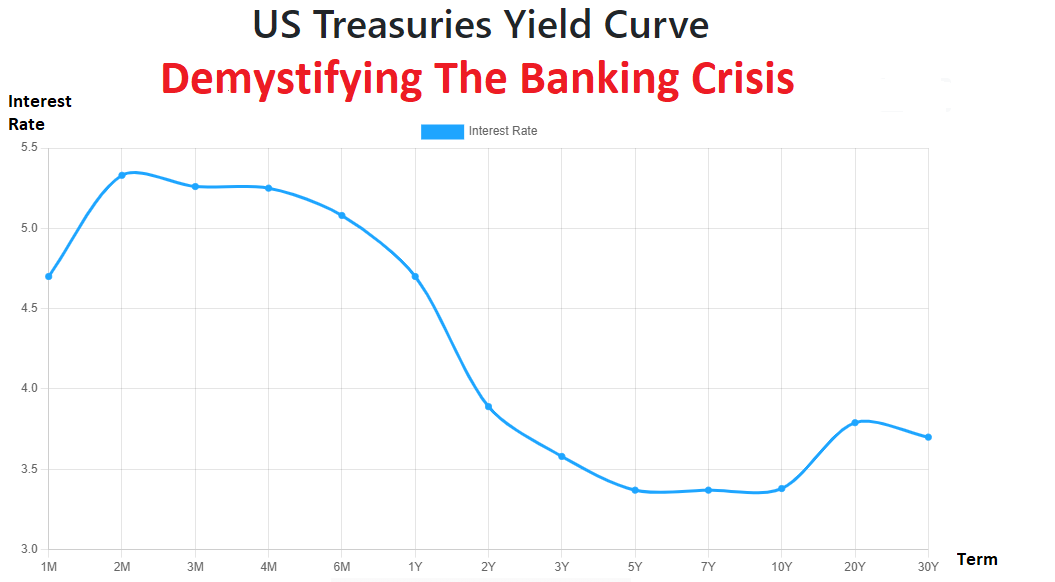

I’m going to show you one chart explaining the totality of the banking crisis. As you look at this chart, the question you need to ask is, where would you place your money based upon the available interest rates on the yield curve? Then, ask yourself where banks have placed excess funds, as required by law and banking regulators.

Money always moves to wherever it’s treated best. When the yield curve inverts, banks are put in the precarious position that they cannot entice investors to keep their savings in their banks. This occurs when short-term treasury bills are offering significantly higher returns than what banks can offer. Over the last 60 days, since the beginning of the banking crisis, this is EXACTLY what has been occurring. Savers have poured into short term treasury bills.

The level of interest rates available on the yield curve are influenced by a combination of market mechanisms and financial institutions, including:

1 . Central banks : Central banks, such as the Federal Reserve in the United States or the European Central Bank, have the power to set short-term interest rates, which can influence the overall level of interest rates in the economy.

2. Bond market participants : The supply and demand for bonds can affect interest rates. When there is high demand for bonds, their prices rise, and their yields (interest rates) fall. Conversely, when there is low demand for bonds, their prices fall, and their yields rise.

3. Economic conditions : The level of interest rates is also influenced by economic conditions, such as inflation rates, unemployment rates, and GDP growth. If inflation is high, interest rates tend to be higher to help combat inflation.

