Leverage in trading is a powerful tool that allows investors to amplify their potential returns by controlling larger positions than their actual capital investment would otherwise permit. Achieved through borrowing funds or credit, using derivatives like options and futures, or trading on margin, leverage can significantly increase both potential profits and risks. While it opens the door to substantial gains, it also exposes traders to heightened potential losses, magnifying the impact of even small market movements. In this exploration of leverage, we will delve into how it operates across various markets—including stocks, options, and futures—to uncover the nuanced dynamics of leveraging techniques. We’ll examine the mechanisms behind leverage, weigh the potential rewards against the risks, and provide insights into managing leverage effectively in different trading scenarios.

By controlling larger positions than would be possible with their available capital alone, traders can participate in markets and opportunities that might otherwise be out of reach, making leverage a powerful tool in the arsenal of financial strategies.

However, leverage is a double-edged sword. While it can magnify gains, it also increases the potential for substantial losses, making it perilous when the market turns unfavorably. Being on the wrong side of the market at the wrong time can lead to rapid losses that not only wipe out initial investments but can also incur debts beyond the original stake. This high-risk scenario underscores the importance of prudent risk management, as the same mechanism that propels profits on upward trends can just as quickly accelerate financial ruin during downturns. Thus, while leverage can be an enticing pathway to accelerated gains, it demands a cautious and informed approach to avoid disastrous outcomes.

Last week in our article we defined “The Trump Trade” that Wall Street is very excited about. Based upon Trump’s policies from his first term analysts are anticipating the following should he become President again:

- A Lower Dollar

- Much Lower Interest Rates

- Higher Stock Market

- Higher Small Cap Stocks

- Higher Inflation

- Higher Precious Metals

- Higher Bitcoin and Crypto Prices

- Much Lower Crude Oil Prices

Some of these expectations appear contradictory on the surface. As traders our only loyalty is to the trend. We have these markets on our radar. The challenge and what we will address in this article is how to address these potential trends.

How much leverage do you think you can handle?

That is a critical question when it comes to trading. The reality is that most traders handle leverage very poorly.

The most risk investment products are considered risky because of the amount of leverage they permit. For example, Commodity Futures contracts are much less volatile than the stock market. The risk in trading futures lies in the leverage that the exchange permits.

Let me explain.

Margin trading with commodity futures operates under a different dynamic compared to stocks due to the standardized contract specifications set by the exchange and the leverage inherent in these contracts. Futures contracts require traders to post a margin, which is a fraction of the contract’s total value, as a performance bond to hold a position. This margin is not a down payment but a security good faith deposit that must be maintained to cover potential losses.

Let’s take the example of crude oil futures, where one contract typically represents 1,000 barrels of oil. If the price per barrel is $85, the total contract value would be $85,000. However, the initial margin requirement might be only $7500, allowing the trader to control a substantial value with a relatively small amount of capital.

To understand this let’s do elementary math.

The contract value is $85,000.

The margin deposit to establish a position is $7,500. This margin deposit is only 8.8% of the total value of the contract. What this means is that if the market goes up 8.8% the trader makes 100% return. If the market goes down 8.8%, they lose everything. If the market goes down more than 8.8%, they lose everything and are on the line for all additional losses.

