Options are risk management tools that are poorly understood by most traders. An option by definition is a contract that gives the buyer the right but not the obligation to buy or sell the underlying asset at a pre-determined price up until a certain expiration date, in exchange for making a premium payment immediately. The buyer of the option is buying PRICE insurance. However, the creator of the option, (the seller) is creating a contractual obligation between themselves and the buyer of the option to either deliver or accept delivery of the asset at the agreed upon price in exchange for the premium they receive. The creator of the option is in fact creating an OBLIGATION.

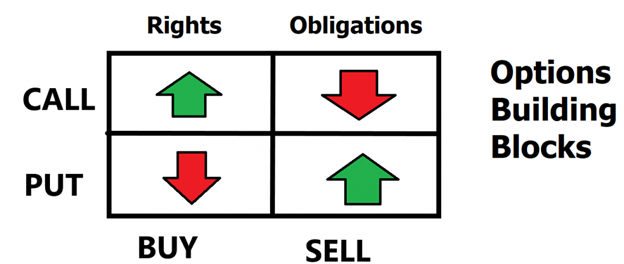

To understand options, we need to explore the four possible option trades.

They are:

BUYING a Call Option . Risk is limited to the premium you pay. Return is theoretically unlimited.

Buying a Put Option . Risk is limited to the premium you pay; Return is limited to the price of the stock if the stock goes to ZERO.

Selling (WRITING) a Call Option . Risk is theoretically unlimited. Return is limited to the premium payment received. This is the maximum potential return.

Selling (WRITING) a Put option . Risk is limited to the price of the stock; in case the stock price goes to zero. Return is limited to the premium received. The premium received is the maximum potential return.

First off, there is some basic terminology and vocabulary to review. Writing an Option means that you are creating the option and collecting the premium. Sometimes the synonym for this is referred to as selling an option. This is also referred to as Naked Option Selling.

In this article, we are going to discuss the risks, rewards, and realities as well as the margin requirements of writing naked options. We will also explore a commonsense strategy of how many traders define future expectations with some very simple common-sense logic.

Writing Options is a common strategy used by professional traders to primarily create income.

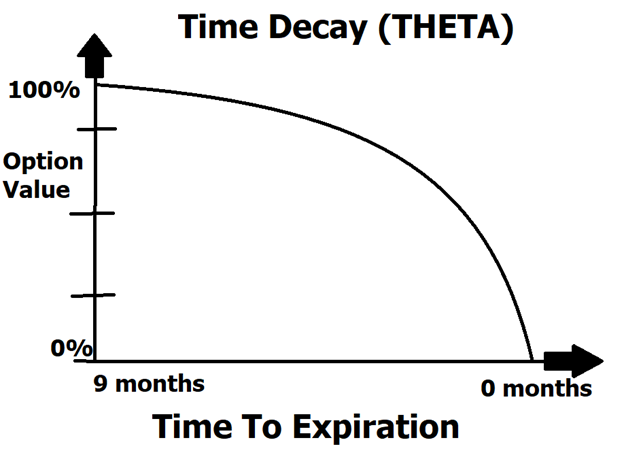

All options are deteriorating assets. This is because an option has a pre-determined lifecycle. The option is only good for a certain period of time. Thus, traders can effectively calculate how much a premium will decay with every passing day, thereby also determining the probability of profit associated with taking a trade.

Let me explain.

