-

View Larger Image

Global debt has skyrocketed to an unprecedented $307 trillion, a jaw-dropping increase of $100 trillion over the past decade, now accounting for 340% of global GDP. This immense burden is why a straightforward escape from a looming recession is virtually impossible. Historically, the remedy for reviving economies after economic contractions has been for governments to escalate deficit spending while central banks unleash vast amounts of new money, flooding the banking system with credit and significantly reducing borrowing costs. This deficit spending is also accelerated in election years when incumbents try to create favor with the voters and present themselves in the best light.

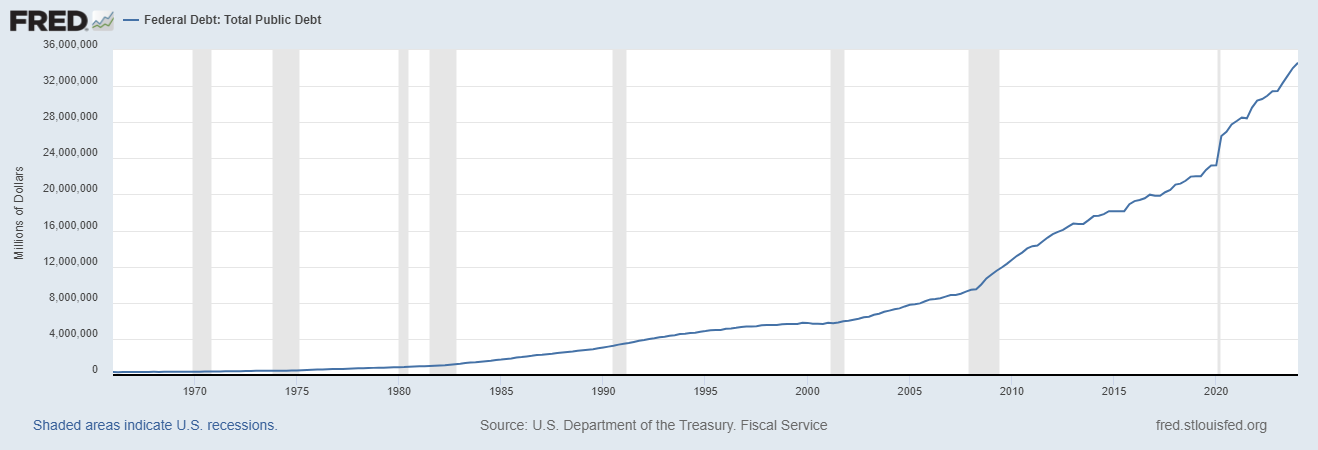

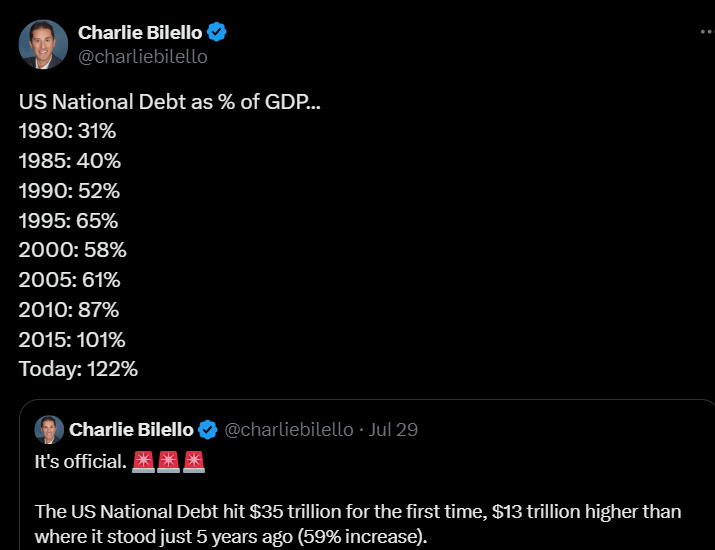

The chart below is of US National Debt which recently surpassed $35 trillion.

The US Debt was only $22 trillion 5 short years ago. When you see a 59% growth is National Debt in 60 months, pay attention. You are being debased.

In this article I will be discussing money viewed as a technology, and the challenges and opportunities that this perspective presents to citizens who are concerned about inflation and currency devaluation. This is not financial or trading advice, merely educational and my opinion.