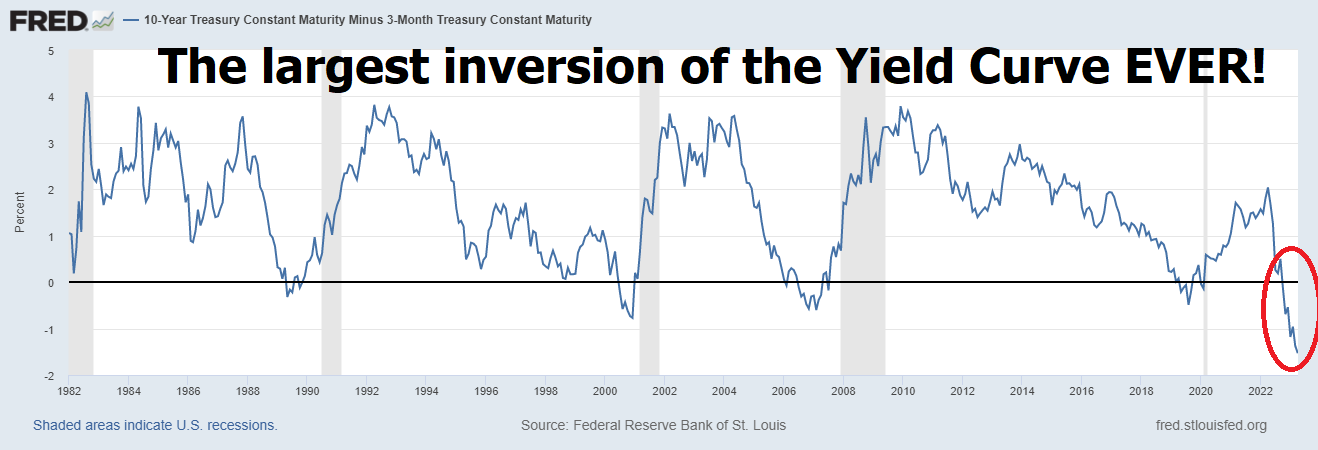

However, the king of the hill as far as the yield curve is concerned is the Federal Reserve. They decide the level of short-term interest rates and in so doing are the primary players in deciding interest rate levels at different points in time. Fed Chairman Powell has raised interest rates 10 consecutive times over the past 14 months at the fastest pace in history. What makes this predicament problematic is that we are being told that the banking sector is “fine” and solvent when all the evidence I look at is completely contrary to that perspective.

What I found striking and perplexing at the beginning of the Federal Reserves press conference yesterday was the following comment from Fed Chairman Jerome Powell:

What no one wants to state or admit is that long dated Treasuries are the new toxic assets . This is what I’ve been writing about extensively on this blog for many years. Debt today is toxic because there has been no means of generating a positive ROI by investing in debt once inflation is taken into account. When the Fed decided to aggressively start raising interest rates all banks were incapable of paying depositors what they can receive from a two-month short-term T-Bill. This is the reason we have a banking crisis occurring.

Why would anyone keep their savings in a bank when the risk of loss is greater, and the return is far less?

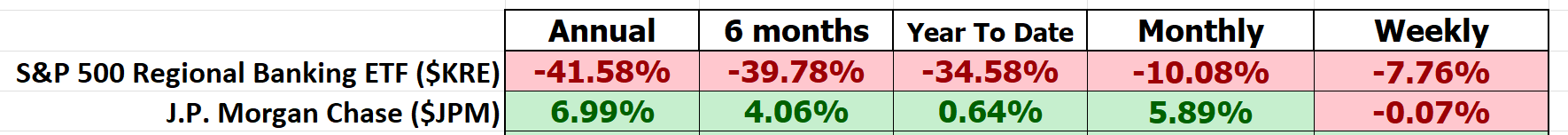

First off, let’s look at the S&P 500 Regional Banking ETF – $KRE. Does this look like a healthy chart to you? Does it look sound and resilient?

We have had President Biden, Treasury Secretary Yellen and Fed Chairman Powell reiterate numerous times that the banking system is sound. The $KRE ETF (SPDR S&P Regional Banking ETF) is an exchange-traded fund that tracks the performance of the S&P Regional Banks Select Industry Index, which includes publicly traded regional banks in the United States. As of May 4th, 2023, the KRE ETF holds positions in 139 regional banks in the US. The performance metrics speak for themselves!

Just last week Moody’s, a top credit rating agency, downgraded 11 regional banks!

Silly question, but how do we define a sound banking system? It is an important question in this economic environment. Does the word “SOUND” now mean that the Federal government is going to backstop all the failures?

Over the last 60 days we have had 3 of the four largest bank failures in history occur. First Republic Bank was seized by regulators, becoming the second largest bank failure in US history. However, if you read the financial media closely many have refused to call it a failure. Congrats to Silicon Valley Bank for holding that title for all a few weeks. It’s not like we’re keeping score, but now SVB drops to third place and Signature Bank to fourth. So, who’s next, folks? Any guesses? The markets think it is PacWest. $PACW is down 80% year over year.

