If you were to take a casual stroll through the digital corridors of the internet, you might be led to believe that the Cantillon Effect is a mere footnote in the grand narrative of economic theory. A quick search on Google or Brave, and you’d be hard-pressed to find a dedicated Wikipedia entry for this term. In fact, the once-existing Wikipedia page for the Cantillon Effect has vanished into the ether, leaving behind only a fleeting reference in the entry for the much-underappreciated French Irish economist, Richard Cantillon.

Now, I’ve leafed through my fair share of economics textbooks, and I can tell you, they barely give the Cantillon Effect the time of day. It’s a topic seldom given the spotlight, even among the most knowledgeable of individuals. The highbrow economic minds in the finance world might even shy away from discussing it, as if it were some sort of taboo.

The Cantillon Effect is far from insignificant. In fact, it’s the pivot point, the balancing act, if you will, between authoritarianism and liberty in the economic realm. So, let’s not allow it to be relegated to whispers and hushed tones. It’s high time we brought the Cantillon Effect into the light and gave it the attention it deserves.

The Cantillon Effect refers to the change in relative prices resulting from a change in money supply. The change in relative prices occurs because the change in money supply has a specific injection point and therefore a specific flow path through the economy. The first recipients of the new supply of money enjoy higher standards of living at the expense of later recipients.

The concept is named after Richard Cantillon, an 18th-century economist who believed the impact of money supply changes on the economy is not uniform or neutral, due to variations in the spending behavior of individuals and businesses. In other words, the Cantillon Effect suggests that where the money is injected into the economy, and who gets to use it first, matters significantly. Those who receive the money early can benefit from it before prices rise (inflation), while those who receive it later or not at all will see their purchasing power decrease as inflation erodes the value of their money.

I have studied my fair share of economic textbooks. I read and study financial media regularly. Rarely is the Cantillon Effect and its implications discussed. The reason Cantillon is not studied or discussed much today is simply because Cantillon’s observations are rooted in understanding why “the haves” have more, and the “have nots”, keep having less and less.

