Over the last several years we have written extensively about how the Western World monetary order is being challenged by numerous alternatives who claim they have built a more equitable global trade framework.

Next week in Johannesburg, South Africa, the BRICS Nations 2023 Summit is occurring, and it’s expected they will announce a new BRICS currency backed in some capacity by Gold to settle trade outside of the U.S. Dollar.

This challenge in our opinion is noteworthy as it enlists most member nations who are dissatisfied with the economic order maintained by Western nations. This article delves into the journey of BRICS, exploring its potential to disrupt the longstanding Western paradigm.

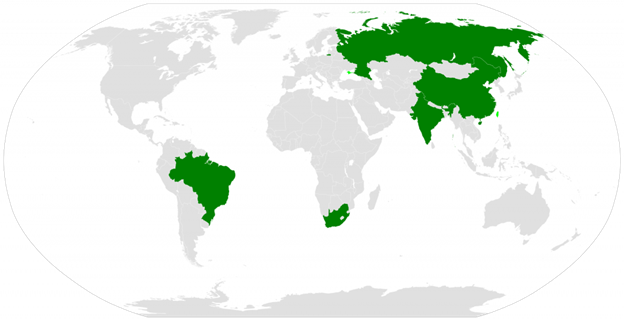

In the aftermath of World War II, the world witnessed the emergence of a Western-dominated order, characterized by political, economic, and cultural hegemony. Institutions like the United Nations, the International Monetary Fund, and the World Bank, along with the pervasive influence of the U.S. dollar, became emblematic of this ascendancy. This Western World Order, with its liberal democratic values and market-driven economies, became the defining framework for global governance and cooperation. However, as the 21st century unfolds, a new collective entity has risen to challenge this dominance: the BRICS nations. Comprising Brazil, Russia, India, China, and South Africa, BRICS represents not just a coalition of rapidly growing economies, but also a confluence of diverse cultures, histories, and political systems. Together, they are poised to redefine the global landscape, presenting an alternative, and in many ways, a counter-narrative to the established Western order.

The ashes of World War II gave birth to a new global landscape, predominantly shaped by the Western powers, chiefly the United States and its European allies. The devastation of the war had left Europe’s traditional powers weakened, paving the way for the U.S. to emerge as the principal architect of the new world order. This era saw the establishment of international institutions, treaties, and alliances that were largely Western-centric, reflecting the democratic and capitalist ideologies of the victors.

The United Nations, founded in 1945, became the centerpiece of this new order, promoting peace, security, and cooperation. However, its Security Council, with permanent members being the major Allied powers, was a clear indication of where the real power lay. NATO, formed in 1949, further solidified the military and strategic dominance of the West, acting as a bulwark against the spread of communism and the perceived threat from the Soviet Union.

In 1944, before the war had even concluded, representatives from Allied nations convened in Bretton Woods, New Hampshire, to lay the groundwork for the post-war economic order. This conference led to the establishment of the Bretton Woods system, which pegged various currencies to the gold-backed U.S. dollar, effectively making it the world’s primary reserve currency.

Two pivotal institutions also emerged from this conference: the International Monetary Fund (IMF) and the World Bank. The IMF was tasked with overseeing the international monetary system, ensuring exchange rate stability, and facilitating balanced growth of international trade. The World Bank, on the other hand, was designed to provide financial and technical assistance for the reconstruction of war-torn Europe and the development of other poor nations.

The dominance of the U.S. dollar, coupled with the influence wielded by the IMF and World Bank, ensured that the West, particularly the U.S., had a significant say in global economic policies. Countries seeking assistance or integration into the global economy often found themselves adhering to Western-prescribed economic reforms and policies.

In essence, the post-World War II era and the Bretton Woods system entrenched the West’s economic, political, and cultural dominance on the global stage. However, as the BRICS nations began their ascent, questions arose about the sustainability and fairness of this Western-centric world order.

The unique position of the West is easy to comprehend when we look at how trade has occurred between nations. Let’s consider a scenario where Russia exports $400 million in Oil to Brazil, and in return, Brazil exports $350 million in Coffee to Russia. Here, we have a $50 million dollar surplus in favor of Russia. To settle this balance, Brazil transfers $50 million dollars to Russia. This scenario is a simple example of how trade has occurred around the world since World War II. Countries would trade goods and services with one another and settle their balances in U.S. Dollars.

