Thomas Carlyle, a Scottish writer and historian, came up with the term “dismal science” when referring to the field of economics in the 19th century. He used it to show he didn’t like economics and its theories. Carlyle wasn’t a fan of economists like Thomas Malthus and David Ricardo, who talked about stuff like how many people were alive and how that threatened the resources of an economy. He thought their ideas were too negative and didn’t capture all the emotions and experiences of real life. Many other leading economic thinkers have used the term “dismal science’ to describe economics because of its lack of empirical proof to substantiate its theories.

In this article, we’re going to explore Modern Monetary Theory (MMT). This is a theory that has become popular lately in economics and was the foundation for the COVID-19 monetary policies as well as much of the stimulus and quantitative easing we have witnessed since the Great Financial Crisis of 2008. MMT says that the government, like the boss of the country, can make its own money without worrying too much about where it comes from. But the important thing is the government needs to spend the money wisely and not create too much of it, or else it can cause problems like prices going up. MMT also says that the government can create jobs and make the economy better by spending money on important things like schools, roads, and healthcare. The foundational principle proposed by MMT is that government is different from you and me. The government as the creator of money does not have to balance its checkbook because it has a never-ending supply and access to money.

Some people think MMT is great because it gives the government more power to manage the economy and help people. They say it can create jobs, reduce poverty, and make life better for everyone. But others have concerns. Critics of MMT can agree with many of the premises proposed by this utopian idea, but they counter the policy proposals by simply looking at the value or purchasing power of the unit of currency that the government is managing.

Stephanie Kelton, an economist and professor at Stony Brook University, is widely recognized as one of the foremost proponents of MMT. She has been instrumental in popularizing MMT through her book “The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy.” Kelton has served as an economic advisor to politicians and has been a prominent speaker on MMT. In “The Deficit Myth” Kelton challenges conventional wisdom about government deficits and offers a fresh perspective on fiscal policy. Kelton argues that deficits are not inherently bad and that our understanding of them is flawed. She asserts that governments with sovereign currencies, like the United States, can create and spend money without being limited by tax revenues or borrowing. Kelton argues that the current rules and laws in place to restrict government spending are remnants of the gold standard and do not apply to a FIAT currency system.

Kelton contends the belief in deficits as a burden on future generations is a myth. Instead, she suggests that deficits can be harnessed to address societal needs and drive economic growth. According to Kelton, the real concern should be on the impact of deficits on inflation and resource utilization rather than the accumulation of debt.

“The Deficit Myth” challenges the traditional thinking that has guided economic policies for decades. Kelton argues for a more expansive role of government in managing the economy, advocating for increased spending on areas like healthcare, education, and infrastructure. She emphasizes the power of fiscal policy as a tool for addressing inequality and achieving full employment.

Overall, Kelton’s book presents a provocative argument that encourages readers to question long-held beliefs about deficits and government spending. She calls for a paradigm shift in how we understand and approach fiscal policy, suggesting that deficits can be harnessed to serve the public interest and promote a more equitable and prosperous society.

Stephanie Kelton argues we need to change the way we think about government deficits and spending. Covid-19 revealed the flaws in our economy, particularly in areas such as employment, healthcare, and housing, and highlighted how inequality exacerbates these issues. Governments around the world responded to the pandemic with extraordinary measures, sending money to individuals, providing free Covid testing, and giving financial support to businesses. Kelton saw this as an opportunity to demonstrate why government budgets don’t work like household budgets, and why our nation can afford to invest in the things we need even after spending trillions to fight the pandemic. However, Kelton notes that we are now falling back into our old habits of thought, asking how we will pay for things, rather than questioning whether they are worth doing and whether we have the resources to do them. Kelton argues that MMT provides an accurate description of how a fiat currency like the US dollar works, and that we need to fix the way we think about the limits on government spending. Congress never has to check the balance in its bank account to figure out whether it can afford to spend more, because as the issuer of the currency, the federal government can never run out of money.

While Modern Monetary Theory (MMT) has gained attention and influenced economic discussions, it is important to note that it has not been explicitly implemented as a comprehensive economic policy framework by any specific country. However, some countries have incorporated elements of MMT or employed policies aligned with certain principles of MMT. Here are a few examples:

1. United States: The United States has implemented expansionary fiscal policies, particularly during economic downturns, which align with certain aspects of MMT. For instance, during the COVID-19 pandemic, the U.S. government passed substantial stimulus packages to provide economic relief and support for businesses and individuals. These measures involved increased government spending and larger budget deficits, reflecting the influence of MMT principles.

2. Japan: Japan has pursued a policy approach known as “Abenomics,” which includes elements that resonate with MMT. The government implemented aggressive fiscal stimulus, engaged in large-scale bond purchases, and actively used monetary policy tools to combat deflation and stimulate economic growth. This approach reflects a departure from traditional concerns about government debt and has been seen as incorporating MMT-like elements.

