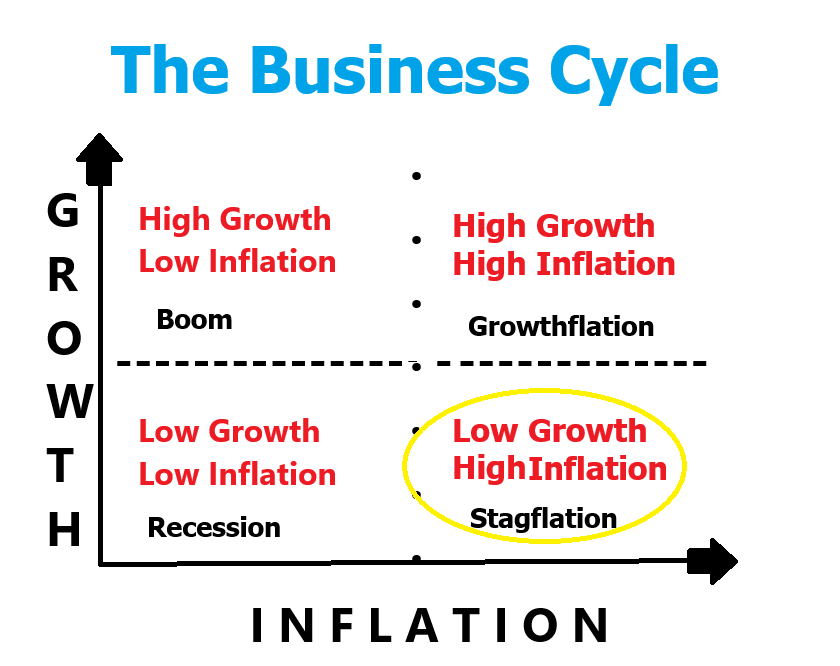

By dissecting each quadrant — increasing growth with increasing inflation, increasing growth with decreasing inflation, decreasing growth with decreasing inflation, and decreasing growth with increasing inflation — we aim to equip traders with the knowledge to tailor their trading approaches to align with these economic trends.

Whether you’re looking to capitalize on a booming economy or safeguard your portfolio against economic downturns, understanding how to navigate these waters can be your greatest asset. Let’s embark on this analytical voyage to uncover how the savvy trader can leverage growth and inflation trends for maximum gain.

The Austrian School of Economics views the business cycle differently than mainstream Keynesian and Monetarist perspectives. Austrian economists argue that the business cycle results primarily from government interference in the economy, particularly through monetary policy. According to Austrian theory, when central banks artificially lower interest rates below their natural market level, they cause an unsustainable expansion of bank credit and create what is known as malinvestment. This malinvestment occurs because lower interest rates make long-term projects appear more profitable than they really are, leading to misallocation of resources in sectors like construction and technology during the boom phase.

As these artificially stimulated projects come to fruition, it becomes apparent that they are not as profitable as expected, leading to a bust phase where these malinvestments are liquidated. This process of liquidation, painful though it may be, is considered necessary for reallocating resources to more efficient uses. Austrian economists emphasize that the real damage is done during the boom phase when resources are misallocated, not during the bust phase when the economy adjusts itself. They advocate minimal interference by central banks and government bodies in the economic cycle, proposing instead a return to a more laissez-faire economic environment where the natural rate of interest is determined by the market rather than central bank policies.

To begin with the key question that smart traders and investors ask regularly, particularly when they are bombarded with economic indicators and reports daily, is where are we now? Sometimes the answer to this question is very simple. Sometimes it requires a lot of work to provide an accurate assessment.

As long-term followers of this space are well aware, I maintain a healthy skepticism towards government economic reports. It’s crucial in the financial markets to foster an independent mindset, drawing one’s own conclusions from the raw data available. The crux of the matter often lies in the definitions—how growth and inflation are quantified and reported. Often, these reports paint an overly rosy picture, touting low inflation and high growth, seemingly detached from the ground realities faced by the average consumer and investor. This disconnect between reported figures and lived experience underscores the necessity for investors to look beyond official narratives, digging deeper to understand the true health of the economy. In doing so, one not only guards against potentially misleading optimism but also hones the kind of critical, independent thinking essential for long-term success in the markets.