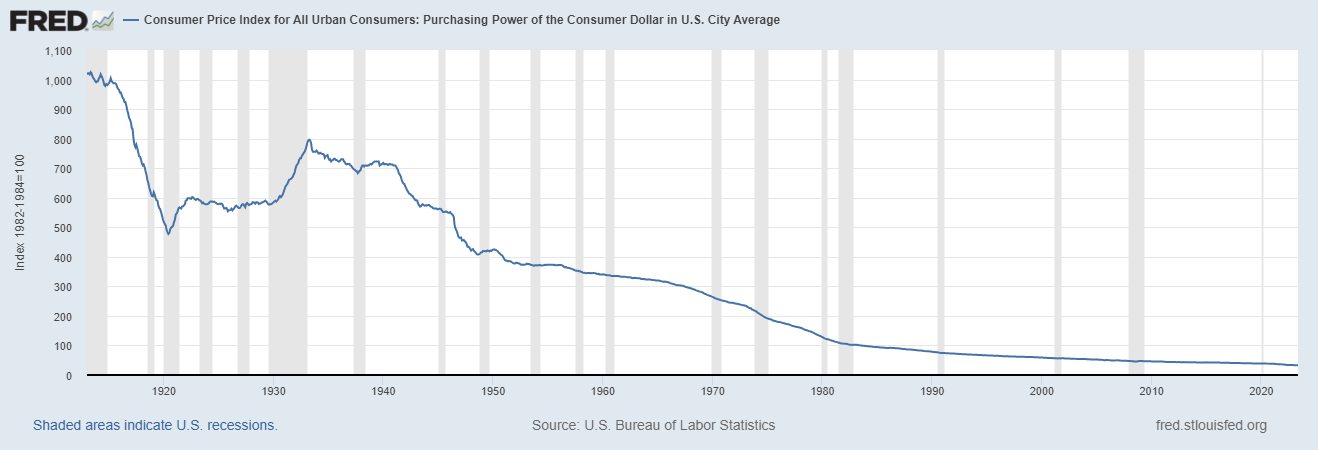

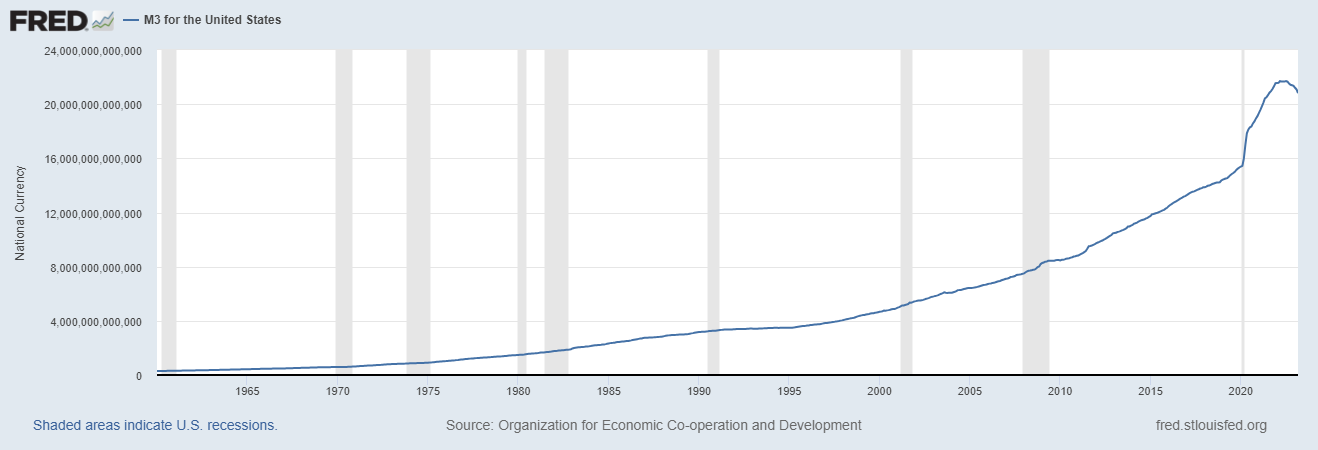

Study the chart below from the St. Louis Fed which shows the purchasing power of the U.S. Dollar, or the growth of the Money Supply. I think these charts are a perfect representation of the Cantillon Effect.

Since the Federal Reserve Act was passed in 1913 the U.S. Dollar has lost almost 98% of its purchasing power. The ramifications of this level of currency debasement are massive as it is clearly not sustainable. Also, observe how the money supply has grown consistently year after year.

What Cantillon was stating is that expansion of the money supply operates as a regressive tax, benefiting those who first receive the new money at the expense of those who receive it later. A regressive tax is a type of tax that takes a larger percentage of income from low-income earners than from high-income earners. But this tax is administered by the ruling political class.

Cantillon, a man of great insight, posited that the distribution of freshly minted money is anything but fair. It’s not a level playing field. The first thing that happens is asset prices skyrocket. And it happens at lightning speed, thanks to the wealthy who, with their pockets full of this new money, chase after a finite supply of assets like stocks or land. (Think of the stock market and housing in 2020 and 2021.)

Cantillon didn’t stop there. He observed that once asset prices have shot up, the money starts to trickle down across the economy. This, in turn, triggers widespread price inflation. And this isn’t just some philosophical musing. It’s the harsh reality of our current economic climate. Just look at the net worth of U.S. households over the past three decades. From 1989 to 2021, the bottom 50% of households saw their collective net worth rise 243% from $761 billion to $2.62 trillion . Meanwhile, the top 1%… Their net worth skyrocketed 769% from $4.78 trillion to a staggering $41.5 trillion. When you compare the change between the top 1% and the bottom 50%, a whopping 95% of the $38.5 trillion increase went to the top 1% of households, while a mere 5% trickled down to the bottom 50%.

And to add insult to injury, our monetary and fiscal authorities have been working in tandem to amplify this Cantillon Effect. And yet, they seem utterly baffled as to why prices are on the rise.

