Today in crypto, Bitcoin’s price in South Korean won plunged after President Yoon Suk Yeol declared martial law in the country, Coinbase CEO Brian Armstrong said the exchange will no longer work with law firms who hire individuals involved in “anti-crypto actions,” and retail crypto trading volume in South Korea reached $18 billion, flipping the country’s stock market amid a frenzy for altcoins.

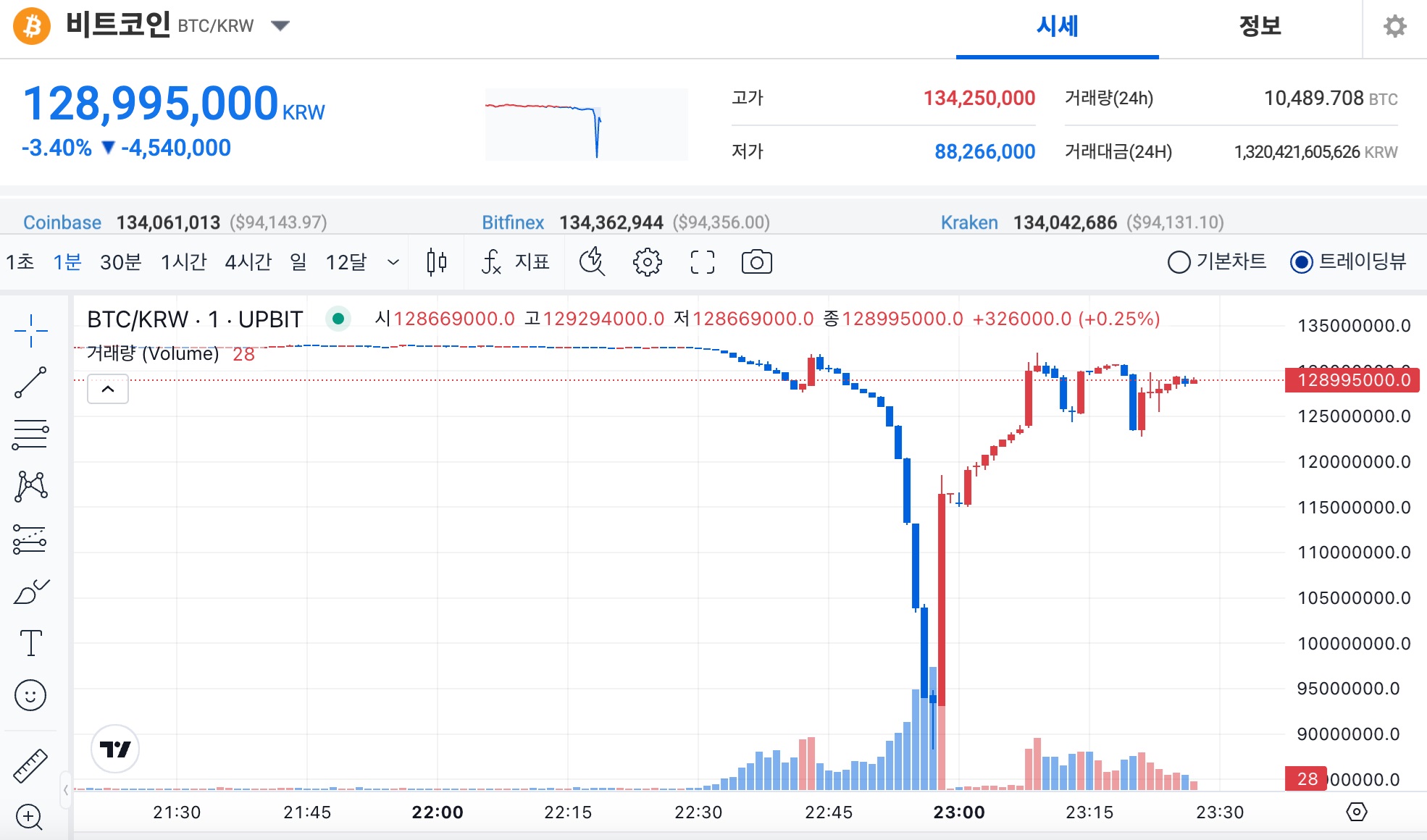

Bitcoin price crashes in South Korea following martial law declaration

Bitcoin’s price on South Korean exchanges plunged on Dec. 3 after President Yoon Suk Yeol declared martial law in the East Asian country.

The Bitcoin-Korean won (KRW) exchange rate plunged from 130 million KRW to 93.6 million KRW following the announcement, according to data from Upbit. This represented a nearly 30% drop.

Yoon’s declaration of martial law came in response to “threats posed by North Korea’s communist forces,” the president said. The measures were intended to “eliminate anti-state elements.”

Yoon also cited attempts by the country’s Democratic Party to remove government officials. Democratic Party leader Lee Jae-myung and others immediately voted to block Yoon’s decree.

“The President should immediately lift the emergency martial law following the voting by the National Assembly,” said Woo Won-sik, the National Assembly Speaker. “Now, the emergency martial law declaration is invalid.”