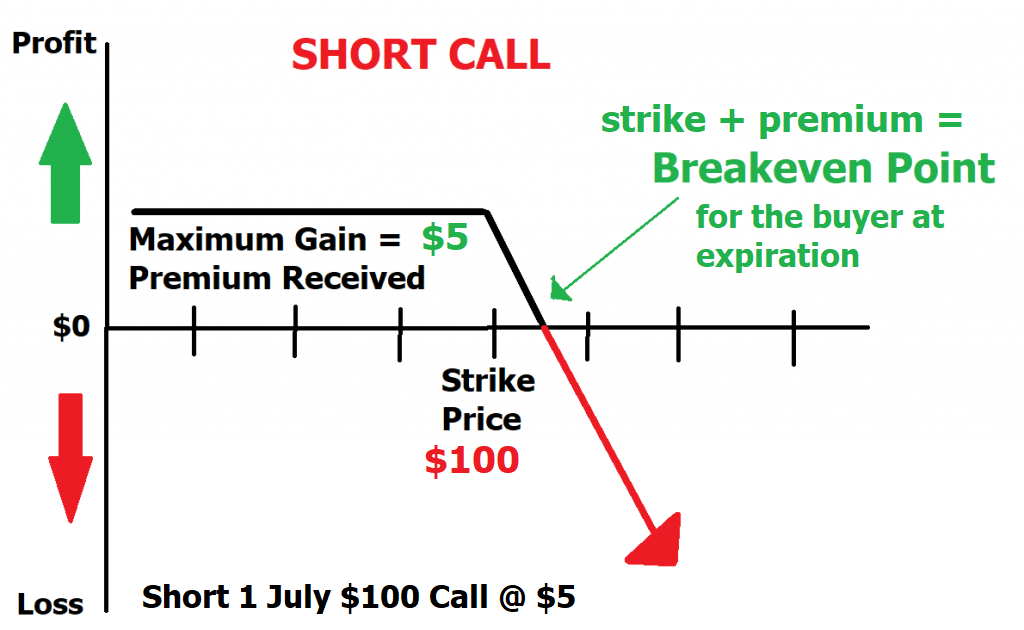

Let’s consider the scenario where XYZ is trading at $100 per share, and the July 100 call option is priced at $5, which amounts to a premium of $500 (since each option contract represents 100 shares). By selling this option, a trader collects the premium upfront and agrees to potentially deliver the shares of XYZ at $100 per share upon the July option expiration.

The risk-reward profile for this strategy can be summarized as follows:

The maximum profit achievable from this strategy is limited to the premium collected, which is $5 in this case. This represents the potential gain for the option seller. This will occur at any price under $100 per share. However, the trade will be profitable at any point UNDER $105 per share.

On the other hand, the risk is theoretically unlimited. Although it is necessary to acknowledge that in theory, the stock price could rise infinitely, the probabilities and market realities usually temper this assumption. It is crucial to balance the potential unlimited risk against actual market probabilities. Additionally, as the option seller, one has the flexibility to close out the position at any desired time and utilize traditional stop-loss mechanisms.

Now, let’s discuss why this tactic can be appealing using some very common-sense logic. Option Sellers are all about understanding the term normal related to an assets stock price.

For example, if an asset had the following average trading range metrics, a trader would use this data and basic trend analysis to initially determine extreme the potential price points of the underlying asset at expiration. While this can be considered a crude and very rough estimate, it provides a trader with a clear expectation of future volatility based upon what has happened in the recent past.

If I was looking at the metrics above, I would consider strike prices these projected price levels where probabilities favor price not reaching. Naturally this basic data cross-referenced with artificial intelligence trend analysis will further improve your overall analysis and chances of success.

With 30 days remaining until option expiration, it is essential to understand that options are time-sensitive contracts. As the expiration date approaches, there is less time for market dynamics to work in favor of the option buyer. For the option buyer the stock will have to be trading above $105 per share at expiration for their purchase to be profitable. This concept is known as time decay. The value of options deteriorates as expiration draws near. Theoretically speaking we can take the $5 premium and divide it by 30 days and effectively estimate how much the option should decay in price each and every day as long as prices remain stable.

Amplify that reality with the fact that for the option buyer the price of the stock needs to rally 5% in 30 days just for them to break even at expiration. While this can potentially occur, you can quickly see that the option seller, the majority of the time, has the probabilities in their favor. Why? For the option seller this trade will be profitable at any price under $105 at expiration. Prove this to yourself the next time you look at any chart. Look at the trading range of the majority of stocks and you will find that a 5% move in 30 days is unusual. The majority of stocks consolidate in narrow trading ranges 70% of the time. These are the stocks that option writers look to focus on.

