The turkey’s long digested, parties have dwindled down and presents sit firmly in the past. Seasonal joy may see a downturn come January, but should we expect a bull run in stocks to lift the spirits? In this article we’ll explore what the January Effect is, its historical relevance, and how to analyze stocks at this time.

What is the January Effect?

The January Effect is a seasonal phenomenon describing the perceived uptrend in stock prices in January. But is it real? Well, a historical trend does indeed exist; for example the Nasdaq 100 has seen January prices rise 31 out of 48 times over the course of the month since 1972.

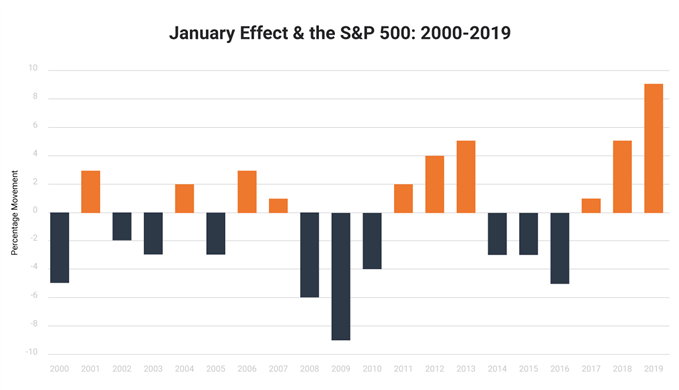

While the more recent trend has been less pronounced across major markets, the last three Januarys have seen uptrends for the likes of the S&P 500 , DAX 30 and Shanghai Stock Exchange (SSE) (see table below). Some have pointed to a pattern of smaller stocks outperforming large ones, but others believe the January Effect is more accurately ascribed to generally depressed stocks regardless of company size.

What causes the January Effect?

The January Effect, when observed, is often said to be prompted by December selloffs that are driven by tax-loss harvesting to offset realized capital gains. The resulting depressed prices of assets is seen in the view of some as an attractive buy proposition at the start of the year.

January stock market trends may also be explained in part by investors putting their seasonal bonuses into stocks, while another influence is likely to be investor psychology; many will be looking to build new portfolios in the new year.

Example of the January Effect on Stocks

The extent to which the January Effect has impacted a selection of major stock indices in recent years can be seen in the table below. For each year, the index's price is measured from the open on the first trading day to the close of the last trading day in the month of January, and the percentage increase or decrease over that time period is shown (to the nearest full percentage point).

As can be seen in the table, the S&P 500 , DAX 30 and the SSE have seen their price rise in January in ten of the last 20 years, the FTSE 100 seven, and the Nikkei 225 six, although all of these assets had seen a January rise in 2019.

January Stock Trends Over a 20-Year Period

| S&P 500 | FTSE 100 | DAX | Nikkei | Shanghai | |

|---|---|---|---|---|---|

| 2000 | -5 | -9 | -2 | +3 | +12 |

| 2001 | +3 | +1 | +6 | -0 | -0 |

| 2002 | -2 | -1 | -1 | -6 | -9 |

| 2003 | -3 | -9 | -5 | -4 | +10 |

| 2004 | +2 | -2 | +2 | -0 | +6 |

| 2005 | -3 | +1 | -0 | -1 | -6 |

| 2006 | +3 | +2.5 | +5 | +2 | +8 |

| 2007 | +1 | -0 | +3 | +0 | +2 |

| 2008 | -6 | -9 | -15 | -10 | -16 |

| 2009 | -9 | -6 | -11 | -11 | +8 |

| 2010 | -4 | -4 | -6 | -4 | -9 |

| 2011 | +2 | -0 | +1 | -1 | -0 |

| 2012 | +4 | +2 | +9 | +3 | +4 |

| 2013 | +5 | +6 | +1 | +5 | +4 |

| 2014 | -3 | -3 | -3 | -8 | -4 |

| 2015 | -3 | +3 | +8 | -0 | +1 |

| 2016 | -5 | -2 | -7 | -7 | -27 |

| 2017 | +1 | -0 | +1 | -1 | +2 |

| 2018 | +5 | -2 | +2 | +0 | +5 |

| 2019 | +9 | +4 | +7 | +6 | +3 |

How to analyze the January Effect

Analyzing the January Effect begins with identifying the stocks that have the potential to dip around the holiday season. At the end of the calendar year, dips are often caused by tax-loss selling – when retail investors sell losing stocks in December to offset capital gains liability – but also by the usual fundamental drivers that affect stocks all year round. Such depressed stocks can potentially be capitalized on by savvy investors; although picking stocks of course carries a significant degree of risk .

January Effect FAQs

Is it just the month of January that has different stock market returns?

It is not only January that can see different stock market returns. According to data from the S&P 500 since 1928, January shows an average 1% return, but this is outperformed by the likes of March (1.2%), April (1.5%) and November (1.5%). September is traditionally a down month (-0.5%), so it may be wise to also consider these seasonal patterns.

Past performance is not indicative of future results.

How can I manage risk while trading stocks during January?

Effective risk management is essential to trading, and no more so than when stock market volatility kicks in. Ensure you protect your account by determining the right stop loss levels, keeping a diverse portfolio, managing emotions and maintaining a positive risk-reward ratio.

What essential knowledge of stock trading do I need to prepare for the January Effect?

Trading the fundamentals may equip you better for any January spike that may arise. This involves researching the company’s financial health, including revenues, future growth potential, and profit margins, as well as other factors such as market share, key staff appointments, and more. Having a handle on these things will allow you to understand a company’s share price movements and put you in a stronger position to predict future swings.

Further reading on stock trading

Looking to broaden your stock portfolio? Why not boost your equities knowledge with our helpful articles.