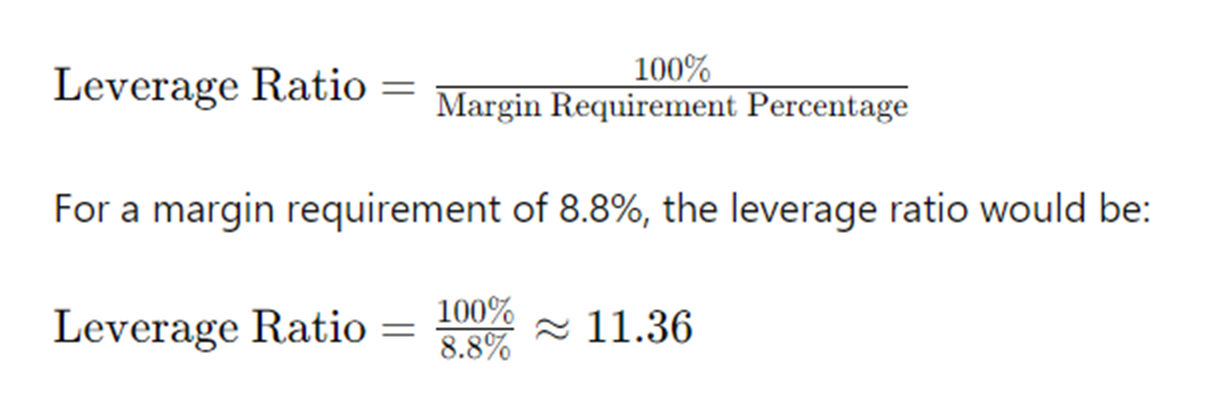

If a trader’s margin requirement is only 8.8% of the contract’s value, they are using a relatively high degree of leverage. To calculate how much leverage this represents, you can use the following formula:

This means the trader is controlling about 11.36 times the amount of the contract value compared to the actual cash they have invested. This high leverage amplifies both potential gains and potential losses, making it a powerful but risky trading strategy. Every $1 deposit controls $11.36 of the underlying asset.

In futures trading there is a maintenance margin requirement which for Crude Oil is $6,600. This stipulates that if a trader puts up the minimum margin requirement of $7,500 and the market drops more than $900, they will receive a margin call which requires that they bring their account up to the $7,500 balance to be able to continue to hold their position. This $900 difference between the margin requirement and the maintenance margin requirement is referred to as the excess margin.

To understand this leverage in even more granular detail I always suggest that what traders do is always recognize the worst-case scenario and how it will occur.

In this example, $900 represents the difference between the margin requirement and the maintenance requirement. This is only 1.05% excess margin and cushion of the commodity futures contracts value.

This means that if Crude Oil were to move 1.05% against a trader, they would receive a margin call and be required to bring their account back to the $7,500 margin requirement balance.

This simple arithmetic is what allows leverage to occur in the commodity future space.

Huge wins and losses are possible, and traders can make or lose giant multiples of their account value.

The reality is that most traders lose in trading commodity futures contracts because they look to enter the market with the minimum margin requirements, and this does not allow them to have much staying power before they receive a margin call.

**Winning Scenario:**

Suppose the price of oil rises to $90 per barrel. The contract value then increases to $90,000. If the trader decides to close the position, the gain on the contract would be $5,000 ($90,000 – $85,000). After returning the initial margin of $7,500, the trader profits $5,000, less any transaction and maintenance fees. This represents a 66% return relative to the initial margin.

**Losing Scenario:**

Conversely, if the price of oil falls to $80 per barrel, the contract value decreases to $80,000. Closing the position at this price, the trader’s loss would be $5,000 ($85,000 – $80,000). If the trader decided that they were to continue to hold the contract they would need to deposit an additional $5000 into their account to maintain the margin requirement for the futures contract. If they decided to take the loss it would result in a $5,000 loss on a $7500 margin requirement which is 66%.

These examples highlight the high stakes involved in futures trading, where the leverage can amplify both profits and losses dramatically. Traders must be vigilant about market conditions, margin requirements, and potential price movements to manage risks effectively in futures trading. The reason most futures traders lose is that they place position on and utilize maximum margin requirement which leaves them with little to no staying power.

Trading Futures has both huge upside and downside potential! Never tread into these waters if you can’t handle the subsequent volatility create by highly leveraged instruments.

Stock Trading on Margin

Margin trading in the stock market is a strategy where investors borrow money from their brokerage firm to purchase more stocks than they can afford with their available funds. This approach essentially uses leverage to increase an investor’s buying power, allowing them to control a larger number of shares with a smaller amount of capital. The borrowed money comes with a pre-determined interest rate, which the investor must pay back, regardless of the trade’s outcome. This rate varies between brokers and is charged on the borrowed funds used to make the trade, thus increasing the cost of investing and the risk.

For instance, consider an investor who wants to buy shares of a company trading at $100 per share. With $5,000 of their own money, they could normally purchase 50 shares. However, using margin, they could potentially buy 100 shares by borrowing an additional $5,000 from their broker. Suppose the interest rate on this borrowed money is 13% annually. If the stock price increases to $120 per share, the investor could sell their shares for $12,000, repay the borrowed $5,000 plus around $650 in interest (assuming the position is held for one year), and end up with a net amount significantly higher than if they had only used their own funds. The net results would be:

Gross profit of $20 per share = $2000

Annual Interest Expense of $650 on $5000 loan at 13% interest.

