Fear and Greed are two of the ongoing emotions investors and traders have to confront whenever they are engaged in the stock market. Fear is an emotion triggered whenever there is a sense or threat of loss. In this article, we are going to explore how professional traders use options to hedge market risk either partially or completely.

Options are derivative instruments. They derive their value, or lack thereof, from the underlying asset. Primarily options are “price insurance agreements” between traders.

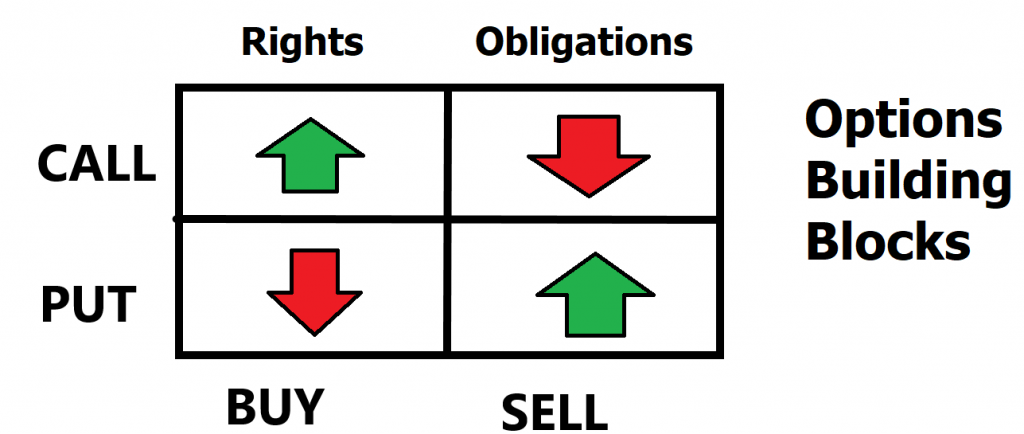

There are four fundamental options strategies. The following graphic views each in isolation and simply focuses on the desired price directionality for the option to be profitable.

Options trading can be complex and nuanced, but it all starts with understanding the fundamental difference between a “right” and an “obligation.” When you purchase an option, you are essentially purchasing the right to buy or sell an asset at a specific price, known as the strike price, before a specific expiration date. This is a contractual agreement, known as a derivative, that is only valid for a certain period. Importantly, the buyer of the option is not obligated to perform – they have the right to choose whether to exercise the option or not.

To simplify this concept, think of it like an insurance policy. As the buyer of the policy, you are paying a premium to have the right to a certain amount of protection for a set period. If something were to happen during that time that triggers the policy, you have the right to make a claim and receive the benefits. But if the policy expires, you lose that protection unless you choose to renew it by paying another premium.

This foundational understanding of options is crucial for traders looking to navigate this market. All options, whether they are calls or puts, share these same key characteristics, and it’s important to understand them before diving deeper into more complex strategies. By grasping the basics of options trading, traders can better manage risk and potentially profit in this exciting and dynamic market.

There are four potential scenarios that exist with options trading.

1) Buying a Call

2) Selling a Call

3) Buying a Put

4) Selling a Put

Each of these scenarios offers a unique and distinct risk/reward profile.

Buying a Call Option gives the buyer the right, but not the obligation, to own the underlying asset between now and the expiration date in exchange for paying a premium. Call option buyers have limited risk as the most that they can lose is the premium that they pay for the call option.

A Call Option Seller (creator of the insurance contract) on the other hand has created an obligation where they accept the premium payment today and are obligated to deliver the underlying asset at the agreed upon price between now and the expiration date if it is exercised. The most amount of money that a call option seller can make is the premium they collect. Theoretically speaking selling call options comes with unlimited risk potential because in theory the underlying asset could go to the price of infinity.

Buying a Put Option gives the buyer the right but not the obligation to sell the underlying asset at an agreed upon price between now and an expiration date. The risk that a put option buyer has is limited to the premium payment.

A Put option seller (creator of the insurance contract) is obligated to own the underlying asset at an agreed upon price between now and an expiration date in exchange for the premium they receive today. Their maximum potential profit is the premium they receive.