One of the huge challenges towards being successful as a trader is understanding what money is and what it represents. We live in a technological age where technology has changed the world and how we view it. Yet, when it comes to money, most people are trapped in a paradigm where they continue to view money from a perspective that disempowers them. Until they understand money, what it is, how it is created and how it is debased they will never comprehend how the financial world truly works.

Technology is the application of knowledge for practical purposes, that solves problems and enhance human capabilities and make life better. Technology is considered meaningful and worthwhile only if it makes life better for those adopting the technology.

Let’s face the stark reality: there simply isn’t a viable path to repay our national debt. Our leaders are backed into a corner, forced to devalue the dollar just to monetize this mountain of debt. This strategy ensures that any assets denominated in U.S. dollars will keep on climbing in dollar terms. This is a harsh and bitter pill to swallow.

Take the S&P 500 as a prime example. It appears robust when you look at it through the lens of U.S. dollars. But when you measure it in ounces of gold—real, hard assets—the picture since the early 1970s hasn’t changed much; it’s essentially flat. This tells us a critical story: the growth we see in the stock market is likely not due to real, intrinsic value increases but rather a result of our currency losing its purchasing power. It’s high time we question the wisdom of our financial strategies and the real health of our economy.

“ It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning,” – Henry Ford

Henry Ford’s quote suggests that the banking and monetary systems are deliberately complex and controlled by a powerful few, leading to manipulation of money supply, creation of money through lending, and heavy reliance on debt, which results in economic inequality and benefits the wealthy. He believed that if the public fully understood these exploitative practices, they would demand significant reform or revolt against the system.

When I look at the world it is my understanding that huge economic myths pervade our understanding. The most toxic myth of all is that you can solve a debt problem by simply creating more debt. We have ample evidence from thousands of years that this is not possible, yet in spite of its falseness, this economic myth continues to wreak havoc. Why? Because the greatest power in the world is the power to control the printing press and supply of money creation.

Friedrich Hayek, an influential Austrian economist, and philosopher argued that true monetary freedom cannot be achieved if governments control money. Hayek believed that when governments control money, they have the power to manipulate its supply and value. This will always lead to inflation, deflation, and other economic issues, often driven by political motives rather than economic necessity. By controlling the money supply, governments will fund their expenditures without direct taxation, which will always erode the value of money over time.

Hayek advocated for the denationalization of money, where multiple currencies could compete in a free market. He argued that competition would lead to better results because currencies would need to maintain their value to be widely accepted. Government monopolies on money prevent this competition, leading to poorer outcomes for consumers. For Hayek, economic freedom was closely tied to individual liberty. He believed that government control of money constrains personal freedom by limiting individuals’ choices in how they store and exchange value. Freeing money from government control would, in his view, enhance personal liberty and economic efficiency.

Hayek recognized that taking money out of government control would be challenging and potentially disruptive if done violently or abruptly. He stressed the need for a peaceful and gradual transition to a system where money is not controlled by governments. This could involve legal reforms, the introduction of private or decentralized currencies, and public education about the benefits of monetary competition.

Hayek’s perspective is that government control over money is inherently flawed and that a free market for currencies, achieved through peaceful means, would lead to more stable and valuable money, enhancing overall economic freedom and efficiency. Currently, money is centralized and those who control the money have tremendous power over the economic livelihoods of those who are forced to utilize that form of money.

I invite people to engage in the following thought exercise about money. When a government exercises its power to print money and debase its currency, it effectively diminishes the value of your time and energy. Think about that for a moment.

By borrowing more money, the government is essentially extracting time and energy from the collective populace of the future. You’re pulling resources from the future with the promise of repayment at a later date. Each time the U.S. government prints a dollar, it reduces the value of the time and effort I’ve invested in earning those dollars. Consequently, the worth of my efforts diminishes.

The problem with this system and logic is that eventually the currency arithmetically must reduce to zero. This is not a criticism, but a mathematical certainty. Until people recognize that this is what FIAT does, they cannot comprehend why prices on everything continue to rise. They expect a political solution and cannot see that the money is broken.

When price rises there are only two questions that need to be answered:

- Did the good become more valuable?

