-

View Larger Image

“There are three types of people in this world: those who make things happen, those who watch things happen, and those who wonder what happened.”

– Mary Kay Ash, the founder of Mary Kay Cosmetics

One of the fascinating things about watching markets is the act of deciphering market signals. Sometimes it is very clear. Sometimes it is very hazy. When those moments of clarity exist and occur there is always huge excitement that you are witnessing the birth of a potential life-changing trend.

Let me explain. As I provide my understanding, I want to emphasize I’m not creating political commentary. As a trader my only loyalty is to the trend. Trends come and go. But when massive trend changes occur it behooves us all to pay attention and to not let an ideology obstruct opportunity.

It’s often quite challenging to understand the birth of a new trend. When it occurs, the changes are very subtle and almost unnoticeable.

In the world of trading, the real action isn’t about predicting election outcomes—it’s about tracing the movement of money. That’s where the true profits lie.

If there’s one thing Wall Street despises, it’s uncertainty. This past weekend has brought a surge of confidence regarding the forthcoming election’s outcome.

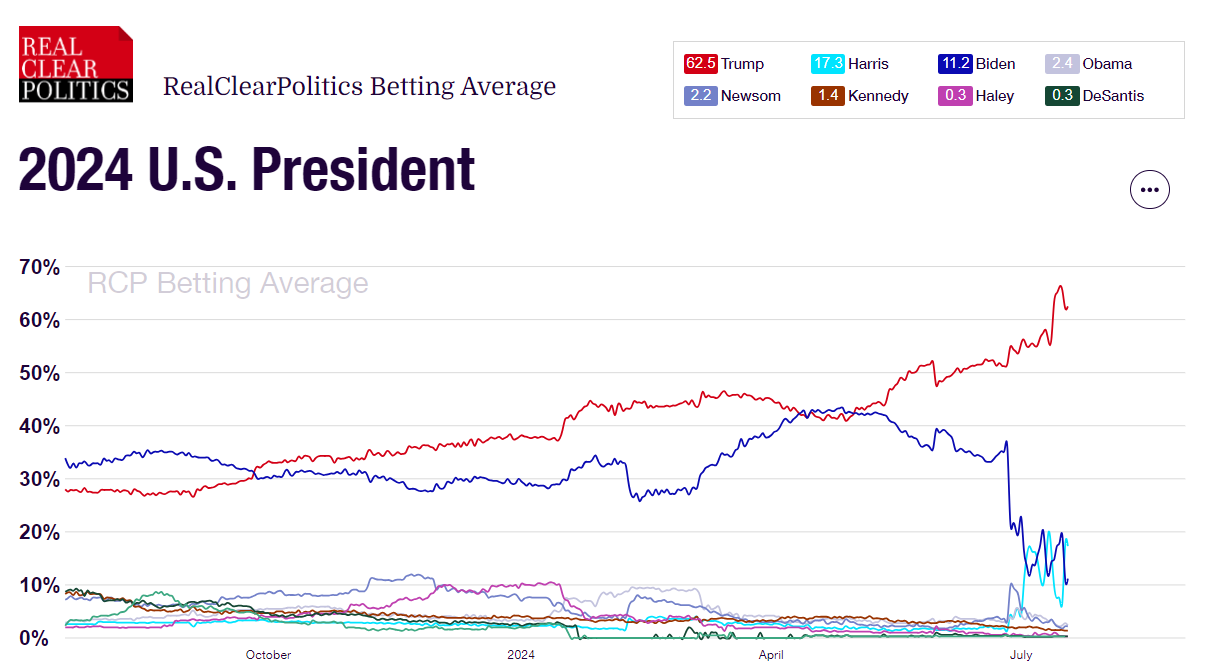

With the odds now strongly favoring a Trump victory in 2024, a critical shift is taking place—something investors need to be acutely aware of: the “Trump Trade” is back in play, with a strong focus on cyclical stocks.

Following the incident in Pennsylvania, betting markets have sharply increased the odds of a Trump win, propelling his chances to nearly 64%.

To understand the implications, let’s take a trip down memory lane. When Trump shocked the world with his 2016 victory, we witnessed dramatic market movements. His financial policies—characterized by deregulation and a pro-small business stance—set the stage for a remarkable rally in small-cap stocks.