The best way to understand HEDGING is to look at a 52-week chart of your favorite asset. We will be looking at the S&P 500 Index as it is a great representation of the broader market. Whenever we look at a trade, we look at what we refer to as the worst-case scenario. In the price history of the chart, we simply connect the high points to the low points to determine and understand risk and volatility before we enter the trade.

You can quickly see that there is tremendous price risk in the S&P 500 Index. There have been 4 declines. For purposes of illustration let’s say you own $1,000,000 in an S&P 500 Index ETF.

The price shocks are substantial and consistent.

- Down 19% in 9 weeks = $190,000 in price risk.

- Down 19% in 9 weeks = $190,000 in price risk.

- Down 9% in 2 weeks = $90,000 in price risk.

- Down 9% in 7 weeks = $90,000 in price risk.

Traders hedge their positions with options to manage this type of price risk and protect themselves against potential losses. Options allow traders to purchase the right to buy or sell an asset at a specific price, known as the strike price, before a specific expiration date. This means that if the price of the asset moves in a direction that is unfavorable to the trader, they can exercise the option and limit their potential losses.

For example, if a trader owns a stock that they believe may decrease in value, they could purchase a put option, which gives them the right to sell the stock at the strike price even if its value drops. This way, if the stock does decrease in value, the trader can exercise the option and sell the stock at the higher strike price, thus limiting their potential losses.

Hedging with options can be an effective risk management strategy for traders who want to limit their exposure to market fluctuations. It can also be used to protect against unforeseen events, such as political or economic instability, that could negatively impact the value of an asset. By using options to hedge their positions, traders can help ensure they are not overly exposed to market risks and can potentially improve their overall returns.

For most stock traders there are two types of hedges that traders regularly engage in. The first is buying put options. The second is selling call options which is only a partial hedge but can still offer the price insurance that traders are looking for.

Traders hedge their positions with options to manage risk and protect themselves against potential losses. Options allow traders to purchase the right to buy or sell an asset at a specific price, known as the strike price, before a specific expiration date. This means that if the price of the asset moves in a direction that is unfavorable to the trader, they can exercise the put option and limit their potential losses.

For example, if a trader owns a stock that they believe may decrease in value, they could purchase a put option, which gives them the right to sell the stock at the strike price even if its value drops. This way, if the stock does decrease in value, the trader can exercise the option and sell the stock at the higher strike price, thus limiting their potential losses.

Hedging with options can be an effective risk management strategy for traders who want to limit their exposure to market fluctuations. It can also be used to protect against unforeseen events, such as political or economic instability, that could negatively impact the value of an asset. By using options to hedge their positions, traders can help ensure they are not overly exposed to market risks and can potentially improve their overall returns.

