Defining “normal” is an elusive quest for traders. For traders, establishing what constitutes normal market behavior is essential; it is the baseline against which the abnormal—and potentially profitable—can be identified. However, this task is fraught with challenges. Markets are dynamic entities influenced by myriad factors including economic indicators, political events, and collective trader psychology, all of which can shift the parameters of normalcy. In finance, unlike in controlled scientific environments, the variables are vast and the conditions ever-changing. This article delves into why, especially in current times, the concept of normalcy in financial markets demands greater attention and a more nuanced approach. We are navigating through an era that is anything but normal, making the understanding of these benchmarks not just an academic exercise, but a necessary tool for any savvy trader.

Our leaders continue to champion a narrative of economic strength and resilience, citing robust employment figures, growing GDP, and lower interest rates as indicators of prosperity. However, despite these optimistic proclamations, the reality on the ground often paints a different picture, making it hard to reconcile this supposed strength with the economic challenges many people face daily. This discrepancy leads to the unsettling conclusion that much of the economic reporting might be more about painting a rosy picture than offering a true reflection of the underlying economic conditions.

The bankruptcy of True Value, a venerable name in the hardware industry, flies in the face of the narrative that we are living through a period of strong economic resilience. How can an economy truly be labeled as thriving when longstanding pillars are crumbling? This event is emblematic of a broader economic malaise that lurks beneath the surface of stock market highs and low unemployment figures. It raises serious questions about the sustainability of growth that fails to protect even the most traditional of businesses. True Value’s downfall is a clear signal that the real economy might not be as healthy as some would have us believe

The recent announcement that Walgreens is closing 1,200 stores, with an additional 800 under evaluation, sharply contradicts the narrative of a strong and resilient economy that leaders often promote. Such a significant reduction in Walgreens’ store footprint highlights underlying weaknesses in the retail sector and broader economic challenges that are not reflected in the optimistic economic indicators touted by officials. This extensive closure speaks volumes about the real health of the economy, indicating that major retailers are struggling to stay afloat in what is purportedly a flourishing economic environment.

Understanding the compounded annual rate of growth (CAGR) of an asset is pivotal in the financial world, especially when evaluating investments over extended periods. This metric offers a smoothed annual rate that accounts for the volatility of market cycles, encompassing both bull and bear phases. By reflecting the geometric progression ratio, CAGR provides a clear picture of an investment’s return on a year-to-year basis, normalized over the duration of the investment. This is crucial because it allows investors to compare the efficacy of various investments without the misleading effects of short-term volatility. In essence, CAGR serves as a leveling tool that brings disparate time frames and volatile market conditions to a common denominator, offering a more accurate reflection of long-term financial performance. This normalization makes it an invaluable metric for assessing the long-term viability and profitability of investments, helping strategists and investors to make informed decisions that align with their financial goals and risk tolerance.

Let me share some metrics that I focus on.

From January 1950 to October 1987 (Black Monday) the Dow Jones Industrial Average increased 889%, which amounts to a compounded annual rate of return of 6.26% every year over that 37-year period. This is often considered the golden age of stock market investing,

From Black Monday in October 1987 to the Great Financial Crisis the Dow Jones Industrial Average increased by 333% in 21 years which is an annual growth rate of return every year of 7.23%. This is substantially higher than the previous time frame.

From the Great Financial Crisis to today the Dow Jones Industrials have increased 410% in 16 years which is a growth rate of 10.72% compounded annual rate of return.

The first realization I had when looking at these values is who would’ve thought after these significant meltdowns that the stock market would advance so quickly?

At this point I could start singing the chorus of “Happy Days are Here Again” or we could try to better comprehend why this is occurring and why it will continue to accelerate moving forward.

Notice anything out of the ordinary in that progression? The annual compounded rate of return of the Dow is currently 71% higher than in the first 37-year period and 49% higher than the second 16-year period.

This is clearly not normal.

When the compounded annual growth rate grows exponentially it would empower you to know what is driving that expansion.

In other words, the rate of growth of DOW is exponentially faster than any other long term time frame in history. Believers will tell you that this is because of the rapid technological change in society and culture.