Reflecting on the aftermath of the 2016 election:

– One-week post-election, small-caps surged by 9%, while the NASDAQ 100 slipped by 0.8%.

– A month later, the $IWM a Russell 2000 proxy ETF skyrocketed by 16.1%, compared to a mere 1.2% gain in the NASDAQ 100.

These historical trends are not just a relic of the past; they are shaping today’s financial landscape.

The current market behavior bears all the hallmarks of the Trump Trade from eight years ago. Let’s delve into some compelling data.

Now, let’s bring this to the present. The recent leadership in the small-cap sector mirrors the Trump Trade perfectly. This rotation, which began on July 11, coincides with a fresh low in the CPI reading and the rising odds of a Trump 2024 victory.

From July 11 through mid-morning on July 16, the top-performing S&P Small Cap 600 sectors are:

– Financials, up 9.42%

– Industrials, up 9.09%

– Consumer Discretionary, up 7.88%

– Health Care, up 7.29%

– Materials, up 7.05%

In contrast, large-cap Information Technology and Communication Services sectors have lagged, down -2.3% and -3.13%, respectively.

On Wall Street over the past few weeks, it is my conviction that the markets are adapting to a very high probability of a second Trump Presidency. I listen to a lot of podcasts, read a lot of articles, watch a lot of market price action and my observation is that Wall Street is front running and positioning themselves in front of what they anticipate Trump 2.0 policies will be. Whether you like or hate “The Donald,” if you watch the way money is flowing in markets some fascinating trends have begun to emerge.

Here is a chart of the Russell 200 Index. The Russell 2000 Index, which measures the performance of the 2,000 smallest publicly traded companies in the Russell 3000 Index, currently has a total market capitalization of approximately $2.9 trillion as of its latest reconstitution in 2024.

The Russell 2000 is widely used to gauge the performance of small-cap companies, which typically have a market capitalization of less than $2 billion. The largest company in the Russell 2000 has a market cap of around $7.1 billion, while the smallest company has a market cap of about $150.4 million.

What is worth noting and remembering about the Russell 2000 Index is that over the last 10 years it has had an annual compounded annual growth rate of 3.46%! When you compare this rate of growth to the S&P 500, the Nasdaq, or the Dow, the Russell has not participated in the recent bull market at all. As a matter of fact, you can see in the chart that it is still trading below the ten-year highs which were posted in 2021. It is the only major stock index that has not performed well over the past several years.

Using the governments Consumer Price Index statistics over the last ten years the average inflation rate in the United States has been almost 3% indicating that the Russell 2000 has barely kept pace with the level of currency debasement that has been occurring.

But look at the chart below of the Russell 2000 Index over the past two months.

Observe that the market was in a consolidating to slight downward trend. Look at where the market was on the date of the First Presidential Debate. And then try and provide a reason for why a market with a Compounded annual Growth rate of only 3.46% over the last 10 years makes an 11% move in 5 trading sessions. Wall Street is betting on the smaller capitalization stocks who they feel will be the beneficiaries of a second Trump administration.

Wall Street is placing bets that Trump 2.0 is a high probability. They are referring to this as the “Trump Trade.” I’m going to outline it here. Again, I’m not advocating or criticizing the trade. I’m simply observing the birth of a massive new trend is emerging.

That move in the Russell 2000 Index is an increase of $300 billion in market capitalization. Pay Attention. Whenever an index moves that much, that quickly, it helps you to better understand what might be occurring fundamentally.

The Trump political philosophy from his first term is characterized by a strong emphasis on nationalism, economic protectionism, and deregulation. It focused on an “America First” approach, advocating for policies that prioritized American interests in international trade, immigration, and foreign relations. Trump pushed for substantial tax cuts and reduced regulatory burdens on businesses to spur economic growth, while also implementing significant tariffs on imported goods, particularly from China, to protect American industries. His administration took a hardline stance on immigration, aiming to restrict both legal and illegal entry into the United States. Additionally, Trump’s foreign policy was marked by a preference for bilateral agreements over multilateral ones, a withdrawal from various international accords, and a contentious relationship with traditional allies, all underpinned by a rhetoric that often-challenged political norms and conventions. The Trump Trade, a term coined following Trump’s 2016 election, embodies the market’s reaction to his pro-business policies.