To visualize the effect of time decay, consider a diagram or graph that depicts the declining value of the option premium as time passes. This diagram helps illustrate how the option seller can benefit from the diminishing time value of the option over the course of its lifespan. Over the last 30 days of an options life the time decay occurs exponentially.

It is important to note that options trading involves risks, and selling options, especially naked options, carries substantial risks. Market conditions, volatility, and other factors can influence the outcome of such strategies. Therefore, it is advisable to thoroughly understand the risks, and employ risk management techniques before engaging in this type of trading.

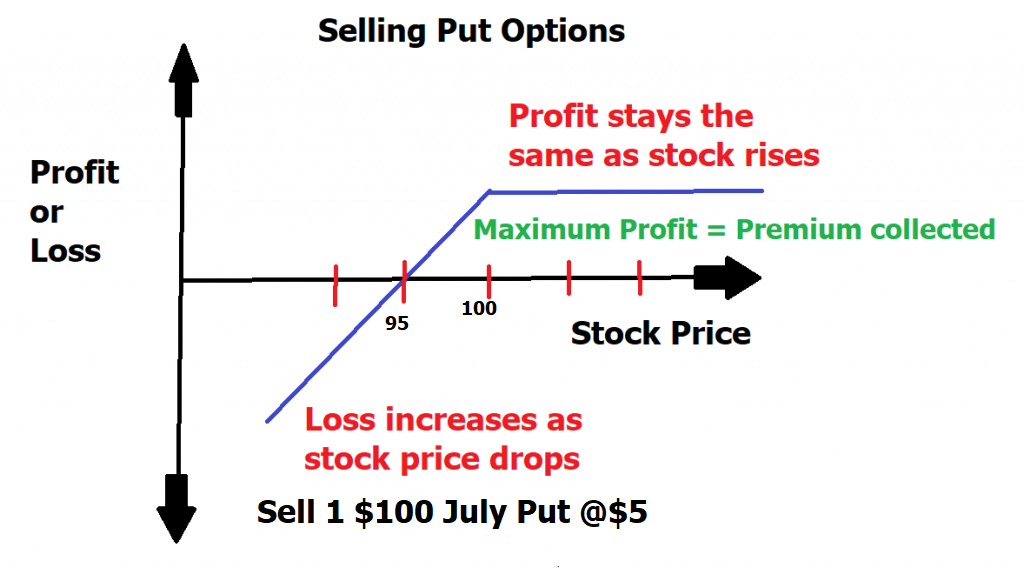

An alternative options writing strategy is selling puts in up trending markets. Whenever a trader SELLS a put option, they are obligating themselves to ownership of the asset at a predetermined price at some point in the future in exchange for a premium payment they receive today. The risk reward profile of this strategy can be outlined as follows:

In this example, the asset is trading at $100 and the put option writer is selling the $100 put option and collecting $5 in premium. This means that this trade would be profitable at any price over $95 at expiration. The option writer will keep the entire $5 premium should the stock expire at expiration at $100 or higher.

The risk is substantial because in theory the stock could go to zero. But this possibility has to be balanced against real world market probabilities. When an investor sells a put option, they receive a premium upfront, which they keep regardless of whether the option is exercised or not. This income can be particularly attractive in periods of low market volatility or when the stock is expected to remain relatively stable.

Another benefit of selling put options is the potential to acquire stocks at a lower price. By selling a put option, the trader is essentially agreeing to buy the underlying stock at a predetermined strike price if the option is exercised. If the stock price remains above the strike price until the option’s expiration, the trader keeps the premium and does not have to buy the stock. However, if the stock price drops below the strike price, the trader may be obligated to purchase the stock at a discount to its current market value, providing an opportunity to enter a position at a potentially lower cost.

Despite these benefits, it’s important to balance the advantages with the risks associated with selling put options. One significant risk is that if the stock price declines significantly, the trader may end up being assigned the stock at a price higher than its market value, resulting in a loss. This risk becomes more pronounced during periods of high market volatility or when there are unforeseen negative events affecting the stock’s price.

All of these factors need to be evaluated before a trade is initiated.