Net Profit of $1,350.00 on margin of $5,000.

Conversely, if the stock price falls to $80 per share, the situation deteriorates quickly.

Gross Loss on $20 per share = $2,000

Annual interest expense of $650 on $5,000 loan at 13% interest.

Net loss of $2,650 on margin of $5,000.

In this example I am assuming a holding time of one year and 13% interest to keep the math simple. In reality, the brokerage firm which loans the funds amortizes the $5,000 loan on a daily basis so the actual results will depend on the actual holding period of the trade.

This example illustrates how stock margin trading can amplify gains but also exacerbate losses, potentially leading to situations where investors owe more than their initial investment. Therefore, while margin trading can be a powerful tool for expanding market exposure, it requires careful risk management and an acute awareness of potential market movements.

Leverage on Options Trading

Options trading carries unique risks and rewards, largely influenced by their nature as time-sensitive and deteriorating instruments. Options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price before the option expires. The value of an option decreases over time, a phenomenon known as time decay, which accelerates as the expiration date approaches. This characteristic makes options a potentially profitable tool for those who can accurately predict market movements over short periods. However, the finite lifespan of options means that even if a trader’s market outlook is correct, a poorly timed trade can still result in a complete loss if the expected market movement does not occur within the option’s active period.

The time-sensitive nature of options often requires sophisticated risk management strategies. Traders must not only be right about the direction and magnitude of a market movement but also about the timing. This aspect can frustrate even experienced traders, as correct predictions about market movements might not translate into profits if the timing is not aligned with the lifespan of the option. Additionally, the leverage effect inherent in options trading can magnify both gains and losses, making it essential for traders to thoroughly understand potential outcomes and to utilize risk mitigation tactics effectively. Managing these elements effectively demands a combination of timely market analysis, experience, and sometimes, a bit of luck. This complexity often steers novices towards simpler, more straightforward trading instruments.

If you comprehend what I have discussed so far you can immediately see the challenge of effectively applying leverage to your account. Derivatives are powerful instruments that offer tremendous opportunity but also can compound problems for those that are not adequately financed.

So, what is the solution to this problem?

For those looking to compound gains with limited risk and avoiding margin calls or dreaded options expirations the alternative solution worth exploring is leveraged ETF’s.

Definition and Mechanics of Leveraged ETFs

Leveraged Exchange-Traded Funds (ETFs) are specialized financial instruments designed to provide amplified returns, usually two or three times the daily performance of their underlying index or asset. Unlike standard ETFs that aim to match the performance of a particular index, leveraged ETFs aim to outperform it, magnifying both the potential gains and losses. They achieve this using financial derivatives such as options, futures, and swaps, along with borrowing, to increase exposure to the underlying assets.

One of the defining features of leveraged ETFs is the daily reset mechanism. This means that the fund adjusts its leverage at the end of each trading day to maintain a constant level of exposure relative to its assets. For example, if a 3x leveraged ETF ends the day up, it will rebalance to maintain three times the exposure to the underlying index for the next trading day. This daily reset is critical as it impacts how results compound over time.

The compounding effects in leveraged ETFs are profound and can be beneficial or detrimental. In trending markets, these effects can significantly boost returns, as gains are reinvested at a higher leverage point daily. However, in volatile markets, where the direction changes frequently, compounding can lead to lower-than-expected returns, or even losses, as each day’s losses diminish the base from which gains must recover.

The main reason that Leveraged ETF’s are an alternative worth exploring is twofold:

- You cannot lose more than what you invest in the ETF.

- An ETF the instrument affords you Staying Power with no worries of margin calls.

A leveraged ETF brings about considerably greater risk than traditional ETF investing. The beauty of the instrument is that it allows you to participate in a very limited format, which is highly recommended. I’ve tested the waters with as little as $100 just to understand the instrument better when I was first getting started.

Leveraged ETFs come in various forms, catering to different strategic needs:

– **Bullish Leveraged ETFs**: These ETFs, often identified with names or symbols including terms like “Bull” or “Long,” aim to deliver multiples (e.g., 2x, 3x) of the daily performance of the indexes they track. They are used primarily by traders who anticipate upward movement in the index.