The “Trump Trade” refers to a market phenomenon characterized by:

Rising Stock Market: Significant gains in the stock market driven by investor confidence in Trump’s economic policies and significantly lower taxes on individuals and businesses.

Surging Cryptocurrencies: Increased value of cryptocurrencies, particularly Bitcoin, as Trump promotes them. Trump is scheduled to speak at the Bitcoin national conference at the end of July in Nashville, TN. Mr. Trump has rebranded himself as the Bitcoin President and wants all Bitcoin to be made in the USA. Anyone who has been in bitcoin for the last several years finds this claim incredulous as the first Trump administration was not exactly bitcoin friendly.

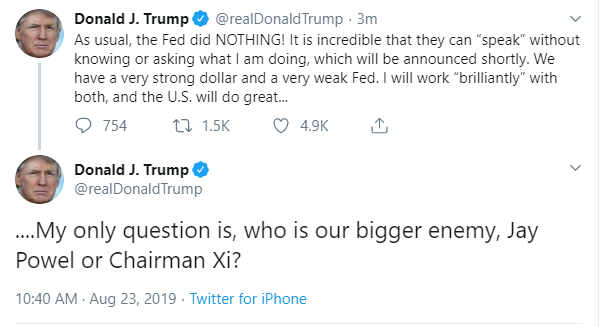

Declining Bond Yields: Lower bond yields due to extensive asset purchases by the Federal Reserve. Mr. Trump is a huge believer in negative interest rates.

Higher Inflation: Increased inflation rates resulting from the devaluation of the US dollar and a growing national debt resulting in massive new debt creation.

End of Wars in Ukraine, Gaza, and Shadow War in Taiwan: Trump is promising an end of all wars once elected.

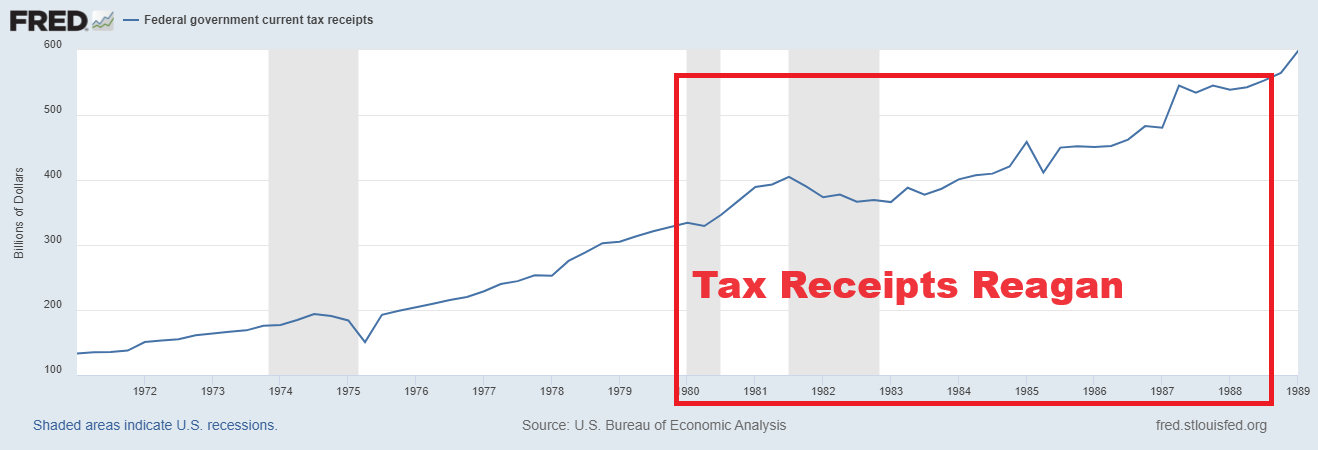

Many Wall Street Analysts are positioning TRUMPONOMICS 2.0 as the return of the Supply Side economics which was introduced by Ronald Reagan when he was running for President in 1979.

Supply-side economics is a theory that focuses on boosting the economy by increasing the supply of goods and services. The idea is that if businesses have fewer taxes and less regulation, they will be able to produce more, hire more people, and invest in new projects. This, in turn, will lead to economic growth and more jobs.