In a Presidential election year, the waters of economic reporting become even murkier, tinged with the hues of political agendas. Incumbents polish their tenure’s economic achievements to a high shine, presenting a picture of prosperity and managed challenges, aiming to secure continuity in governance. Conversely, the opposition mounts the rooftops, vociferously arguing that only a radical policy shift can propel the nation towards genuine progress. This orchestrated cacophony of economic narratives forces a discerning approach, as I’ve come to realize that nearly every piece of economic data released is laced with politicization. In such a climate, skepticism isn’t just useful — it’s essential. It allows us to peel back the layers of partisan presentation, seeking out the core truths that will guide sound investment and economic predictions devoid of electoral influence.

Many often mistake the Consumer Price Index as the definitive gauge of inflation — a perception that couldn’t be further from the truth. According to the CPI, inflation hovers around 2.6%. However, if we define inflation as I do, emphasizing the erosion of the currency’s purchasing power concerning the goods and services we commonly use, a more realistic figure would be closer to 6%. Reflect on your personal expenses over the past five years: consider the rise in taxes, both direct and indirect. Think about the cost of gasoline, food, health insurance, and housing. And what about mortgage rates? They’ve surged by 100%. Clearly, the purported 2.6% inflation rate starkly underrepresents reality. Amidst these misleading government reports, the need for independent thinking becomes paramount. We must recognize that without a recession or depression, inflation will not decelerate, and understanding its true impact — along with the distorted representations we’re fed — is critical for making informed decisions in the financial markets. This highlights why, especially during an era of politicized economic reporting, maintaining a healthy skepticism and verifying facts independently is not just prudent, it’s necessary.

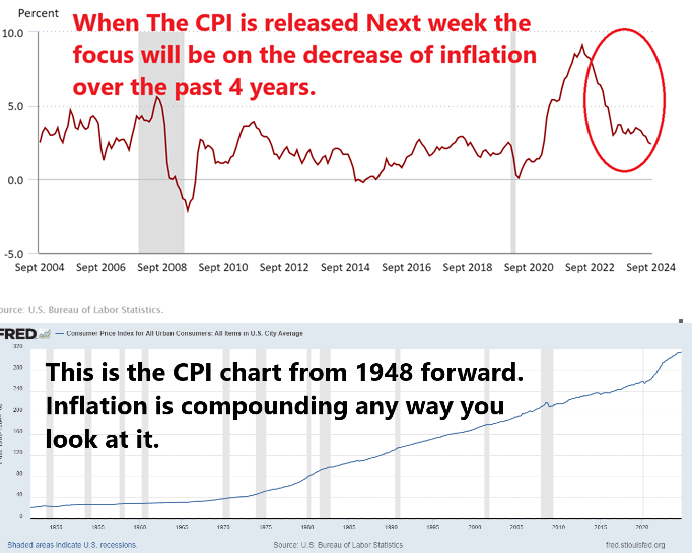

Next week will bring us the latest installment of the Consumer Price Index (CPI), and you can bet that before the ink is dry on the report, publicists and propagandists will be crowding the airwaves and digital spaces, singing praises for the Federal Reserve and Treasury’s handling of inflation. But let’s be clear: this fanfare often overlooks the critical layer of context that’s essential for understanding the real narrative.

Looking at inflation with a narrow, short-term lens may provide a distorted picture — akin to judging the quality of a movie based solely on its climax without considering the entire plot. Yes, the latest figures might show a decrease in the year-over-year rate of inflation, suggesting a narrative of success in monetary policy. However, when we pull back the camera to view the broader scene, inflation has been compounding over the long term, and that tells a more troubling story. This persistent rise in prices over many years, despite recent declines in growth rates, indicates that inflation remains a stubborn beast, far from being caged and tamed.

The reality is that interpreting the CPI — and indeed, any economic data — requires more than just digesting numbers. It demands an understanding of the broader economic context, historical trends, and the real-world impacts on everyday lives. As next week’s figures roll out, remember that the ensuing media blitz often serves more to distract than to inform, framing a narrative that may not fully align with the lived experiences of many.

Next week when the CPI report is released you will be bombarded with an intense focus of how much inflation has improved in the last 4 years. Understanding the toxic nature of inflation is crucial due to its compounding effects, which systematically erodes purchasing power — a loss that is essentially irreversible. When inflation pushes prices up, they seldom revert to previous levels; instead, the pace of increase might simply decelerate. This subtle yet persistent rise is deceptive. For instance, consider an item priced at $1. If inflation causes the price to rise to $1.05 one year, then $1.09 the next, followed by $1.12 and $1.14 in subsequent years, this incremental hike represents a continuous erosion of purchasing power. Politicians may tout this slowing pace as a victory in “battling inflation,” but this is often a misleading portrayal, minimizing the ongoing impact of inflation. It’s a charade that obscures the true economic burden placed on consumers, making it imperative to scrutinize why prices are escalating in the first place. This is why a deep understanding of the causes and mechanics of inflation is essential, rather than relying on the often-polluted economic reporting that paints a rosier picture than reality justifies.

