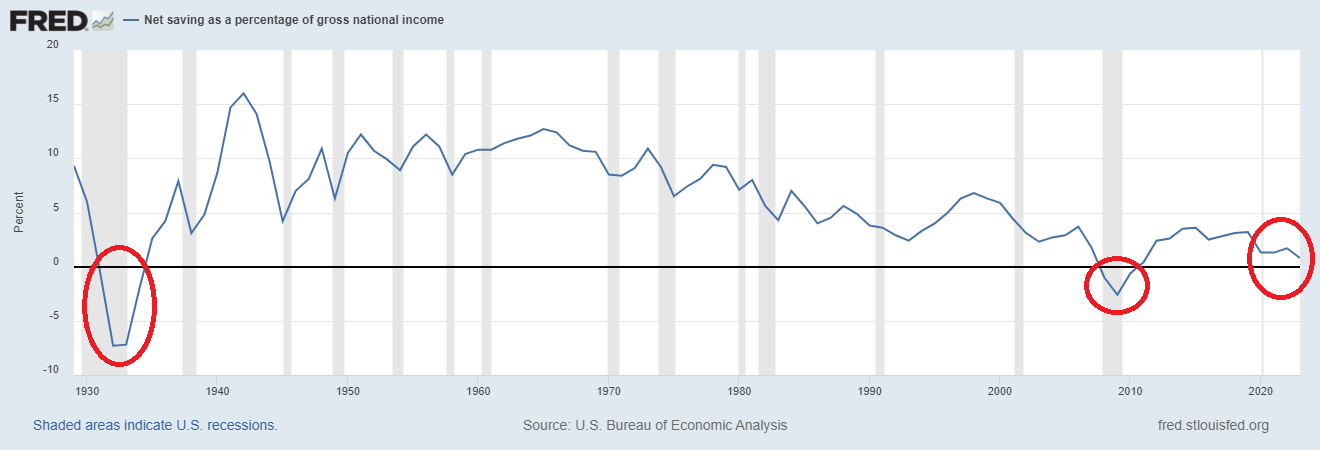

US net savings as a percentage of GDP across households, businesses, and the government have dipped into the red for six quarters straight. Translation: Americans are spending way more than they’re earning. We’ve only seen this kind of savings slump twice since 1930 — back in the crisis years 2008 and 2020. And here’s a kicker: over the past year, the US government’s deficit ballooned to a whopping $2.1 trillion with spending soaring to $6.9 trillion. Meanwhile, the personal savings rate has shrunk to a mere 2.9%, nearly scraping the bottom since the 2008 financial meltdown. We’re talking about a national savings crisis, folks.

A strong economy is founded upon a strong savings rate. We are at the 3 rd lowest savings rate level in the last 95 years.

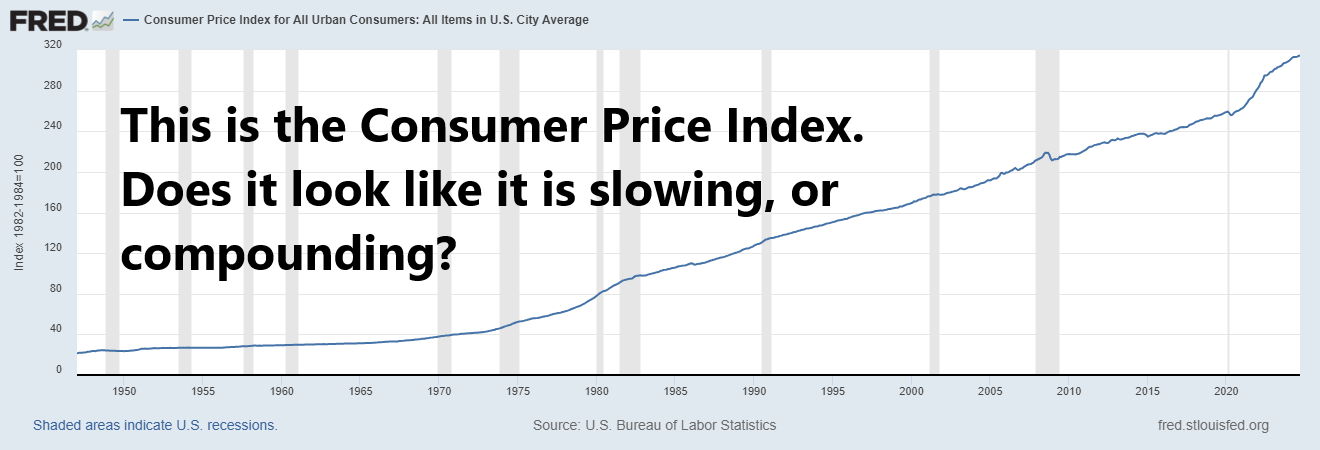

Better yet, look at the chart of the Consumer Price Index. They talking heads applaud the success the Fed has had in reducing inflation. Look at the following long-term chart maintained by the Fed of the CPI. Does it look like it is slowing or compounding?