- Or is the rise in price occurring because the currency is becoming less valuable and more of the debased currency is needed to acquire it?

When the government prints more money, it **devalues** the existing currency. This isn’t just some abstract economic principle; it’s a direct **theft** of the time and energy that hardworking Americans have already expended to earn that money. This **debasement** forces individuals to toil longer and harder just to maintain the same standard of living, as their savings and earnings are systematically eroded over time.

But this problem is equally toxic on another level, if government controls the money, and the money printer, it controls which groups and problems will receive the new money that is created.

James Grant is a renowned financial journalist and historian, best known as the founder and editor of Grant’s Interest Rate Observer, a twice-monthly journal on financial markets. With a keen insight into economic trends and monetary policy, he is widely respected for his critical analysis and historical perspective on interest rates and the broader financial landscape. James Grant’s statement that “government is the fire department and the arsonist” is a powerful metaphor highlighting the contradictory role of government in economic crises. On one hand, governments are often seen as the rescuers during financial downturns. They implement policies to stabilize markets, inject liquidity, and provide bailouts to prevent economic collapse. This is akin to the fire department rushing to put out a blaze, offering immediate relief and support to prevent further damage. Governments step in to save banks, businesses, and, ostensibly, the broader economy, presenting themselves as the protectors of economic stability.

On the other hand, Grant’s analogy also points to the idea that governments to be the very cause of the crises they later attempt to mitigate. Through policies like excessive money printing, unchecked spending, and poor regulation, governments ignite financial instability, loss of purchasing power, and inflation. By creating environments ripe for bubbles and unsustainable debt, they set the stage for the very disasters they claim to prevent. Thus, when they arrive to extinguish the flames, it is their actions that often started the fire in the first place. This dual role creates a cycle of dependency and mistrust, where the government’s efforts to “save” the economy are seen as both necessary and suspect, perpetuating a cycle of crisis and intervention.

While the wealthy can shield their assets by investing in appreciating items like real estate or stocks, the average American finds it increasingly challenging to keep up as their purchasing power dwindles. This orchestrates a divide where a tiny elite accumulates more wealth without contributing additional time or energy, while the majority struggle to sustain their livelihoods, breeding societal tension and dissatisfaction.

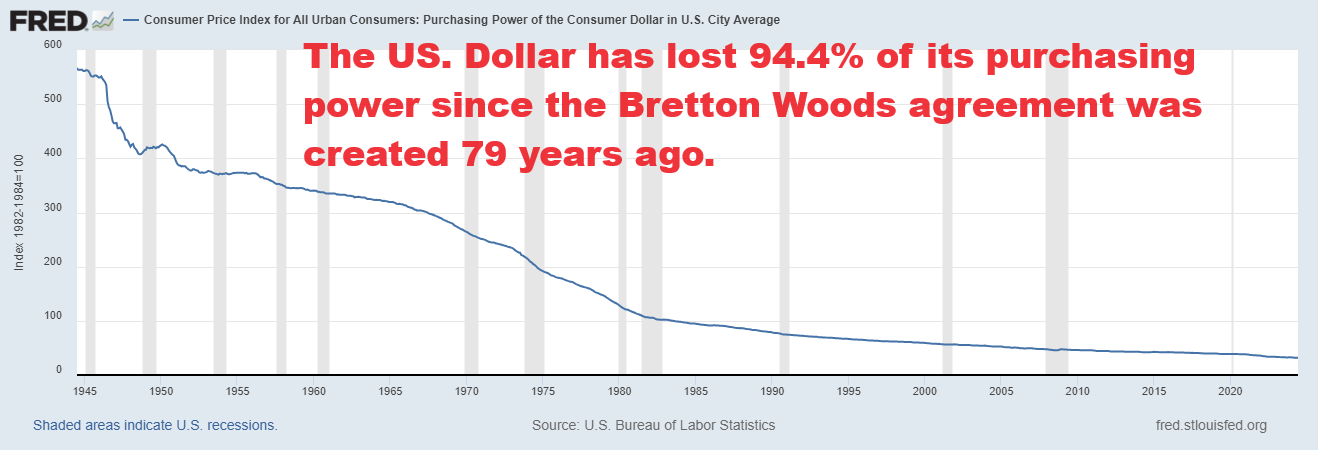

Below is a chart of the Purchasing Power of the U.S. Dollar since the Bretton Woods Agreement going into effect in July 1944. This agreement made the US Dollar the reserve currency of the world. Notice a bias in this trend? This is the most stable fiat currency in the world, and it has lost 94.4% of its purchasing power in the last 79 years. This graph also explains why de-dollarization is occurring around the world.