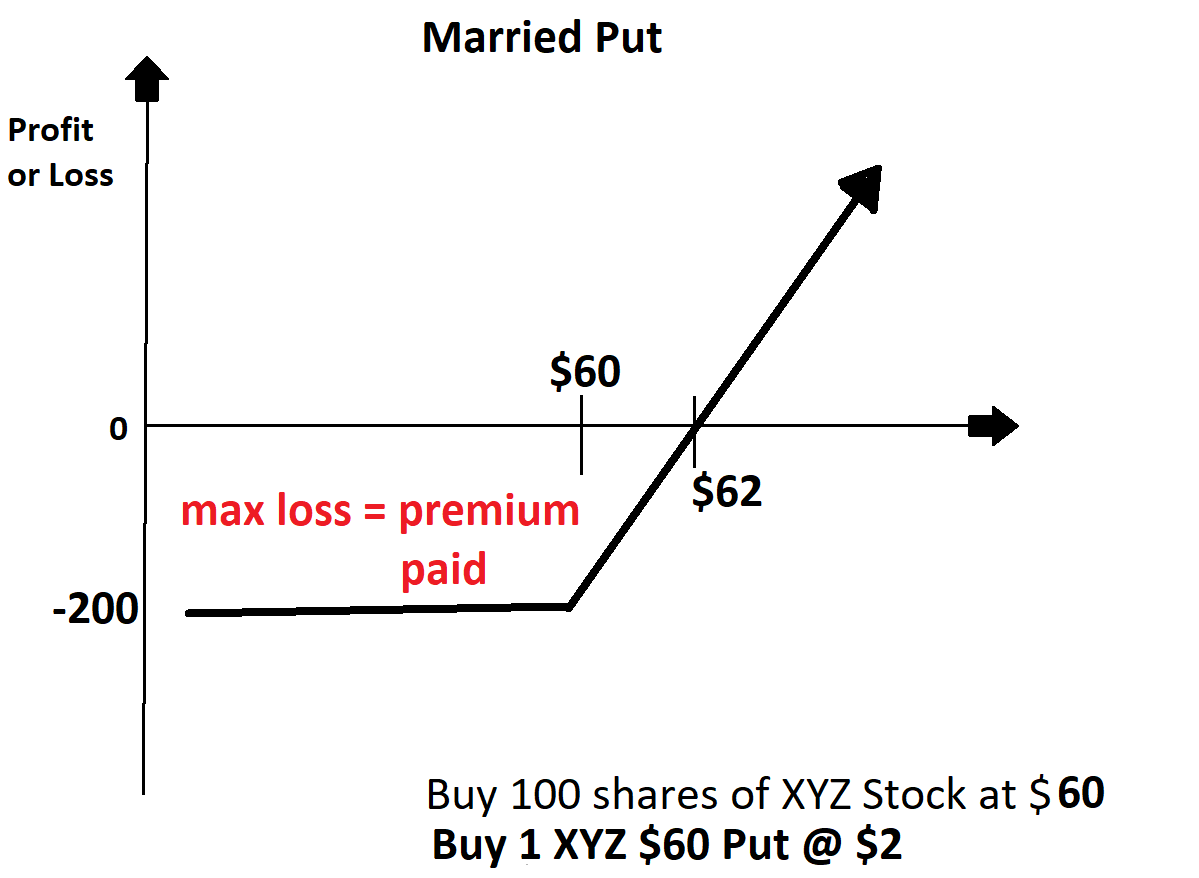

When an options trader is bullish on a stock but cautious of near-term uncertainties, they may use a married put strategy to gain the benefits of stock ownership, such as dividends and voting rights, while also having downside protection. This strategy is also referred to as a synthetic long call because its profit potential is equivalent to that of a long call. With a married put the most that a trader can lose is the premium payment.

Max Loss Occurs When Price of Underlying <= Strike Price of Long Put

The married put strategy provides unlimited profit potential, just like a long call. To calculate the profit, use the following formula:

Maximum Profit Potential = Unlimited

Break Even = Purchase Price of Stock + Premium Paid for Put Option

It is illustrated graphically with the exact same risk reward characteristics as those of owning a call option.

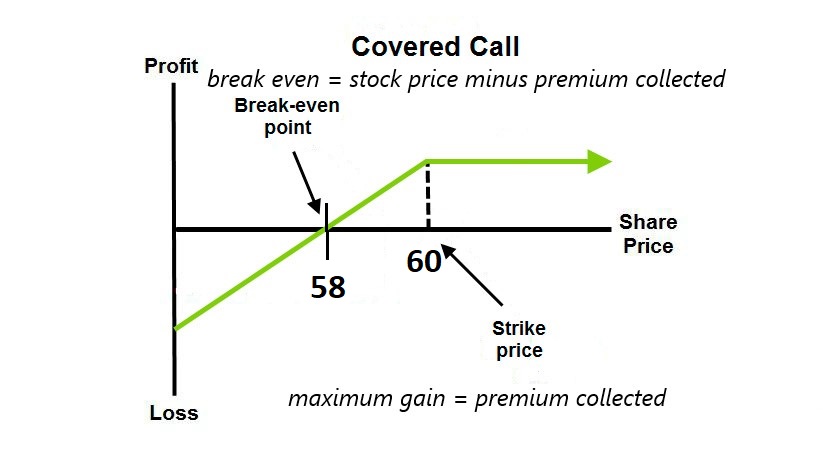

An alternative form of hedging is to sell call options against an existing long-stock position. This has numerous benefits but also several risks that need to be evaluated.