I consider that to be the utmost in propaganda. It would be much more honest to point out that as the value of the U.S. dollar goes down compared to goods and services the value of the stock markets accelerates higher.

Let me explain.

Since I was 10 years old and first learned about investing, I became enamored with the idea of becoming a millionaire. That used to be the American Dream after all. Make a fortune and then retire and live off the interest rate that you can earn by placing your wealth in safe assets.

The problem with that idea is that the Fed and U.S. Treasury put an end to that dream when currency devaluation became the norm along with fiat currencies.

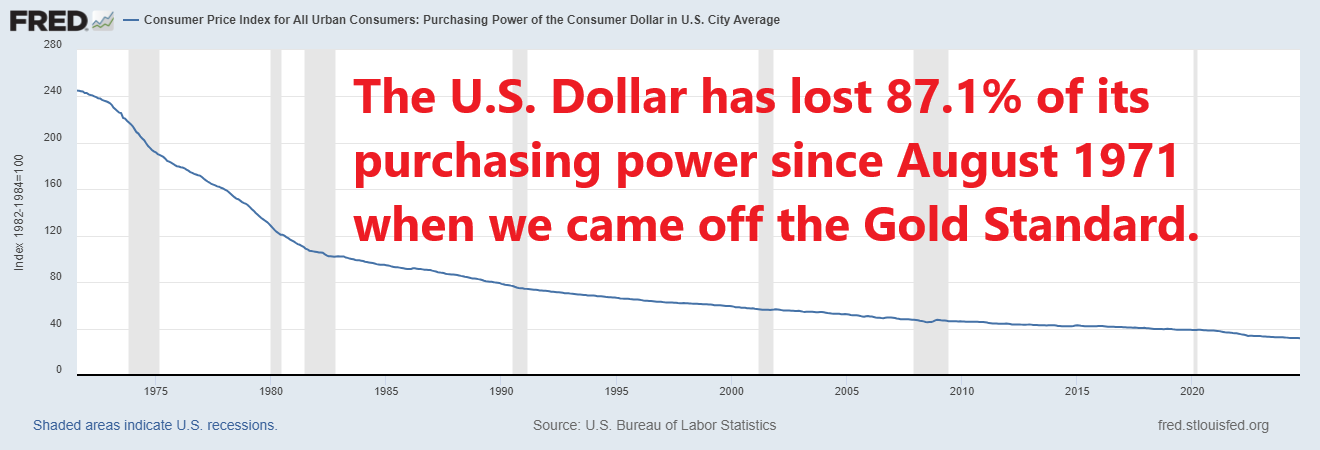

Most people and traders are completely unaware of the persistent currency devaluation which has become the norm in financial circles. One million U.S. dollars in August 1971 would have to be worth $9.7 million today to maintain purchasing power. This reality explains why everything costs more because the value of the currency continues to be debased.

More importantly, it also explains that while you may be earning more, it is not keeping up with the cost of living. So, we have two stories unfolding the “haves” which are asset-rich, and the “have nots” which are asset-poor.

The preference for a strong currency among citizens presents a real conundrum for the government, particularly in today’s economic climate where high interest rates are essential to bolster currency strength but are a double-edged sword for government fiscal health. High interest rates, while beneficial in strengthening the currency and reducing inflation, make government borrowing costlier, potentially leading to a dire fiscal predicament where servicing existing debt becomes unsustainable. For traders and investors, this scenario demands a sophisticated understanding of the interplay between economic policies and market dynamics. Observing every shift in policy or economic indicators is crucial, as the government is more likely to prioritize manageable interest rates over maintaining a strong currency to prevent a financial crisis. This insight is vital for making informed decisions in the financial markets.