Critics of this system claim that the U.S. Dollar receives a massive unfair privilege by forcing other nations to trade in U.S. dollars.

This scenario creates huge demand for the U.S. dollar. It also allows the United States’ economic policies to be exported to the world since they all engage in trade with one another. This advantageous position is due to the widespread acceptance of US dollars as the world’s primary reserve currency. The BRICS nations feel that they are being taken advantage of and are organizing their collective to be able to trade with one another outside of the U.S. Dollar.

The term “BRIC” was initially coined in 2001 by Jim O’Neill, an economist at Goldman Sachs, in a paper titled “Building Better Global Economic BRICs.” The acronym originally referred to four emerging economies: Brazil, Russia, India, and China, which were all at a similar stage of newly advanced economic development. South Africa joined the group in 2010, leading to the addition of the capital “S” in BRICS.

The significance of BRICS wasn’t just in their individual economic potential but also in their collective capacity. These nations represented a shift in global economic power, with predictions suggesting that by 2050, they could eclipse the combined economies of the world’s current wealthiest countries.

The BRICS nations recognized the potential of their collective strength and began annual diplomatic meetings in 2009. These summits have since evolved to discuss cooperation in various sectors, from trade and investment to science and technology.

You can only begin to recognize the significance of the BRICS collective when you begin to calculate their power as a joined force. For example, Saudi Arabia’s potential entry into the BRICS alliance presents a constellation of economic and geopolitical force. Russia and Saudi Arabia, both vying for supremacy as two of the globe’s foremost oil titans. Yet, this partnership extends beyond crude dominion, delving into the realm of nuclear armament where Russia and China preside over substantial arsenals, forming a formidable union within the BRICS.

Moreover, the inclusion of India and other participants swells this coalition’s might, commanding a staggering 50 percent of Earth’s inhabitants and a formidable 54 percent of global GDP.

Gone are the vestiges of the ‘third world.’ These economies, far from being mere basket cases, burgeon as the driving engines of global economic dynamism. What transpires here is an aggregation of premier economies, characterized by their scale and potency: massive amounts of natural resources, bullion reserves, expansive territories, burgeoning populations, and formidable militaries.

This is no ordinary alliance. It’s a geopolitical force that underscores its force and, in many respects, positions it on par with the collective might of the West.

The roster of nations aligning to embrace the BRICS coalition and adopt its novel currency is undergoing a remarkable expansion. What began as a consortium of 19 nations in April has blossomed into an impressive cohort of 41 countries by the close of June. The countries, primarily hailing from the realms of Asia, Africa, and Eastern Europe, are evidence of a palpable interest in embracing the BRICS currency paradigm. Among the ranks of countries displaying a keen intent to integrate into the BRICS fold ahead of the upcoming summit, a diverse and extensive list unfurls. This ensemble encompasses a broad spectrum of nations including Afghanistan, Algeria, Argentina, Bahrain, Bangladesh, Belarus, Egypt, Indonesia, Iran, Kazakhstan, Mexico, Nicaragua, Nigeria, Pakistan, Saudi Arabia, Senegal, Sudan, Syria, the United Arab Emirates, Thailand, Tunisia, Turkey, Uruguay, Venezuela, and Zimbabwe.

In summary, the rise of the BRICS nations challenges the traditional Western-centric world order. Their combined economic prowess, diverse cultures, and strategic initiatives offer an alternative vision for global governance and cooperation, making them major players on the world stage.

More importantly, by creating a BRICS currency member state of the BRICS collective will be able to trade with one another outside of the U.S. dollar.

Since the end of World War II, the U.S. dollar has enjoyed unparalleled dominance in global finance. The Bretton Woods Conference of 1944 established the dollar as the world’s primary reserve currency, pegged to gold. Even after the gold peg was abandoned in 1971, the dollar’s supremacy remained largely unchallenged, serving as the primary medium for international trade, oil transactions, and as a reserve currency for central banks worldwide. However, the rise of the BRICS nations has begun to pose a significant challenge to this established order.

The BRICS nations, aware of their collective economic strength, have worked together for the last 17 years to organize and create the idea of a new global reserve currency. Such a currency would reduce the world’s dependency on the dollar and, by extension, the influence the U.S. holds over global economic policies. While the idea is still in its nascent stages, the very discussion indicates a growing dissatisfaction with the dollar-centric global financial system.