Lastly, what makes naked options writing attractive is the potential returns on margin. Most brokers require that a trader has at least $20,000 in equity in their account to be permitted to sell options. The reasoning for this is simple. A well-capitalized trader is less prone to taking foolish risks that will put the brokerage company at risk. During slower more stable market trading environments many brokerage firms will lower the required amount of equity in an account to $10,000 to be able to write options.

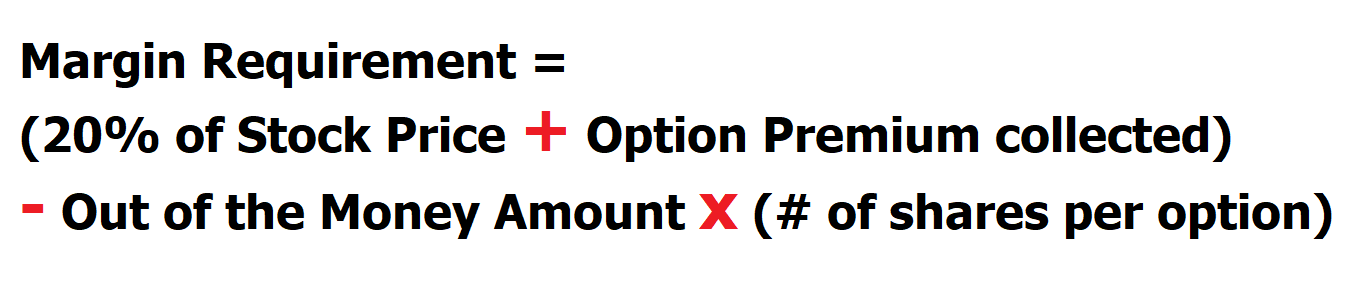

Here is the formula for how most brokerage companies calculate margin requirements for naked option writing:

Using the formula above on a stock that is trading at $100 per share we can calculate the margin as follows:

20% of stock price = $20

Premium collected = $5

Total = $25

Times the # of shares each option represents = 100

= $2,500 margin requirement.

This margin requirement is always marked to the market and will change based upon where the underlying stock is trading on every given day. It is always important to compare the premium you are collecting into your account against the margin requirement.

In conclusion, learning to write options in trading accounts to generate income can be a compelling strategy for traders, provided they carefully balance the risks against the potential rewards. Selling premium, through naked options writing, can offer traders an opportunity to earn income from the premiums collected upfront and potentially acquire stocks at a lower cost. However, it is crucial for traders to educate themselves thoroughly on the intricacies of options trading, understand the risks involved, and implement appropriate risk management strategies.

By gaining a deep understanding of options and diligently assessing market conditions, traders can effectively navigate the potential pitfalls of selling options and capitalize on the income-generating potential. It is essential to be mindful of the risks associated with selling options. Adequate risk management and continuous education are key to mitigating these risks and maximizing the benefits of this strategy.

Ultimately, for traders willing to put in the effort to gain the necessary knowledge and experience, selling premium can be a sound strategy to generate income in their trading accounts. It offers the potential for consistent profits while simultaneously providing opportunities to benefit from market conditions. However, traders must approach options writing with caution, understand the associated risks, and employ prudent risk management strategies to achieve long-term success in their trading endeavors.

Great trading is never about how much you make when you are right. It is always about how little you lose when you are wrong. When you learn how to sell Options and collect premiums you can be wrong and still make money. In other words, the stock can rally more than you expected but the decay in time premium still allows you as an options writer to profit from the trade.

But here is where things can get really exciting. Imagine using Artificial Intelligence to put the odds even further in your favor!

How?

Vantagepoint forecasts trend direction up to 3 days in advance with up to 87.4% accuracy!

That should get you pretty excited because it is a game-changer.

This is the winning combination.

Find the trend.

Scrutinize the 1–3-day forecast.

Write Options against the prevailing trend with minimal risk.

Manage the RISK on the trade.

Lather. Rinse. Repeat.

The Answer AI offers may surprise you.

This is how small traders grow their accounts by taking small bites out of the market consistently.

Intrigued? Visit with us and check out the a.i. at our

Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.