So, what is the solution to this problem? The first thing we need to comprehend is that FIAT technology benefits the few at the expense of the many. Currency debasement is the main feature in current monetary technology because it allows governments to debase currency, instead of imposing new taxes, for whatever projects they deem to be important. This jeopardizes the economic well-being of the many and makes saving in that currency very hazardous.

If we genuinely understand how toxic this is, we begin to comprehend how it creates a distrust in whomever controls the money printer and all of the institutions of government. Wealthy people instinctively understand that they do not keep their reserves in cash and cash equivalents because this makes you vulnerable to currency debasement. Instead, the wealthy, and those aspiring to be wealthy move their savings into assets that the government cannot debase. This is the recipe for class strife and wealth inequality.

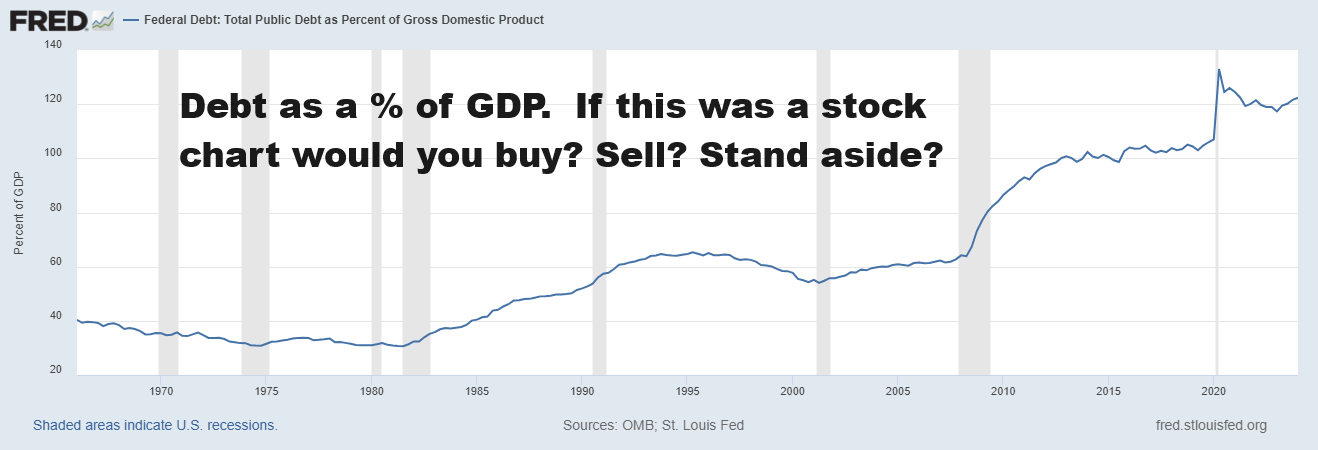

Here is a chart maintained by the Federal Reserve of St. Louis on current US Debt as a percentage of GDP. As you look at this chart, if this were an asset of a stock, how would you trade it? Would you buy, sell, or stand aside?

When I look at the DEBT to GDP percentage chart, I am convinced that the currency debasement party is just getting started. DEBT is going to explode higher. It is a mathematical certainty.

I share that chart and tweet because I consider it to be the most concise meaningful way to describe the destruction of the U.S. Dollar. U.S. Debt just hit $35 trillion. Debt is growing exponentially. Purchasing power is cratering. The only solution the Fed and US Treasury have is to create more debt. They either actually believe that you handle a debt problem by creating more debt, or they are completely inept.