Here’s how it works:

1. **Lower Taxes for Businesses and Individuals:** When taxes are reduced, businesses have more money to invest in their operations, such as buying new equipment or hiring more employees. Individuals also have more money to spend, which can increase demand for goods and services.

2. **Less Regulation:** By reducing government regulations, businesses can operate more efficiently. This means they can produce goods and services more quickly and at a lower cost.

3. **Increased Production:** With lower taxes and fewer regulations, businesses can produce more. This increase in production (supply) helps the economy grow.

4. **Job Creation:** As businesses expand and produce more; they need more workers. This leads to more job opportunities and lower unemployment.

5. **Economic Growth:** The overall goal is to make the economy stronger. When businesses thrive, they contribute to the economy by paying taxes, employing people, and creating products that people need and want.

Economist Arthur Laffer created supply side economics. Laffer’s contribution to political philosophy was that the more you tax something the less you get of it. While this idea makes sense, it was referred to as “Voodoo economics” by George H.W. Bush during the republican primaries leading up to the 1980 Presidential election.

– Supply-side economics believes that helping businesses and producers (the supply side) will lead to a stronger economy.

– Lowering taxes and reducing regulations are the main tools used to achieve this.

– The ultimate goal is to increase production, create jobs, and grow the economy.

Supply-side economics is sometimes called “trickle-down economics” because the promises benefits to businesses are expected to “trickle down” to everyone in the economy. Supply-side economics and Trumponomics share a foundational emphasis on stimulating economic growth by enhancing the productivity and profitability of businesses. Both approaches advocate for significant tax cuts, particularly for corporations and high-income individuals, with the belief that reducing tax burdens will incentivize investment, spur business expansion, and create jobs. Additionally, they favor deregulation to remove barriers that may hinder business operations and growth. By focusing on boosting the supply side of the economy—through increased production and investment—both supply-side economics and Trumponomics aim to generate widespread economic benefits, such as higher employment rates and increased overall economic activity. Trumponomics, specifically, incorporates these principles within the broader context of President Donald Trump’s economic policies, which also include a focus on trade renegotiations and infrastructure spending to further drive economic growth.

While Trumponomics and supply-side economics share similarities in their focus on tax cuts and deregulation to stimulate economic growth, they diverge significantly on the issue of tariffs and trade policy.

Supply-side economics generally advocates for free trade, emphasizing the removal of barriers to international trade. The theory posits that reducing tariffs and other trade barriers allows for a more efficient allocation of resources, leading to lower prices for consumers, increased competition, and ultimately, greater economic growth. Supply-side proponents argue that free trade promotes innovation and efficiency, benefiting the economy by allowing businesses to access larger markets and source cheaper inputs.

Trumponomics, on the other hand, includes a protectionist stance on trade, characterized by the imposition of tariffs on imported goods. President Donald Trump’s economic policies aimed to protect American industries from foreign competition, reduce trade deficits, and encourage domestic production. Trump imposed tariffs on a variety of goods, particularly targeting countries like China, with the goal of protecting American jobs and industries from what he viewed as unfair trade practices. This protectionist approach contrasts sharply with the free trade orientation of traditional supply-side economics. A second Trump Presidency is promising 80% to 100% tariffs on Chinese manufactured goods.

In summary, while both supply-side economics and Trumponomics aim to stimulate economic growth, they differ significantly in their approach to trade.

Supply-side economics favors free trade and minimal tariffs to achieve global economic efficiency, whereas Trumponomics employs tariffs and protectionist policies to safeguard domestic industries and reduce trade deficits.

Looking back at the economic boom of the 1980’s under the Reagan Presidency, the government lowered taxes and collected more revenue than it ever had in its history. Politicians continued to spend even more than the revenue that was created, which accelerated the budget deficits.

I have shared the Trump economic platform and tried to explain it as objectively as possible so that you can understand the trend that Wall Street is excited about in the “Trump Trade.”

Wall Street is envisioning massive debt creation to continue funding the federal deficits. This will be accompanied by lower taxes which “SHOULD” bring in more revenue than what is currently occurring. Trump argues that tariffs will create a fairer economic playing field and also bring in additional revenue from those who close off their markets to American products.