3. Australia: While not explicitly adopting MMT, Australia has implemented policies that align with some MMT principles. The government has utilized expansionary fiscal policy during economic downturns, focusing on infrastructure spending and job creation. Additionally, Australia has maintained relatively low interest rates and has shown flexibility in managing deficits. These actions reflect an approach that considers the potential of fiscal policy to address economic challenges.

Regarding the results of such policies, evaluating the specific impact of MMT-influenced policies can be challenging, as multiple factors contribute to economic outcomes. The effects of policies depend on various economic conditions, the implementation approach, and the scale of the measures undertaken. Furthermore, MMT is a framework that encompasses multiple dimensions beyond government spending, such as taxation and inflation control.

While it’s difficult to isolate the effects of specific policies influenced by MMT principles, proponents argue that expansionary fiscal policies can stimulate economic activity, employment, and demand. Critics express concerns about potential inflationary pressures and long-term debt sustainability, emphasizing the need for careful management and balancing of fiscal measures.

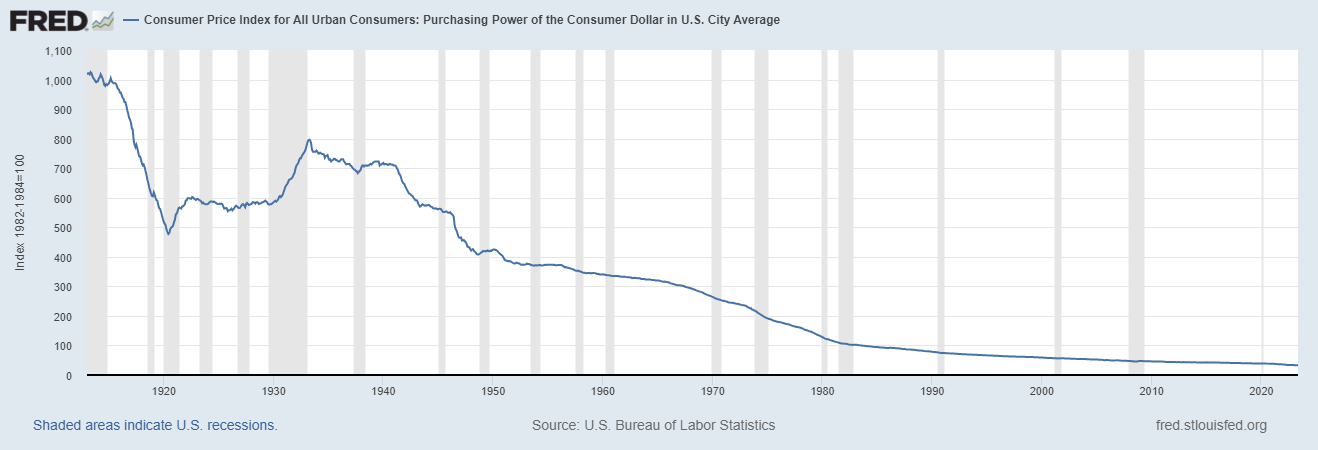

Proponents of Modern Monetary Theory (MMT) argue that government spending can be financed through money creation without significant concerns about inflation. However, critics, including prominent figures like Milton Friedman and the Austrian School of Economics, present an alternative perspective on the potential consequences of excessive money creation. I’ve been unable to find a perspective from proponents of MMT that claims they can change or eliminate the trajectory of purchasing power loss in the following graph maintained by the Federal Reserve.