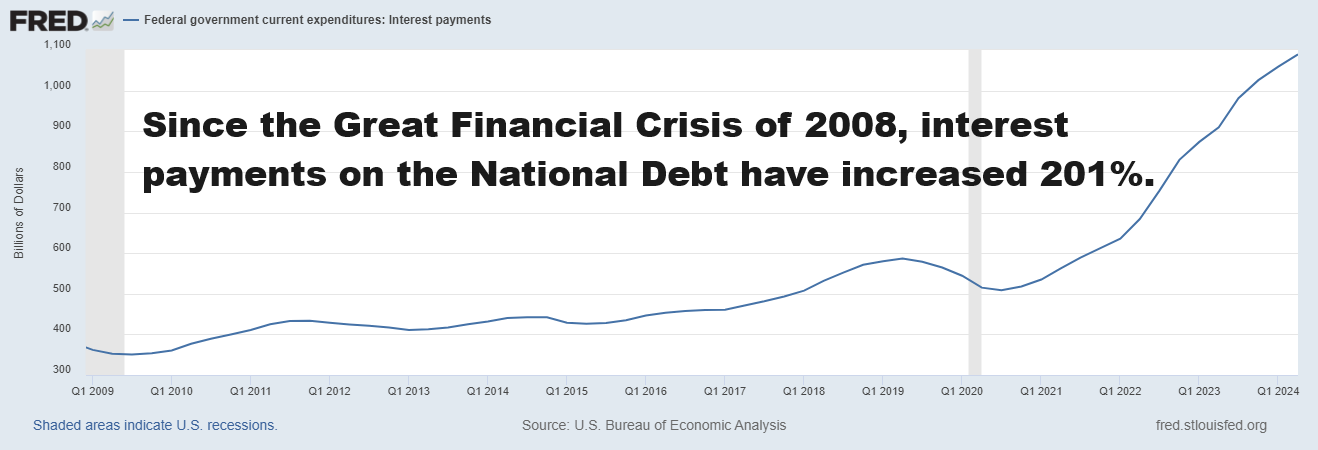

Debt has been growing exponentially since the Great Financial Crisis.

How has that worked out so far? Falling incomes and rising prices are everywhere to be seen. Here is a chart showing the exponential increase for interest payments on the US National Debt which have increased 201% since the Great Financial Crisis. This is the fastest growing part of the US Budget and has surpassed military spending, Medicare, and Medicaid.

Imagine a form of money that is fixed, immune to debasement. This ensures that the time and energy of those who hold it remain intact. Such a currency exists beyond the reach of governments, central authorities, corporations, or any individual. This concept is incredibly powerful when considering how to preserve our time and energy. Throughout history, humanity has strived to achieve this. Bitcoin, in my opinion, represents our closest attempt to a perfect store of collective time and energy. In the past, gold held this position.

Enter Bitcoin, a revolutionary technological solution to these systemic issues. With its fixed supply, Bitcoin cannot be **debased**. Unlike fiat money, Bitcoin’s value isn’t at the mercy of government policies or inflationary pressures. It’s a reliable store of value for people’s time and energy. By adopting Bitcoin, individuals can safeguard their labor’s worth and potentially diminish the systemic inequalities perpetuated by our current financial system. Transitioning to a Bitcoin standard is not just about currency; it’s about restoring fairness and stability, ultimately benefiting society.

Bitcoin, much like any traditional currency, gains its value by meeting the six essential characteristics of money: durability, portability, divisibility, fungibility, scarcity, and acceptability. Each plays a crucial role in defining its utility and, by extension, its worth.

There’s a growing consensus that Bitcoin may indeed represent an evolutionary leap in the concept of money. Unlike traditional currencies, Bitcoin’s digital framework prevents duplication. Its open-source code is widely accessible, yet the network’s unique properties extend well beyond mere software. Over more than a decade, Bitcoin has consistently demonstrated its decentralized nature and resistance to censorship. The robustness of its operational rules over time underscores a resilience that few, if any, other forms of money have managed to exhibit.

This enduring reliability and the innovative underpinnings of Bitcoin not only challenge but also redefine the conventional attributes of money, suggesting a potential shift in the financial paradigms we’ve come to accept.

While some market analysts argue that public debt and deficits are inconsequential, this view is flawed. Excessive debt and deficits act as a tax on future consumption, leading to higher inflation rates and slower growth. The U.S., with its status as the issuer of the world’s reserve currency and its highly liquid bond market, will always find buyers for its debt—even if it means purchasing it itself. However, the critical question is: at what interest rate? Despite the US holding the world’s reserve currency, this did not prevent the benchmark Treasury Note from soaring to 15% in 1980. Inflation and credit risks have the potential to drive US rates skyward again. It has happened before, and it will undoubtedly happen again.