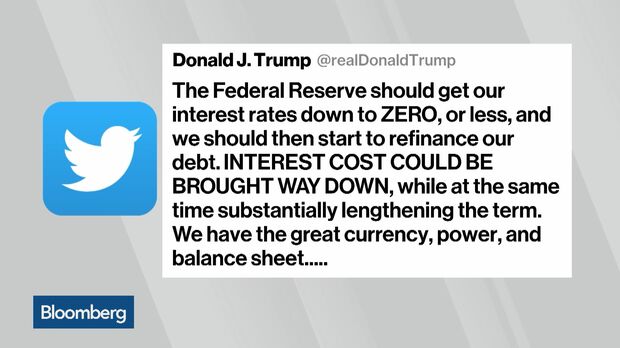

I’m not advocating or criticizing the Trump platform. I’m simply observing the markets start to adapt to this reality. For those traders that were active during the first Trump administration you might remember these very memorable tweets where Trump clearly outlines his love of negative interest rates and protectionist policies:

Trump is advocating the perspective that negative interest rates can stimulate higher economic growth even amidst inflationary pressures by effectively reducing the cost of borrowing for businesses and consumers, encouraging increased spending and investment. When interest rates are negative, banks are incentivized to lend more, as holding excess reserves becomes costly. This leads to greater availability of credit for companies to expand operations, invest in new technologies, and hire more workers, thereby driving economic activity. Consumers, facing lower borrowing costs, are more likely to take loans for significant purchases such as homes and cars, further boosting demand across various sectors. Additionally, negative rates can weaken the national currency, making exports cheaper and more competitive on the global market, which can enhance trade balances and support domestic industries. While inflationary pressures may persist, the overall increase in economic output, employment, and consumer spending can lead to a robust and dynamic economic environment, ultimately fostering sustainable growth.

Market Beneficiaries of a Second Trump Administration –

Expect Dollar Devaluation

Dollar devaluation refers to the reduction in the value of the U.S. dollar relative to other currencies. This can make U.S. exports cheaper and more competitive abroad, potentially boosting sectors like manufacturing and agriculture.

**Markets Benefited**

– **Export-driven industries**: Manufacturers and agricultural producers stand to gain from increased competitiveness abroad.

– **Commodities**: Commodities priced in dollars, like oil and metals, might become more attractive to foreign buyers.

Expect Lower Bond Yields

Lower bond yields indicate a decrease in the interest rates on government bonds, which can signal an environment of lower inflation and accommodative monetary policy.

**Markets Benefited**:

– **Real Estate**: Lower yields often translate to lower mortgage rates, benefiting real estate markets.

– **Stocks**: Equities tend to benefit from lower bond yields as investors seek higher returns, driving money into the stock market.

Expect Lower Regulation

Reduced regulation can lower compliance costs for businesses, potentially boosting profitability and encouraging investment.

**Markets Benefited**:

– **Energy**: The oil and gas industry would see increased drilling and production activities due to eased regulations.

– **Financial Services**: Banks and financial institutions would benefit from relaxed regulatory scrutiny, leading to higher profitability.

– **Tech**: Technology companies may experience less regulatory interference, fostering innovation and growth.

Expect Lower Crude Oil Prices

Lower crude oil prices can reduce input costs for many industries and lower transportation costs for goods and services.

**Markets Benefited**:

– **Transportation**: Airlines, shipping, and logistics companies benefit directly from lower fuel costs.

– **Manufacturing**: Lower energy costs can reduce production expenses, boosting margins.

Perspective for Bitcoin and Crypto

Trump’s favorable stance towards Bitcoin and cryptocurrencies would lead to increased adoption and regulatory clarity.

**Markets Benefited**:

– **Cryptocurrency**: Bitcoin and other cryptocurrencies would see increased institutional investment and broader acceptance as a monetary instrument.

– **Tech and Fintech**: Companies involved in blockchain technology and digital payments would thrive.

Perspective for Gold and Silver

Precious metals like gold and silver often serve as hedges against inflation and currency devaluation. However, lower bond yields and higher debt would be expected to spur precious metals prices significantly higher.

