United States Security and Exchange (SEC) Chair Gary Gensler didn’t invent “regulation by enforcement,” though many in the crypto sector may say he did.

Still, his aggressive regulatory approach, characterized by myriad lawsuits against cryptocurrency and blockchain firms — while at the same time providing little actionable guidance, like no-action letters — will mark his legacy as SEC chair.

As reported, Gensler will be stepping down from the SEC on Jan. 20, when the new presidential administration takes charge in Washington, DC. For many in the crypto sector, this day couldn’t come soon enough.

Tyler Winklevoss recently said no apology could “undo the damage” Gensler has caused to the crypto sector. As reported by Cointelegraph: “Winklevoss argued that Gensler took the regulation-by-enforcement approach to the crypto industry, showing little regard for anyone working in the sector.”

An attorney, who asked not to be identified, told Cointelegraph: “Gensler’s attempt to assert exclusive authority over digital assets and all blockchain offerings and trading activity by simply claiming that all tokens are securities without any real guidance made the US market nearly untenable for blockchain companies.”

On the other hand, there were those outside the cryptoverse who saw Gensler’s approach as simply consistent with enforcement actions taken by US agencies over the past 75 years, especially when it came to establishing guardrails for emerging technologies.

Others counter that even if that were the case, the SEC, under his tenure, took regulation by enforcement (RBE) to a new level. Moreover, he seemed unwilling to explain himself and appeared to want deliberately to sow uncertainty and doubt about the new industry’s core technologies.

Gensler didn’t invent RBE

“Of course, we have seen regulation by enforcement before, and not just from the SEC,” Carol Goforth, Clayton N. Little Professor of Law at the University of Arkansas (Fayetteville), told Cointelegraph.

When a new technology emerges, regulators are often hard-pressed to stay on top of it, she said. They begin by applying existing regulations to the new technology — whether the internet or cryptocurrencies or some other technology.

“And the only way they can do that is typically by providing warnings of their intentions — which the SEC has certainly done — and then by initiating enforcement actions to prove that they mean what they have said.”

“Before the 1960s, federal regulators just didn’t write substantive regulations like those the crypto industry is demanding,” Todd Phillips, assistant professor of legal studies at Georgia State University’s J. Mack Robinson College of Business, told Cointelegraph. “They just brought enforcement actions. The SEC is carrying on a long tradition here.”

Related: Suriname the next Bitcoin Nation? Crypto inspires Parbhoe to fight corruption

The SEC isn’t the only government agency that’s had recourse to RBE. The US Consumer Financial Protection Bureau, for instance, also has been criticized for using this approach where litigation is employed to “introduce or test out novel legal theories and frameworks that could have been the product or subject of legislative or administrative rulemaking.”

What’s different here?

Still, even if regulation by enforcement has long existed in the US and has been used by agencies besides the SEC, that doesn’t necessarily excuse Gensler’s actions. Even if he didn’t invent RBE, he may have misapplied it, or taken it too far, as some say.

“Regulation by enforcement is a tool for regulatory agencies; however, the problem with the SEC’s approach is that it was the only tool it chose to utilize,” Karen Ubell, a partner in law firm Goodwin Procter LLP’s technology group and co-chair of its digital currency and blockchain practice, told Cointelegraph, adding:

“That tool was a sledgehammer designed not just to block progress in the industry, but also used to do a job that actually requires something much more tailored.”

If RBE was meant to provide some regulatory clarity for the crypto/blockchain sector, it hasn’t succeeded, said Goforth. There remains a sort of “disconnect” between what the SEC says is clear, and what others see when they look at crypto assets, she said.

“The fact that we still do not have a clear path to compliance for businesses and that there is disagreement at the court level as to how existing rules and regulations should apply to crypto, suggests that new rules or regulations might be a more effective way to proceed,” Ubell said.

Lawsuits will continue even with Gensler gone

Others say that the SEC didn’t have a choice but to act as it did. The agency doesn’t have the legal authority to write regulations that define which crypto assets come within the scope of securities laws, and which do not, according to Phillips, who added:\

“If the SEC thinks that some crypto assets are securities that are being sold illegally, its only option is to bring enforcement actions like it’s been doing.”

So Phillips diverges with those in the cryptoverse who say that Gensler has brought a “reign of terror” against the industry? “The SEC is simply bringing targeted enforcement actions under the securities laws, as it has been instructed by Congress to do,” he said.

Moreover, if the SEC hadn’t brought these lawsuits, private parties would have. “There have been many lawsuits brought by purchasers of crypto assets alleging that the tokens were securities, and even after Gensler is gone, we’re still liable to see those lawsuits continue,” Phillips added.

Goforth agreed that private parties would still bring lawsuits even if the SEC didn’t, especially in instances of fraud, market manipulation or other misconduct in connection with a particular crypto asset or platform, adding:

“But that would be a more even playing field than having to defend against a regulator that has essentially unlimited assets that it has often brought against small or already failing or failed businesses.”

Still, Stephen Diamond, an associate professor of law at Santa Clara University, disagreed that there was anything problematic about whether a transaction is considered a security under federal law based on the Supreme Court’s 1946 Howey decision.

Howey provides a “simple, clear, straightforward” test that is still relevant and useful — even in the age of crypto and blockchain, he told Cointelegraph.

Indeed, he denies that regulation by enforcement exists, calling RBE “a myth.” What Gensler has done is simply enforcement, applying the Howey test to the crypto assets sector — and for doing that the crypto industry has “targeted him unfairly, abused him.”

