BRASILIA (Reuters) - Brazil's currency weakened on Monday (NASDAQ: MNDY ) as President Luiz Inacio Lula da Silva's administration postponed the release of long-awaited spending-containment measures, despite earlier signals of an imminent announcement.

The real fell about 1% against the U.S. dollar, extending its decline for the year to over 16%.

The currency's drop, which raises import costs and adds to inflationary pressures, follows the government's hesitation to announce a fiscal package to curb the rapid rise in mandatory spending following Finance Minister Fernando Haddad's suggestion that this would happen last week.

Since then, however, the government has offered no concrete timeline for the announcement, with Lula holding a series of meetings with his economic team and ministers from other areas likely to be affected by budget cuts.

"The inflationary impact of a weaker currency is severe and is already affecting market expectations," said Paulo Gala, chief economist at Banco Master.

"A spending cut package would help with this, it would help reduce the risk premium on long-term interest rates and the exchange rate," he noted, adding that Donald Trump's victory in the U.S. presidential election is another significant factor fueling inflationary pressures ahead.

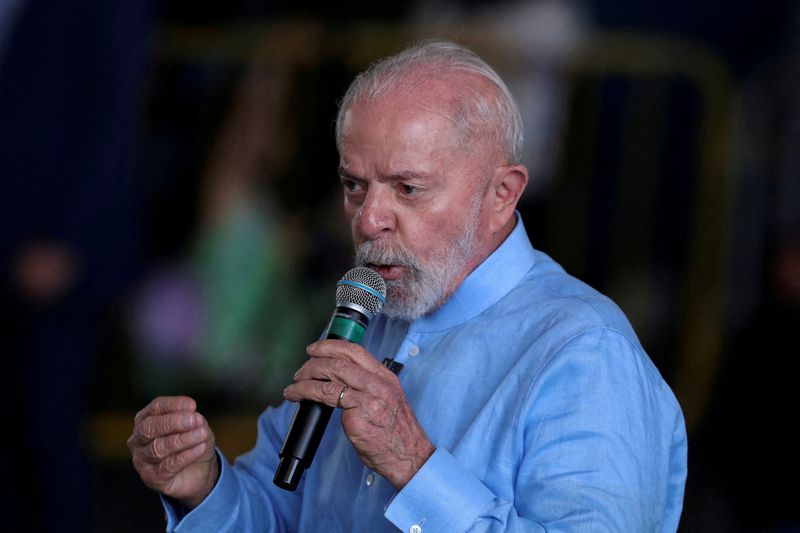

In a television interview on Sunday, Lula pledged to counter the "speculative greed" of financial markets, adding that Congress and the judiciary should also contribute to spending cuts.

Last year, Lula approved a new fiscal framework combining primary budget targets with a cap allowing for spending growth up to 2.5% above inflation.

But certain expenditures, such as pensions and some social benefits, have been rising much faster, squeezing other budget items like investments and operational costs under the overall spending cap.

Economists and some government officials acknowledge this trend could jeopardize the fiscal framework's sustainability over the coming years, impairing its capacity to stabilize public debt growth.

“This spending cut package is necessary. It has to happen, regardless of any delay,” former central bank chief and finance minister Henrique Meirelles said.

Speaking at an event in Sao Paulo, however, he expressed doubt that the initiative would be enough to ease concerns over the growth of public debt, which he described as “unsustainable”.