**Markets Benefited** :

– **Precious Metals**: Investors might turn to gold and silver as safe-haven assets amidst economic uncertainty or inflationary pressures.

– **Mining**: Companies involved in the extraction and processing of these metals could see increased demand.

Perspective on Stocks

Overall, the stock market would also benefit from a combination of pro-business policies, tax cuts, and deregulation.

**Markets Benefited**:

– **Broad Market**: Generally, equities may see a boost from a pro-business environment and investor confidence in economic growth.

– **Specific Sectors**: Energy, financials, industrials, and technology sectors could particularly benefit from targeted policies.

While both supply-side economics and Trumponomics advocate for lower taxes and deregulation, Trumponomics is distinct in its protectionist stance. This protectionism can benefit certain domestic industries in the short term but may lead to trade tensions and retaliatory tariffs. The emphasis on dollar devaluation would boost export-driven industries but might raise the cost of imports, potentially leading to inflation. Lower bond yields and deregulation generally support a bullish stock market, though the long-term sustainability depends on broader economic factors, including the impacts of increased national debt and potential inflation. The positive outlook for cryptocurrencies, precious metals, and certain commodities reflects market expectations of increased volatility and hedging behaviors under a second Trump administration.

Since the failed assassination attempt on Trump last week the Trump Trade has clearly been in play. Will this continue? How realistic is Trumponomics? I have more questions than answers.

Next week I will elaborate on the Trump Trade by exploring the risks and reward potential of the leveraged ETF marketplace and how traders are exploiting these trends. Leveraged ETFs offer a captivating alternative to the high-stakes realm of futures and options trading, drawing investors with their unique blend of allure and intrigue. These financial instruments are built upon a foundation of derivatives, yet they provide a safer haven for those wary of the volatile risks typically associated with such markets. The most enticing aspect of leveraged ETFs is the absence of potential margin calls, a stark contrast to futures and options. This means investors can only lose their initial investment, offering a layer of security while still enabling them to amplify returns. This distinctive feature positions leveraged ETFs as a compelling option for those seeking enhanced returns without the daunting prospect of losing more than they put in.

What aspects of the Trump Trade are in play now?

This is why I always advise traders to embrace artificial intelligence trading software to do the heavy lifting.

Before the advent of artificial intelligence, we all embraced dogma, relying heavily on rigid theories of cause and effect to explain the workings of the financial world. This perspective, though traditional, proved to be very limiting in its scope and adaptability. To truly build wealth, it’s essential to identify the most promising trends and learn how to align with them effectively. A.I. excels in this area, offering unparalleled capability to analyze vast amounts of data, predict market movements, and position us on the right side of the right trend at precisely the right time.

Currency debasement in a fiat economic order is a ticking time bomb. Unlike gold or silver, fiat currencies rest on nothing but the shaky promise of the government. This system hands central banks the dangerous power to print money at their whim, a temptation too often indulged. When they do, it floods the market with paper money, leading to inevitable devaluation. The fallout? Inflation, or worse, hyperinflation, where the buying power of your hard-earned money evaporates like morning mist. Just look at Zimbabwe in the late 2000s or Venezuela today. Their currencies became worthless scraps of paper, plunging millions into poverty, creating catastrophic shortages, and eroding any trust in the financial system. Savings? Gone. Investments? Decimated. The entire economy? In shambles. The antidote to this problem for traders is embracing artificial intelligence to improve your decision-making processes.

Are you ready to take your trading strategy to the next level and dominate today’s fast-paced financial markets? Get ready for an exclusive online artificial intelligence trading masterclass that will transform the way you trade forever! Discover the power of Artificial Intelligence and how it can boost your trading performance beyond your wildest dreams. Picture this: predicting market movements with pinpoint accuracy, riding the right trends at the perfect moments. Our cutting-edge AI-powered system delivers outstanding results, steering traders through every market twist and turn with ease. Don’t miss out on this game-changing opportunity to stay ahead of the curve and achieve trading success like never before!

Intrigued?

Visit with us and check out the A.I. at our

Learn how our A.I. trading software can help you navigate the tumultuous financial landscape ahead.

Next week we will do a deep dive on Leveraged ETF’s.

Let’s Be Careful Out There.

It’s Not Magic.

It’s Machine Learning.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.