When the money supply is increased, folks have more cash to splash on goods. But if the supply of goods doesn’t keep pace with the money supply, prices will inevitably rise. Each dollar becomes less valuable as they become more plentiful.

Let’s paint a picture here. Imagine a central bank decides to pump up the money supply. The first to get their hands on this new money are usually banks and financial institutions, who can lend or invest this money before prices in the economy have had a chance to rise. As this new money permeates the economy, demand for goods and services increases, pushing up prices. By the time this new money reaches the average Joe, like workers receiving their wages, prices have already gone up. So, even though they have more money, their buying power may have actually decreased. That, my friends, is the Cantillon Effect in action.

Investors, usually the first in line for the new money, can snap up assets at lower prices and then sit back and watch the profits roll in as prices rise. This initial windfall is most evident in the financial markets.

Next up are the corporations, especially those with a large investor base or those big enough to quickly convert investments into production. These corporations can take advantage of lower prices for intermediate goods before those prices start to climb.

But what about the workers, particularly wage earners? They’re the last to see any benefit. By the time their wages increase, the cost of living has already risen due to inflation. This effect hits even harder for those living paycheck to paycheck or those with their savings in a bank account, as they lose money to price increases.

What is most toxic about this scenario is that it is considered “normal.” It is how things are done and have always been done.

I was recently listening to a podcast on economics and the host was stating that his home in 1930 was valued at $100,000. Today that same home on the tax rolls was valued at over $30 million. In other words, the annualized compound growth rate for the home averaged 6.5% each year over the 92 years. The point the host was making is that no economist anywhere in the world would claim that inflation in the United States averaged over 6.5% every year since 1930. Yet his home was proof that housing prices had increased at that annualized rate.

The point he was making was the Cantillon Effect. He owned the home and benefited from the price increases. In other words, he was a HAVE. However, had he not owned the home several decades ago, he would have been boxed out and been unable to acquire the home because inflation was growing faster than his ability to generate wealth. This is exactly the condition that many people find themselves in today, particularly when they are first-time home buyers.

The Cantillon Effect has significant implications for economic inequality. This is because the effect describes how changes in the money supply don’t affect all individuals in an economy equally. Instead, those who receive the new money first (often banks, financial institutions, and the wealthy) benefit more than those who receive it later (often the middle class and the poor).

Here’s how it works:

1. **First Receivers Benefit More:** When the money supply is increased, the first recipients of this new money (often banks and other financial institutions) can lend or invest this money before the general price level in the economy has increased. This means they can buy assets at lower prices and then sell them at higher prices once inflation has taken effect. This increases their wealth.

2. **Later Receivers Benefit Less or Suffer:** By the time this new money trickles down to ordinary workers and consumers, prices in the economy may have already risen. This means that even though these individuals have more money, their purchasing power may have decreased because the cost of goods and services has increased. This can lead to a decrease in their real wealth.

3. **Wealth Inequality Increases:** Over time, this process can lead to an increase in wealth inequality. Those who can receive and invest the new money early can increase their wealth significantly, while those who receive the new money later may see their real wealth decrease. This can exacerbate existing wealth inequalities in an economy.

The Cantillon Effect is a critical concept in understanding the distributional effects of monetary policy. It highlights how policy decisions have different impacts on different sectors of the economy, leading to potential disparities in wealth and economic outcomes. However, the Cantillon Effect points to how wealth is created disproportionately by those who control the levers of money creation.

Why is this important?

As traders, we are always looking to make sense of the financial media. Unless you’ve been living under a rock over the three years you’ve probably noticed that Wall Street has been screaming for more stimulus. Next time you see it, recognize this is the Cantillon Effect in action. QE1, QE2, QE Infinity, stimulus. Money Printer go “Brrrrrr”. When the money is created the assets the wealthy own increase in price because they are already owners of the assets that will INFLATE.

But what about the wage earners? Sure, they’ve had some help from direct stimulus, but they haven’t enjoyed the same benefits from asset appreciation. They’re getting the short end of the stick. And with inflation driving up the cost of food and energy, their standard of living is taking a hit. That, my friends, is the Cantillon Effect in action.