Any child can quickly observe that in the previous example cited that prices have risen 14% in 4 years. But this simplicity is prohibited in economic reporting. Instead, what we hear is that the Fed and Treasury have tamed inflation because prices are rising slower than they were 4 years ago.

So, the initial question we must always ask ourselves is – where are we NOW in the business cycle? When I read the tea lives and economic indicators, I conclude that we are clearly in an area of STAGFLATION which is LOW GROWTH and HIGH INFLATION.

Here is a brief description of each quadrant of the business cycle:

1. Increasing Growth, Increasing Inflation (Growthflation): This quadrant is characterized by a robust economic expansion accompanied by rising price levels. Typically observed during a recovery phase following a recession, this stage sees increased consumer spending, reduced unemployment, and heightened business investment. Inflation rises because the demand for goods and services outstrips supply, prompting businesses to hike prices. Central banks often monitor this phase closely as prolonged inflation can lead to economic instability.

2. Increasing Growth, Decreasing Inflation (BOOM): An ideal scenario for many economies, this quadrant features strong economic growth coupled with stable or falling price levels. This can occur due to increased productivity, technological advancements, or effective supply chain improvements that enhance output without corresponding price increases. It is also influenced by competitive market pressures and regulatory policies that help maintain price stability despite economic growth.

3. Decreasing Growth, Decreasing Inflation (Recession): Often signaling a move towards recession, this quadrant is marked by slowing economic activity and reduced inflation rates. Factors such as decreased consumer confidence, reduced spending, and investment cutbacks contribute to this slowdown. Lower demand leads to lower prices, exacerbating the economic downturn. Central banks may respond with stimulative monetary policies to reverse or mitigate the decline.

4. Decreasing Growth, Increasing Inflation (Stagflation): Known as stagflation, this troubling phase combines economic contraction with rising inflation. It can be triggered by supply shocks, such as increased oil prices or geopolitical tensions, which raise costs for producers and consumers alike, even as economic growth stalls. This quadrant poses significant challenges for policymakers, as traditional tools like adjusting interest rates may not simultaneously address both stagnation and inflation.

Central bank policies, government fiscal strategies, technological advancements, and global economic interactions collectively steer the tides of the business cycle, influencing each quadrant’s unique economic climate. As central banks adjust interest rates, they directly affect liquidity and borrowing costs, thereby encouraging spending during times of lower rates and cooling off an overheated economy with higher rates. Simultaneously, government actions in the form of spending and taxation can either fuel economic growth or impose austerity to rein in inflation. Moreover, technological progress propels productivity, potentially driving growth that does not necessarily trigger inflation, ideally positioning an economy within the second quadrant. Finally, the intricate web of international trade and foreign investments plays a critical role, as these factors integrate domestic economic activities with broader global dynamics, impacting both growth and inflation in complex, often unpredictable ways.

By understanding the driving forces behind each quadrant of the business cycle, traders can better anticipate market conditions and tailor their investment strategies accordingly.

Best and Worst Assets to Invest in Each Quadrant of the Business Cycle:

1. Increasing Growth, Increasing Inflation (Growthflation):

– Best Assets: Commodities, real estate, and stocks in sectors like energy and materials typically perform well as they benefit from rising prices and robust economic activity.

– Reasoning: These assets often see price appreciation in an environment where the economy is strong and inflation is rising, as demand for natural resources and real estate increases.

– Worst Assets: Long-term fixed-income securities, such as long-duration bonds, usually underperform due to the dual impact of rising interest rates and inflation eroding the real returns.

– Worst Sectors: Telecom, Fixed Income, $USD, Tech, Consumer, Industrials

– Reasoning: Higher inflation often leads to higher interest rates, which inversely affect bond prices, especially those with longer durations.

2. Increasing Growth, Decreasing Inflation (Boom) :

– Best Assets: Growth stocks, particularly in technology and consumer discretionary sectors, as these companies can expand margins in a growing, low-inflation environment.