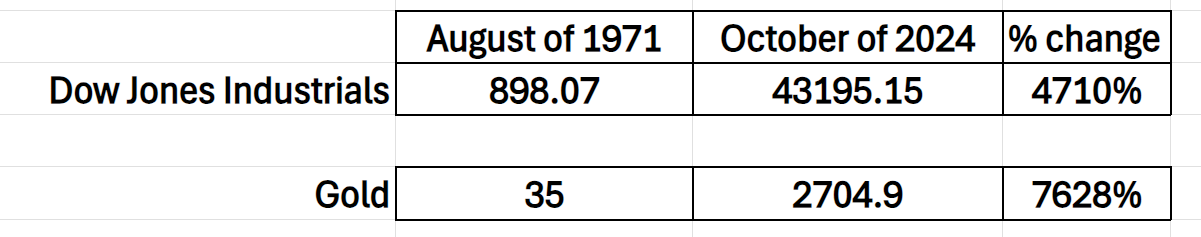

Let me share with you a graphic which keeps me sane during difficult financial times. Here is a snapshot of how the Dow Jones has performed since August 15, 1971, compared to the price of Gold.

Since President Nixon took the U.S. off the Gold Standard the price of the Dow Jones Industrials has increased 4,710% over the last 53 years.

What is a sobering reality though that you won’t hear discussed on Bloomberg TV, CNBC, or Fox Business that over the same time frame the price of Gold is up 7,628%!

What used to be money has outperformed the DOW Industrials by 62%!

This fact by itself should speak volumes on how ineffective the Federal Reserve has been in managing the economy over the last five decades.

As I have explored in previous articles, the national debt crisis is a ticking time bomb set to unleash a significant financial upheaval, or what we might call ‘the great melt-up.’ In today’s analysis, I delve into why the powers-that-be have chosen the path of exponential inflation rather than deflation. Let’s be clear: the goal here isn’t to frighten, but to inform. Forewarned is forearmed. With exponential inflation on the horizon, unlike deflation, the preparation strategies are markedly distinct and absolutely essential.

Let’s dissect why exponential inflation is more palatable to our government and the Federal Reserve than deflation. Fundamentally, it boils down to a pervasive spending problem among our politicians. The federal government consistently outspends its revenue, amassing an unsustainable debt load. Recognizing the impossibility of repayment, the Treasury, in concert with the Federal Reserve, has resorted to massive currency printing—triggering inflation. Currently, as our deficit and interest payments on the debt surge, inflation follows suit. For those who believe inflation is tapering off, I would caution against complacency. We might just be in the calm before the storm.

We are at a crossroads with two potential fiscal policies: significant cuts leading to deflation or continued excessive spending driving us towards exponential inflation. I argue we have all witnessed exponential inflation for decades. The challenge moving forward is that it will accelerate, and it will drive asset prices much higher.

Consider the political implications of austerity: to balance the budget, the government would need to cut $2 trillion annually, with Social Security alone costing $1.5 trillion. Proposing to eliminate such a vital program would alienate 72 million Americans who rely on these payments, effectively ending any politician’s career. It’s apparent why our leaders won’t choose deflation — it’s politically disastrous and economically insufficient.

Try and envision a scenario where the government cuts every expense by 40% to balance the budget — Social Security, Medicare, Defense, Health Care, Education — all reduced significantly. It’s a rational but extremely harsh approach. The political implications? They are profound. Such widespread cuts would be wildly unpopular and politically destructive.

It’s evident why our politicians steer clear of proposing massive spending cuts as a solution to deflation. It’s simply not feasible in a political context.

Consider the implications of severe government cutbacks combined with a halt in Federal Reserve printing — this would likely lead to deflation and an economic depression, with a significant drop in asset prices. The majority stake in these assets is held by the Super Rich. It’s counterintuitive for them to support policies that would devalue their holdings and reset their financial gains. Alternatively, exponential inflation represents a more appealing scenario for the wealthy. Under such conditions, asset values, from equities to real estate, would not just stabilize but potentially skyrocket, further entrenching the wealth of the affluent while the middle class and asset-less find themselves further marginalized.

In the context of exponential inflation, there’s a distinct advantage for the Super Rich that’s often overlooked. When the Federal Reserve injects trillions into the economy, the distribution of this money is far from equitable. The financial elite not only access this money first but also receive a disproportionately larger share. This inequity is evident in the comparison between typical stimulus measures for the public and the substantial financial support provided to the wealthy through various programs. This dynamic not only exacerbates wealth inequality but also serves as a political strategy, with politicians using the promise of more money to garner votes, all while downplaying the inflationary consequences.