Yesterday, I decided to watch the markets trade after the close. Here were a handful of the results from the banking sector in afterhours trading:

PacWest ($PACW) down -30%

Western Alliance ($WAL) down -25%

Metropolitan Bank ($MBC) down – 21%

HomeStreet Bank ($HMST) down – 15%

Zions Bank ($ZION) down -10%

KeyCorp ($KEY) down -7%

Harbor One ($HONE) down – 6%

Citizens Financial ($CFG) down -5%

Why would these financial institutions continue to sell off abruptly if everything is, ok?

The interest rate on 30-year mortgages has been below the Fed Funds rate of 5% since May 2010. The reason this is important is that after the Great Financial Crisis, it was the Fed that told us that lowering interest rates to zero percent was necessary to stimulate the economy. They are 100% responsible for the creation of this mess. Now as the Fed tries to reverse course on that unmitigated disaster, ALL BANKS CANNOT pay depositors a rate comparable to what they can receive from a risk-free T-bill yield. THAT spells C-R-I-S-I-S!

Oh, it’s just the same old story. First Republic had too many long-dated securities that decreased in value thanks to the Fed’s aggressive monetary policy. And as depositors withdrew their money, the bank went into a massive liquidity crisis. No big deal, right?

Regulators scrambled to find a buyer for First Republic. But never fear, JP Morgan Chase swooped in to acquire a sweet deal: $173 billion in loans, $30 billion in securities, and $92 billion in deposits for only $10.6 billion. And if that’s not enough, the FDIC will cover 80% of all credit losses that JP Morgan suffers from bad loans.

The interest rate JP Morgan received was undisclosed as was the average interest rate on loans from First Republic. But if you are a freethinker and simply look at $173 billion in loans an interest rate of only 6.1% generates $10 billion in interest per year which is roughly the equivalent of the purchase price. And they get $92 million in deposits and $30 billion in securities. Talk about taking over a competitor for literally pennies on the dollar.

Sure, it’s a great deal for JP Morgan, but at what cost to the US taxpayers? The FDIC estimates that cleaning up this mess will cost about $13 billion. And let’s not forget, JP Morgan becomes even bigger, just what we all wanted. They get access to an immediate $2.6 billion profit from the transaction.

The stock market does not agree with the sentiments of our leaders that all is “fine.” Unless of course you look at J.P. Morgan in comparison to the Regional Banks!

What do the US Treasury and Federal Reserve want us to believe? That these failures are just “idiosyncratic” events. That’s a dangerous evasion, and we all know it.

Let’s face the facts, almost half of America’s 4,800 banks are already burning through their capital buffers. And while they may not have to mark all losses to market under US accounting rules, that doesn’t make them solvent. Someone will have to take those losses eventually. It’s spooky, to say the least. Thousands of banks are underwater, and we can’t pretend that it’s just about Silicon Valley Bank and First Republic. A lot of the US banking system is potentially insolvent.

And brace yourselves, because the full shock of monetary tightening by the Fed has yet to hit. A great wall of debt is facing a refinancing cliff-edge over the next six quarters. Only then will we learn if the US financial system can safely deflate the excess leverage induced by extreme monetary stimulus during the pandemic.

But it doesn’t end there. According to a report by banking experts, more than 2,315 US banks are currently sitting on assets worth less than their liabilities.

Depositors fled First Republic Bank at a fast and furious pace last week, despite an earlier infusion of $30bn from a group of big banks. And when white knights probed a possible takeover, they recoiled once they examined the books and discovered the scale of real estate damage . The FDIC had to seize the bank, wiping out both shareholders and bondholders. It took a whopping $13bn subsidy and $50bn of loans to entice JP Morgan to pick up the pieces.

The US authorities can contain the immediate liquidity crisis by guaranteeing all deposits temporarily. But that doesn’t address the greater solvency crisis. The Treasury and FDIC are still in the denial phase. They blame the failures on reckless lending, bad management, and over-reliance on foot-loose uninsured depositors by a handful of banks. Does that sound familiar to you? It should. It’s what they said.