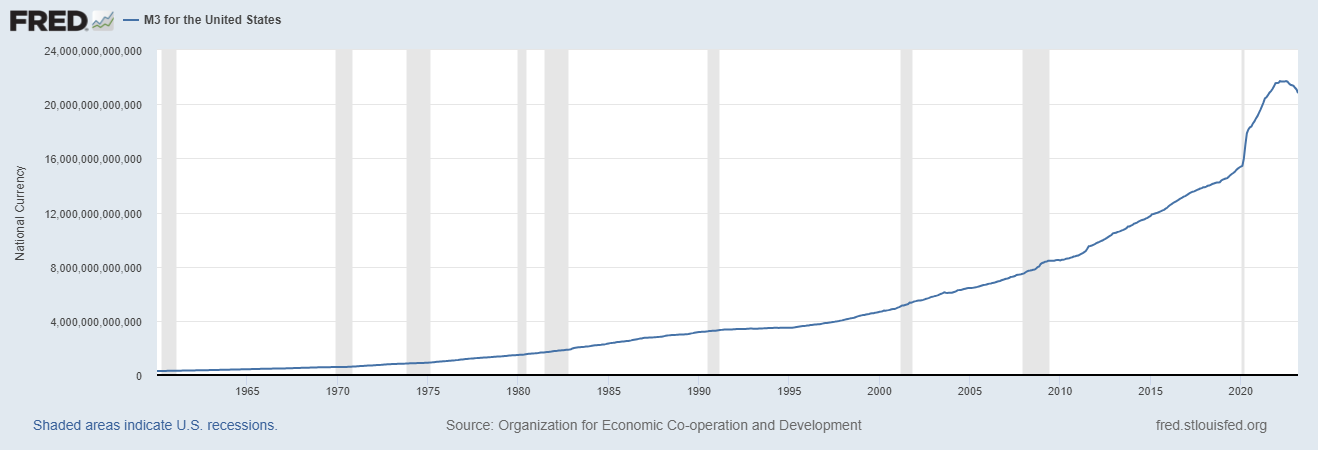

It’s these very things which Kelton describes as the benefits and positive attributes of Modern Monetary Theory that lead critics to point to the historic levels of 9% inflation in 2021, and loss of purchasing power after the government spent $7 trillion dollars to stimulate the economy during the pandemic. Traditional economists understand when more currency is produced, it leads to a decrease in value because it can purchase fewer goods and services than before. This phenomenon is known as inflation, where prices rise due to an oversupply of money in the economy. The concept of supply and demand plays a key role in this understanding, as an increase in the supply of money without a corresponding increase in the availability of goods and services diminishes the purchasing power of each unit of currency.

According to Milton Friedman, a Nobel Laureate economist and advocate of monetarism, an excessive increase in the money supply leads to inflation. Friedman argues that when governments create more money, it dilutes the purchasing power of existing money in circulation. As a result, prices rise, leading to inflationary pressures. Friedman emphasizes the relationship between money supply and inflation is not a one-to-one correlation, but sustained increases in the money supply will eventually lead to rising prices.

The Austrian School of Economics, which includes economists such as Friedrich Hayek and Ludwig von Mises, shares these concerns about the potential inflationary risks associated with MMT. They argue that when governments increase spending by creating new money, it distorts price signals in the economy and disrupts the coordination of resources. This distortion can lead to malinvestment and economic imbalances, ultimately leading to economic instability and potential hyperinflation. The Austrian School emphasizes the importance of sound money and the market-driven allocation of resources for maintaining price stability and economic efficiency.

Critics of MMT, including Friedman and the Austrian School of Economics, caution against the potential consequences of unrestrained money creation. They argue that while MMT may offer short-term benefits in terms of increased government spending and employment, the long-term risks of inflation and economic distortions cannot be ignored. They stress the importance of prudent fiscal and monetary policies that prioritize price stability and market-based resource allocation to ensure sustainable economic growth.

Critics say if the government makes too much money, it can cause prices to go up and make things more expensive for us. They also worry that the government might not be able to control spending and could leave us with a lot of debt to deal with.

Another point critics bring up is the idea of full employment. MMT suggests that the government can create jobs by spending more money. But some people disagree and think that the government’s involvement in creating jobs can mess up how things work in the job market. They believe that it’s better for jobs to come from private businesses, entrepreneurs, and for improvements in productivity. They argue that relying too much on the government for job creation will cause problems and make things less efficient in the long run.

Critics also worry about the long-term effects of having big government deficits and debts under MMT. They say that even though the government can create money, if they spend too much and don’t control their spending, it will lead to financial instability. This means things could get unstable and uncertain in the economy, and it could burden future generations with lots of debt that they’ll have to deal with.

So, while MMT has gained attention and popularity, there are still many debates and questions about its effectiveness. Critics argue that the main reason MMT is embraced by government is primarily because it condones that government is the primary driver of economic activity in the economy. Any economic theory which gives more economic control over economic activity will always be endorsed by the status quo.

Modern Monetary Theory is important primarily because of how government policy can influence the value of your portfolio, your investments, and your trading decisions.

Over the last two years have you noticed that every time we enter a sudden decline in stock prices that Wall Street is screaming for more stimulus to support stock prices? The point I’m making is that if you plan to survive in today’s markets you had better be armed with tools that can keep you on the right side of the right trend at the right time.

The financial landscape is littered with ideologues who are convinced their ideas will eventually be proven correct. As a trader, you cannot have any tolerance for opinions. As traders, our only loyalty is to the trend.

While economics has been labeled as the “dismal science,” it doesn’t mean that our trading portfolio needs to reflect that gloomy perspective. By embracing innovative ideas and staying informed about evolving economic theories, we can navigate the financial landscape with optimism and seize opportunities for growth and prosperity thanks to the power of A.I., machine learning and neural networks.

These are the ideas, concepts and situations which we address in our live trainings where we teach traders how to trade with artificial intelligence , machine learning and neural networks.

The only thing that matters in trading is what price does. Everything else is just noise. This is one of the hardest lessons for traders to comprehend because they expect harmony between what is reported on the news and how a market behaves.

I want to propose that just as Wall Street fixates on the position of STIMULUS, you as a trader should focus your attention on how artificial intelligence defines the trend and the best move forward.

Don’t equate headline news with the market you are trading.

Don’t try to make sense of what the financial media is reporting on the economy with what you are trading.

In other words, don’t let an opinion get in the way of your trading.

Define the trend.

Define your risk.

And recognize that change will continue to happen faster and faster.

We live in exciting times.

A.I. is the framework where risk and opportunity are very clearly defined.

Remember, artificial intelligence has decimated humans at Poker, Jeopardy, Go! and Chess. Why should trading be any different?

Visit with us and check out the A.I. at our Next Free Live Training.

Discover why Vantagepoint’s artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.