In the context of exponential inflation prices, as long as an owner of real estate can maintain a job it will become easier for them to pay down their mortgage. Their real estate will increase in value because the currency continues to be devalued. Their salary will not keep pace with inflation, but the illusion of prosperity will prevail. This is the same predicament facing the federal government.

Or consider a world where deflation hits hard, slashing prices and costs by 50% overnight. Economically, this sounds like a relief, but the reality is far grimmer. Imagine your salary is cut in half, yet you’re still staring down a $300,000 mortgage. What seemed manageable yesterday becomes an insurmountable challenge today. This scenario extends to our national debt. In a deflationary environment, the real value of debt inflates, making it increasingly difficult for the government to manage its financial obligations. It’s a stark reminder of the double-edged sword that is deflation.

Here’s the hard truth: for the decision-makers — the Super Rich — We’ve been deferring this fiscal reckoning for decades, and now what’s left isn’t much of a path at all, but rather a precipice. Detractors have long argued that the predictions of economic collapse were exaggerated; however, their analyses lacked insight. Consider an individual swamped with debt; eventually, the creditors come calling. Similarly, the U.S. is nearing a point with its

runaway deficits and debt where something’s got to give. Though exponential inflation growth is not expected to hit its stride until around 2040, the anticipated insolvency of Social Security by 2033 could accelerate this crisis. We are on a dangerous path that demands attention.

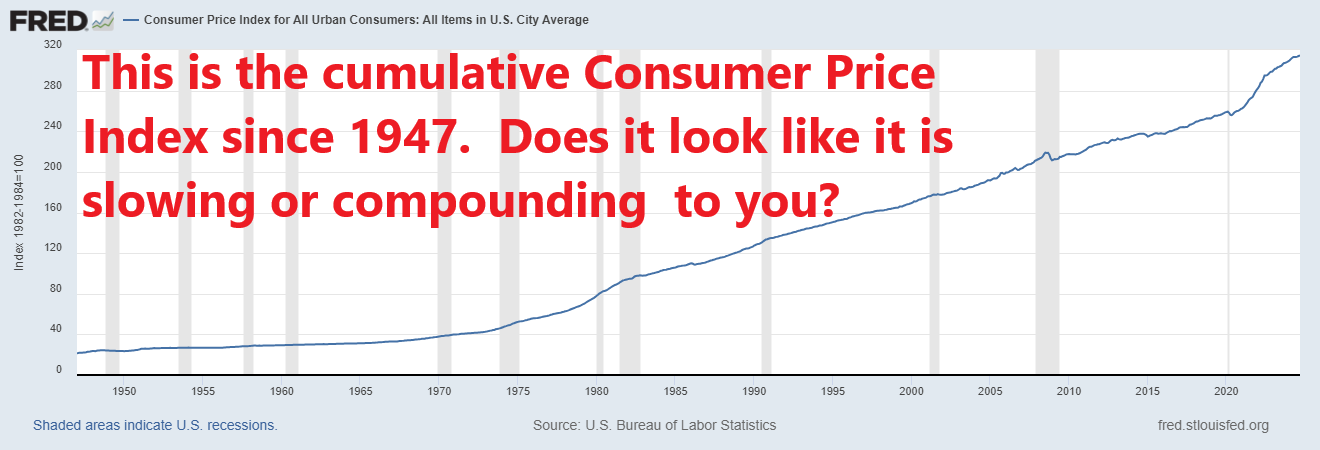

The devaluation of money over time is an economic reality that’s both profound and persistently misunderstood. In essence, if the value of money decreases by a consistent percentage annually — regardless of whether that’s as high as 10% or as low as 0.1% — we are witnessing an exponential decay in purchasing power. This pattern means that with each passing year, the money in your wallet buys less and less, accelerating in its loss of value as the years stack up. It’s crucial to recognize this trend because, although annual inflation rates may see some variability, the long-term trajectory generally adheres to a steady rate of decrease. This consistent erosion is what lays the foundation for economic policies and personal savings strategies alike.