Selling call options as a hedging strategy is not foolproof . The maximum hedge that an investor can gain from selling a call option is only the premium collected. If the stock price rises significantly above the strike price, the investor may have to sell the stock at a lower price than the market value. This means that the investor may miss out on potential gains if the stock continues to rise. Therefore, investors should carefully consider their risk tolerance before using this strategy.

This is also known as covered call writing. This strategy involves selling call options on a stock that the investor already owns. By selling the call option, the investor earns a premium, which helps offset any potential losses in the stock. However, the maximum gain for the investor is limited to the premium collected, and the potential loss of profit can be significant if the stock price rises above the strike price. Additionally, the investor may miss out on any further gains in the stock if it continues to rise.

Despite the potential drawbacks, covered call writing remains a popular strategy for investors looking to hedge their price risk in the stock market. It allows investors to earn income while still retaining some ownership of the stock. However, investors should carefully consider their risk tolerance and financial goals before using this strategy, as it may not be suitable for everyone. Overall, selling call options can be an effective form of hedging against price risk, but it is important to weigh the pros and cons before implementing this strategy.

What is critical to understanding about selling call options as a hedge to price risk is that the most protection you can gain in implementing this strategy is the option premium you collect.

So, for example, let’s say that $XYZ stock is trading at $60.

The $XYZ 60 put option is trading at 2. It expires in one month.

Selling call options in this regard is an attractive strategy if you think that the upside potential is limited, and the market has a sideways bias. Since the premium collected is $2 this means that the stock could fall to $58 for the break-even price to occur.

Important takeaways from Covered Call Writing:

If an equity owner doesn’t anticipate significant price appreciation for their stocks, they can use the covered call strategy to generate additional income.

A “covered” position requires the trader to hold 100 shares of the underlying stock for each call option sold, which acts as a protective measure against downside risk.

Most traders selling covered calls prefer using “out-of-the-money” call options due to their higher probability of expiring worthless, which can result in a profit for the trader.

The covered call strategy can be profitable in various market conditions, including bearish, neutral, and slightly bullish markets, offering traders flexibility in their trading strategies.

One should be aware of the potential risks associated with the covered call strategy, as the maximum loss on the trade is relatively high due to the underlying stock’s downside risk.

Traders and investors with a grasp of the risk/reward potential of this type of trade use the strategy tens of thousands of times daily. However, the actual yield from the trade can only be determined on the options expiration date or when the trader closes out the trade.

Please note that covered call writing is only a partial hedge because the maximum protection you gain is the premium you collect by selling the call option. This works effectively in sideways trending markets but is completely ineffective should a substantial downtrend occur.

Hedging is risk management in action. It is used by traders and investors to reduce the potential risks associated with their investments. Essentially, hedging involves opening an offsetting position to an existing investment to mitigate the risk of potential losses. Hedging is crucial in trading because managing risk is the most fundamental aspect of successful trading. By taking measures to reduce exposure to risk, traders can protect their trades from significant losses in turbulent market conditions.

The entirety of trading can be reduced to two questions:

What if I’m right?

What if I’m wrong?

Trading is a defensive activity that requires an extreme focus on managing risk and learning from losing trades. By recognizing the threat of loss due to uncertainty and becoming an expert in taking losses, traders can effectively manage risk and increase their chances of success. It is important to analyze risk and find trading opportunities with the best risk/reward ratios.

In today’s global markets, artificial intelligence is an absolutely essential tool for successful trading. Attending our . can provide traders with the opportunity to learn how to leverage artificial intelligence to improve their trading results and gain a competitive edge in the market.

Artificial intelligence is not “a would be nice to have” tool.

It is an “absolutely must-have” tool to flourish in today’s global markets.

Intrigued? Visit with us and check out the A.I. at our .

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.