Gensler, in Diamond’s view, has, in fact, done an “exemplary job” as SEC chair, acting in a manner consistent with 75 years of US securities enforcement history.

Ubell argues that the SEC has done little during Gensler’s tenure to provide regulatory clarity to what is a new asset class — even with all its lawsuits:

“The only other guidance provided by the SEC was statements from Gensler and his predecessor along the lines that every token is a security when in reality tokens can represent almost anything and to make such a broad, all-encompassing statement about a category of wide-ranging assets requires a more nuanced analysis and left far too much to interpretation.”

Among actions the agency could have taken other than enforcement were no-action letters, compliance and disclosure interpretations, staff-written legal bulletins, additional 21A Reports “or other tools that SEC staff commonly uses to provide guidance on novel and nuanced topics.”

Should the US follow MiCA’s lead?

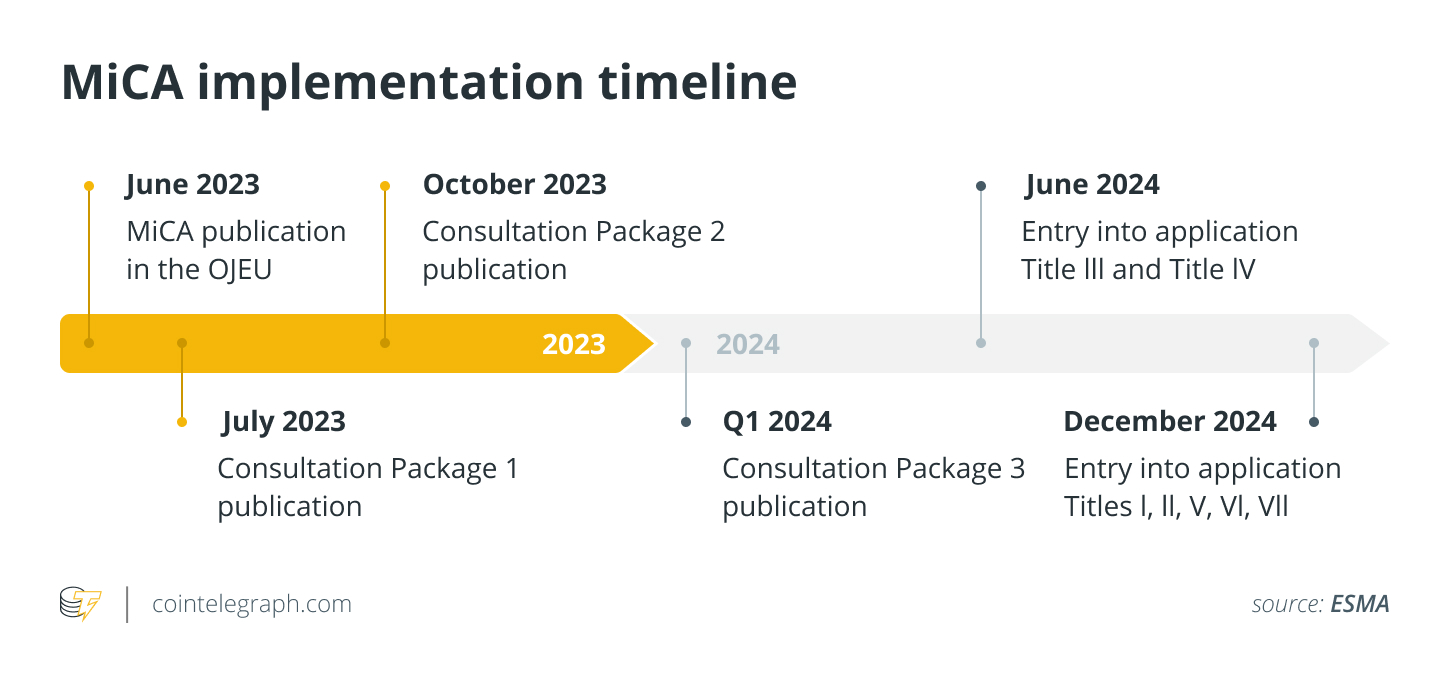

Would everyone stand to gain if the US created rules and regulations to govern crypto and blockchain markets along the lines of what the European Union has done with its MiCA process? Europe arguably hasn’t had recourse to a regulation-by-enforcement approach.

“In Europe, the focus has been more on creating detailed regulatory frameworks, such as the Markets in Crypto-Assets Regulation (MiCA), rather than relying on enforcement to shape compliance,” Annabelle Rau, an attorney at McDermott Will and Emery (Germany), told Cointelegraph.

Recent: ‘ Science needs an update’: How DeSci can fix junk science and cure baldness

“I sincerely hope that we will see reasonable regulation of crypto asset transactions in the foreseeable future,” said Goforth. “Reasonable information should be required before crypto assets can be sold, but regulation should not be used to drive business away from the US or deprive US citizens of the right to decide for themselves whether or not to invest in any particular asset.”

The crypto industry would like to see legislation along the lines of FIT21 or even a comprehensive regime under the oversight of the Commodity Futures Trading Commission, said Phillips, adding, “While many progressives want to just give everything to the SEC.” All this will have to be sorted out.

Some action must be taken, Phillips said. “If Congress doesn’t step in and address the application of the securities laws to crypto assets, the courts are going to do it instead.” He added that “having the courts decide this issue once and for all just isn’t an outcome that anyone wants.”