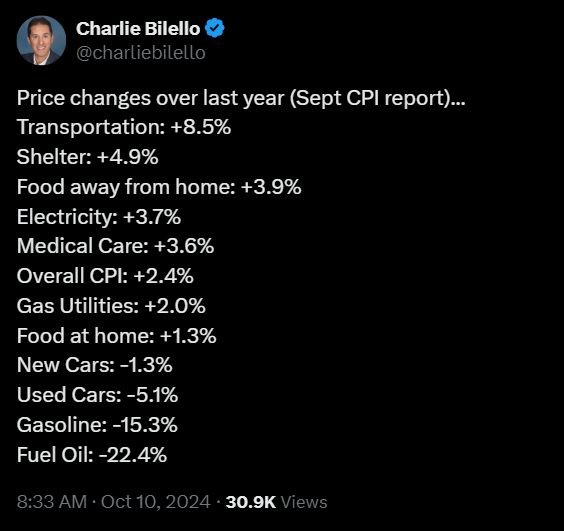

The Fed and Treasury are taking a victory lap when the last Consumer Price Index report came in at 2.4%. Imagine that. Cheerleaders in the financial media are beside themselves that the Fed has won the inflation battle.

Let’s get real. The Consumer Price Index is not reflective at all about what is taking place in the economy. If I were to weigh the items in the following graphic 5 times heavier than the positive values, I could show that the CPI was at zero % over the past year. How often do you buy a new car? How often do you buy a used car?

Your understanding of history will always depend upon where your starting and ending points are.

This exponential inflation has forced a disconnect between what is happening in the economy and what is happening in the financial markets. Asset prices are going up because the currency value is going down. It is slightly more complicated than that, but not by much.

The government needs a weak currency to survive.

As more currency is printed and demand remains constant the currency is projected to become weaker.

Anything priced in a weakening currency goes up in price.

As you see asset prices increase in value, is it because of strength in the economy? Greater demand? Or a weakening currency?

The government has one play left in the playbook – accelerate the debasement of the currency. Prepare accordingly.

As a trader it is imperative that your best interests and those of the government diverge greatly.

I would urge you to be highly skeptical of government reporting.

I would urge you to recognize that in an age of persistent currency debasement what was once considered normal, is now antiquated.

When Gold, which used to money, is massively outperforming the top stock market indexes it should lead you to rethink how you protect your wealth moving forward.

In this roller-coaster year of 2024, where volatility isn’t just a buzzword but our daily reality, the secret to success is staying proactive, not reactive. You can’t just sit back and hope for the best. As I’ve laid out in this piece, we’re grappling with risks and market distortions like never before, all thanks to skyrocketing debt and persistent currency debasement.

The decision-making landscape today is fraught with complexities that defy simple logic. This isn’t the time for wishful thinking; it’s the time to embrace cutting-edge technologies like artificial intelligence trading software.

A.I. and neural networks, with their ability to crunch vast amounts of data and derive actionable insights, are crucial in navigating these treacherous financial waters. So, ask yourself, are you making the most of this technology?

What has been your track record since the Great Financial Crisis? Is your portfolio matching the Dow’s performance of up 410%?

So, don’t just sit around waiting for the Fed to do the hokey pokey. Get yourself informed with the top-notch insights the A.I. trading software can provide. I mean, seriously, if A.I. can thrash humans at poker, chess, Jeopardy, and Go, what makes you think trading is any different?

It is essential for your financial protection that you position yourself correctly in the right financial assets moving forward.

Knowledge, my friend. It’s power, and A.I.? It’s the key to unlocking that power and using it to your advantage. So, go out there and make those savvy moves. Your financial future will thank you. Join us for a FREE Live Training.

We’ll show you at least three stocks that have been identified by the A.I. that are poised for big movement… and remember, movement of any kind is an opportunity for profits!

Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind. Intrigued? Visit with us and check out the A.I. at our Next Live Class.

Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

It’s not magic. It’s machine learning.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.