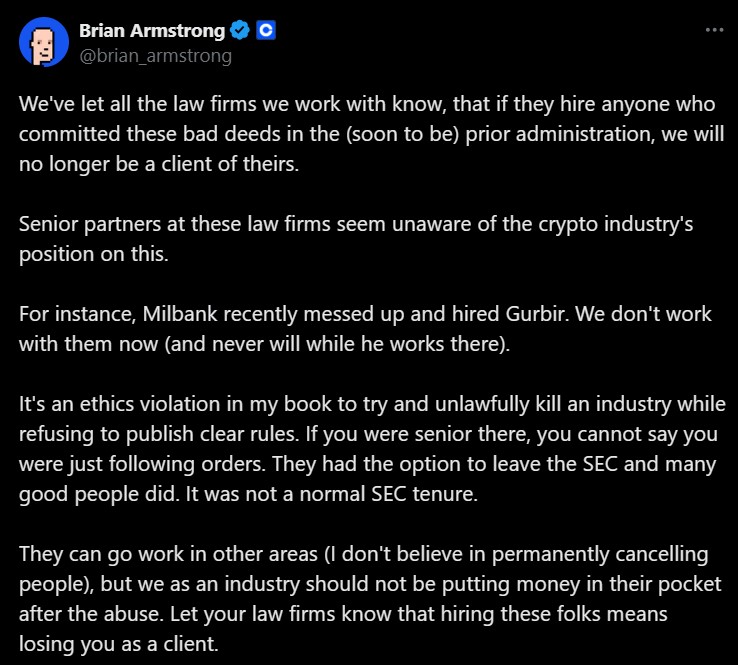

Coinbase will drop law firms who hire anti-crypto former SEC staff — CEO

On Dec. 3, Armstrong said in an X post that Coinbase will avoid law firms that hire people who tried to “unlawfully kill” an industry without clarifying the rules. He urged the crypto community not to support individuals who had worked against the sector.

Armstrong claimed senior partners at law firms are often unaware of the crypto industry’s position on this issue. He encouraged community members to make their law firms aware that hiring anti-crypto officials could result in losing business.

Armstrong said that Coinbase ended its relationship with Milbank after the law firm hired Gurbir Grewal, the former enforcement director at the United States Securities and Exchange Commission.

On Oct. 2, the SEC announced that Grewal would resign from his position at the agency. The securities regulator said that Grewal had recommended over 100 enforcement actions to address “widespread noncompliance” in the digital asset industry.

On Oct. 15, Milbank said it had onboarded the former SEC official to its litigation and arbitration group. Milbank chairman Scott Edelman praised Grewal’s “record of success” as a federal prosecutor and the SEC’s enforcement head.

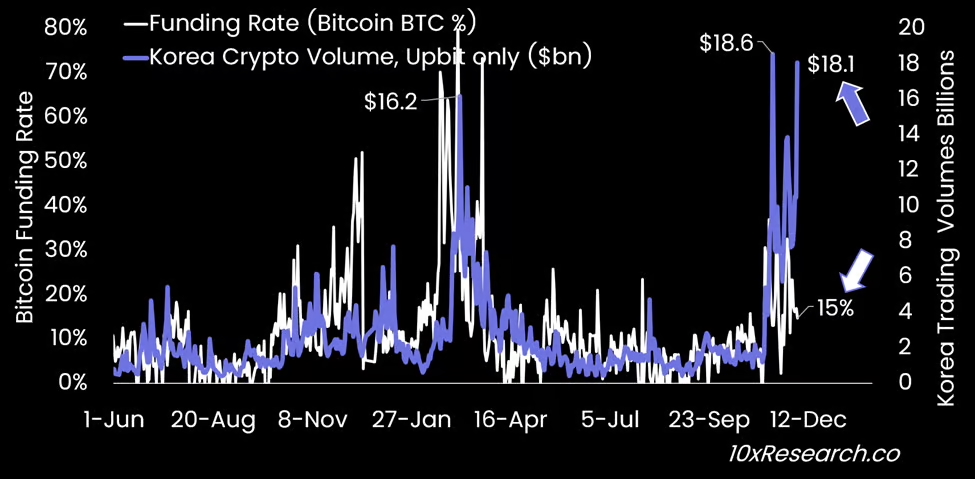

South Korea crypto trading volume hits $18 billion amid altcoin frenzy

Retail trading volumes for cryptocurrencies in South Korea surged to $18 billion in the last 24 hours, outperforming the country’s entire stock market by 22% as local traders frenzy over altcoins including Ripple’s XRP (XRP).

In a Dec. 2 research report , 10x Research founder Markus Thielen said retail crypto trading volumes had reached their second-highest level of the year on Dec. 2, with South Korean traders rushing to buy “high momentum” altcoins.

In the report, Thielen shared that Ripple’s XRP token XRP$2.54 witnessed over $6.3 billion in volume on the day in South Korea, Dogecoin DOGE$0.4091 came in second at $1.6 billion, followed by Stellar XLM$0.512 at $1.3 billion, Ethereum Name Service ENS$39.85 at $900 million and Hedera HBAR$0.3194 at $800 million.

Additionally, Thielen noted that Bitcoin’s funding rate was running at a “relatively mild” 15% — which combined with the uptick in interest for altcoins, suggests that the initial stages of an “alt season” may be well underway.