The effortless and undeserved piling up of riches is a significant side effect of the money-printing machine, and this is the phenomenon we know as the Cantillon Effect. The rich get richer.

Centralized control of money. This is also what we call the Cantillon Effect.

But here’s the rub: this system sets the stage for a silent war between generations. Those reaping the benefits of this system must persuade each new generation into accepting a starting line that’s miles behind those who cashed in years ago. That’s the harsh reality of the Cantillon Effect.

It is a recipe for class warfare based upon widening wealth inequality.

I probably sound old-fashioned, but I can’t help but think about this every time I shop at the grocery store.

I can afford the significantly higher prices.

But I know that others cannot.

What’s the solution? For me it is crystal clear that the crypto industry is a direct threat to the Cantillon Effect. Notice how the regulators are trying to make them extinct.

To quote Nobel Prize winning economist, Milton Friedman, “There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction and does it in a manner which not one man in a million is able to diagnose.”

The Federal Reserve has played a significant role in amplifying the volatility we see in the stock market. This volatility tends to deter long-term investment and instead fuels short-term speculation. The Fed, in its attempt to steer the economy through monetary policy, wields the power to sway markets with its decisions on interest rates and other measures that can redirect the flow of investment capital. The anticipation surrounding the Fed’s actions often triggers substantial swings in the stock market, as investor sentiment shifts in response to interest rate adjustments and changes in quantitative easing measures. These shifts in sentiment can drive stock prices in either direction, making the stock market a barometer of sorts for the perceived effectiveness of the Fed’s actions. In essence, the Federal Reserve’s policies are a key determinant of market volatility.

Artificial intelligence (AI), machine learning (ML), and neural networks are potent tools that can significantly enhance traders’ decision-making processes when leveraged appropriately. AI shines in its ability to detect patterns in the stock market that might elude traditional analysis methods. ML excels in processing vast volumes of trade data swiftly and accurately, facilitating quicker, more precise decisions. Neural networks allow traders to draw on past experiences to inform future trading decisions, potentially reducing the risk of expensive errors. The combined power of these three tools can empower traders to make informed, confident decisions with a higher likelihood of success.

At the end of the day, the bottom line is indeed the bottom line. This sentiment underscores the necessity of making tough decisions. For traders, it’s about staying financially viable, outpacing inflation, and maintaining competitiveness in a dynamic market.

It all boils down to maximizing profits by aligning oneself with the right trend at the right time.

The Fed’s asset purchases, which are often assets that no one else will touch, are leading to a devaluation of the dollar. This, in turn, is driving up the price of financial assets.

While I’ve shared my perspective on the current economic environment, I want to emphasize that I never allow my personal opinions to influence my trading decisions.

My understanding of reality is shaped by my perceptions and experiences. However, I’ve come to realize that my personal universe of understanding is quite limited. That’s why I rely on artificial intelligence, neural networks, and machine learning to guide my trading decisions.

Every trader has experienced disastrous trades. The difference between winners and losers is that winners extract valuable lessons from their losses.

The power of artificial intelligence lies in its ability to learn from what doesn’t work, remember it, and then explore alternative solutions. This feedback loop has been instrumental in building the fortunes of every successful trader I know.

Consider this: AI applies mistake prevention to uncover what is true and viable. It’s a continuous, 24/7 process that AI applies to any problem it’s tasked with solving.

This should excite you because it’s a game-changer.

Don’t just sit around waiting for the Fed to change course.

Stay abreast of the highest probability analysis provided by artificial intelligence.

Since artificial intelligence has beaten humans in Poker, Chess, Jeopardy and Go! do you really think trading is any different?

Knowledge. Useful knowledge. And its application is what A.I. delivers.

You should find out. Join us for a FREE Live Training.

We’ll show you at least three stocks that have been identified by the A.I. that are poised for big movement… and remember, movement of any kind is an opportunity for profits!

Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

Intrigued? Visit with us and check out the a.i. at our Next FREE Live Training. .

Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.