In a direct challenge to Western financial institutions like the World Bank and the International Monetary Fund (IMF), the BRICS nations established the New Development Bank (NDB) in 2014. Headquartered in Shanghai, the NDB aims to mobilize resources for infrastructure and sustainable development projects within BRICS nations. Unlike the World Bank, which often imposes stringent conditions on loans, the NDB offers terms that are more favorable to developing nations, reflecting the priorities and values of the BRICS countries. The National Development Bank also has hundreds of billions of dollar assets available for immediate loans which certainly makes it a power to be reckoned with.

The creation of the BRICS New Development Bank (NDB) holds significant economic and geopolitical implications, representing a strategic move by the BRICS nations (Brazil, Russia, India, China, and South Africa) to assert their influence on the global financial stage. The establishment of the NDB marks a departure from the traditional dominance of Western-led financial institutions like the International Monetary Fund (IMF) and the World Bank, which are often criticized for their perceived lack of representation and responsiveness to the needs of developing economies.

The BRICS NDB holds significance through diversifying funding sources for infrastructure, empowering emerging economies to prioritize their development, and promoting South-South cooperation. Its focus on infrastructure aids economic growth, challenges Western financial dominance, contributes to global multipolarity, and demonstrates BRICS cohesion in complex projects.

The creation of the BRICS New Development Bank represents a landmark development in the global financial landscape. It not only provides a vehicle for funding crucial development projects but also signifies the increasing influence of emerging economies in shaping the trajectory of the global economy. The NDB’s establishment embodies the BRICS nations’ aspirations for greater autonomy, equity, and representation in the international financial system.

One of the most tangible challenges to Western economic systems is the increasing number of trade agreements and partnerships within the BRICS bloc. These agreements often bypass Western financial systems entirely. By trading in their local currencies, the BRICS nations reduce their reliance on the U.S. dollar, insulating themselves from dollar-centric global economic shocks and increasing their economic sovereignty.

A significant indicator of the changing global economic landscape is the shift in GDP dynamics. Recent data suggests that the combined GDP of the BRICS nations has surpassed that of the G7, a group of the world’s seven largest advanced economies. This shift not only signifies the growing economic power of the BRICS nations but also underscores the declining economic influence of traditional Western powers.

While the U.S. dollar’s dominance since World War II has been a defining feature of the global economic landscape, the rise of the BRICS nations represents a significant disruption to this status quo. Through initiatives like the NDB, exploration of a new global reserve currency, and intra-BRICS trade agreements, these nations are carving out a new economic order, one where the balance of power is more evenly distributed. The implications of this shift are profound, signaling a move towards a more multipolar world where the West’s economic influence is balanced by the emerging powers of the East and South.

As the global landscape continues to evolve, the BRICS nations are poised to play an even more significant role in shaping the future. Their collective economic and political clout, combined with their desire to challenge the status quo, suggests a future where the balance of power may shift more towards the East and South.

Here’s a glimpse into what the next decade might hold:

**Potential Scenarios for the Next Decade**

1. **BRICS-led Financial Systems**: With the BRICS nations exploring alternatives to the U.S. dollar and the establishment of institutions like the New Development Bank, we might see a world where multiple reserve currencies coexist, reducing the West’s financial influence.

2. **Collaborative Global Leadership**: Instead of a bipolar world dominated by the U.S. and China, we might see a multipolar world where BRICS nations collectively negotiate with Western powers, leading to more balanced global policies.

3. **Regional Influence**: BRICS nations might exert more influence in their respective regions, leading to regional trade agreements and setting standards that neighboring countries might adopt.

Technology is a great leveler, and BRICS nations are investing heavily in it. Whether it’s India’s IT sector, China’s advancements in AI and 5G, or Brazil’s biofuel innovations, technology is allowing these nations to leapfrog traditional development stages. This technological prowess will enable BRICS to challenge the West’s dominance in innovation, potentially leading to a world where the next big tech breakthroughs come from Shanghai, Bangalore, or Johannesburg instead of Silicon Valley.

At the heart of the BRICS challenge to the Western world order is a fundamental redefinition of what money is and how it’s used. The exploration of a new global reserve currency, possibly backed by tangible assets like gold or a basket of goods, is a direct challenge to the fiat currency system dominated by the U.S. dollar. Moreover, the interest in cryptocurrencies and digital currencies by BRICS nations suggests a future where money is decentralized, digital, and not tied to any single nation’s economic health. This shift could democratize global finance, reduce the impact of economic shocks in any single country, and lead to a more stable global financial system.