It’s Deja vu all over again as it was J.P. Morgan in 2008 that took over the failing Bear Stearns for pennies on the dollar as well.

First Republic, which primarily lent to technology start-ups, came unstuck on commercial real estate. And unfortunately, it won’t be the last on that score. Office blocks and industrial property are in the early stages of unwinding, and we’re in the midst of a nearly perfect storm.

Interest rates have gone up 400 to 500 basis points in a year, and financing markets have almost completely shut down. There’s four to five trillion dollars of debt in the commercial property sectors, of which about a trillion is maturing in the next 12 to 18 months.

The losses may not be as bad as the subprime crisis, but that doesn’t mean the threat is trivial. US commercial property prices have so far fallen by just 4% to 5%. Capital Economics expects a peak-to-trough decline of 22%, which will wreak further havoc on the loan portfolios of the regional banks that account for 70% of all commercial property financing.

But it’s not just the commercial real estate market that’s in trouble. Silicon Valley Bank’s travails were different. Its sin was to park excess deposits in what is supposed to be the safest financial asset in the world: US treasuries. It was encouraged to do so under the risk-weighting rules of the regulators.

The root cause of this bond and banking crisis lies in the erratic behavior and perverse incentives created by the Fed and the US Treasury over many years, culminating in the violent lurch from ultra-easy money to ultra-tight money now underway. They first created “interest rate risk” on a galactic scale, and now they’re detonating the delayed time bomb of their own creation.

The horrible truth is that the world’s superpower central bank has made such a mess of affairs that it has to pick between two poisons: either it capitulates on inflation, or it lets a banking crisis reach systemic proportions. We are witnessing a controlled demolition of the regional banks and a consolidation of greater and greater banking power to the top money center banks.

The challenge for traders and investors is simply that the trading landscape benefits the bears when BANKS cannot generate profits. Look over economic horizons marked by banking crises, and you will see that the opportunity was always clearly on the downside.

Market downturns can be daunting for many investors, but they can also present unique opportunities to grow your portfolio. Learning about options trading strategies such as buying puts, selling calls, and short selling the market can help you take advantage of market declines and potentially profit from them. Don’t let a bear market scare you away from investing – instead, educate yourself on these powerful tools that can help you navigate volatile market conditions.

Learning how to buy puts, sell calls, and short the market can be a game-changer for your investment strategy. These options trading strategies can help you hedge against potential losses, generate additional income, and take advantage of market declines. By mastering these techniques, you can position yourself to potentially profit from even the most challenging market conditions. So why not invest some time in learning these strategies and adding them to your toolkit? You might just find that the next market downturn is your chance to shine.

As a trader, you know how crucial it is to stay ahead of market trends and make informed decisions that can lead to better trades and risk management. Embracing artificial intelligence trading software might revolutionize your trading decision-making process, as it holds the key to unlocking numerous advantages in this fast-paced financial world. For instance, by analyzing vast amounts of data swiftly and adapting to market changes in real-time, A.I.-powered trading software can identify lucrative opportunities and exploit them before a human trader would even have the chance to react. Furthermore, A.I. algorithms can identify patterns that might escape even the sharpest of human eyes, leading to smarter trading strategies and allowing you to make decisions based on solid data analysis rather than relying on intuition alone. When it comes to risk management, AI trading systems can assess possible outcomes and their probabilities more quickly and accurately than their human counterparts, providing you with vital information on where and when to trade. In summary, adopting artificial intelligence trading software into your decision-making process is not only a wise choice but a potentially game-changing approach to making more profitable trades and managing risk more efficiently.

Things are going to get very interesting in the financial markets over the coming weeks as everyone looks for safe havens. The yield curve takes no prisoners.

I’d like to invite you to attend one of our Free Live Trainings so that you can see the power of trading with artificial intelligence in real time.

This is how VantagePoint artificial intelligence simplifies and empowers traders daily!

Visit With US and check out the a.i. at our

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.