– Reasoning: With stable or decreasing inflation, these sectors can maintain or reduce costs while benefiting from increased consumer spending.

– Worst Assets: Gold and other inflation hedges tend to underperform, as the need for a hedge against inflation diminishes.

– Reasoning: Lower inflation expectations reduce the attractiveness of Gold and similar assets, which do not offer yields or dividends .

3. Decreasing Growth, Decreasing Inflation (Recession) :

– Best Assets: Government bonds and high-quality corporate bonds, as investors seek safety and stable returns in a slowing economy.

– Reasoning: Bonds become more attractive due to their relative safety and the lower interest rate environment that typically accompanies a decelerating economy .

– Worst Assets: Cyclical stocks, such as those in the industrial and consumer discretionary sectors, often perform poorly as they are hit hard by decreasing demand.

– Reasoning: Reduced economic activity leads to lower consumer spending and business investment, which directly impacts the revenues and profits of cyclical industries.

4. Decreasing Growth, Increasing Inflation (Stagflation):

– Best Assets: Tangible assets like Gold, Silver, Bitcoin, and commodities, which can serve as a store of value when currency value deteriorates in real terms.

Best Sectors: Tech, Utilities, Energy, Industrials.

– Reasoning: These assets typically retain or increase in value during periods of high inflation and economic stagnation, offering a hedge against inflation.

– Worst Assets: High-growth stocks and long-term bonds are particularly vulnerable, as stagnant growth hurts corporate earnings and inflation erodes the real value of fixed-income returns.

– Worst Sectors: Credit, Financials, REIT’s. Materials and Telecom.

– Reasoning: In a stagflation environment, the lack of economic growth combined with high inflation creates a hostile environment for both equity and debt investments focusing on growth and fixed returns, respectively.

By understanding these dynamics, investors can better align their portfolios with the prevailing economic conditions, optimizing returns and managing risks according to the phase of the business cycle.

Navigating the business cycle can often resemble trying to chart a course through fog — challenging even for the most seasoned financial professionals. The real-time complexities of economic indicators and their contradictory signals can make pinpointing our exact phase within the business cycle a daunting task. The pragmatic solution, then, is not to dwell excessively on intellectual accuracy about cycle phases but to shift focus sharply towards market performance — identifying the winners and losers. Ultimately, the essence of successful trading and investment isn’t rooted in theoretical correctness but in the timely alignment with prevailing market trends. Being on the right side of the right trend at the right moment is what separates the prosperous from the perennially perplexed in the world of finance. This approach not only simplifies decision-making but also aligns it closely with tangible outcomes, allowing traders and investors to navigate through economic ambiguity with confidence.

