It will be of no surprise to readers of this blog that I often find myself completely at odds with the prognostications of the Federal Reserve. Their logic defies common sense and appeals to economic illiteracy more often than not. Since the Great Financial Crisis in 2008, they artificially manipulated the interest rate market to zero percent to “stimulate” the economy. While this sounds plausible on the surface, it ignores the myriad of unintended consequences that this policy has manifested in the economy and the multitude of problems that it has created.

The most important price in a free-market capitalist economy is the cost of money. When that price is manipulated to manage the economy better, it is fair to say that we are no longer practicing capitalism and are engaged in central planning for the greater good.

The Austrian School of Economics has long warned of the unintended consequences that may arise from a zero-interest rate policy implemented by the Federal Reserve. Among these consequences are primarily the misallocation of resources , which occurs when artificially low interest rates make it easier for businesses to access credit, leading to overinvestment in certain sectors that may not be viable in the long term.

Another risk associated with low interest rates is asset price inflation, as investors seek higher returns in stocks and real estate, causing bubbles that will eventually burst, leading to nasty market corrections. Additionally, the lower interest rates may increase the money supply, triggering an increase in the prices of goods and services, resulting in inflation.

Furthermore, low-interest rates may discourage saving as savers earn less interest on their savings, leading to a reduction in overall savings, which ultimately impacta investment and economic growth in the long run. Low interest rates have been the safe and traditional path that retirees take to safeguard their savings in retirement. Low interest rates encourage borrowers to take on excessive risk, leading to defaults and bankruptcies.

The manipulation of interest rates can also lead to boom-and-bust cycles in the economy, as businesses overinvest during the boom phase, leading to a bust when the market corrects itself. Finally, when interest rates are kept low, businesses may not invest in capital goods, leading to a reduction in capital accumulation over time, known as capital consumption.

Worst of all is that low-interest rates make it impossible for pensions to effectively plan how they will be able to pay their obligations to their pensioners.

All these unintended consequences underscore the risks associated with a zero-interest rate policy, which the Federal Reserve must carefully consider when making decisions that will impact the economy.

Over the past week, as I have digested the top financial news in the stock market, I see massive conflicting stories which illustrate the Fed’s attempts at unwinding the zero interest rate policies of the recent past.

For example, just this past week we have seen stocks like $MSFT, $GOOG and $META all absolutely crush their earnings estimates by roughly 10%. The tendency upon hearing this type of news is to get bullish again. But on the flipside, we also have the recurrence of the banking crisis looming again with stocks like First Republic Bank ($FRC) losing over 65% of its stock value in just the last few days and having lost over 90% year to date. The simultaneous convergence of both stories creates a trading environment of anxiety and stress as market participants try to ascertain what is true and determine where the risk and opportunity are in the markets.

Keep in mind that the 2 nd and 3 rd largest bank failures in U.S. history happened earlier this year . The largest banks in the country have contributed over $30 billion to First Republic to shore up deposits and try to make sure that it survives. Should First Republic Bank fail it will be among the top 5 largest bank failures in history. It would mean that 3 of the 5 largest bank failures in history all occurred in the past 90 days.

The problem highlighted by First Republic Bank is indicative of the entire banking system. Banks cumulatively are all still holding over $650 billion of losses on their Treasury Bond portfolios which if marked to market would make them insolvent.

That situation in and by itself is quite intimidating. But let’s look internationally. Argentina is facing 100% inflation. The Central Bank of Argentina just raised interest rates in the country to 81%. And within that predicament we can clearly see the seeds yield discontent . What good is earning an 81% yield if inflation is 100%? All returns are always measured against the inflationary pressures in the economy.

In a story in the New York Times this week:

On Friday, Moody’s downgraded the ratings of 11 regional banks, citing “a deterioration in the operating environment and funding conditions.”

“ In calls with investors about their latest financial results last week, regional bank leaders tried to cast the crisis as a moment that had passed. The banks also distanced themselves from rivals still caught in the storm, like First Republic, which reported on Monday that it had lost $102 billion in customer deposits. “

While it is true that all bull markets must climb a wall of worry, the fundamental challenge facing the economy today is that we have more than twice as much debt as we did during the Great Financial Crisis. Now over the last 14 months, we have had the Federal Reserve raising interest rates at the fastest pace in history. Yet most financial pundits in the media try to tell you that twice the debt at 5x the interest rate is nothing to worry about!

Call me skeptical.

While Fed Chairman Jay Powell may be valiantly attempting to correct the errors of his predecessors it is patently obvious why depositors are reluctant to keep their funds in banks.