– **Bearish Leveraged ETFs**: Conversely, bearish or “inverse” leveraged ETFs aim to provide multiples of the opposite of the daily performance of their benchmarks. These are utilized in strategies betting on the decline of an index, with naming conventions that include “Bear” or “Short.”

– **Sector-Specific Leveraged ETFs**: These funds target specific sectors of the economy, such as technology, healthcare, or financial services, offering leveraged exposure to sector-specific indices. This allows traders to apply leveraged strategies to more focused areas within the market, capitalizing on sector-specific trends and movements.

Understanding these fundamentals provides traders with a foundation for making informed decisions when incorporating leveraged ETFs into their trading strategies, balancing potential high returns against the risks of amplified losses and the effects of daily resets and market volatility.

Leveraged Exchange-Traded Funds (ETFs) are investment funds that use financial derivatives like options and futures and debt to amplify the returns of an underlying index. Unlike traditional ETFs, which aim to replicate the performance of an index, leveraged ETFs aim to multiply the returns, typically seeking to deliver 2x or 3x the daily performance. These are particularly volatile and are best suited for short-term trading due to their daily reset and compounding effects.

ETF instruments offer all of the leverage of derivatives without the complexity or hassles traditionally associated with margin trading. They derive their value from an underlying asset and are used as tools for speculation, hedging, or risk management. They also allow for significant use of leverage, which can magnify gains and increase the potential for losses.

Understanding these nuances is crucial for investors to choose the right instrument that matches their investment goals, risk tolerance, and market view.

Why is this important?

One of the strongest market signals you will ever witness is when an asset is making new all-time highs or new 10-year highs. While this is rare, when it occurs it is a very clear signal that the market is overcoming all barriers related to its success. We write and analyze this phenomena regularly in our weekly A.I. stock spotlight which you can find on our website.

Based upon the “TRUMP TRADE” narrative, here are some of the charts worth monitoring for this very powerful setup.

Here’s the S&P 500. Observe how the market penetrated the All-Time High barrier 7 months ago and kept moving higher.

Here’s a chart of Bitcoin. Observe how $BTC/USD went to new All-time highs and the OLD ALL time high has acted as resistance for the last 4 months.

Here’s a chart of Gold. Observe how the All Time high was breached 6 months ago and the market never really looked back.

Here is the chart of the Russell 2000 Index which is small cap stocks which is approaching its 52 week high and about 9.5% below its all-time highs.

VantagePoint Software users can drill down into these markets to receive guidance from the artificial intelligence on a daily basis. I advise to place the Trump Trade markets on your radar and particularly pay attention to the Neural Index and Predictive Blue Line for short term trading opportunities.

Here are some of the leveraged ETF’s that are worth exploring if you agree with the narrative behind the Trump Trade.

### Stocks

1. **ProShares UltraPro QQQ (TQQQ)**: Seeks to provide 3x the daily performance of the Nasdaq-100 Index.

2. **Direxion Daily S&P 500 Bull 3X Shares (SPXL)**: Seeks to provide 3x the daily performance of the S&P 500 Index.

3. **Direxion Daily Small Cap Bull 3X Shares (TNA)**: Seeks to provide 3x the daily performance of the Russell 2000 Index.

### Bonds

1. **ProShares Ultra 20+ Year Treasury (UBT)**: Seeks to provide 2x the daily performance of the ICE U.S. Treasury 20+ Year Bond Index.

2. **Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF)**: Seeks to provide 3x the daily performance of the ICE U.S. Treasury 20+ Year Bond Index.

### Commodities

1. **ProShares Ultra Bloomberg Crude Oil (UCO)**: Seeks to provide 2x the daily performance of the Bloomberg Commodity Balanced WTI Crude Oil Index.

2. **VelocityShares 3x Long Natural Gas ETN (UGAZ)**: Seeks to provide 3x the daily performance of the S&P GSCI Natural Gas Index ER (Note: UGAZ was delisted in 2020, but similar funds may be available).

### Metals

1. **ProShares Ultra Silver (AGQ)**: Seeks to provide 2x the daily performance of silver bullion as measured by the U.S. Dollar price for delivery in London.