The BRICS alliance’s success might attract other emerging economies looking for alternatives to the Western-led global order. Nations in Africa, Southeast Asia, and Latin America, which have traditionally been under the influence of Western powers, might see alignment with BRICS to assert their independence and pursue their development agendas. The inclusion of more countries into this bloc would further amplify its global influence.

In conclusion, the next decade promises to be a transformative one in the global landscape. The BRICS nations, with their combined economic, political, and technological might, are poised to redefine many of the global norms we take for granted. Their challenge to the Western world order isn’t just about power or influence; it’s about creating a more inclusive, balanced, and equitable global system. The world is watching closely with the emergence of a gold backed currency for trade purposes, clearly challenging the U.S. dollar’s global dominance. This proposal will impact the Euro, prompting the EU to seek collaboration, while Asian economies like Japan and South Korea will need to adjust due to their BRICS trade ties. Likewise, the Middle East will reevaluate the “petrodollar” system, and African nations could benefit from increased BRICS investments. With Brazil as a BRICS member, Latin America would play a pivotal role in this currency shift. Global entities like the IMF and World Bank will have to reconfigure their currency strategies, marking this as a clear turning point in 21st-century global finance.

Against this backdrop of hopeful improvement for BRICS nations there is huge drama unfolding.

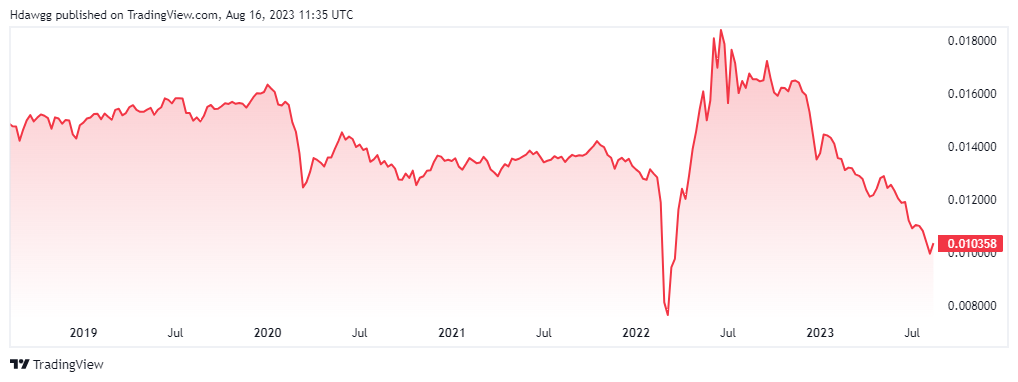

The Chinese economy is contracting heavily as its real estate market craters. Also, the Russian Ruble for the first time in 18 months is now trading below the level where the West imposed sanction against them.

We certainly do live in interesting times. And it is very true that because of how quickly these developments occur, it is extremely challenging to determine how to navigate the volatility that these events create.

The financial rollercoaster is about to take a wild turn in the coming weeks.

Over the past few weeks, the credit rating agencies have downgraded U.S. credit, as well as the banking crisis is still far from over.