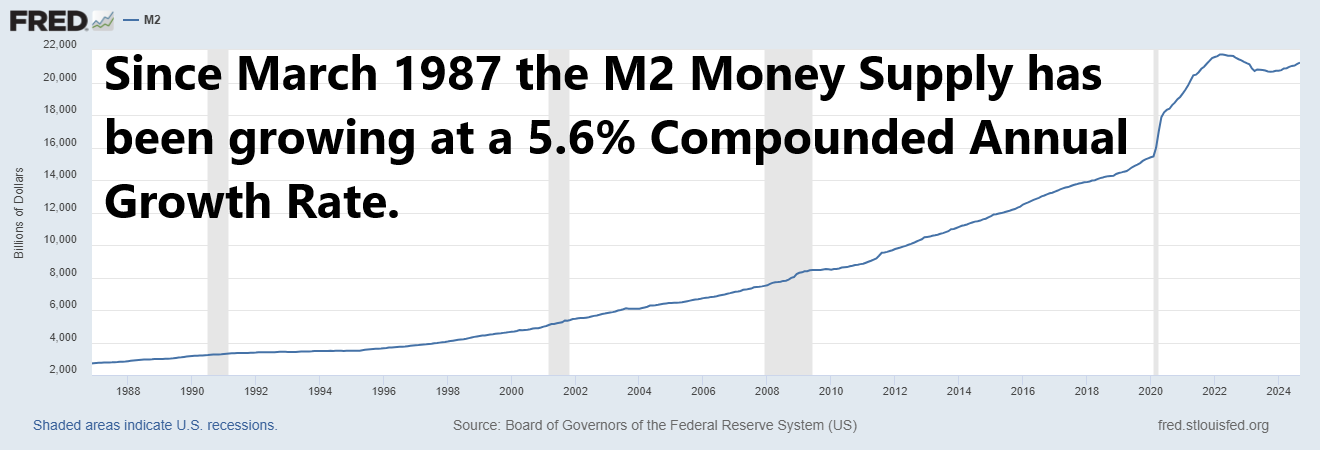

What troubles me most about what is happening in the financial markets is that over the longer term, with the benefit of hindsight, I can easily that that the price of financial assets has increased because the currency is being debased. I expect this trend to accelerate moving forward. Think about it, if a currency is depreciated by 10% everything priced in that currency increases in value.

For the government to survive, it needs a weaker currency—it’s the oldest trick in the book, inflate the debt away while the public barely notices.

But for anyone with financial sense, aligning your personal fortunes with a depreciating currency is like trying to run up a down escalator. Jones has always understood that true success in trading and investing means safeguarding against this very kind of erosion. You can’t build wealth when your currency is crumbling beneath you. Instead, Jones would argue, you need to hedge, pivot, and find assets that thrive in this environment—whether it’s Bitcoin, gold, or equities that can withstand the debasement storm. He’s made it clear: survival in this game means staying ahead, not falling in line with the government’s need for a weaker dollar.

Here is a chart of the M2 money supply going back to 1987. Historically it has averaged a CAGR of 5.6%. And I believe it is very conservative to think that will be expanding leading to more inflation in the months and years ahead.

I know this sounds extreme, like a wild conspiracy theory, but spend enough time watching the Fed and government economic reports, and you’ll realize that “economic truth” barely resembles anything they put out. It’s like watching a magician — what you think you’re seeing isn’t what’s really happening. Economic propaganda has become a master tool, reshaping perceptions, especially for traders and investors who need crystal-clear data to make real decisions. When the numbers—whether it’s inflation, unemployment, or GDP — are massaged and spun, finding the real story is like solving a puzzle with missing pieces.

It’s the classic case of, “if it walks like a duck and quacks like a duck, but the government calls it a fish,” you’re left wondering what reality even is. Investors are stuck trying to decipher if the data is real or if it’s been re-engineered to fit some political or institutional agenda. In this mess, trust evaporates. For traders, it’s not just confusing — it’s dangerous. You’re navigating through a minefield of misinformation, hoping your next move doesn’t blow up in your face.

My advice: pay attention to what GOLD is doing. I agree with Jones that “all roads lead to inflation.” Clearly Gold is signaling more inflation and currency debasement dead ahead. When Gold outperforms financial assets, the talking heads don’t know what to say about the rest of the economy.

Artificial intelligence is no longer a concept confined to Silicon Valley dreams—it’s transforming every industry you can think of. In healthcare, A.I. is powering diagnostic tools that can predict diseases with startling accuracy. In retail, it’s driving personalized shopping experiences that feel like a personal assistant, one that knows what you want before you do. Even industries as old as time, like farming, are turning to A.I. for precision agriculture, optimizing every drop of water and nutrient for maximum yield. In finance, the algorithms have already replaced thousands of human analysts, predicting market trends in the time it takes most people to blink. AI is reshaping the world, and you must ask yourself: shouldn’t you be trading with A.I. too?

After all, A.I. has already outsmarted humans at Checkers, Chess, Poker, and Go—games once thought to require deep human intuition and skill. If AI can conquer complex games like these, why should trading be any different? We live in a time where markets are more volatile than ever, and geopolitical forces are shaking the financial foundation we stand on. The BRICS nations are holding a meeting in Moscow right now, challenging the U.S. dollar as the world’s reserve currency. Oddly enough, there’s barely a whisper about it in the mainstream U.S. media. If that doesn’t underscore the power dynamics at play and the need for more sophisticated trading tools like A.I., I don’t know what does.

Traders, pay attention. This isn’t just another election cycle; it’s the moment for those in power to put a glossy sheen on the economy, to make things look better than they are. But here’s something you might not have known: Gold is hitting new all-time highs against foreign currencies. That’s right—what used to be money is outperforming almost everything priced in fiat. The financial narrative you’re being fed is a carefully crafted one. Use that knowledge as your filter when you hear political promises in the days leading up to the election. What you see may not be what you get, but A.I.? That might just be your way to cut through the noise.

I invite you to visit with us at our next live online free training where we teach traders how to trade with artificial intelligence.

Let’s be careful out there.

It’s not magic.

It’s machine learning.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.