In recent developments surrounding Bitcoin and the U.S. political landscape, two presidential candidates, RFK Jr. and Donald Trump, have made significant announcements regarding the cryptocurrency. RFK Jr. proposed making Bitcoin a strategic reserve asset, with plans to purchase 550 Bitcoin daily until the U.S. amasses 4 million Bitcoin, equating it to the gold reserves in Fort Knox. This move is aimed at combating government corruption and promoting financial freedom. Trump echoed similar sentiments, advocating for a strategic national Bitcoin stockpile reserve, and emphasizing the need to protect individual freedoms. Both candidates aim to challenge the Biden administration’s anti-crypto stance, which has included aggressive measures such as proposing a 30% tax on Bitcoin mining electricity.

The impressive thing about Bitcoin as money, is that it is technology, and it does not care what politicians do, or say. The bitcoin blockchain continues recording all bitcoin transaction on a transparent ledger and will continue to do so, regardless who is President and what occurs in the economy.

What has made the bitcoin community so excited as of late is that $19,733,672 bitcoin have already been mined. Since there will only be another 1.27 million more bitcoin mined in the next 115 years if the politicians start acquiring bitcoin the number has to increase massively. Also, there are already 93 million people who already have exposure to crypto and this represents a huge voting bloc.

But the political importance of the Bitcoin community is underscored by the fact that the FairShake PAC, representing Bitcoin and crypto interests, has become the largest super PAC, surpassing even the Make America Great Again super PAC. This highlights the substantial financial backing and influence of the Bitcoin community, making it a significant voter base for presidential candidates. The community’s focus is not just on Bitcoin but on the broader issue of financial freedom, advocating for the right to choose how to save and spend money.

The Democratic party, recognizing the growing support for Bitcoin, has attempted to reset their stance with the crypto industry. Despite the Biden-Harris administration’s historically aggressive actions against cryptocurrency, including lawsuits and regulatory hurdles, Kamala Harris’s campaign has shown interest in improving relations with crypto companies. However, this move has been met with skepticism, with critics pointing out that actions speak louder than words. The administration’s recent actions, such as moving $2 billion of seized Bitcoin shortly after Trump’s speech, suggest a continued effort to undermine the pro-Bitcoin stance of their political rivals.

Senator Cynthia Lummis has also played a crucial role in advocating for Bitcoin within the U.S. government. She has proposed a bill to hold Bitcoin as a strategic reserve for 20 years and to establish decentralized Bitcoin vaults operated by the Treasury. Lummis’s plan includes a significant purchase program to mirror the size and scope of gold reserves, aiming to solidify Bitcoin’s role in the U.S. financial system. Her proposals highlight the growing acceptance and integration of Bitcoin at the governmental level, despite the current administration’s opposition.

These current events reveal a significant shift in the political and financial landscape, with Bitcoin becoming a central issue in the upcoming elections. The actions of RFK Jr., Trump, and Lummis demonstrate a commitment to integrating Bitcoin into the U.S. economy and protecting financial freedom.

Here are ten key reasons why Bitcoin is considered superior in preserving purchasing power compared to traditional fiat currencies:

1. **Limited Supply**: Bitcoin has a capped supply of 21 million coins, preventing inflation caused by an unlimited money supply, which is a common issue with fiat currencies.

2. **Decentralization**: Unlike fiat currencies controlled by central banks, Bitcoin operates on a decentralized network, reducing the risk of manipulation by any single authority.

3. **Built-in Scarcity**: The Bitcoin protocol includes halving events approximately every four years, which reduce the rate at which new bitcoins are created, inherently limiting inflation.

4. **Global Accessibility**: Bitcoin can be accessed and used globally without the need for traditional banking systems, making it a universal store of value that is not tied to the economic conditions of any single country.

5. **Resistance to Censorship**: Bitcoin transactions cannot be blocked or censored by governments or financial institutions, ensuring that users can make purchases and transfers without interference.