Simple question.

Would you rather earn 4.77% in a money market fund, or 2.25% by keeping your money in a bank? What logic is there for savers to keep their savings in banks when the yield is substantially less than what is immediately available in a money market fund?

A money market fund is a type of mutual fund that invests in short-term, low-risk debt securities such as commercial paper, certificates of deposit, and US Treasury bills. These funds are typically managed to maintain a stable net asset value of $1 per share.

Money market funds can offer higher rates of return than banks because they invest in higher-yielding securities that are not typically available to banks. Banks are subject to regulatory requirements that limit the types of investments they can make and the amount of risk they can take. Money market funds, on the other hand, are not subject to the same regulatory restrictions and can invest in a wider range of securities, including those with slightly higher levels of credit or interest rate risk.

In addition, money market funds can pool the assets of many individual investors, which allows them to achieve greater economies of scale and reduce operating expenses. This can lead to higher returns for investors, even after deducting the fund’s management fees.

It’s important to note that while money market funds are generally considered low-risk investments, they are not insured by the Federal Deposit Insurance Corporation (FDIC) like bank deposits are. Therefore, investors should carefully consider the risks and rewards of investing in a money market fund before deciding. Many investors who do not believe the government reporting on inflation have completely left the “yield chase” game and have instead opted to move to alternate stores of value like precious metals or cryptocurrencies.

The point I’m making is to simply look at the seeds of the current banking crisis. Money will always move to wherever it is treated best. There is no logical reason for investors to keep the bulk of their savings in a bank, when money markets are offering significantly higher rates of return.

However, this is where the story and analysis get much more interesting.

How do you measure the risk associated with your money market fund? This is not an easy question to answer. The risk of default is minor, but the risk of continued currency debasement is substantial. When you invest in a money market fund, most of the fund is invested in government paper. Although money market funds are generally considered low-risk investments, there are still some risks associated with investing in them. Some of these risks include:

Credit Risk: Money market funds invest in short-term debt securities issued by corporations, banks, and governments. These securities carry varying degrees of credit risk, which is the risk that the issuer may default on their obligation to repay the principal and interest on the security.

Interest Rate Risk: Money market funds are subject to interest rate risk, which is the risk that the value of the fund’s holdings will decline if interest rates rise. When interest rates go up, the value of existing fixed-rate securities goes down, which can negatively impact the fund’s returns.

Liquidity Risk: Money market funds invest in securities that can be sold quickly, but there is always the risk that the market for those securities could freeze up, making it difficult to sell them at a fair price. If a fund is forced to sell securities in a distressed market, it could lead to losses for the fund and its investors.

Regulatory Risk: The regulations that govern money market funds can change over time, which could impact the fund’s returns or cause it to become less liquid. For example, in 2008, the Reserve Primary Fund “broke the buck,” meaning its net asset value fell well below $1, due to losses on Lehman Brothers debt securities. This led to regulatory changes aimed at making money market funds more resilient.

And so, it goes.

Hopefully, you can now understand why I contend that the banking crisis is far from over and the seeds of “yield discontent” are responsible for the huge uptrends we have seen recently in precious metals and bitcoin.

But much more tension and dissonance are brewing in the economy.

Recently the Conference Board forecasted a 99% probability that the economy will enter a recession in the next 12 months.

The Conference Board is a global, independent business membership and research association that provides trusted insights for what’s ahead to help leaders navigate economic and business challenges. The organization was founded in 1916, and it is headquartered in New York City, with offices in Brussels, Beijing, Hong Kong, and Singapore.

The Conference Board conducts research, convenes conferences and events, makes forecasts, and provides economic data and analysis to help organizations understand and address critical business issues. They cover a broad range of topics, including the global economy, labor markets, corporate governance, sustainability, and human capital.

The accuracy of The Conference Board’s forecasts depends on the specific forecast and the time horizon being considered. Some of their forecasts have been highly accurate, while others have been less so. It is important to note that economic forecasting is inherently difficult, and even the best forecasters are likely to make some errors.

The Conference Board is an independent organization, funded primarily by their members, who include many of the world’s leading corporations, as well as academic institutions and nonprofit organizations. This funding model allows The Conference Board to maintain its independence and objectivity in its research and analysis.

Here is the chart they published with the following analysis:

Observe the accuracy of their last two forecasts. The first forecast occurred about 7 months before the Great Financial Crisis. The second forecast occurred in January 2020 before the pandemic.