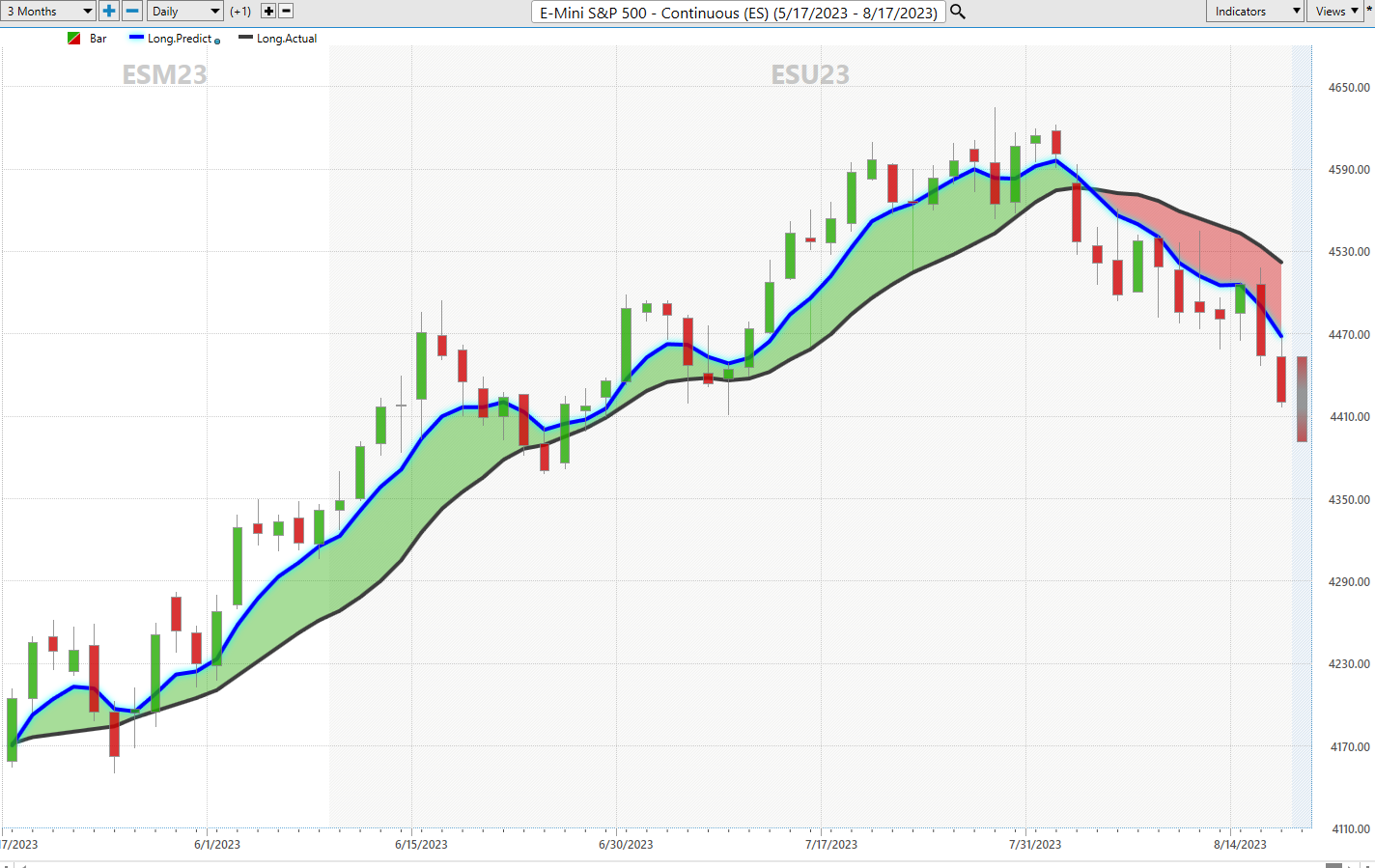

If you’ve been keeping up with my writings, you know I’m bracing for some major market turbulence, especially with the BRICS nations’ announcements.

Now, I’ve been around the block a few times, and if there’s one thing I’ve learned, it’s that having a solid strategy is key. But what’s the secret sauce to navigating these choppy waters?

Enter Artificial Intelligence (A.I.).

You might raise an eyebrow, but trust me, A.I., along with Machine Learning and Neural Networks, are the game-changers we’ve all been waiting for. They’re not just the future; they’re the here and now.

I won’t mince words: I’m pretty darn convinced stocks are headed south. But my guiding light, my “NORTH STAR”, is always the trend that A.I. points out. It’s like having a supercharged engine under the hood, ensuring you’re always on the right track.

For those who get jittery thinking about the survival of the fittest, maybe the trading game isn’t for you. But for those who want to be on top, it’s all about having the sharpest tools in the shed.

Why is A.I. the ace up my sleeve? It’s simple. It learns from mistakes, adapts, and then charts the best course forward. It’s this feedback loop that’s the secret weapon behind every trading mogul I’ve come across.

And let me tell you, it’s exhilarating!

While the pundits and experts are busy debating high-brow economic theories, I’ve got my eyes on the prize: the trend. And that’s where VantagePoint’s A.I. comes in, cutting through the noise and giving traders the clarity they need. So, are you ready to ride the wave with me?

Pay Attention.

Visit with us and check out the A.I. at our Next FREE Live Training.

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.