6. **Transparency**: The Bitcoin blockchain provides a transparent record of all transactions, which helps prevent fraud and unauthorized printing of currency, common criticisms of fiat systems.

7. **Portability**: Bitcoin can be easily transported and used anywhere with internet access, unlike physical money, which can be cumbersome and sometimes restricted across borders.

8. **Divisibility**: Bitcoin can be divided into very small fractions (up to eight decimal places), making it adaptable for micro-transactions, which is not always practical with fiat currency due to physical limitations and handling costs.

9. **Sovereignty**: Bitcoin provides users full control over their assets without the need for intermediaries, allowing individuals to manage their own wealth and potentially reducing reliance on unstable fiat currencies.

10. **Adoption and Network Growth**: As adoption grows, Bitcoin’s network becomes more robust and secure, potentially increasing its value over time as more users accept and trust it as a store of value, contrasting with fiat currencies, which may lose value due to inflation and economic policies.

Bitcoin requires study to comprehend the powerful alternative it offers. I highly recommend that you take the time to put in the effort to comprehend bitcoin. At its core we are witnessing a battle between centralized solutions and decentralized alternatives. This conflict spans financial, political, and economic realms, focusing on a clash that aims to define freedom, liberty, and value moving forward.

Centralized Systems are controlled by a single entity or a small group, such as major banks, large corporations, or government agencies. The main advantage of centralized systems is their efficiency in decision-making and management. Everything is controlled from the top down, which can streamline processes but also leads to a concentration of power. This centralization can be risky as it may lead to corruption, inefficiency, or unfair practices if not properly managed.

Decentralized systems distribute power across many different participants. Examples include blockchain technologies and decentralized autonomous organizations (DAOs), which operate without central control. These systems promote fairness and equality by ensuring no single party has full authority, which can protect against abuses of power and promote more democratic participation. However, the lack of centralized control can sometimes lead to inefficiency and complicate coordination and decision-making processes.

This ongoing battle between centralized and decentralized systems will significantly shape our future societal structures. The outcome will influence how we manage money, govern, and conduct business, balancing efficiency with fairness and control with freedom.

Bitcoin’s status as a formidable player in the monetary arena hinges on its scarcity and decentralized nature, far removed from any centralized software manipulation. It’s this intrinsic design that promotes gradual yet significant adoption and increases liquidity, continually bolstering the network’s overall value. As individuals recognize and move away from lesser monetary systems, they’re not just switching lanes; they’re upgrading to a financial superhighway that Bitcoin paves.

This dynamic makes Bitcoin’s unique attributes nearly impossible to replicate. Simply put, Bitcoin isn’t just surviving in the competitive landscape—it’s thriving. Each transaction and every new user expands its scale, enhancing its monetary properties at the expense of weaker systems. This isn’t just about technology; it’s a full-blown monetary evolution, proving that once a robust system like Bitcoin gains momentum, trying to outpace or copy it is like trying to reinvent the wheel—unnecessary and futile.

As Bitcoin continues to gain mainstream acceptance, its impact on politics and the economy will likely become more pronounced, shaping the future of financial regulation and individual freedoms.

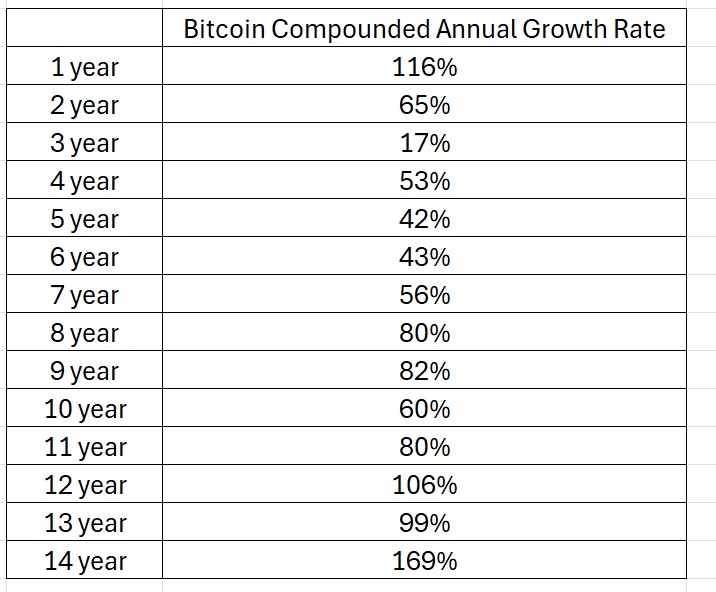

One of the most basic ways that people evaluate the effectiveness and feasibility of an investment or medium of exchange is by utilizing the Compound Annual Growth Rate Metric.