2. **Direxion Daily Gold Miners Bull 3X Shares (NUGT)**: Seeks to provide 3x the daily performance of the NYSE Arca Gold Miners Index.

### Forex

1. **ProShares UltraShort Euro (EUO)**: Seeks to provide 2x the inverse daily performance of the U.S. Dollar price of the Euro.

2. **ProShares Ultra Yen (YCL)**: Seeks to provide 2x the daily performance of the U.S. Dollar price of the Yen.

### 2x Bitcoin ETFs

1. **ProShares Ultra Bitcoin Strategy ETF (UBTC)**

– **Objective**: The ProShares Ultra Bitcoin Strategy ETF seeks to provide twice (2x) the daily performance of Bitcoin futures contracts. The fund aims to achieve this leverage by investing in Bitcoin futures contracts listed on the Chicago Mercantile Exchange (CME). The ETF allows investors to gain leveraged exposure to Bitcoin’s price movements without directly holding the cryptocurrency.

2. **Direxion Daily Bitcoin Bull 2X Shares (BTCC)**

– **Objective**: The Direxion Daily Bitcoin Bull 2X Shares aims to deliver twice (2x) the daily performance of Bitcoin futures contracts. It does this by using leverage to amplify the daily returns of Bitcoin futures. The ETF is designed for short-term traders looking to capitalize on short-term movements in Bitcoin prices.

1. **Volatility Shares Bitcoin Strategy 2x ETF (BITX)**

– **Objective**: The Volatility Shares UltraPro Bitcoin Strategy ETF seeks to provide three times (2x) the daily performance of Bitcoin futures contracts. By utilizing leverage, the fund aims to magnify the daily returns of Bitcoin futures, offering traders the potential for significant gains (or losses) based on the daily price movements of Bitcoin.

The primary objective of 2x ETFs is to provide magnified exposure to the daily price movements of Bitcoin. By using leverage, these ETFs aim to offer twice or three times the daily return of Bitcoin futures contracts. This allows traders to potentially realize greater profits from short-term price movements compared to unleveraged ETFs. However, the use of leverage also increases the risk of significant losses, making these ETFs more suitable for experienced traders who actively manage their positions and understand the risks involved.

The leveraged exposure is achieved through the use of derivatives such as futures contracts, which are rebalanced daily to maintain the target leverage ratio. Investors in these ETFs should be aware of the potential for volatility decay and tracking errors over longer holding periods, as the funds are primarily designed for short-term trading.

These leveraged ETFs are designed to amplify daily returns, which means they can offer significant gains but also pose considerable risks, especially over longer holding periods. Investors should understand the mechanics and risks involved before investing in leveraged ETFs.

My suggestion is that you put a handful of these leveraged etf’s on your trading radar and track their performance on a daily and weekly basis so that you understand the leverage inherent within these instruments.

You are more likely to lose lots of money (or hypothetically make lots of money) when you trade on margin.

Risk is the threat of loss due to uncertainty.

But here is the crazy thing….

Your purchasing power in dollars is guaranteed to evaporate slowly unless you do something to increase the size of your stack.

My advice is simple. Learn How to Trade with Artificial Intelligence.

Are you capable of finding those markets with the best risk/reward ratios out of the thousands of trading opportunities that exist?

Knowledge. Useful knowledge. And its application is what ai delivers.

Artificial intelligence is not “a would be nice to have” tool.

It is an “absolutely must have” tool to flourish in today’s global markets.

Folks, I’m not here to cry doomsday. Just because the skies might seem stormy doesn’t mean we’re on the brink of financial ruin. But let’s face it—being prepared is always smarter than being blindsided. Whether it’s a market dip, a spike in crude oil prices, or something totally out of left field, having a solid game plan is your best defense. That is what a.i. brings to the table.

The financial world is always shifting beneath our feet.

We’re stepping into new and uncharted territory. It’s time to adapt, to learn, and to equip ourselves with the knowledge and tools to navigate this brave new financial frontier.

So, as you push forward, keep your eyes wide open, stay sharp, and keep your strategy nimble. Remember, in the face of uncertainty, knowledge is your greatest weapon. Stay informed, diversify your portfolio, and be ready to pounce on opportunities when they arise.

Intrigued? Visit with us and check out the A.I. at our

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.