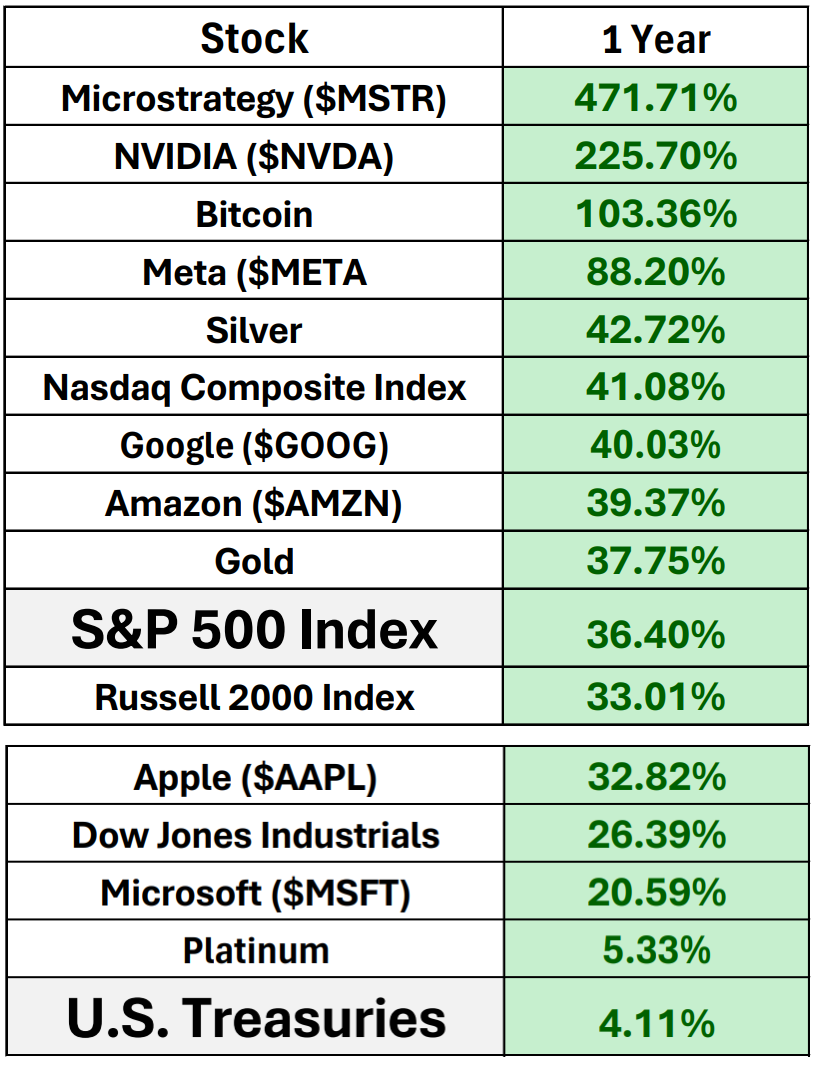

For example, here is a list of some of the top performers over the last 52 weeks.

As you study them, were you aware of these performance metrics?

How did you do in your portfolio over the past 52 weeks?

What is your investment thesis and strategy moving forward?

What I find fascinating about the current environment that we are in is that Gold and Silver are outperforming the major stock market indexes. The Magnificent 7 and Microstrategy are lifting the S&P 500 Index and this is the first positive performance Treasuries have had in the last 4 years.

My thesis is that the Treasury market is uninvestible and that the Fed is buying all the debt to fund the U.S. government and avoid a recession. There might be a great opportunity for a bull market in Treasuries soon, but it is a completely fabricated market brought to you by Jerome Powell and company because no one wants our debt obligations when our debt is increasing exponentially.

Look, no matter how you slice it or how thick your wallet is, there are only a couple of real plays for every investor and trader today. So, what’s your game plan for making your way through the jungle that is today’s financial markets?

Let me lay it out straight—there’s a mad dash to debase our currency, and it’s not slowing down. This wild economic climate is squeezing traders into narrower and narrower time frames as everyone scrambles for a piece of the yield pie.

Real assets? Their prices are only going north as the frenzy for yield cranks up. There’s a deluge of cheap capital inundating the market, and let’s not even get started on the disastrous monetary stimulus — our economy’s guzzling it down like free liquor at a Vegas casino.

Now, here’s the million-dollar question: Do you have the savvy to spot the hottest trends at just the right moment? What’s your master plan to keep your purchasing power from evaporating as this whole circus act keeps escalating?

Can you discern the markets that offer the most tantalizing risk/reward probabilities from the myriad trading options at your fingertips? Imagine wielding the power of actionable intelligence and deploying it with laser-like accuracy. This is the edge that artificial intelligence brings to the financial arena.

Many of the traditional market indicators, developed in the 1970s and 1980s, often miss the mark when it comes to forecasting future market movements. Yet, ponder this: artificial intelligence has triumphed over humans in realms of strategy and intellect like Chess, Poker, Blackjack, Go, and Jeopardy. Why should the realm of trading be an exception? Repeatedly, the machine has shown its superiority over human judgment.

What implications does this have for you as a trader?

I’ve shared my insights that we’re witnessing stagflation in a Presidential election year.

In these uncertain times, the paramount concern for any savvy investor should be the fortification of their portfolio. As we navigate through today’s particularly volatile financial terrain, it becomes crucial to adopt a pragmatic and repeatable system that not only identifies but capitalizes on resilient market trends, particularly those that flourish even during economic downturns.

So, what’s the optimal strategy for not just surviving but thriving in today’s unpredictable markets? The answer is increasingly pointing towards Artificial Intelligence (A.I.) . In an age where market volatility is the only constant, A.I., along with Machine Learning and Neural Networks, has transitioned from being a mere luxury to an absolute necessity. These advanced tools are now essential allies, arming traders with the insights needed to safeguard and grow their investments amidst the chaos.

its ability to learn from failures, remember them, and pivot to find solutions. This Feedback Loop is the cornerstone of every successful trader’s fortune. Embrace it and secure your financial future.

Visit With US and check out the A.I. at our Next Free Live Training.

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.