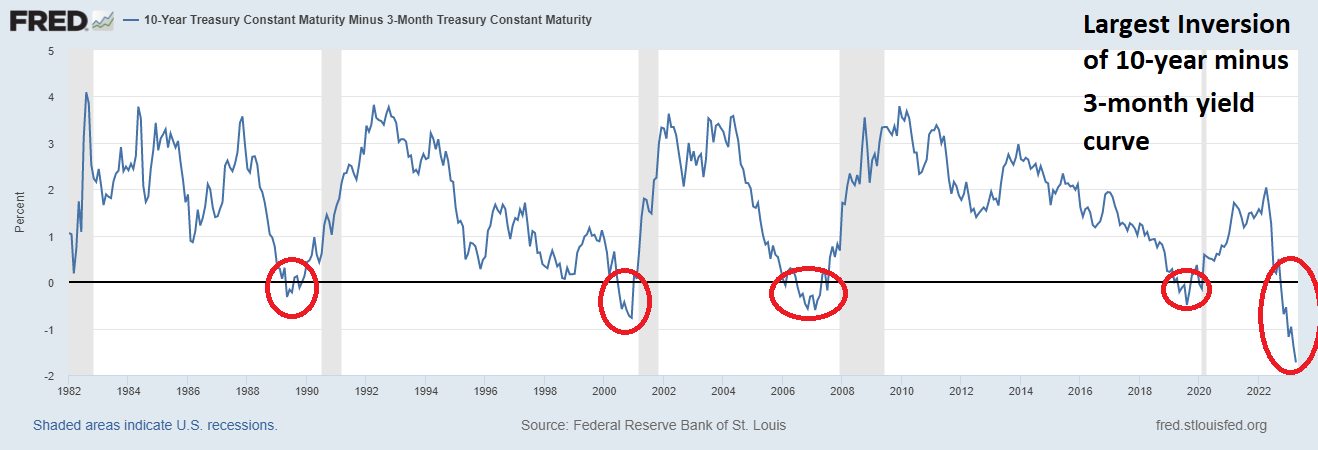

According to traditional economic thought, an inversion of the yield curve almost always precedes a recession. This happens because the Federal Reserve raises short-term interest rates to control inflation, causing a higher yield on short-term bonds than long-term bonds, which in turn leads to an inversion of the yield curve. This hike in borrowing costs can cause businesses and consumers to pull back on their spending, ultimately slowing economic growth.

Furthermore, an inverted yield curve can lead to reduced lending and investment from banks and other financial institutions. This is because they may be hesitant to lend at long-term rates when they can borrow at higher short-term rates, ultimately creating a ripple effect that can slow down economic activity.

Additionally, investor pessimism can arise when the yield curve inverts, leading to a decrease in stock prices and an increase in demand for safer assets such as bonds. This can also cause a decline in capital investment from businesses that are less willing to invest in long-term projects requiring significant funding when borrowing costs are high.

Finally, an inverted yield curve can cause a decrease in consumer confidence, as it is often seen as a sign of an impending economic downturn. This can lead to a decrease in consumer spending, ultimately slowing down economic growth.

All of these factors combined can create a self-reinforcing cycle that ultimately leads to a recession. While an inverted yield curve is not a surefire indicator of a recession, it is often considered a warning sign that investors should pay attention to.

Here is the latest chart From the St. Louis Federal Reserve showing that the inversion of the 10-year Note versus the 3-month Treasury Bill at its worst level in history.

It’s frustrating to see the banking crisis still ongoing. The situation is dangerous, and while catastrophic failure isn’t inevitable, we can’t afford to be complacent. Despite this, I believe that the banking sector will survive and even thrive. The government and central bank are highly motivated to protect depositors and prevent bank runs. What we can almost guarantee is that they will turn on the money printer and debase the currency.

Another simple question.

Should a recession occur in the next 12 months as forecasted by the Conference Board, how do you protect the value of your savings and investments?

Do you know how to find the strongest trends and opportunities?

What has your performance been over the past 14 months while the Fed has been raising interest rates at the fastest pace in history?

I’d like to invite you to attend a Free Live Training where we teach traders how to prepare for what’s coming next using artificial intelligence.

Today Artificial Intelligence, Machine Learning and Neural Networks are an absolute necessity in protecting your portfolio.

I, like everybody else, have my opinions about what will happen next. But I never let my opinion get in the way of what the artificial intelligence is forecasting.

While reporters, talking heads and analysts want to discuss esoteric economic ideas, my only loyalty as a trader is to the trend! This is how Vantagepoint artificial intelligence simplifies and empowers traders daily!

Intrigued? Visit with us and check out the A.I. at our Next Free Live Training.

Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

It’s not magic. It’s machine learning.

Make it count!

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.