The Compound Annual Growth Rate (CAGR) is like figuring out the average annualized growth rate of your money if it grows a bit every year. Here’s how to think about it: Imagine you have some money in an investment, like a little tree that grows over time. You start with a certain amount of money (we’ll call it the seed), and after a few years, that money grows to a bigger amount (the tree).

To find the CAGR, you look at how much the money grew from the seed to the tree and then figure out what the average growth would be each year to reach that bigger amount. This helps smooth out any ups and downs in how fast the money grew each year. It’s like saying, “On average, my little tree grew this much every year.”

CAGR is helpful when you want to compare different things you might invest in, like two different trees. Even if they grow differently each year, CAGR lets you see which one, on average, grew more each year. This makes it easier to choose which investment might be better in the long run. It’s like comparing different trees to see which one gets the biggest on average every year, no matter if some years are really good and some are not so good.

The table below shows the CAGR of Bitcoin which holds the claim to having the top compounded annual growth rate of any asset class in the history of finance.

I trust that this data and analysis will encourage you to think more discerningly about your investment choices and how you process the often fear-driven headlines that bombard us daily. As we navigate the complexities of financial markets, it’s essential to look beyond the immediate noise and consider the broader implications of where we choose to allocate our resources.

I would also like to invite you to learn how to decipher market trends using artificial intelligence. This is something VantagePoint a.i. has been dedicated to for the last 43 years. The key question we focus on in our Live Online Master Class Training is How Do You Find What to Trade? And How Do You Define a Healthy Trade? These are very critical questions that we all need answers to in an age of perpetual currency debasement.

The Internet Revolution of the 1990s transformed how we communicate, conduct business, and access information, linking the globe in ways we had never seen before. These strides have undeniably propelled democracy, equality, economic development, and technological innovation forward in our modern era.

Yet, amidst these significant social advancements, the perplexing reality is that the value of our money continues to erode. How can this possibly be seen as beneficial? How have we come to accept this ongoing devaluation without demanding accountability?

One of the particularly vexing aspects of economics is the notion that “more” does not automatically equate to “better.” To truly gauge the worth of money and prices, adjustments for inflation are essential. Unfortunately, many overlook this critical step. They assume that having more currency means they are better off. But it’s only when you delve into why more currency is needed for the same goods and services that the damaging impact of inflation—essentially a silent tax and a form of theft—becomes clear.

As I project forward, my foundational belief stands firm: the Fed will inevitably need to introduce a significant influx of new money to continue financing government operations. In the financial environment we navigate today, the devaluation of currency isn’t merely a temporary concern—it’s a persistent reality that subtly diminishes your purchasing power as we speak.

This condition in the economy doesn’t give us much choice; it transforms every one of us into speculators. There’s a widespread, almost instinctual understanding that the value of tomorrow’s dollar will inevitably be less than today’s. This unavoidable trend compels us to continuously reassess how we preserve and grow our wealth.

Amid this challenging scenario, however, lies a remarkable opportunity: leveraging cutting-edge technologies like Artificial Intelligence (A.I.) in trading. A.I. technology provides a critical advantage in this new financial paradigm, not merely adapting our strategies to market fluctuations but revolutionizing our methods to counteract the erosion of wealth. With A.I., we can navigate these turbulent financial waters with more precision, turning potential threats into avenues for strategic investment and growth.

Join us for a transformative journey at our Live Online Free Masterclass on A.I. trading. Here, you’ll gain the insights to fully harness A.I.’s potential, turning the relentless challenge of currency debasement into a strategic advantage that not only preserves but multiplies your wealth. Embrace this opportunity to redefine your trading and investment strategy and step into a realm where financial foresight meets technological prowess.

I invite you to learn how to forecast trends using artificial intelligence at our Next Free Live Training.

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.